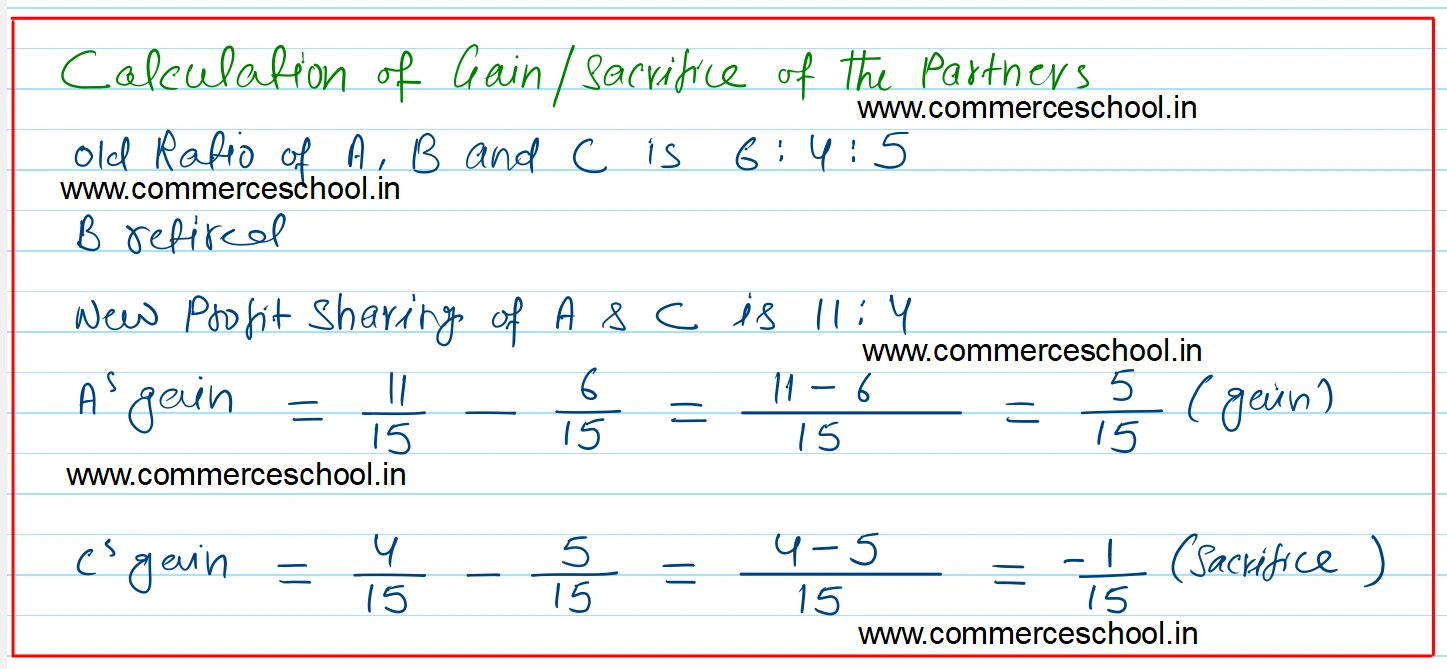

A, B and C were partners sharing profits in the ratio of 6 : 4 : 5. Their capitals were A – ₹ 1,00,000, B – ₹ 80,000 and C – ₹ 60,000. On 1st April 2023, B retired from the firm and the new profit sharing ratio between A and C was decided as 11 : 4

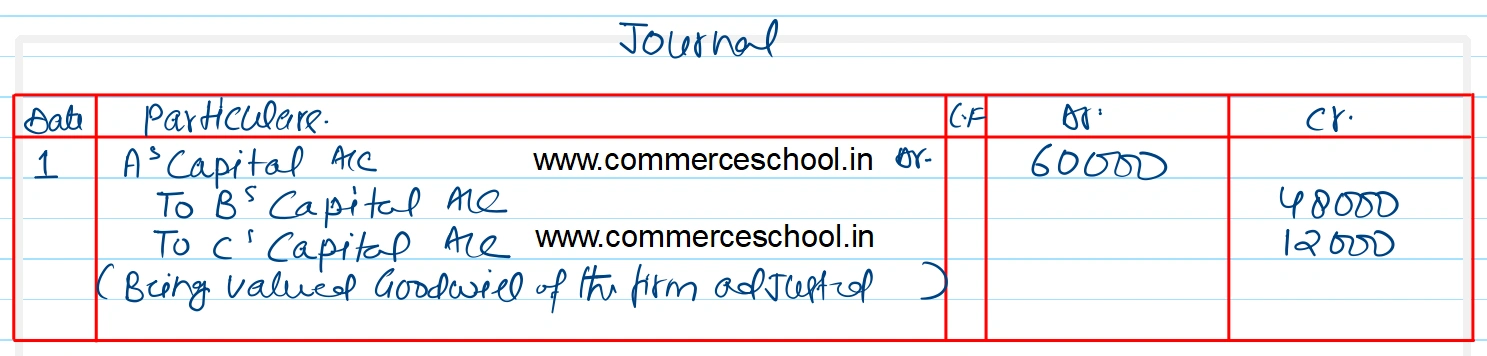

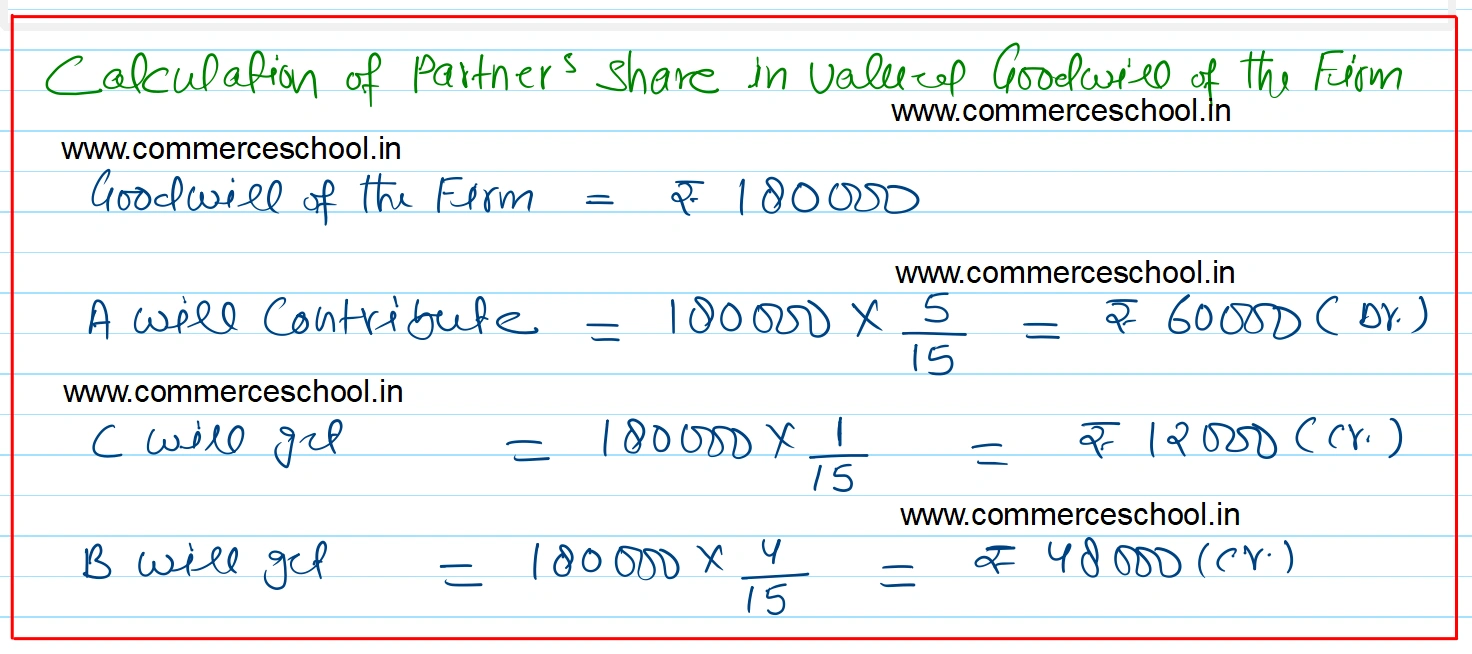

A, B and C were partners sharing profits in the ratio of 6 : 4 : 5. Their capitals were A – ₹ 1,00,000, B – ₹ 80,000 and C – ₹ 60,000. On 1st April 2023, B retired from the firm and the new profit sharing ratio between A and C was decided as 11 : 4. On B’s retirement the goodwill of the firm was valued at ₹ 1,80,000. Showing your calculations clearly pass necessary journal entry for the treatment of goodwill on B’s retirement.

[Ans. Only A gains 5/15. C has also sacrificed 1/15. Hence A will be debited by ₹ 60,000 and B and C will be credited by ₹ 48,000 and ₹ 12,000 respectively.]

Anurag Pathak Answered question