Prepare a Cash Flow Statement from the Balance Sheets given below Share Capital ₹ 5,00,000 Reserves & Surplus ₹ 2,25,000

Prepare a Cash Flow Statement from the Balance Sheets given below:-

| Particulars | Note. No. | 31st March, 2023 | 31st March, 2022 |

| I. EQUITY AND LIABILITIES: | |||

|

(1) Shareholder’s Funds: (a) Share Capital (b) Reserves & Surplus |

5,00,000 2,25,000 | 5,00,000 90,000 | |

|

(2) Non-Current Liabilities Long-term Borrowings |

25,000 | — | |

|

(2) Current Liabilities: (a) Trade Payables (b) Short-term Provisions |

1,00,000 15,000 | 80,000 20,000 | |

| Total | 8,65,000 | 6,90,000 | |

| II. ASSETS: | |||

|

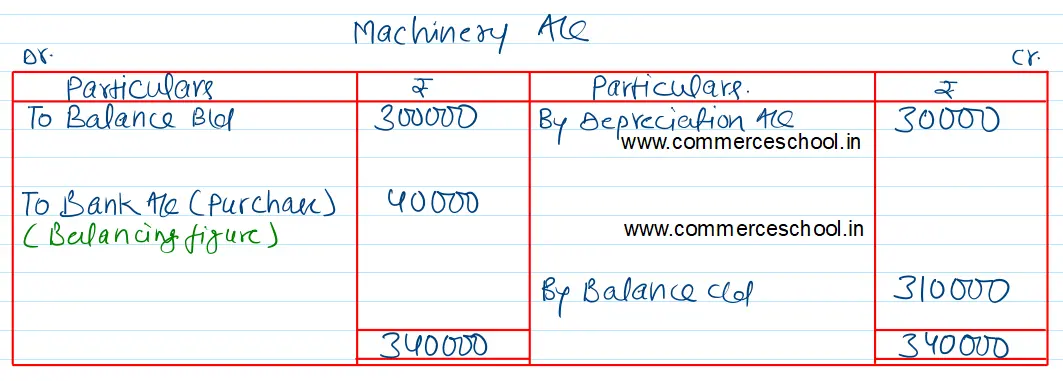

(1) Non-Current Assets: (a) Property, Plant and Equipment and Intangible Assets (i) Property, Plant and Equipment (Machinery) |

3,10,000 | 3,00,000 | |

|

(2) Current Assets: (a) Current Investments (b) Inventory (c) Trade Receivables (d) Cash & Bank Balance |

16,000 3,20,000 2,00,000 19,000 |

20,000 1,50,000 2,10,000 10,000 |

|

| Total | 8,65,000 | 6,90,000 |

Notes to Accounts:-

| 31.3.2023 | 31.3.2022 | |

|

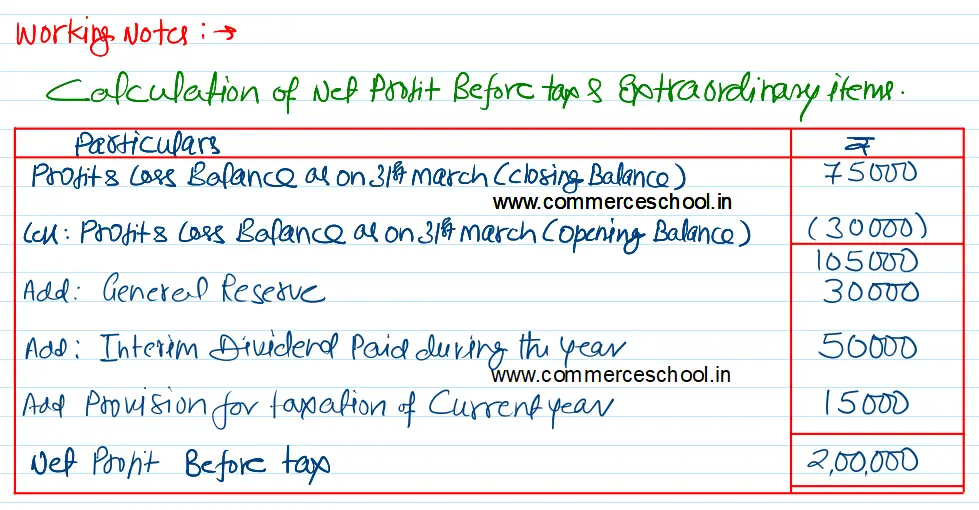

(1) Reserve & Surplus General Reserve Profit & Loss Balance |

1,50,000 75,000 |

1,20,000 (30,000) |

| 2,25,000 | 90,000 | |

|

(2) Long-term Borrowings: Mortgage Loan |

25,000 | — |

|

(3) Short-term Provision Income Tax Provision |

15,000 | 20,000 |

Additional Information:-

(i) Depreciation written off on machinery @ 10% on last year’s balance.

(ii) Interim Dividend paid during the year @ 10% on Share Capital.

(iii) Mortgage Loan was taken on 1st July 2022 @ 10% p.a. Interest has been paid up-to date.

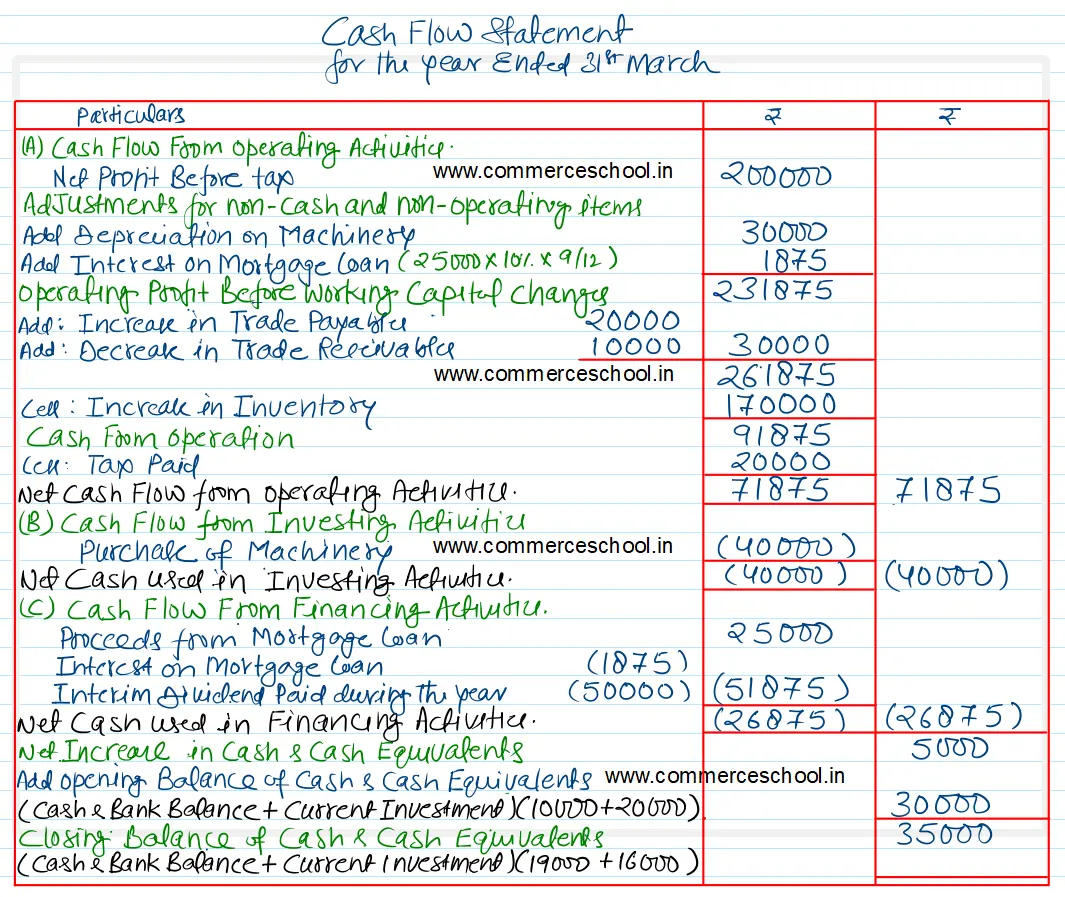

[Ans. Cash from Operating activities ₹ 71,875; Cash used in investing activities ₹ 40,000; and Cash used in financing activities ₹ 26,875.]

Hint. Current Investments will be included in Cash & Cash Equivalents.