Prepare a Cash Flow Statement from the following Balance Sheets of Dry Fruits Ltd Share Capital ₹ 2,00,000

Prepare a Cash Flow Statement from the following Balance Sheets of Dry Fruits Ltd.:-

| Particulars | Note. No. | 31st March, 2022 | 31st March, 2021 |

| I. EQUITY AND LIABILITIES: | |||

|

(1) Shareholder’s Funds: (a) Share Capital (b) Reserve and Surplus |

2,00,000 84,000 |

2,00,000 (8,000) |

|

|

(2) Non-Current Liabilities: Long-term Borrowings |

1,35,000 | 1,00,000 | |

|

(3) Current Liabilities (a) Trade Payables |

68,000 | 62,000 | |

| Total | 4,87,000 | 3,54,000 | |

| II. ASSETS: | |||

|

(1) Non-Current Assets: (a) Property, Plant and Equipment and Intangible Assets (i) Property, Plant and Equipment |

1,20,000 | 1,30,000 | |

|

(2) Current Assets: (a) Current Investments (Marketable Securities) (b) Inventories (c) Trade Receivables (d) Cash & Cash Balance |

22,000 61,000 40,000 2,44,000 |

15,000 80,000 29,000 1,00,000 |

|

| Total | 4,87,000 | 3,54,000 |

Notes to Accounts:-

| 31.3.2022 (₹) | 31.3.2021 (₹) | |

|

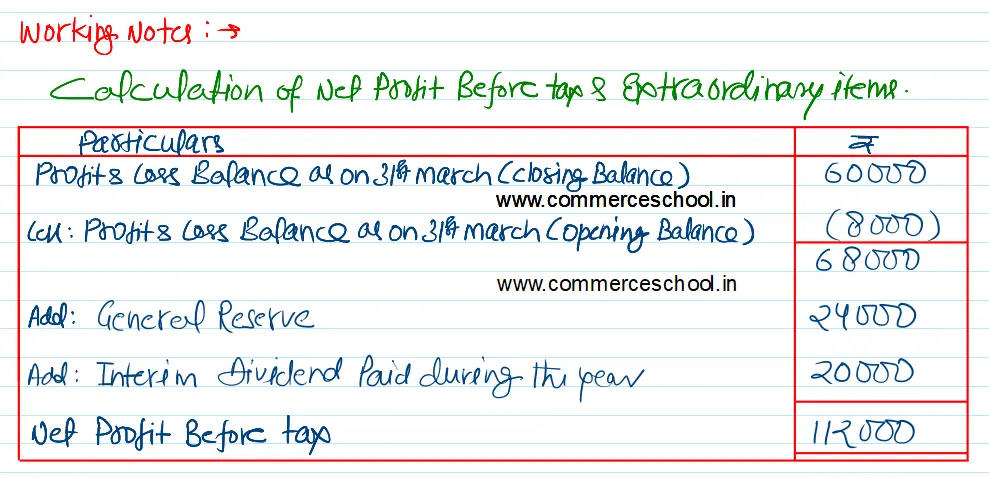

(1) Reserve & Surplus: General Reserve Profit & Loss Balance |

24,000 60,000 |

__ (8,000) |

| 84,000 | (8,000) | |

|

(2) Long-term Borrowings: 12% Mortgage Loan |

1,35,000 | 1,00,000 |

|

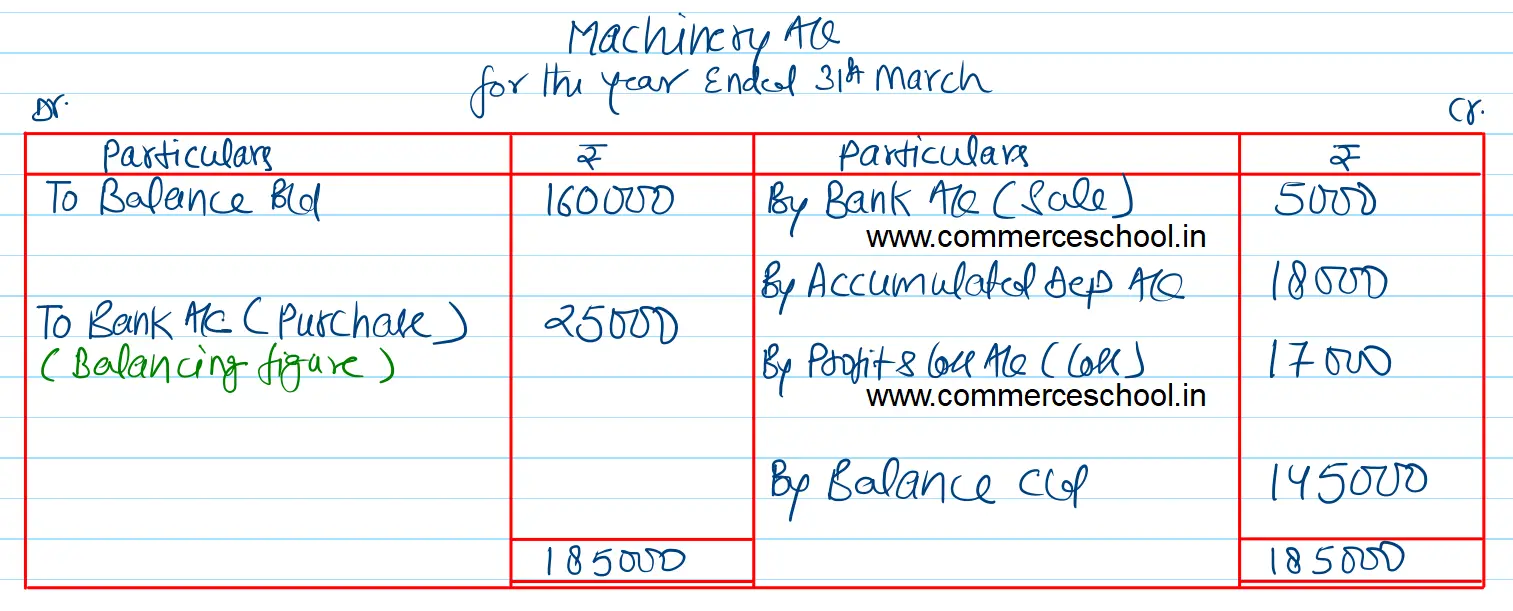

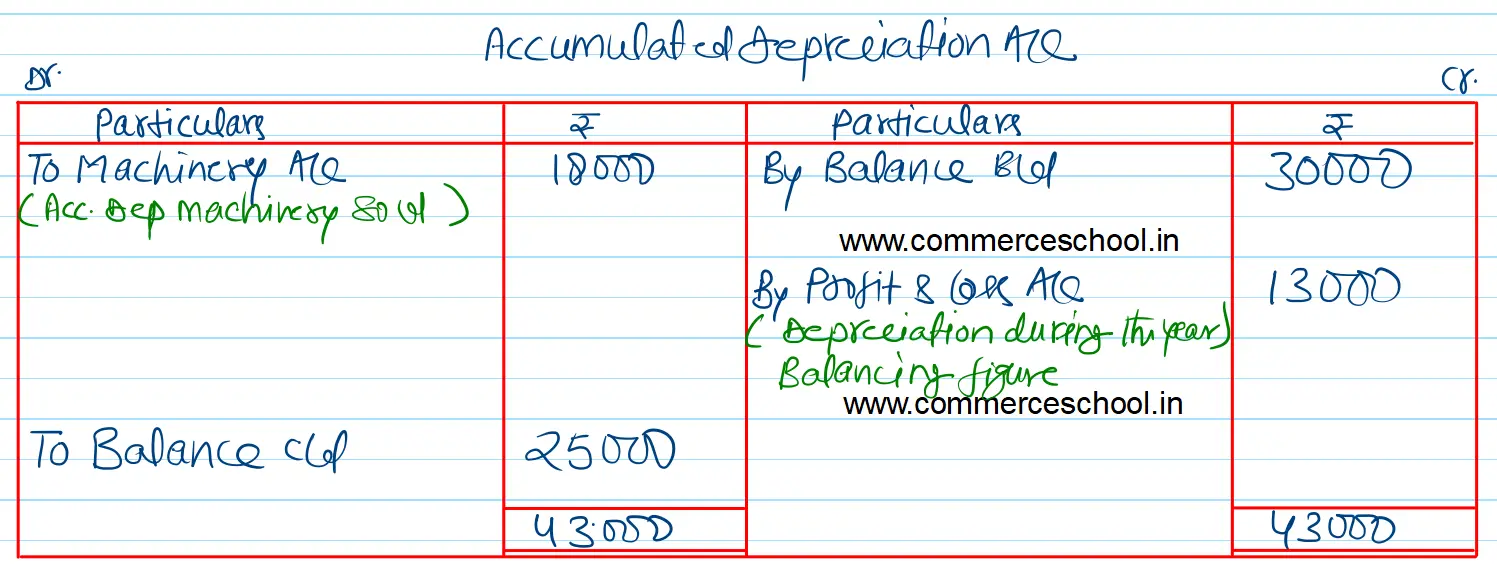

(3) Property, Plant and Equipment Machinery Less: Accumulated Depreciation |

1,45,000 25,000 |

1,60,000 30,000 |

| 1,20,000 | 1,30,000 |

Additional Information:-

(1) Interest paid on mortgage loan amounted to ₹ 14,100.

(2) Interim Dividend paid during the year ₹ 20,000.

(3) Machinery costing ₹ 40,000 (accumulated depreciation thereon being ₹ 18,000) was sold for ₹ 5,000.

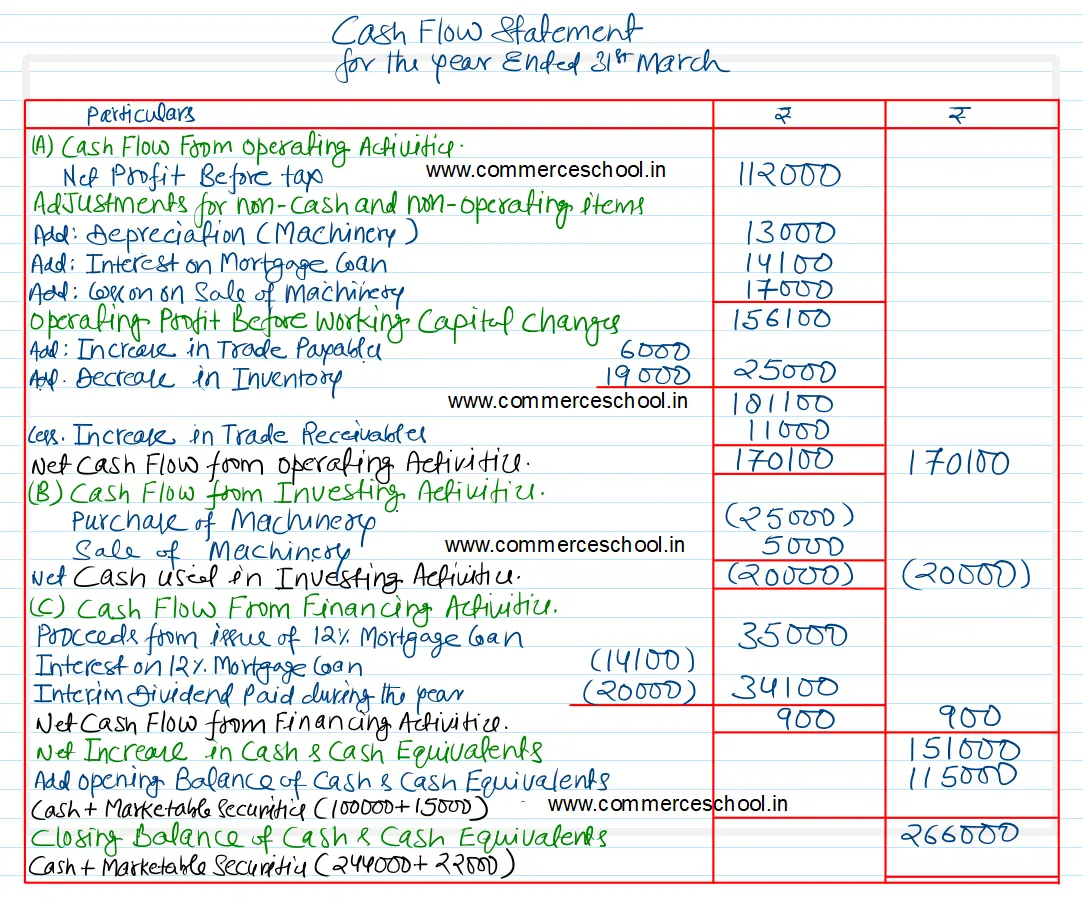

[Ans. Cash from operating activities ₹ 1,70,100; Cash used in investing activities ₹ 20,000; and Cash from financing activities ₹ 900.]