A, B and C were partners in a firm having capitals of ₹ 2,00,000; ₹ 2,00,000 and ₹ 80,000 respectively on 1st April, 2022. Their Current Account balances were A : ₹ 20,000; B : ₹ 10,000 and C : ₹ 5,000 (Dr.)

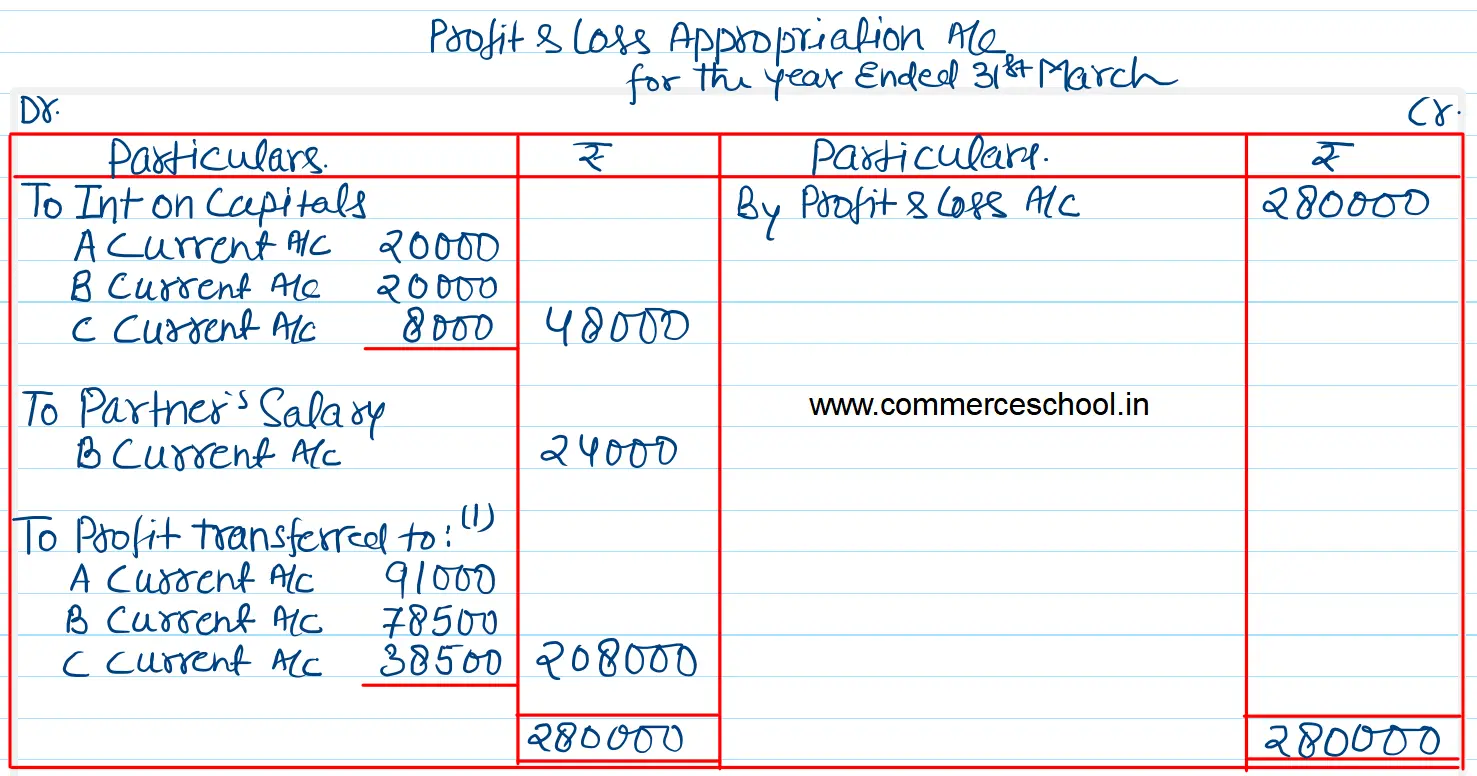

A, B and C were partners in a firm having capitals of ₹ 2,00,000; ₹ 2,00,000 and ₹ 80,000 respectively on 1st April, 2022. Their Current Account balances were A : ₹ 20,000; B : ₹ 10,000 and C : ₹ 5,000 (Dr.). According to the partnership deed the partners were entitled to interest on capital @ 10% p.a. B being the working partner was also entitled to a salary of ₹ 6,000 per quarter. The profits were to be divided as follows:

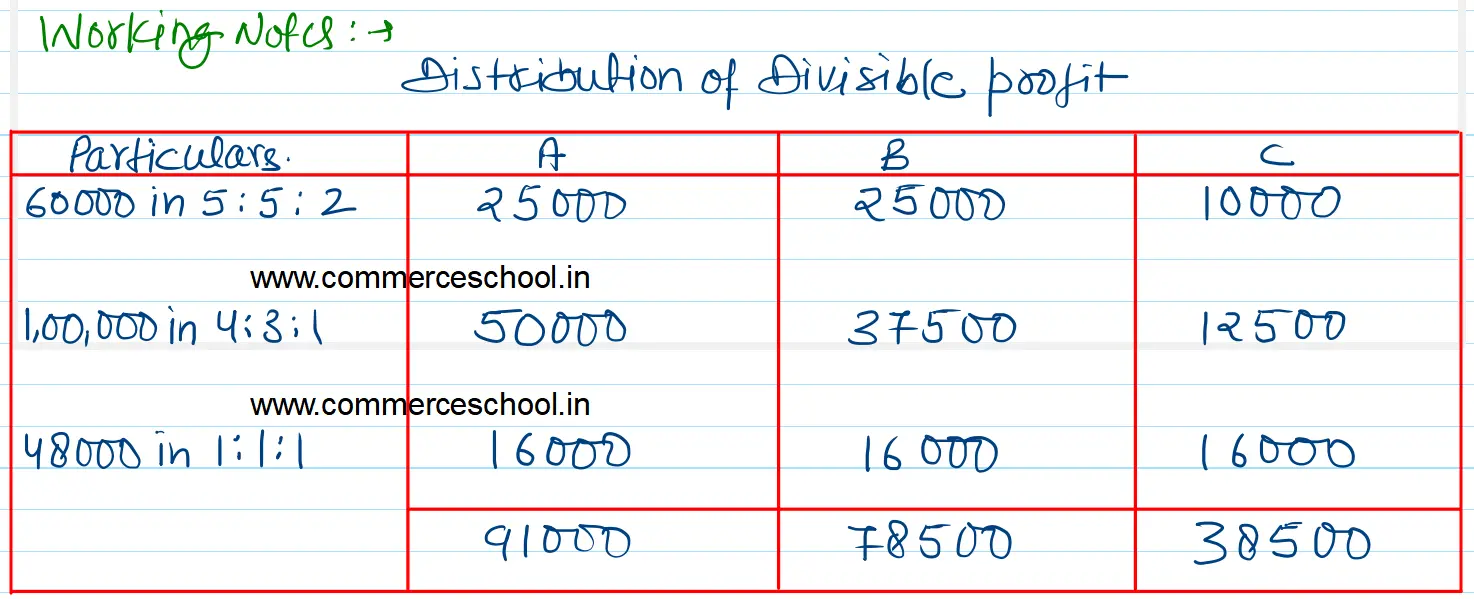

(a) The first ₹ 60,000 in proportion to their capitals.

(b) Next ₹ 1,00,000 in the ratio of 4 : 3 : 1.

(c) Remaining profits to be shared equally.

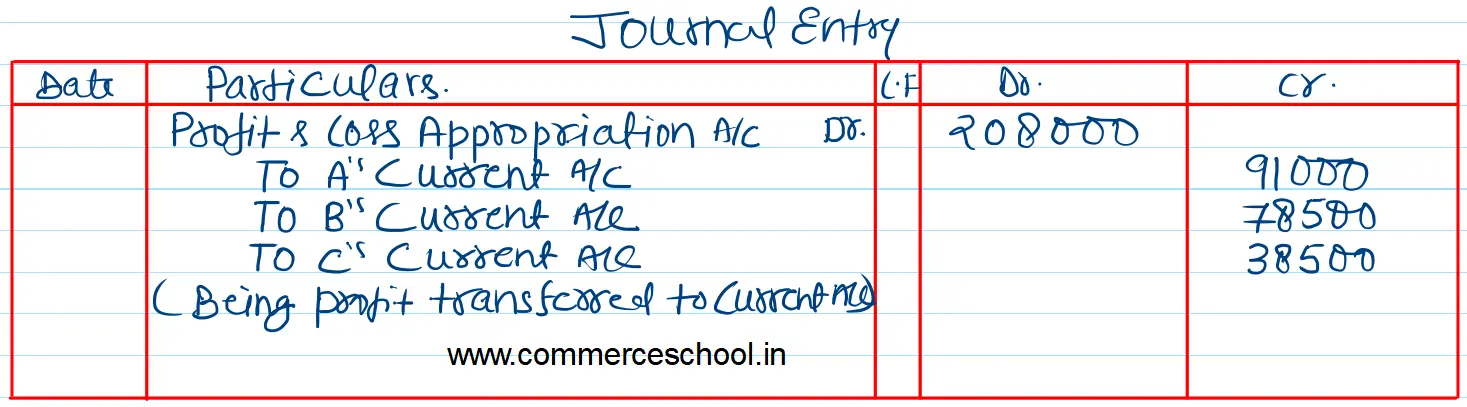

The firm made a profit of ₹ 2,80,000 for the year ended 31st March, 2023 before charging any of the above items. Prepare the Profit & Loss Appropriation Account and pass necessary journal entry for apportionment of profits.

[Ans. Share of Profit : A ₹ 91,000; B ₹ 78,500 and C ₹ 38,500.]