Anita, Gaurav and Sonu were partners in a firm sharing profits and losses in proportion to their capitals. Their Balance Sheet as at 31st March, 2019 was as follows:

Anita, Gaurav and Sonu were partners in a firm sharing profits and losses in proportion to their capitals. Their Balance Sheet as at 31st March, 2019 was as follows:

Balance Sheet of Anita, Gaurav and Sonu as at 31st March, 2019

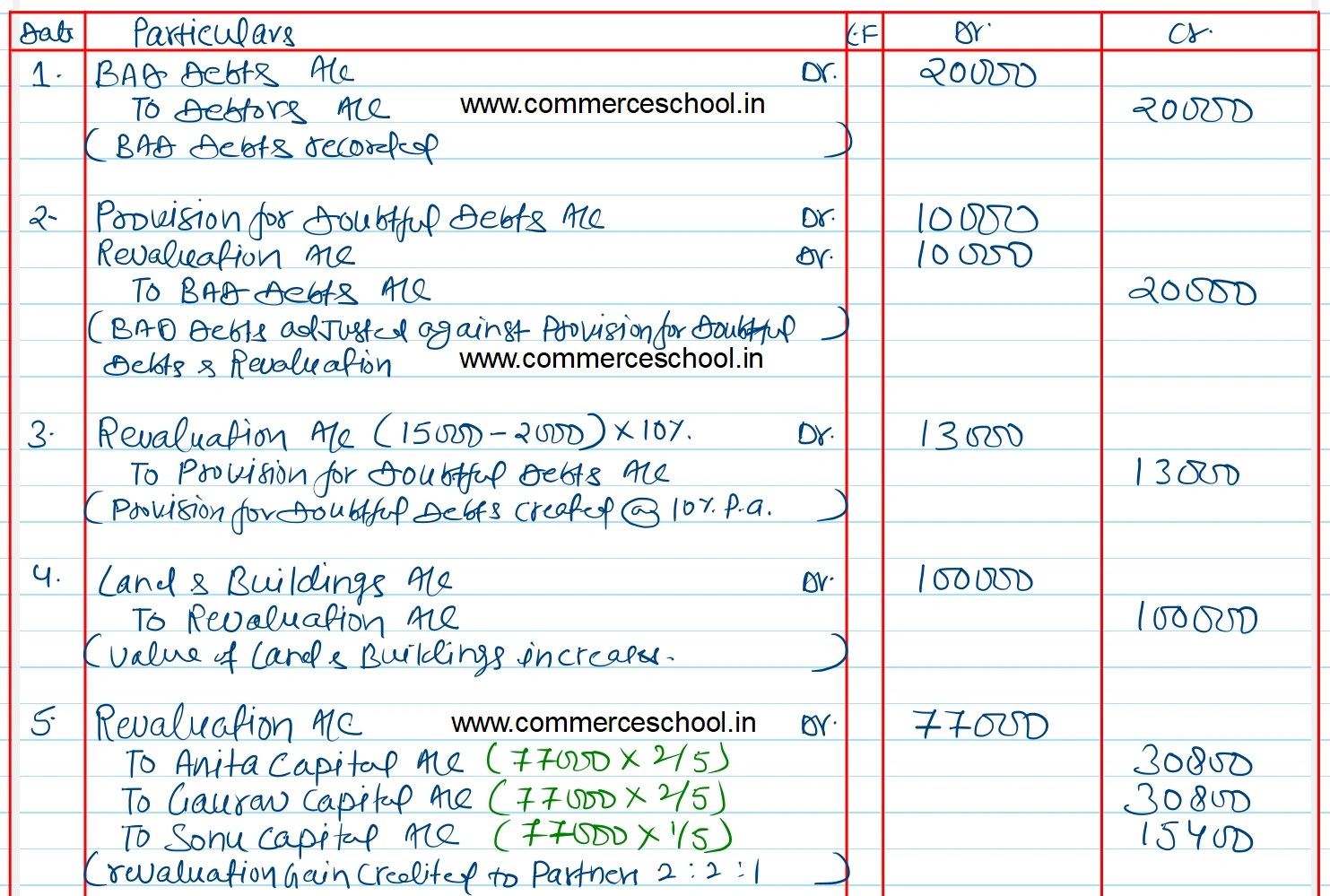

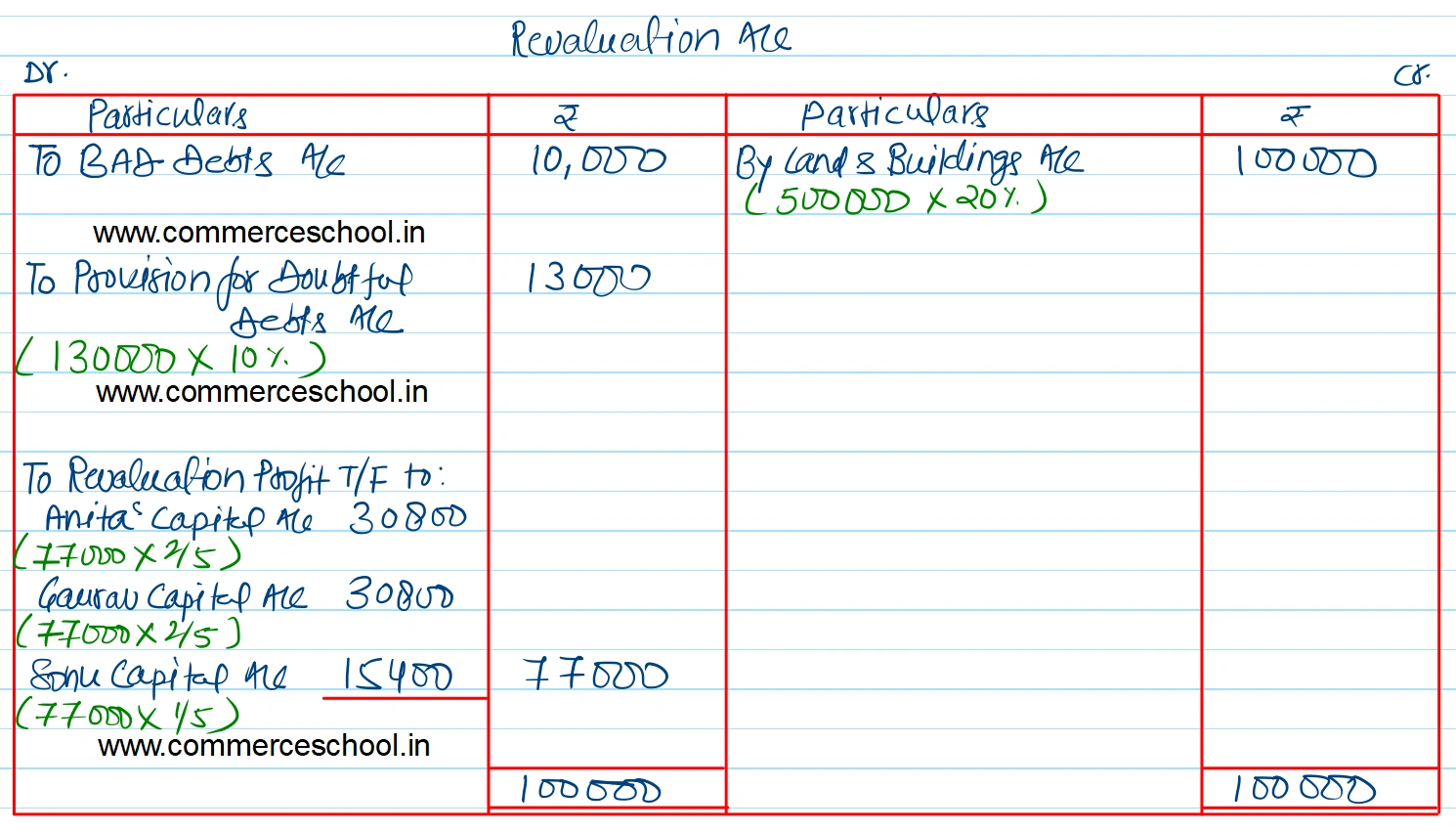

On the above date, Anita retired from the firm and the remaining partners decided to carry on the business. It was agreed to revalue the assets and reassess the liabilities as follows:

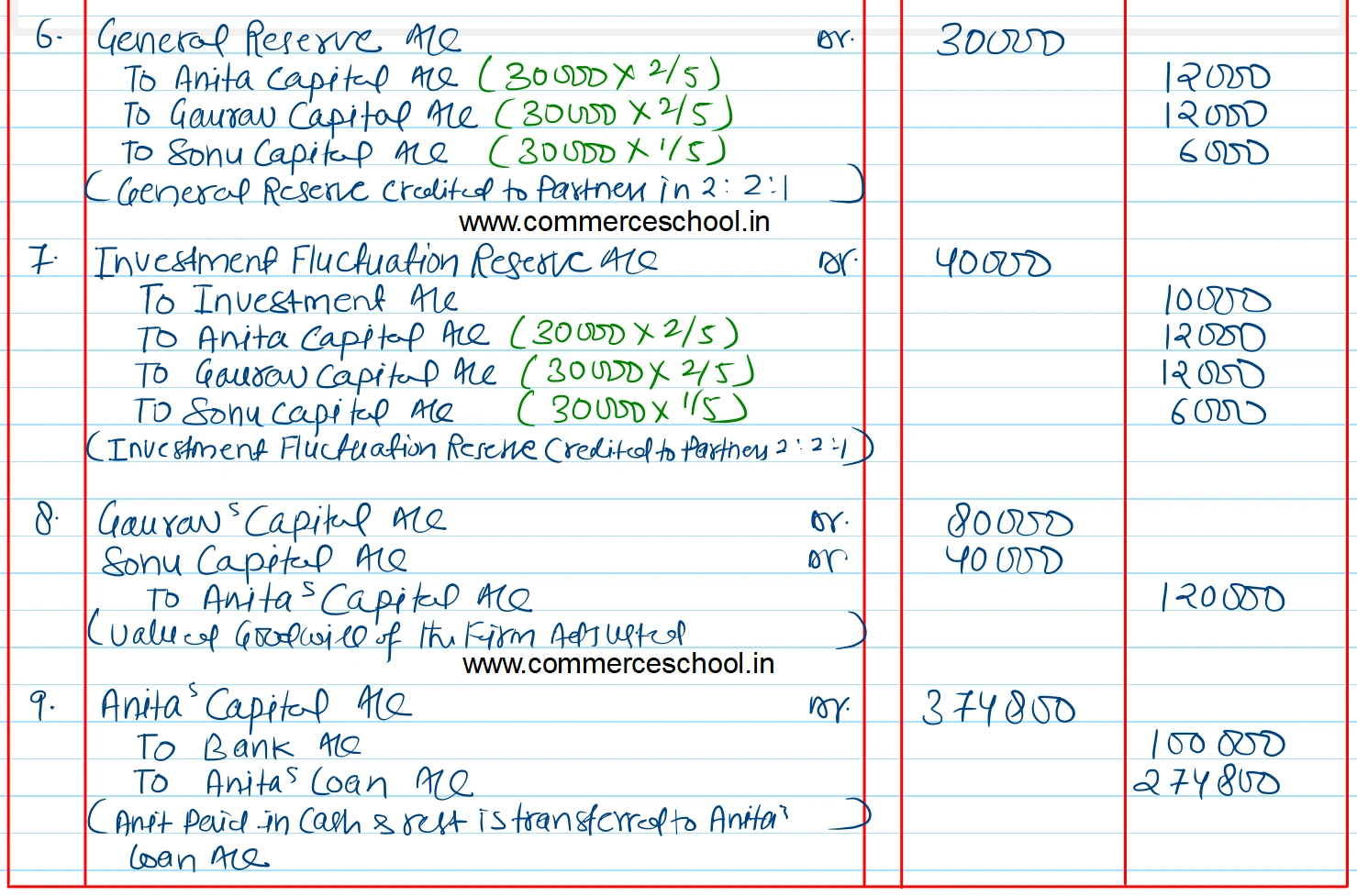

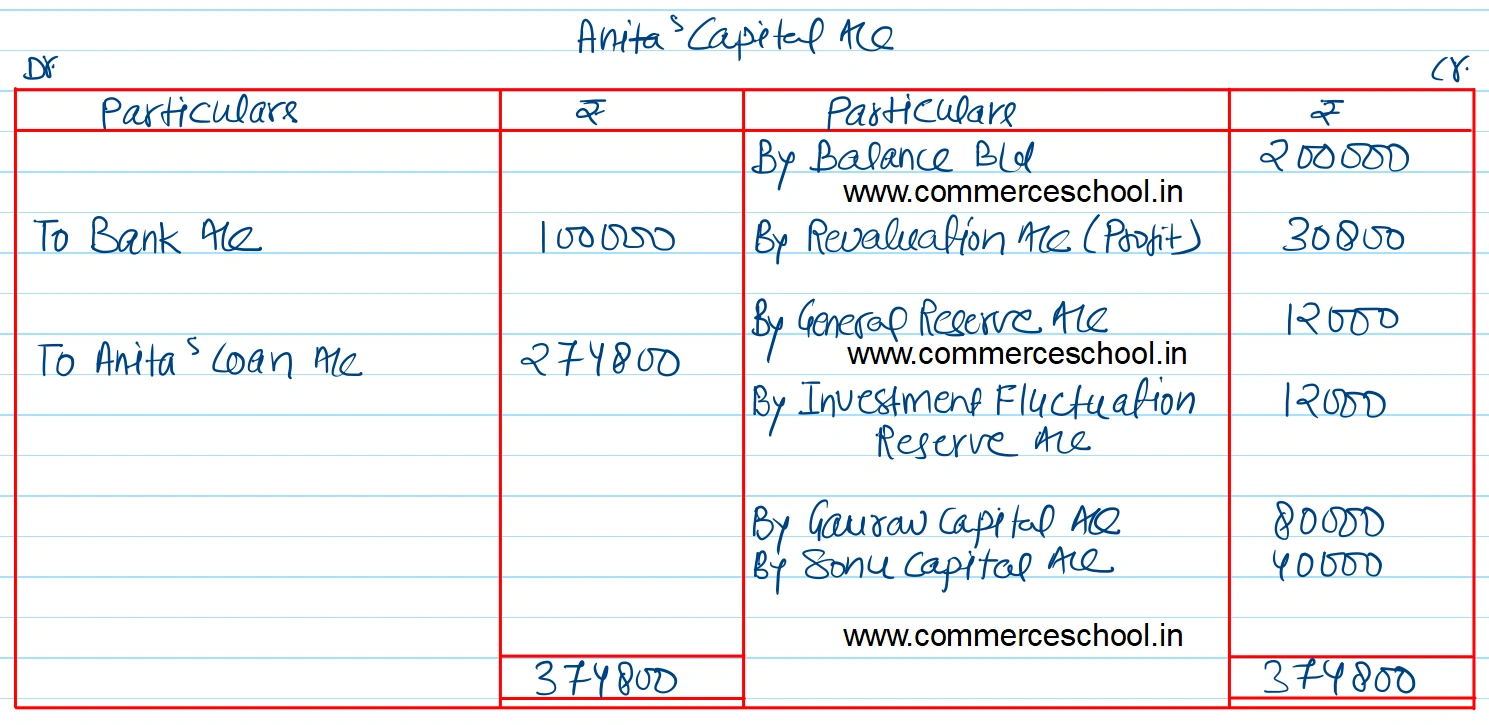

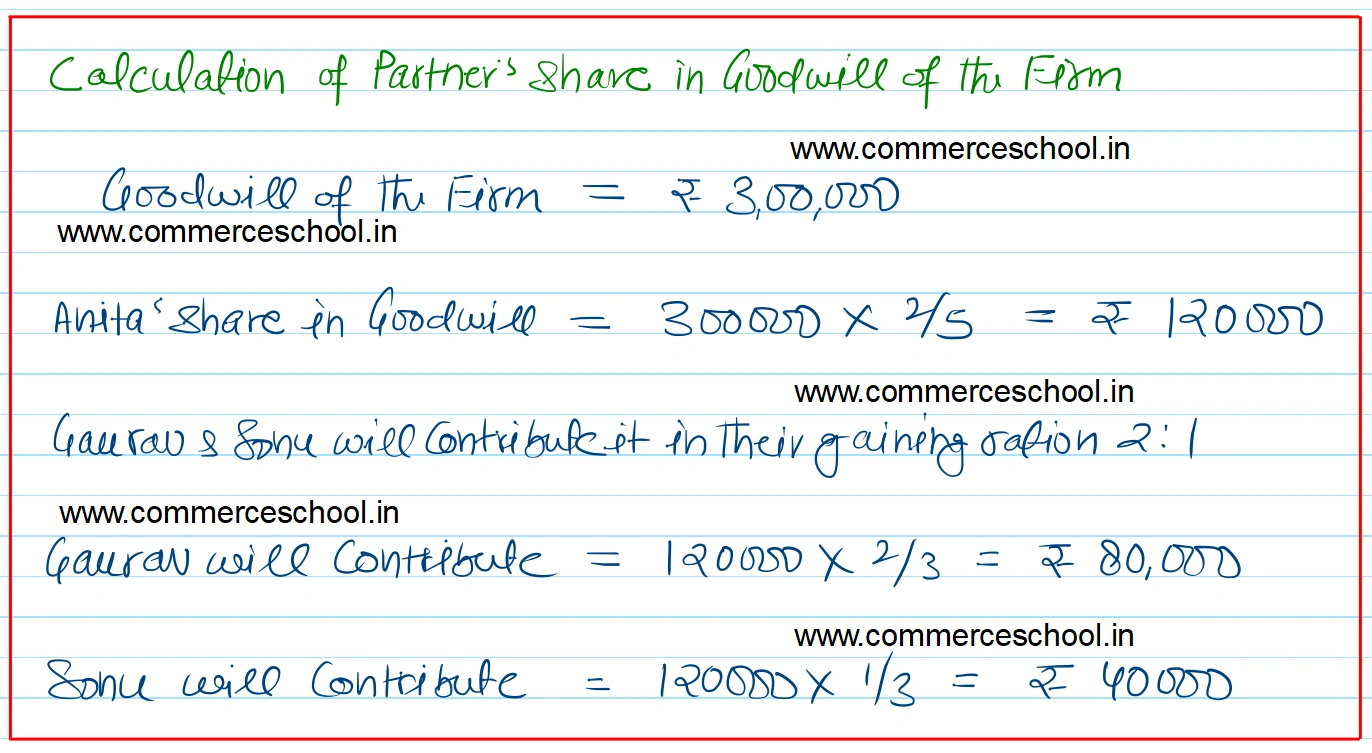

(i) Goodwill of the firm was valued at ₹ 3,00,000 and Anita’s share of goodwill was adjusted in the capital accounts of the remaining partners, Gaurav and Sonu.

(ii) Land and Building was to be brought up to 120% of its book value.

(iii) Bad Debts amounted to ₹ 20,000. A provisoin for doubtful debts was to be maintained at 10% on debtors.

(iv) Market value of investments was ₹ 1,10,000.

(v) ₹ 1,00,000 was paid immediately by chque to Anita out of the amount due and the balance was to be transferred to her loan account which was to be paid in two equal instalments along with interest @ 10% p.a.

Prepare necessary journal entries on 31st March, 2019.

[Ans. Gain on Revaluation ₹ 77,000; Amount transferred to Anita’s Loan A/c ₹ 2,74,800.]

| Liabilities | Amount | Assets | Amount |

| Capitals: Anita Gaurav Sonu | 2,00,000 2,00,000 1,00,000 | Land and Building | 5,00,000 |

| Investments | 1,20,000 | ||

| Investment Fluctuation Reserve | 40,000 | Debtors 1,50,000 Less: Provision for Doubtful Debts 10,000 | 1,40,000 |

| General Reserve | 30,000 | Stock | 1,00,000 |

| Creditors | 4,60,000 | Cash at Bank | 1,70,000 |

| 10,30,000 | 10,30,000 |

Anurag Pathak Answered question