The balance in Plant & Machinery account and Accumulated depreciation account as on March 31, 2023 and 2024 stood as follows: Plant & Machinery costing ₹ 12,80,000

The balance in Plant & Machinery account and Accumulated depreciation account as on March 31, 2023 and 2024 stood as follows:

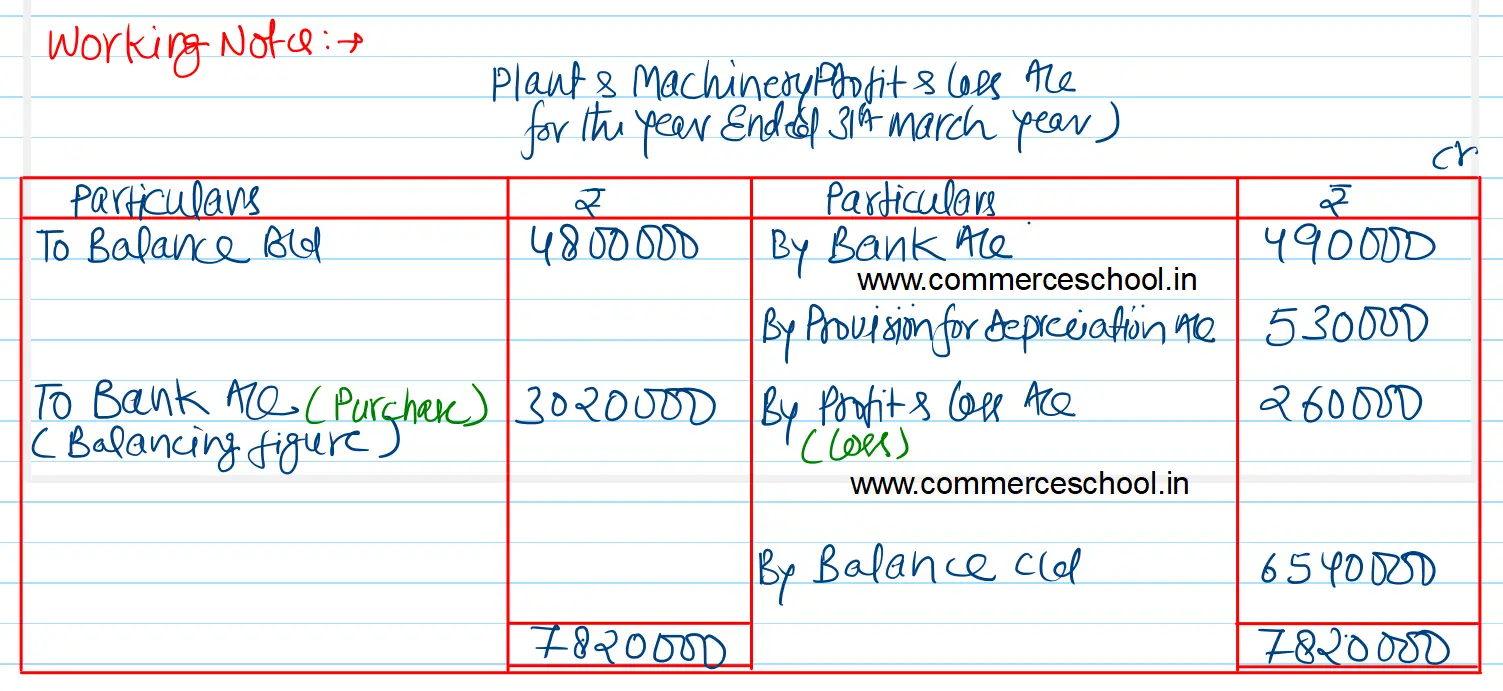

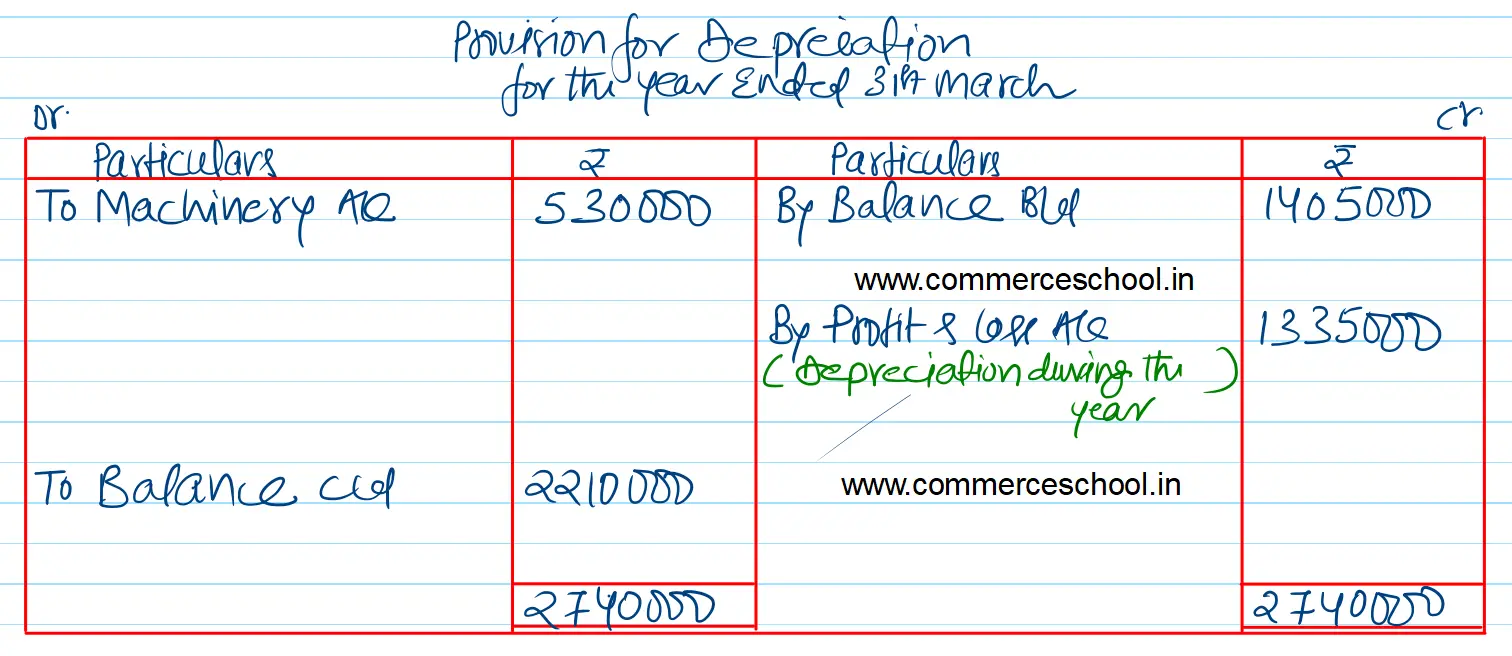

Plant & Machinery costing ₹ 12,80,000 accumulated depreciation thereon ₹ 5,30,000 was sold at a loss of ₹ 2,60,000.

You are required to :

(i) Compute the amount of plant and machinery purchased, sold and depreciation charged for the year.

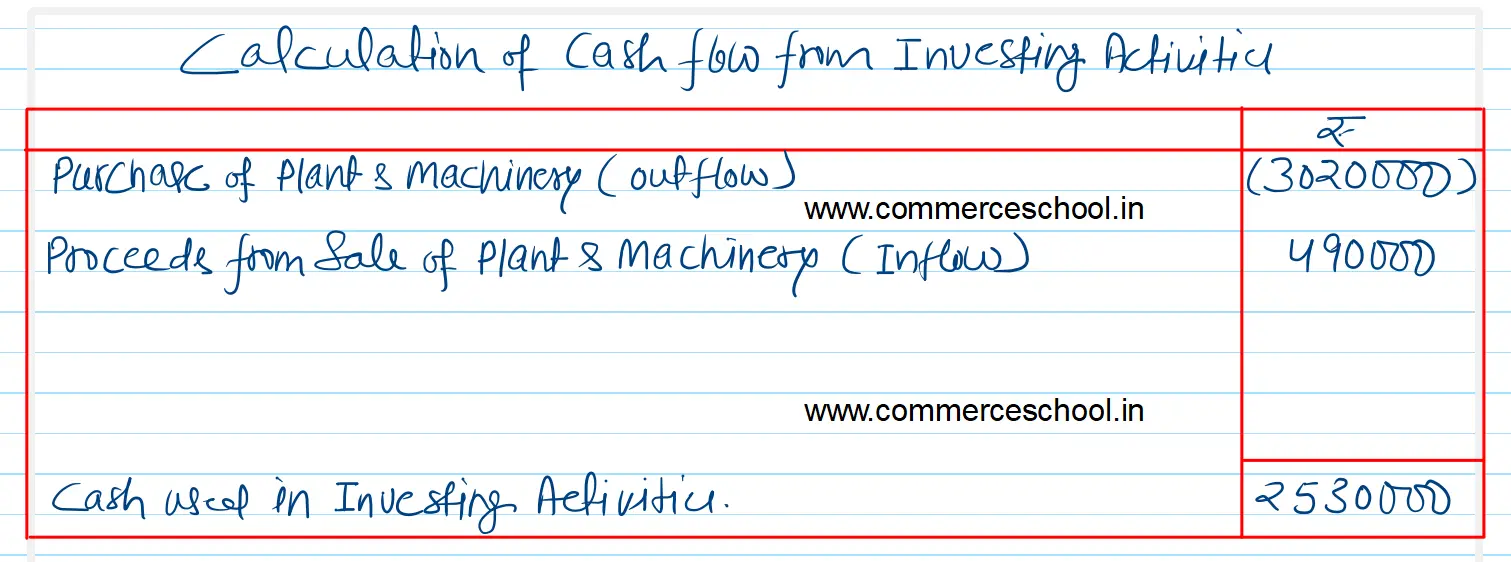

(ii) How each of the item related to plant & machinery will be reported in the statement of cash flows.

[Ans. (i) Inflow from sale of plant & machinery ₹ 4,90,000 and outflow on purchase of plant & machinery ₹ 30,20,000 will be reported under the head ‘Cash flow from investing activities’.

(ii) Loss on sale of plant & machinery ₹ 2,60,000 and current year’s depreciation ₹ 13,35,000 will be added to net profit while computing cash flow from operating activities.]