P, Q and R were partners sharing profits in the ratio of 1 : 3 : 2. Following was their Balance Sheet as at 31st March, 2022:

P, Q and R were partners sharing profits in the ratio of 1 : 3 : 2. Following was their Balance Sheet as at 31st March, 2022:

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 2,80,000 | Land and Building | 5,00,000 |

| Outstanding Expenses | 15,000 | Investments (Market Value ₹ 1,10,000) |

1,25,000 |

| Workmen Compensation Reserve | 60,000 | Stock | 2,20,000 |

| Investment Fluctuation Reserve | 45,000 | Sundry Debtors | 3,20,000 |

| Capital Accounts: P Q R |

2,00,000 5,00,000 3,00,000 |

Bank Balance | 1,60,000 |

| Advertisement Suspense | 75,000 | ||

| 14,00,000 | 14,00,000 |

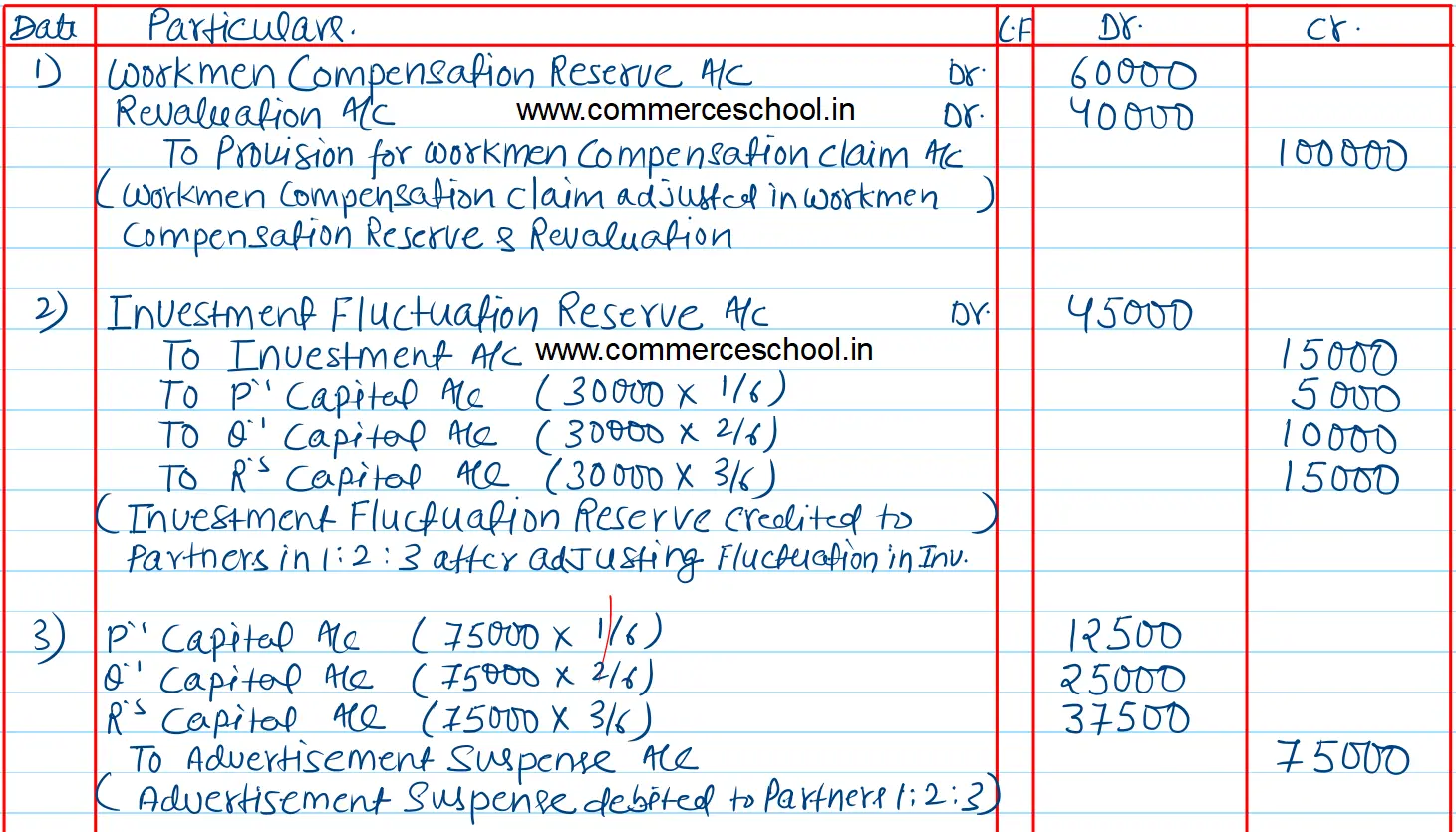

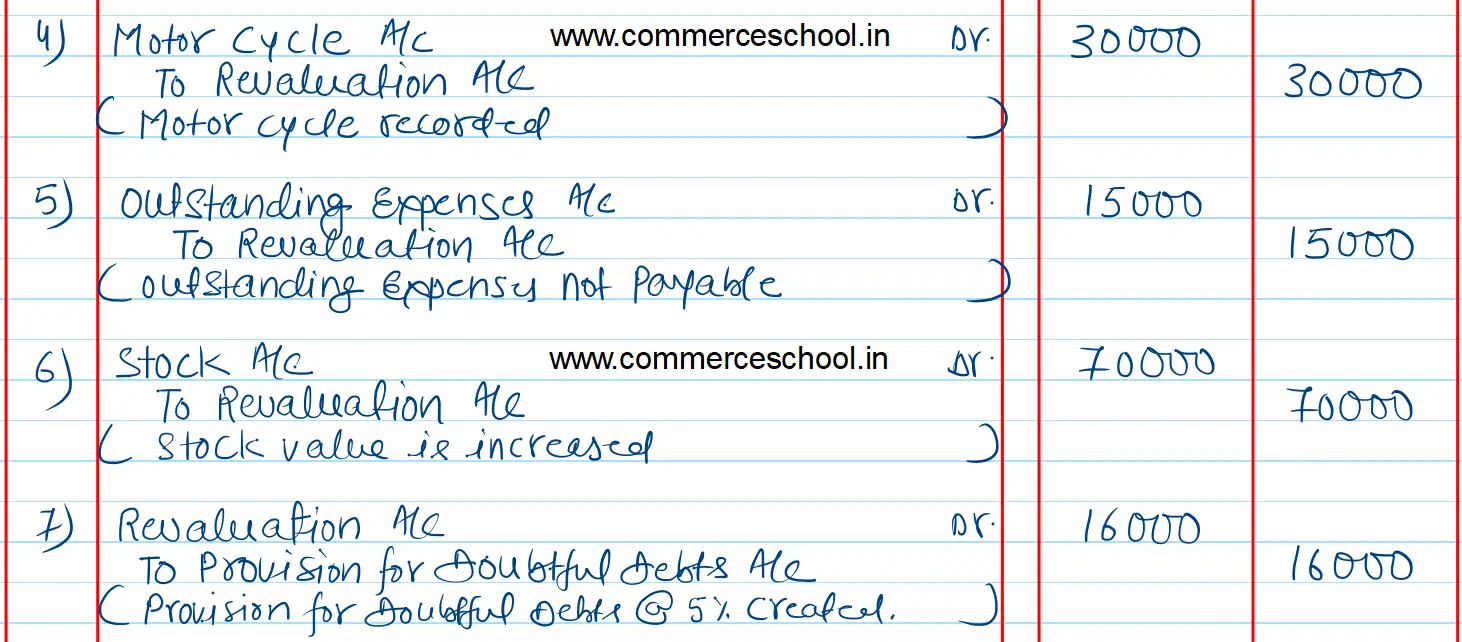

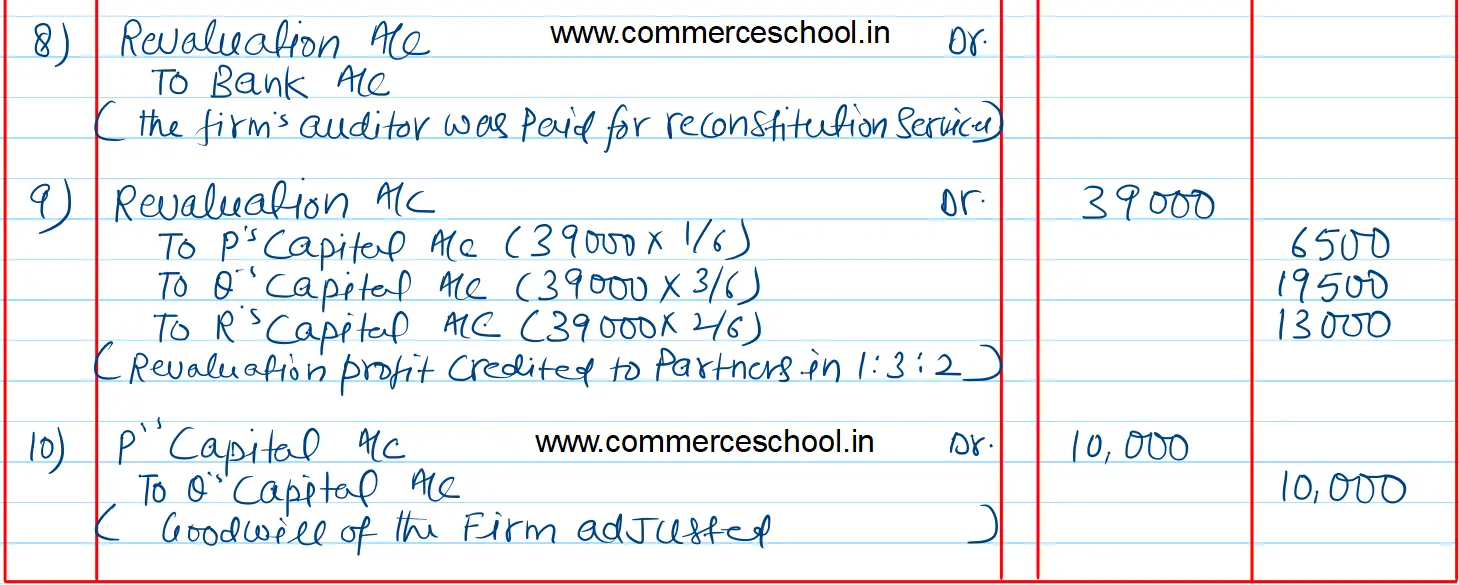

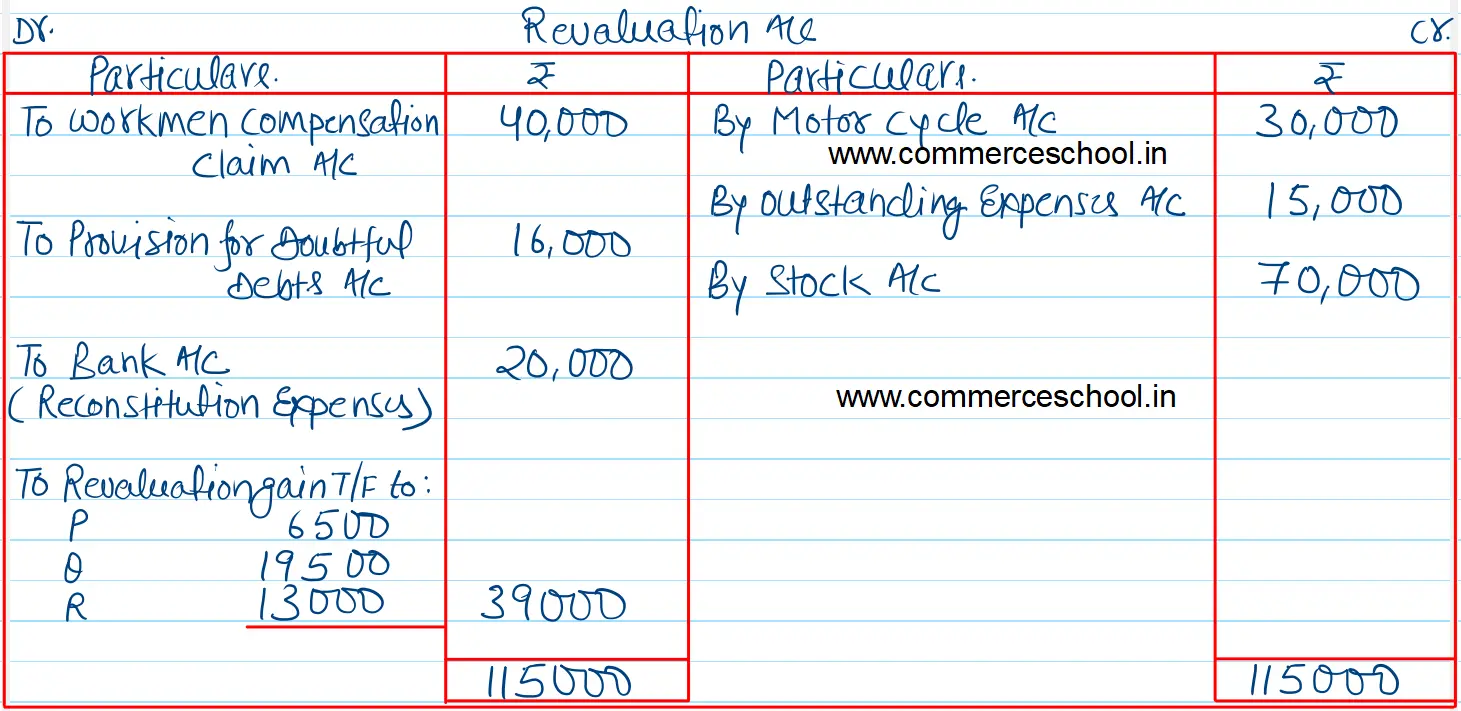

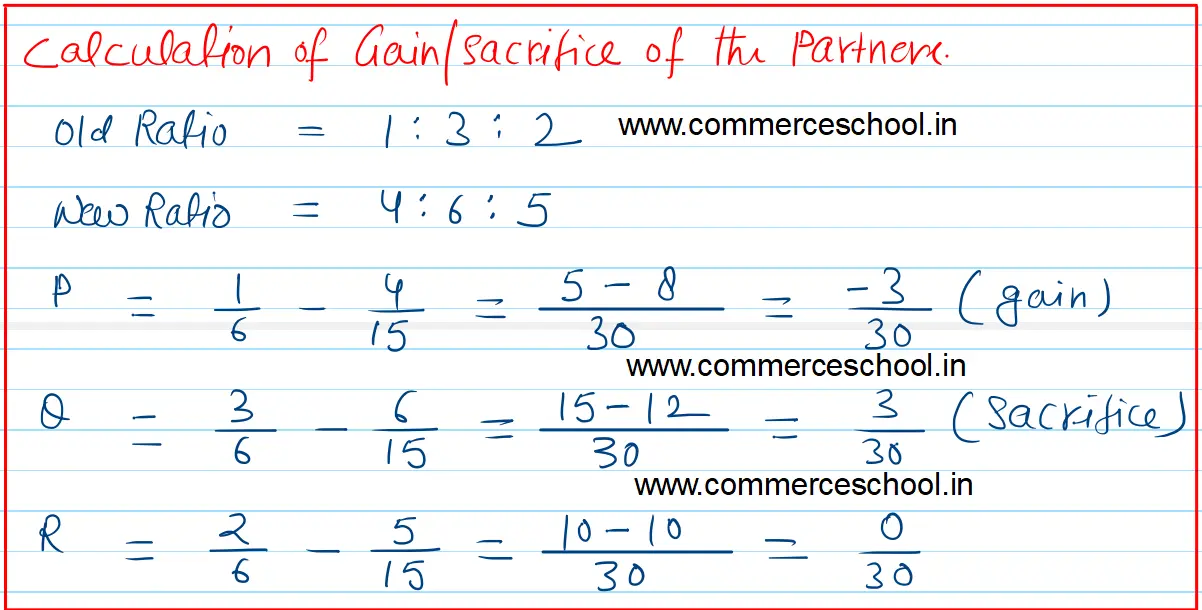

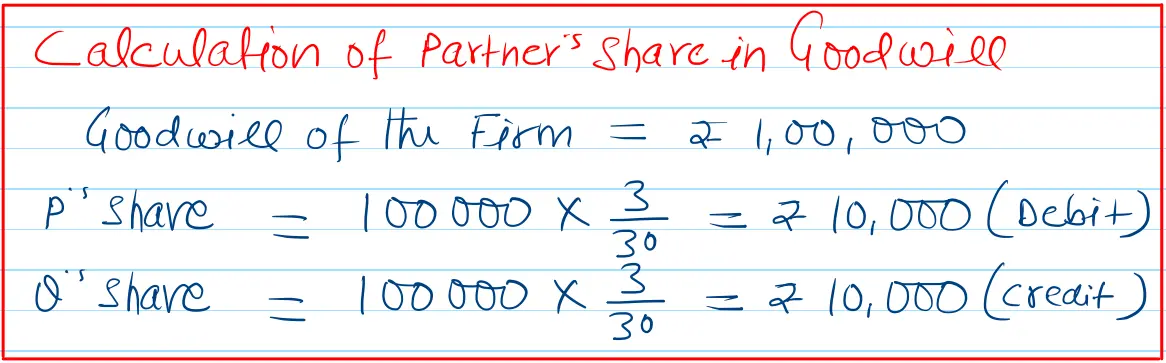

On 1st April, 2022 they decided to share future profits in the ratio of 4 : 6 : 5. It was agreed that: (I) Claim for Workmen’s Compensation has been estimated at ₹ 1,00,000. (ii) A motorcycle valued at ₹ 30,000 was unrecorded and is now to be recorded in the books. (iii) Outstanding expenses were not payable any more. (iv) Value of stock be increased to ₹ 2,90,000. (v) A provision for doubtful debts be created @ 5% on Sundry Debtors. (vi) Goodwill is valued at ₹ 1,00,000. (vii) The work for reconstitution was assigned to firm’s auditors. They were paid ₹ 20,000 for this work. Pass journal entries and prepare Revaluation Account. [Ans. Gain on Revaluation ₹ 39,000.]