X, Y and Z are partners sharing profits and losses in the ratio of 5 : 3 : 2. Their position as at 31st March 2023 was as follows:

X, Y and Z are partners sharing profits and losses in the ratio of 5 : 3 : 2. Their position as at 31st March 2023 was as follows:

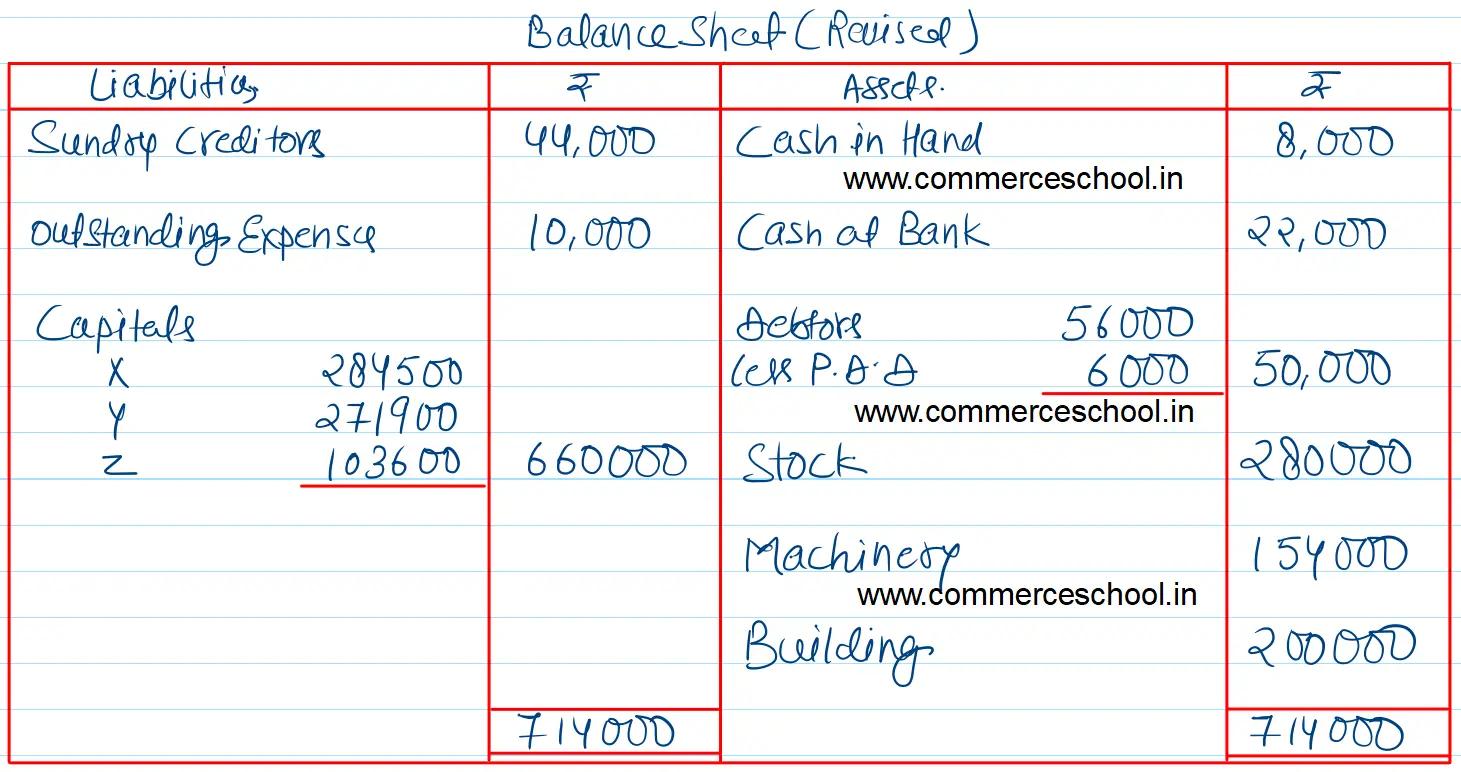

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 44,000 | Cash in Hand | 8,000 |

| Outstanding Expenses | 10,000 | Cash at Bank | 22,000 |

|

Capitals: X Y Z |

2,80,000 2,80,000 1,00,000 |

Debtors 56,000 Less PDD 6,000 |

50,000 |

| Stock | 2,80,000 | ||

| Machinery | 1,54,000 | ||

| Building | 2,00,000 | ||

| 7,14,000 | 7,14,000 |

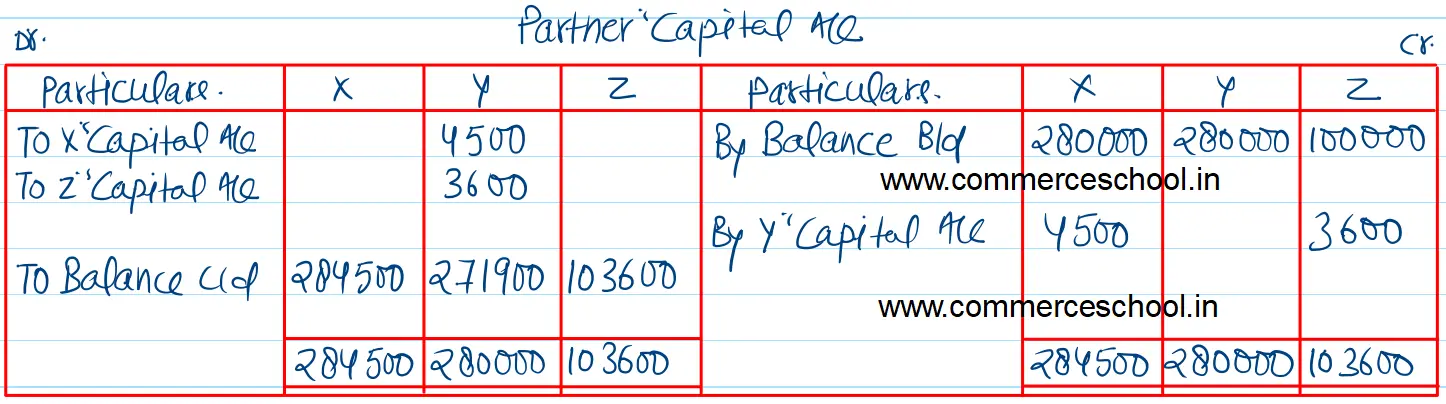

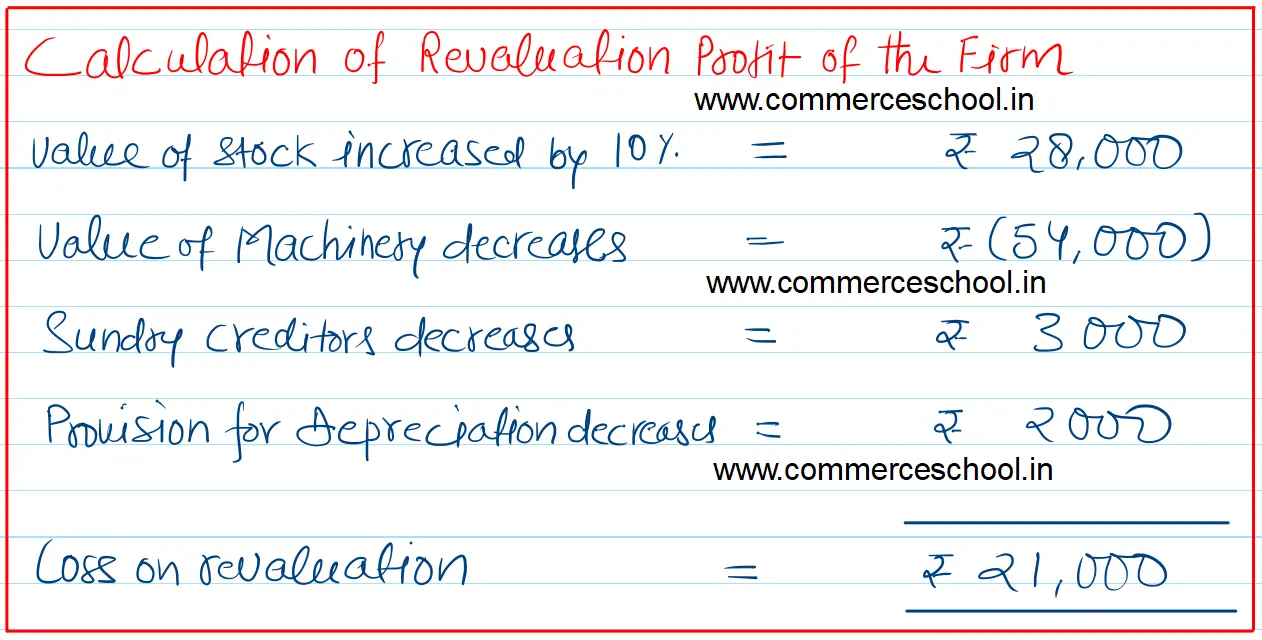

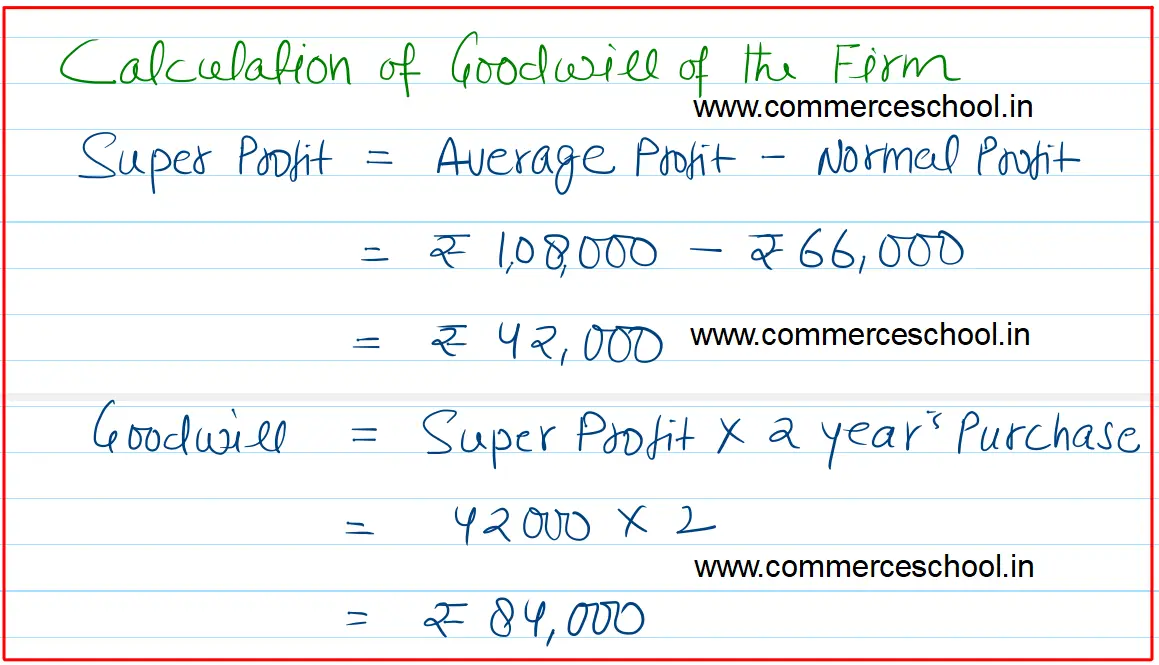

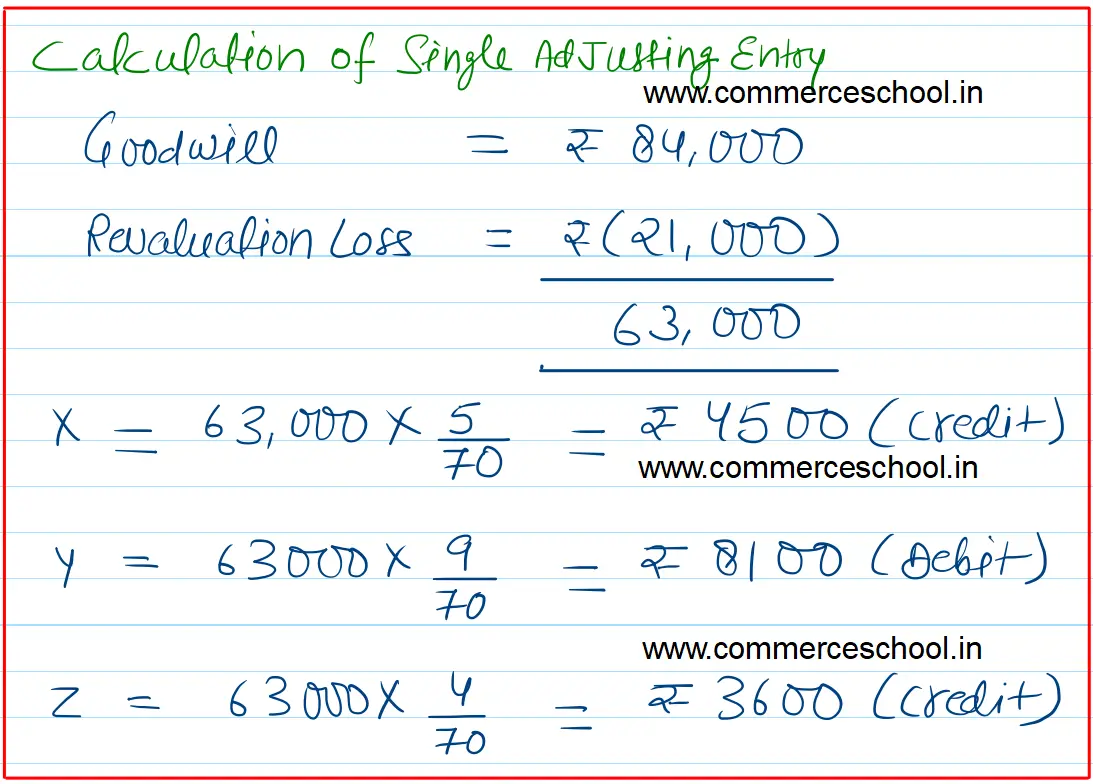

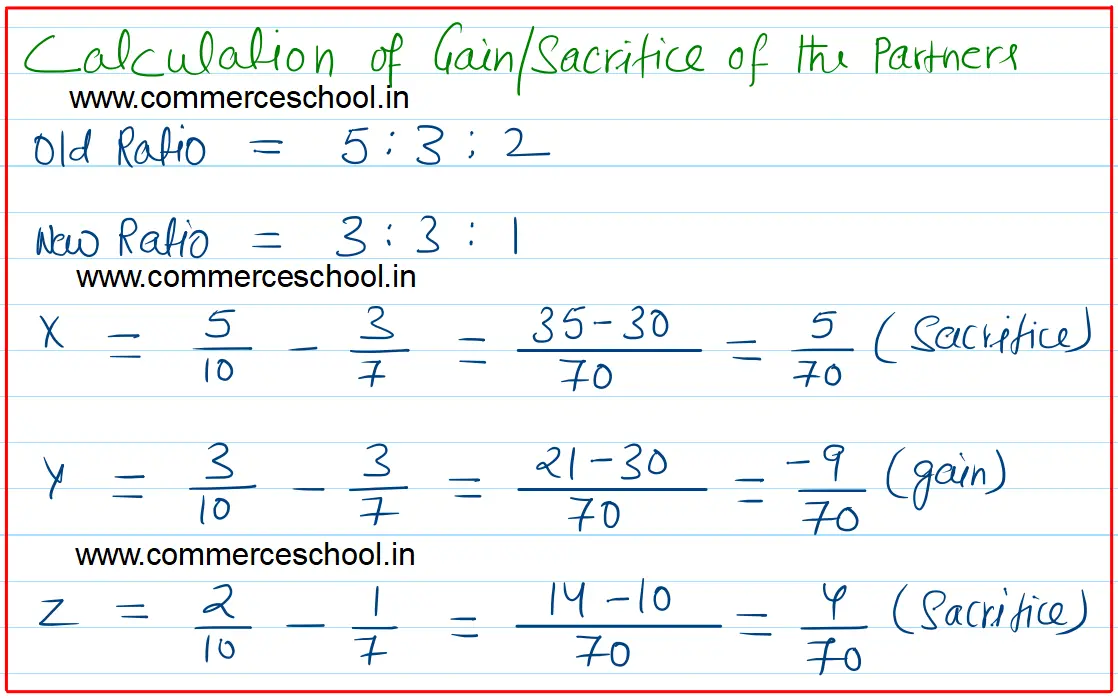

It was decided that with effect from 1st April 2023, profit and loss sharing ratio will be 3 : 3 : 1. They agreed on the following terms: (i) Goodwill of the firm be valued at two year’s purchase of the average super profits of last three years. Average profits of the last three years are ₹ 1,08,000, while the normal profits may be taken at ₹ 66,000. (ii) Provision on debtors be reduced by ₹ 2,000. (iii) Value of stock be increased by 10% and machinery be valued at ₹ 1,00,000. (iv) An item of ₹ 3,000 included in sundry creditors is not likely to be claimed. Partners do not want to record the altered values of assets and liabilities in the books. Pass an entry to give effect to the above and prepare the revised balance sheet. [Ans. Loss on Revaluation ₹ 21,000; Value of Goodwill ₹ 84,000. Debit Y by ₹ 8,100 and Credit X and Z by ₹ 4,500 and ₹ 3,600 respectively. Total of Balance Sheet ₹ 7,14,000.]