X, Y and Z were partners in a firm sharing profits in 5 : 3 : 2 ratio. On 31st March, 2023 Z retired from the firm. On the date of Z’s retirement the Balance Sheet of the firm was as follows:

X, Y and Z were partners in a firm sharing profits in 5 : 3 : 2 ratio. On 31st March, 2023 Z retired from the firm. On the date of Z’s retirement the Balance Sheet of the firm was as follows:

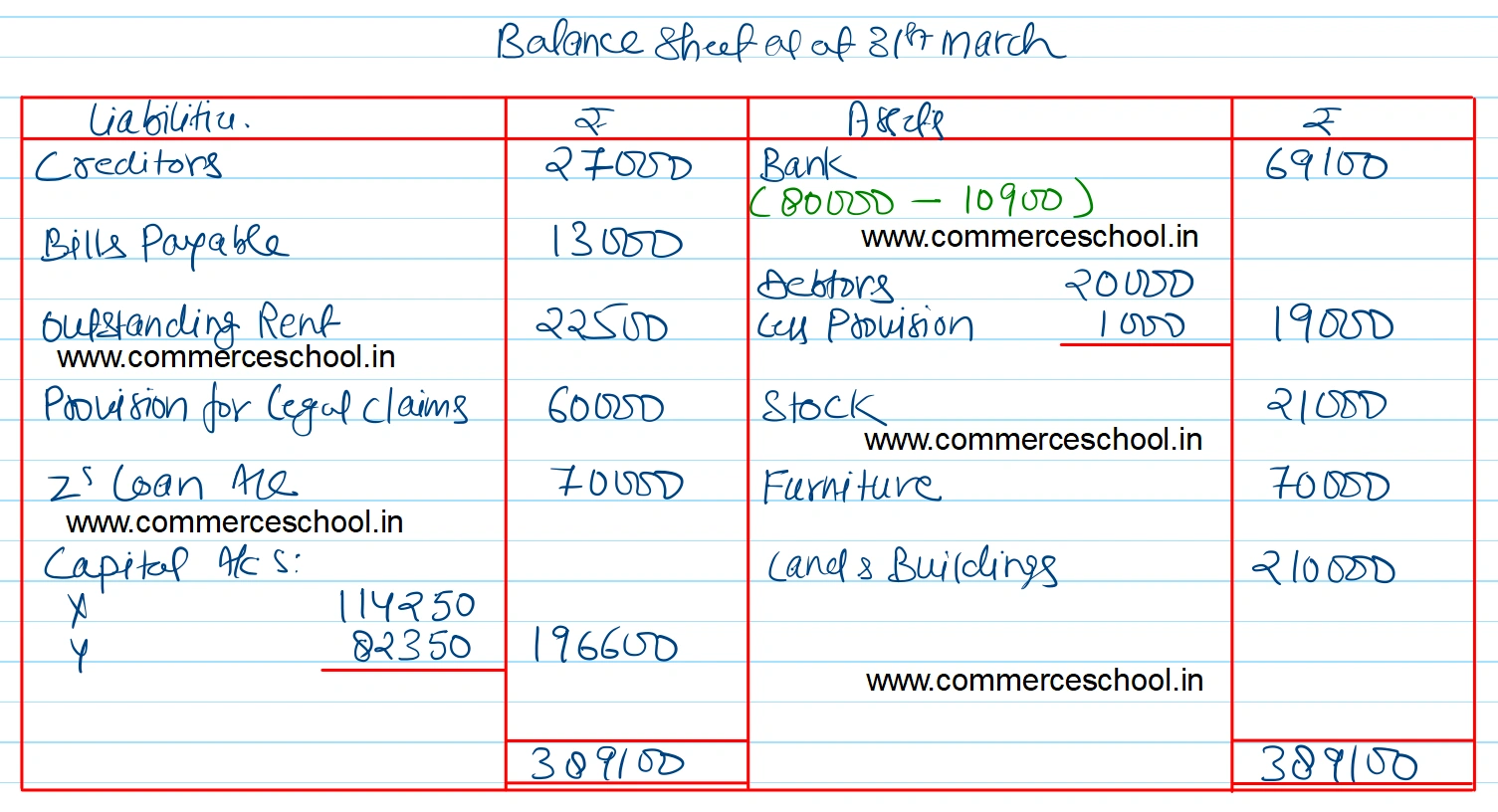

Balance Sheet of X, Y and Z as at 31st March, 2023

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 27,000 | Bank | 80,000 |

| Bills Payable | 13,000 |

Debtors 20,000 Less: Provision for Doubtful Debts 500 |

19,500 |

| Outstanding Rent | 22,500 | Stock | 21,000 |

| Provision for Legal Claims | 57,500 | Furniture | 87,500 |

| Capital A/cs: X Y Z | 1,27,000 90,000 71,000 | Land and Building | 2,00,000 |

| 4,08,000 | 4,08,000 |

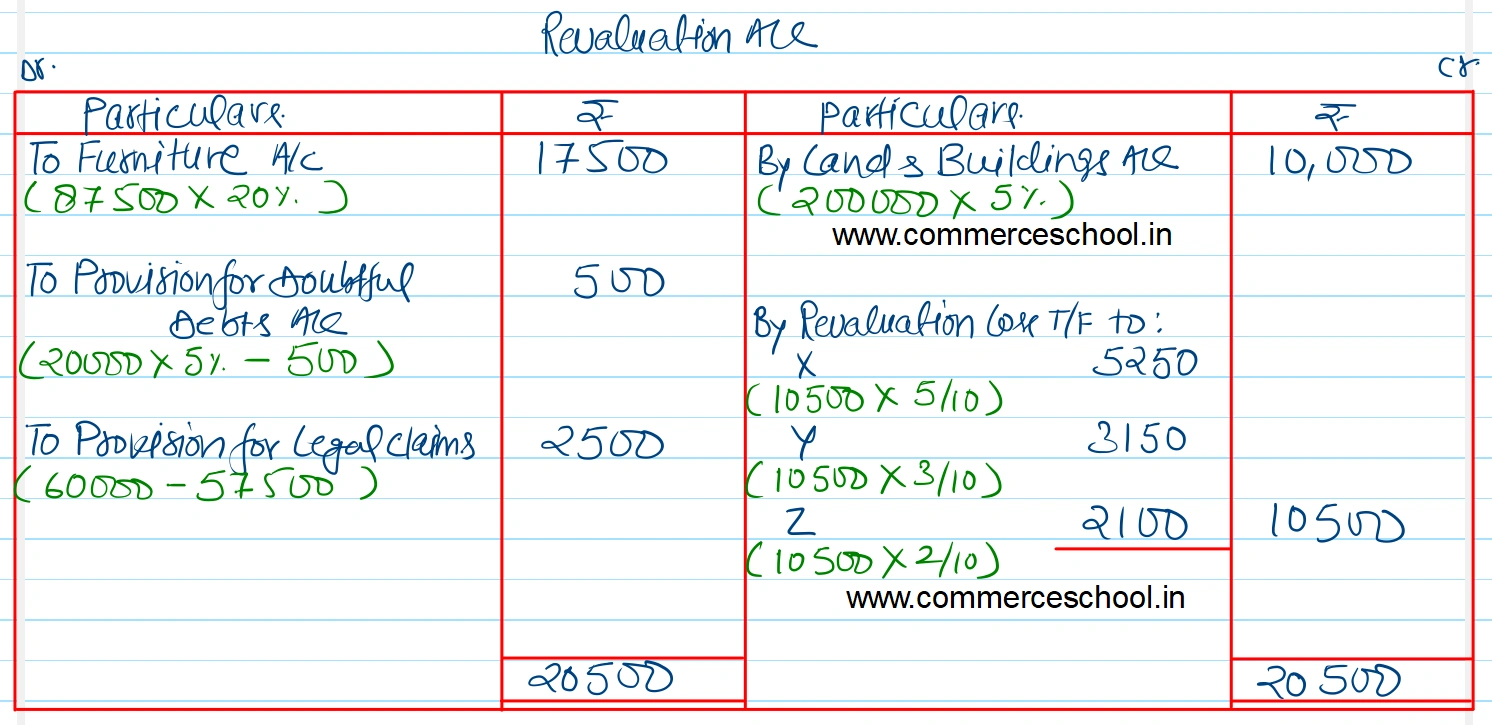

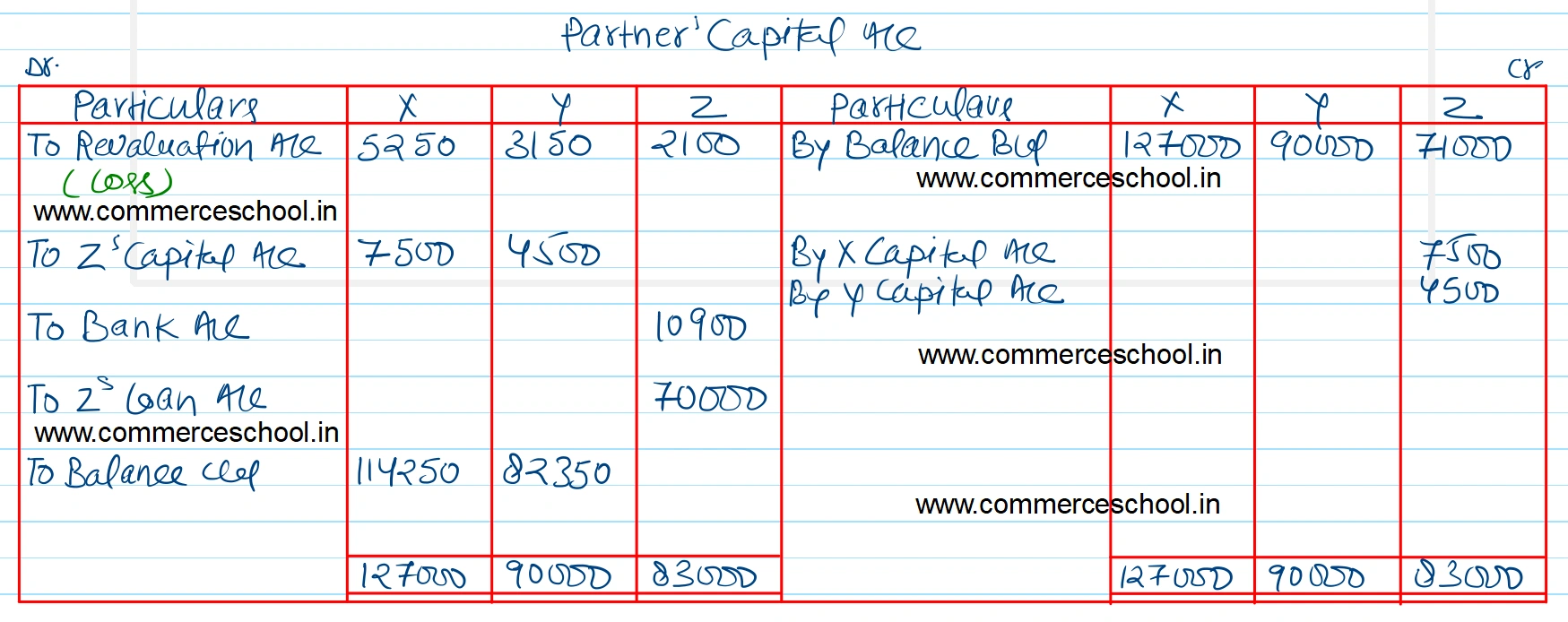

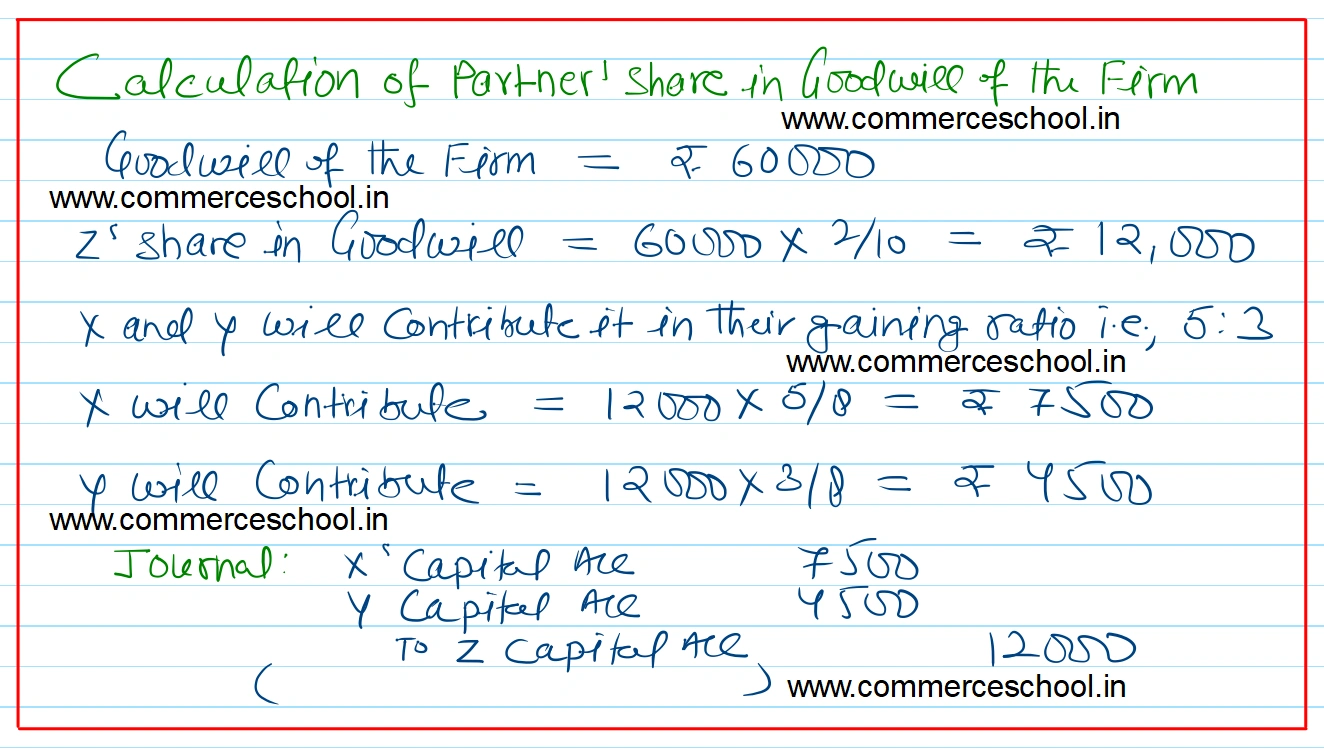

On Z’s retirement it was agreed that: (i) Land and Building will be appreciated by 5% and furniture will be depreciated by 20%. (ii) Provision for doubtful debts will be made at 5% on debtors and provision for legal claims will be made ₹ 60,000. (iii) Goodwill of the firm was valued at ₹ 60,000. (iv) ₹ 70,000 from Z’s Capital Account will be transferred to his loan account and the balance will be paid to him by cheque. Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of X and Y after Z’s retirement. [Ans. Loss on Revaluation ₹ 10,500; Balance amount paid to Z by Cheque ₹ 10,900; Capital Accounts X ₹ 1,14,250 and Y ₹ 82,350; Balance Sheet Total ₹ 3,89,100.]