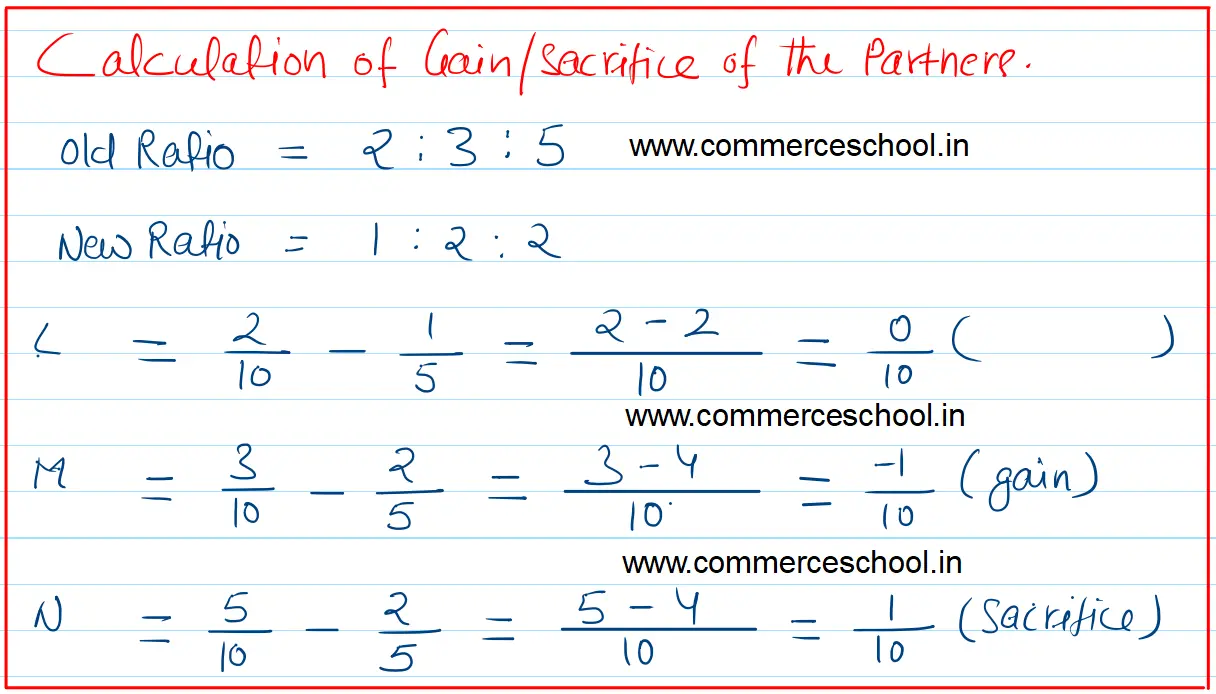

L, M and N were partners in a firm sharing profits in the ratio of 2 : 3 : 5. From 1st April, 2018 they decided to share the profits in the ratio of 1 : 2 : 2

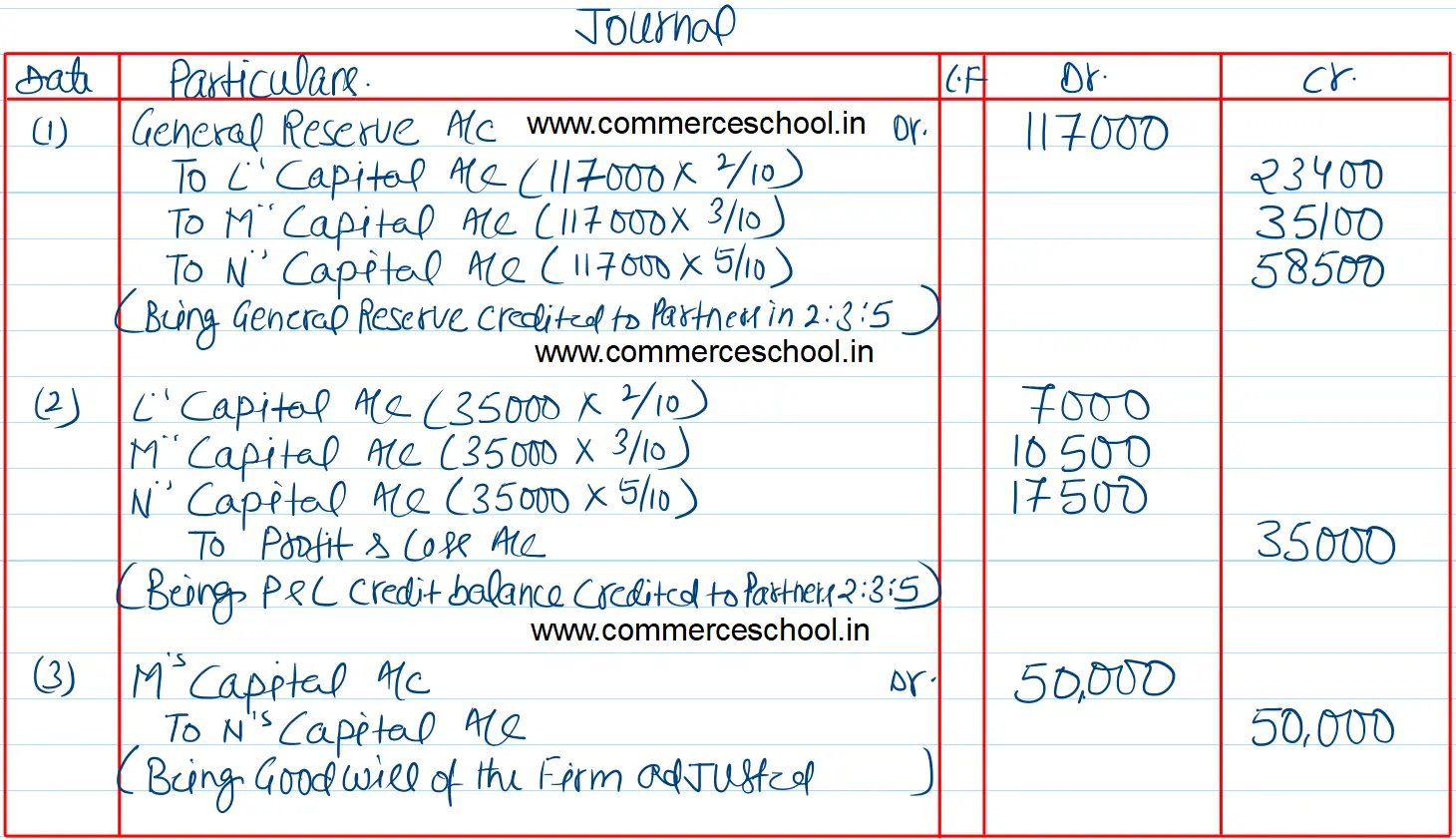

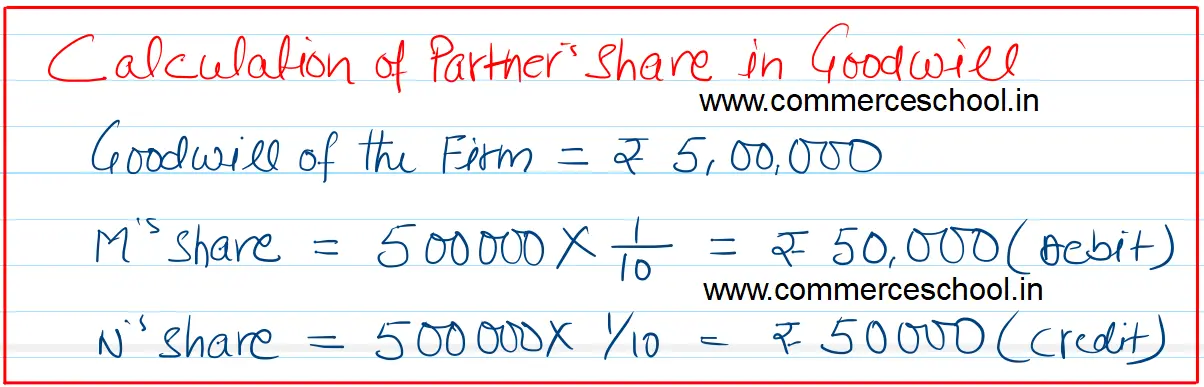

L, M and N were partners in a firm sharing profits in the ratio of 2 : 3 : 5. From 1st April, 2018 they decided to share the profits in the ratio of 1 : 2 : 2. On this date, the Balance Sheet showed a credit balance of ₹ 1,17,000 in General Reserve and a debit balance of ₹ 35,000 in Profit and Loss account. The goodwill of the firm was valued at ₹ 5,00,000. The revaluation of assets and reassessment of liabilities resulted into a gain of ₹ 30,000.

Pass necessary journal entries for the above transactions on the reconstitution of the firm.

[Ans. Adjustment for Goodwill : Dr. M’s Capital A/c and Cr. N’s Capital A/c by ₹ 50,000.]

Anurag Pathak Answered question