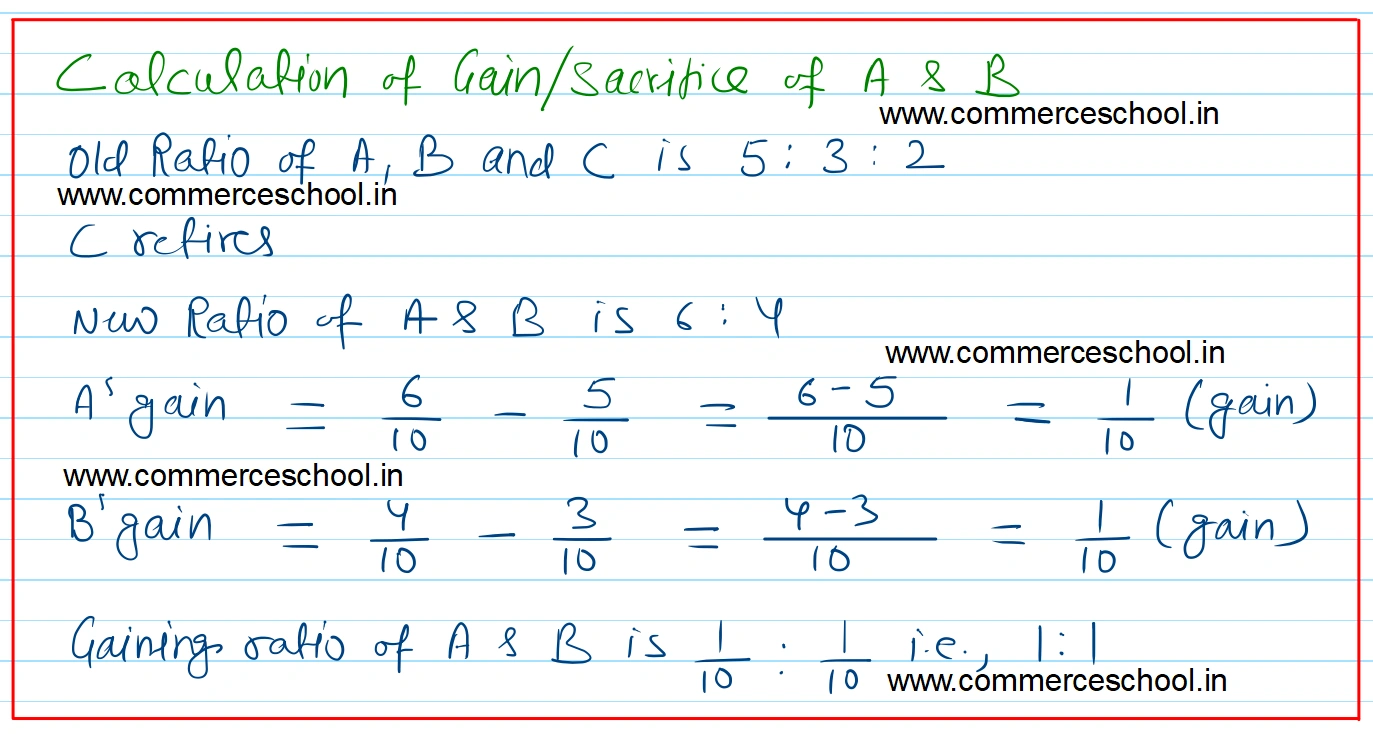

A, B and C are partners sharing profits in the ratio of 5 : 3 : 2. C retires and A and B agree to share future profits in the ratio of 6 : 4

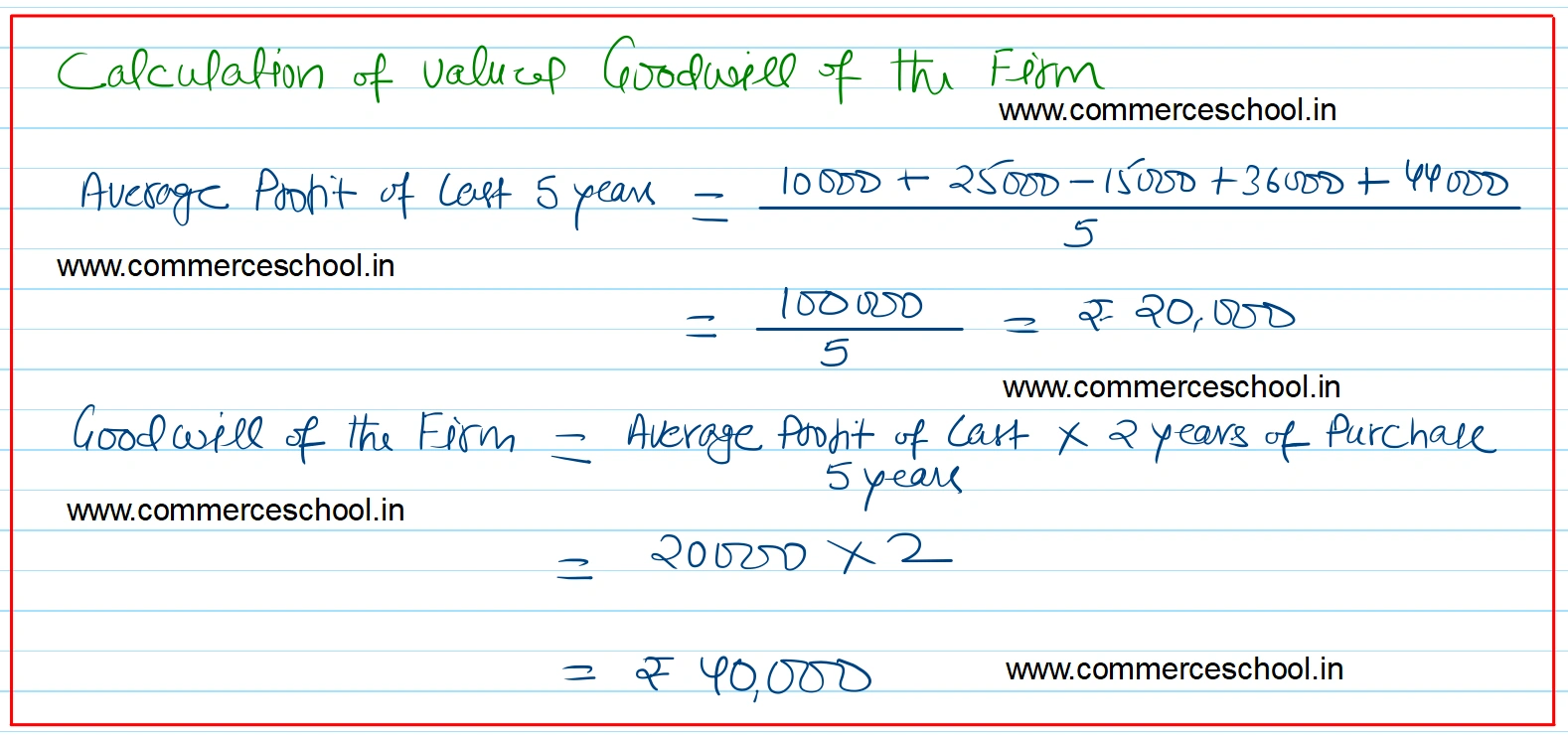

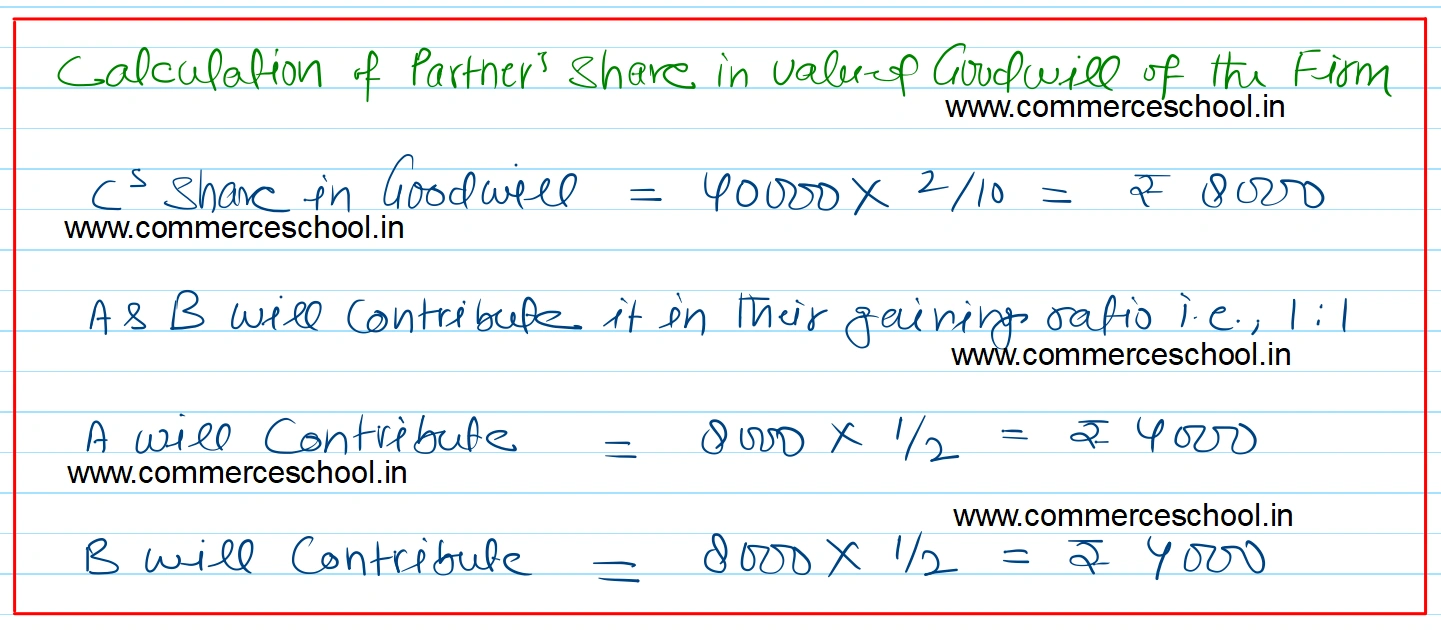

A, B and C are partners sharing profits in the ratio of 5 : 3 : 2. C retires and A and B agree to share future profits in the ratio of 6 : 4. Goodwill is to be taken at two year’s purchase of the average profits of the last 5 years, which were ₹ 10,000′ ₹ 25,000; ₹ 15,000 (Loss); ₹ 36,000 and ₹ 44,000 respectively.

At the date of C’s retirement, following balances appeared in the books of the firm:

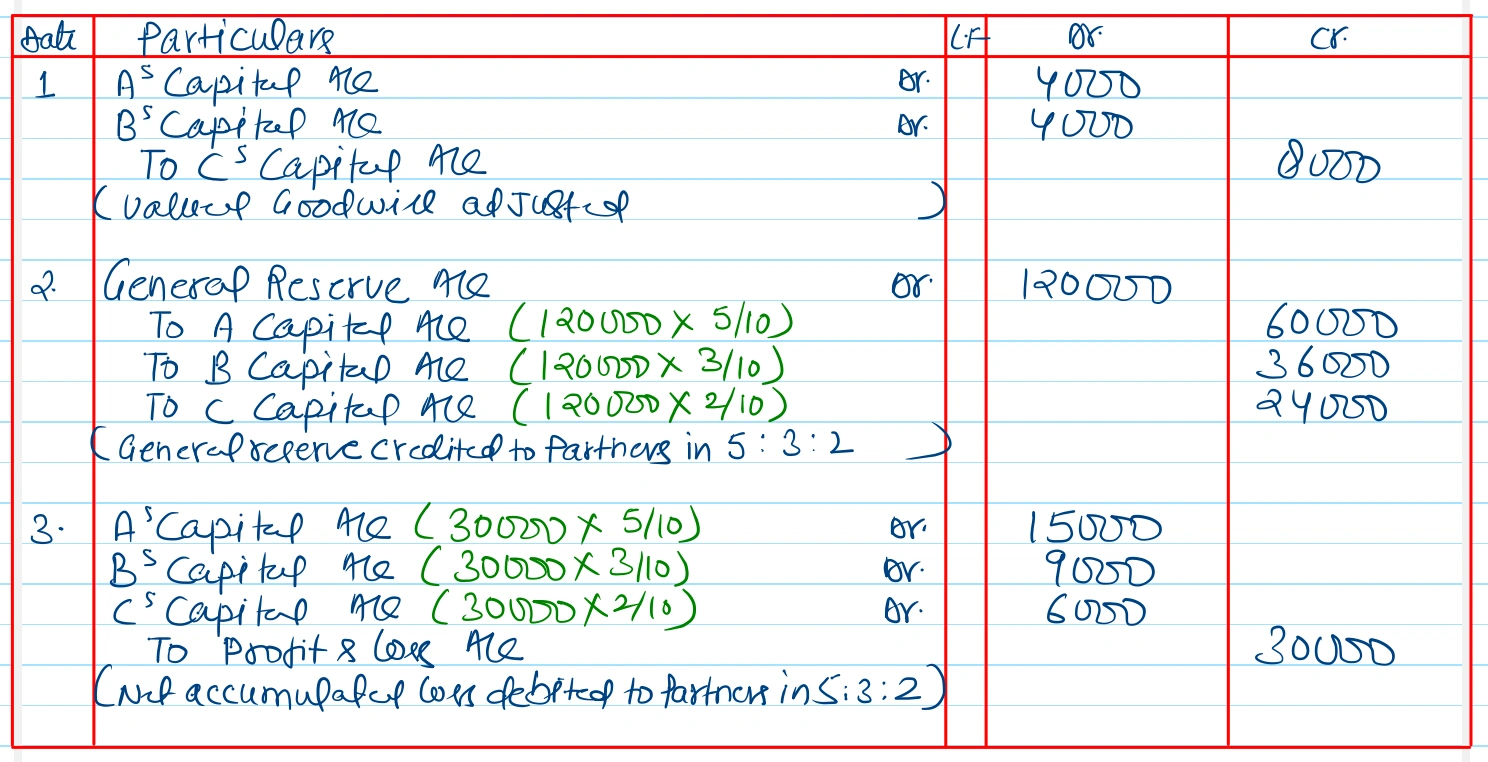

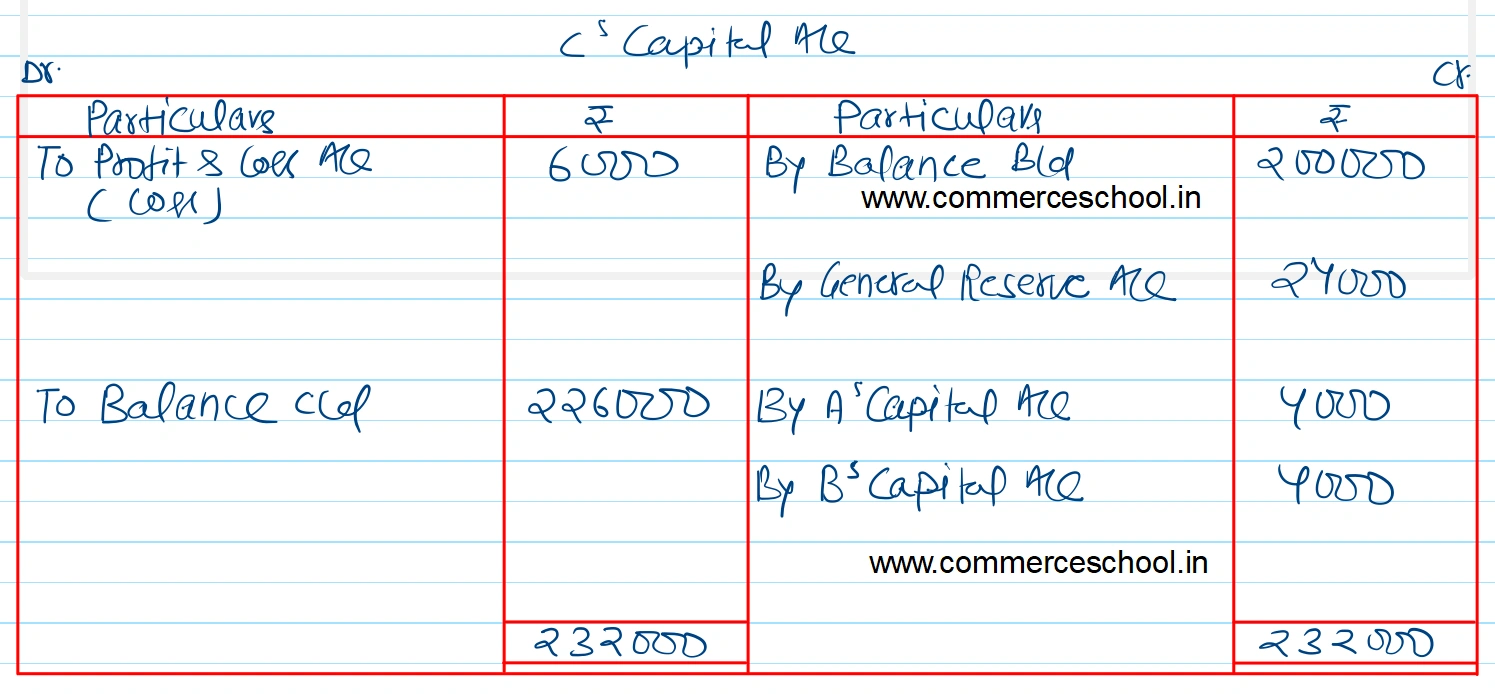

You are required to record necessary journal entries in the books of the firm and prepare C’s Capital Account on his retirement.

[Ans. Amount due to C transferred to his Loan A/c ₹ 2,26,000.]

| ₹ | |

| General Reserve | 1,20,000 |

| Profit & Loss Account (Dr.) | 30,000 |

| C’s Capital | 2,00,000 |

Anurag Pathak Answered question