L, M and N are partners sharing profits and losses in equal proportion. On 31st March 2021, their balance sheet was as follows:

L, M and N are partners sharing profits and losses in equal proportion. On 31st March 2021, their balance sheet was as follows:

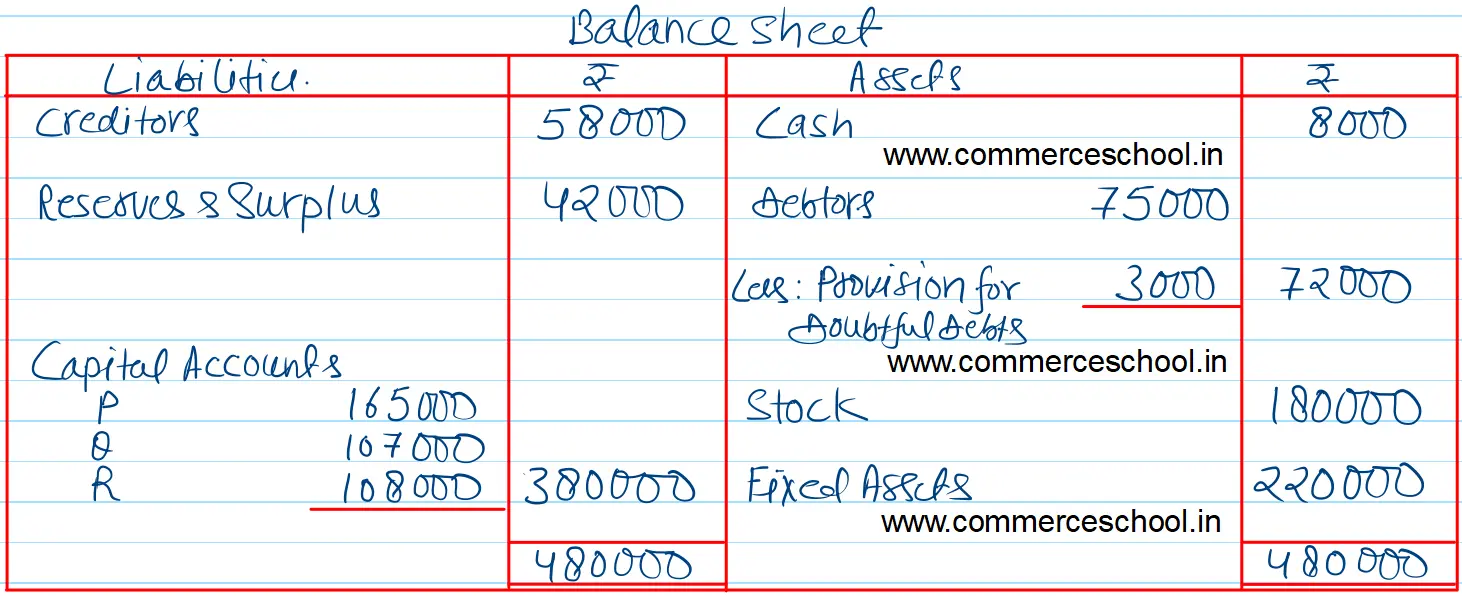

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 58,000 | Cash | |

| Reserves and Surplus | 42,000 |

Debtors 75,000 Less PDD 3,000 |

72,000 |

|

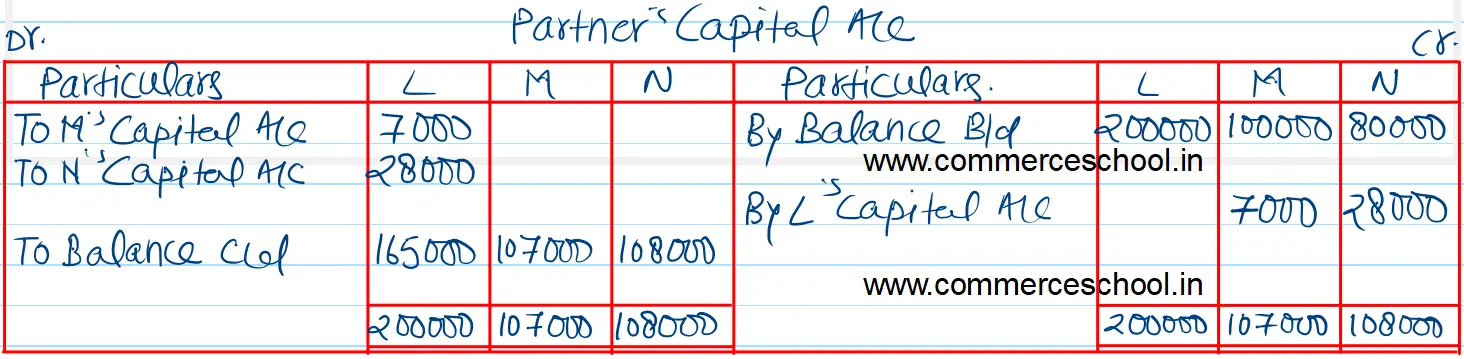

Capital Accounts: L M N |

2,00,000 1,00,000 80,000 |

Stock | 1,80,000 |

| Fixed Assets | 2,20,000 | ||

| 4,80,000 | 4,80,000 |

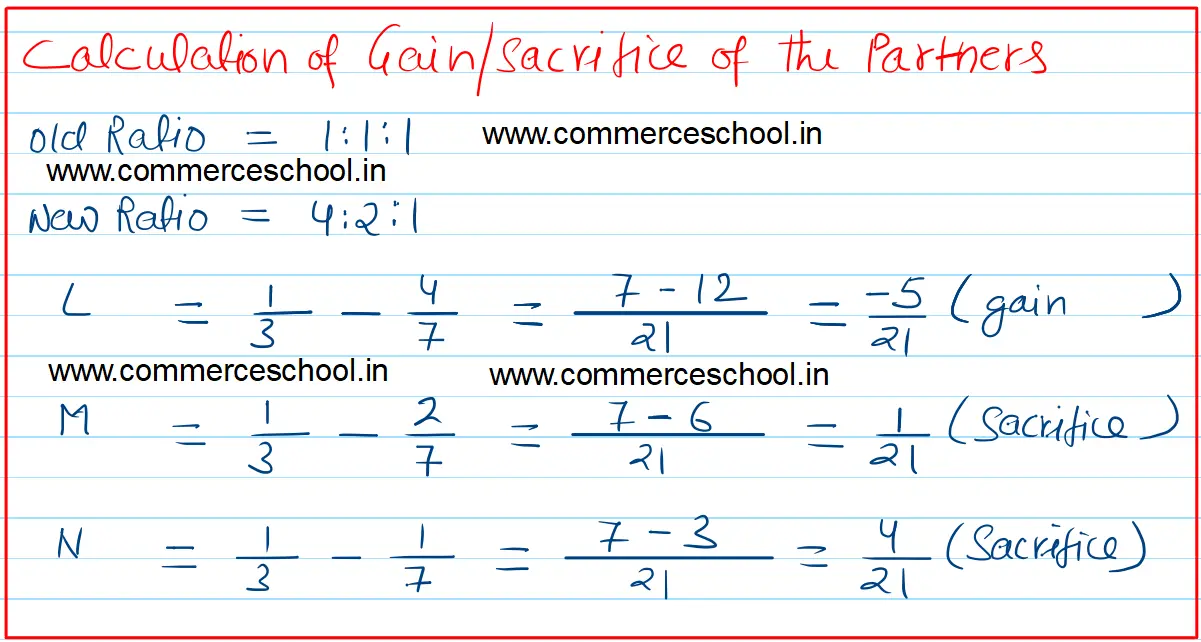

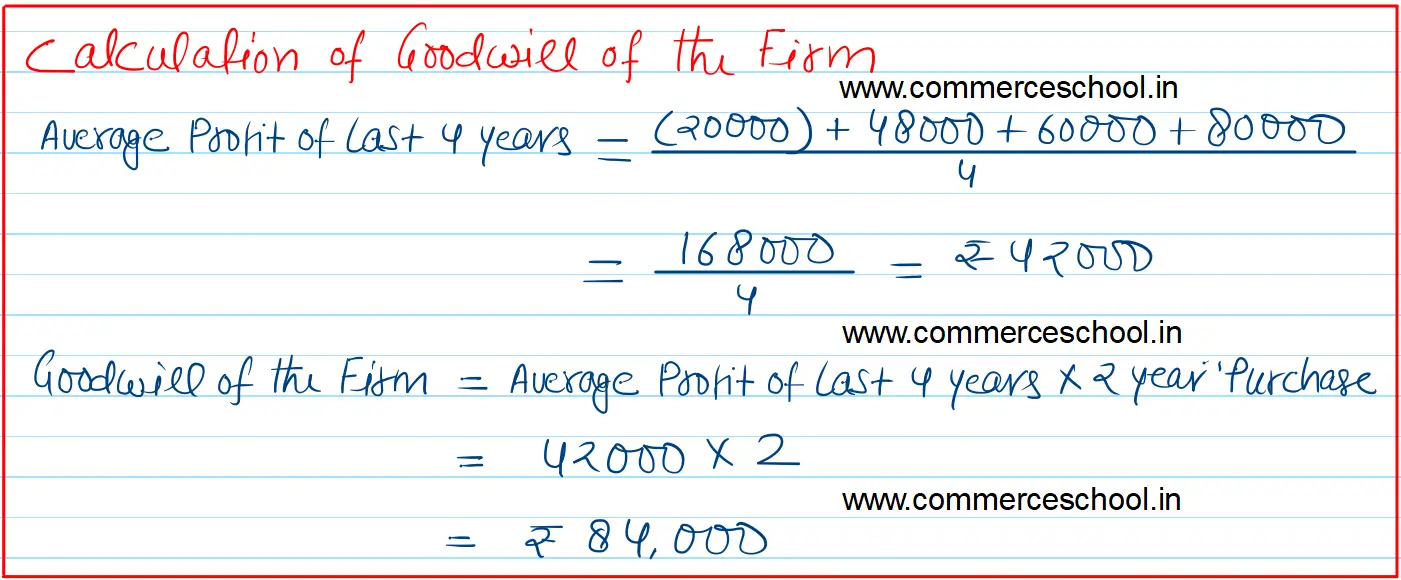

The partners decided that with effect from 1st April 2021, they will share profits and losses in the ratio of 4 : 2 : 1. For this purpose goodwill is to be valued at 2 year’s purchase of the average profits of the last four years, which were:

| Year ending 31st March 2018 | 20,000 (Loss) |

| Year ending 31st March 2019 | 48,000 (Profit) |

| Year ending 31st March 2020 | 60,000 (Profit) |

| Year ending 31st March 2021 | 80,000 (Profit) |

They further agreed that:

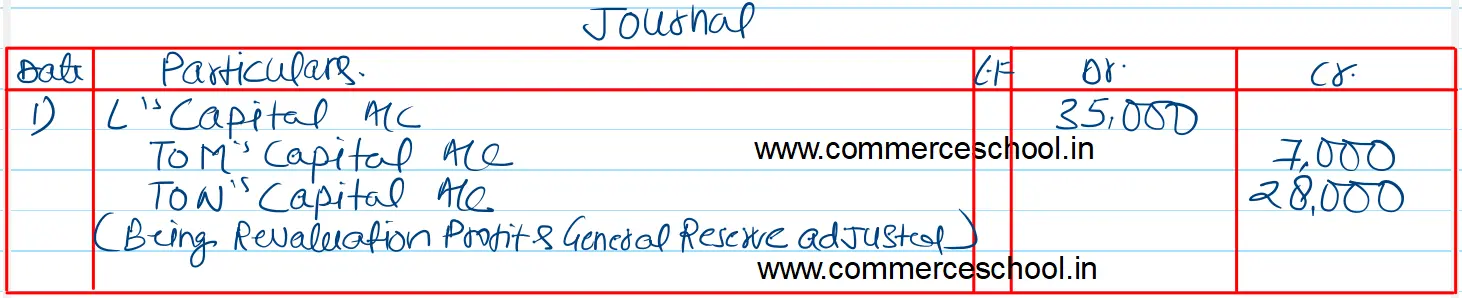

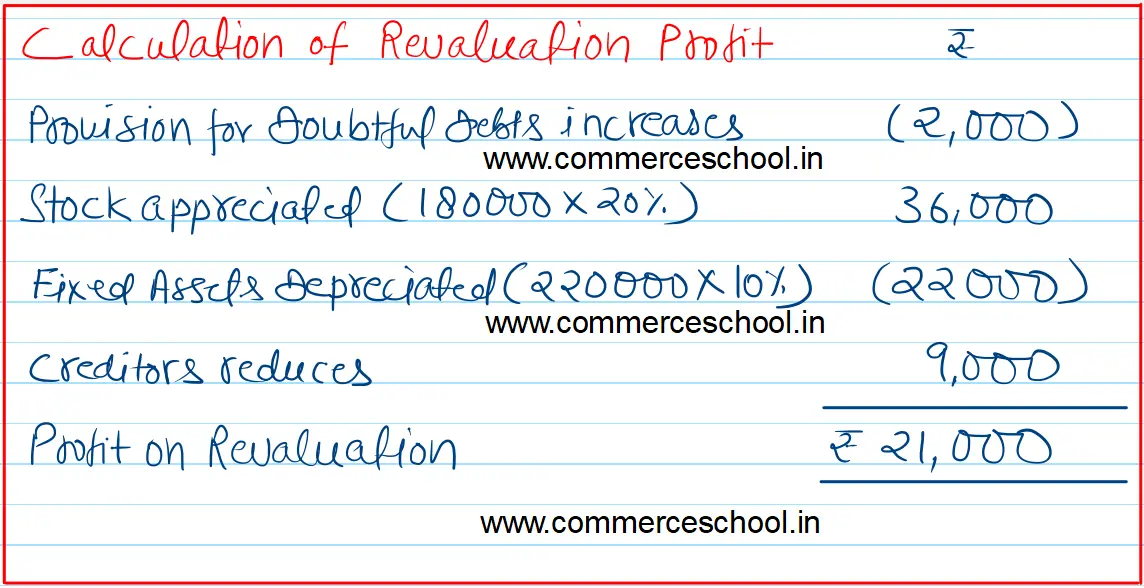

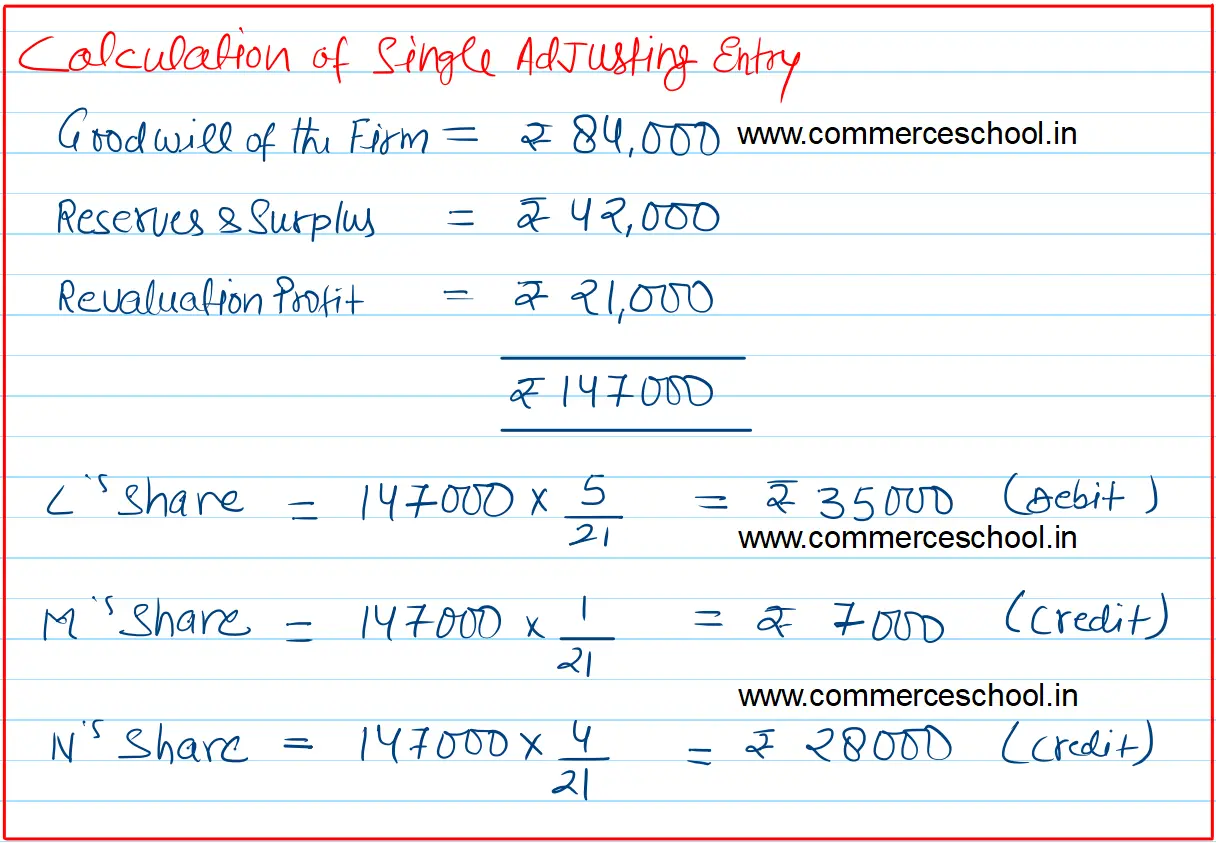

(I) Provision for doubtful debts be increased by ₹ 2,000. (ii) Stock be appreciated by 20% and fixed assets be depreciated by 10%. (iii) Creditors be taken at ₹ 49,000. Partners do not desire to record the revised values of assets and liabilities in the books. They also desire to leave the reserve and surplus undisturbed. You are required to give effect to the change in profit sharing ratio by passing a single journal entry. Also prepare the revised balance Sheet. [Ans. Value of Goodwill ₹ 84,000; Profit on Revaluation ₹ 21,000; Adjustment entry: Debit L by ₹ 35,000 and Credit M and N by ₹ 7,000 and ₹ 28,000 respectively. Total of Balance Sheet ₹ 4,80,000.]