Lalit, Madhur and Neena were partners sharing profits as 50%, 30% and 20% respectively. On 31st March, 2021, their Balance Sheet was as follows:

Lalit, Madhur and Neena were partners sharing profits as 50%, 30% and 20% respectively. On 31st March, 2021, their Balance Sheet was as follows:

On this date, Madhur retired and Lalit and Neena agreed to continue on the following terms:

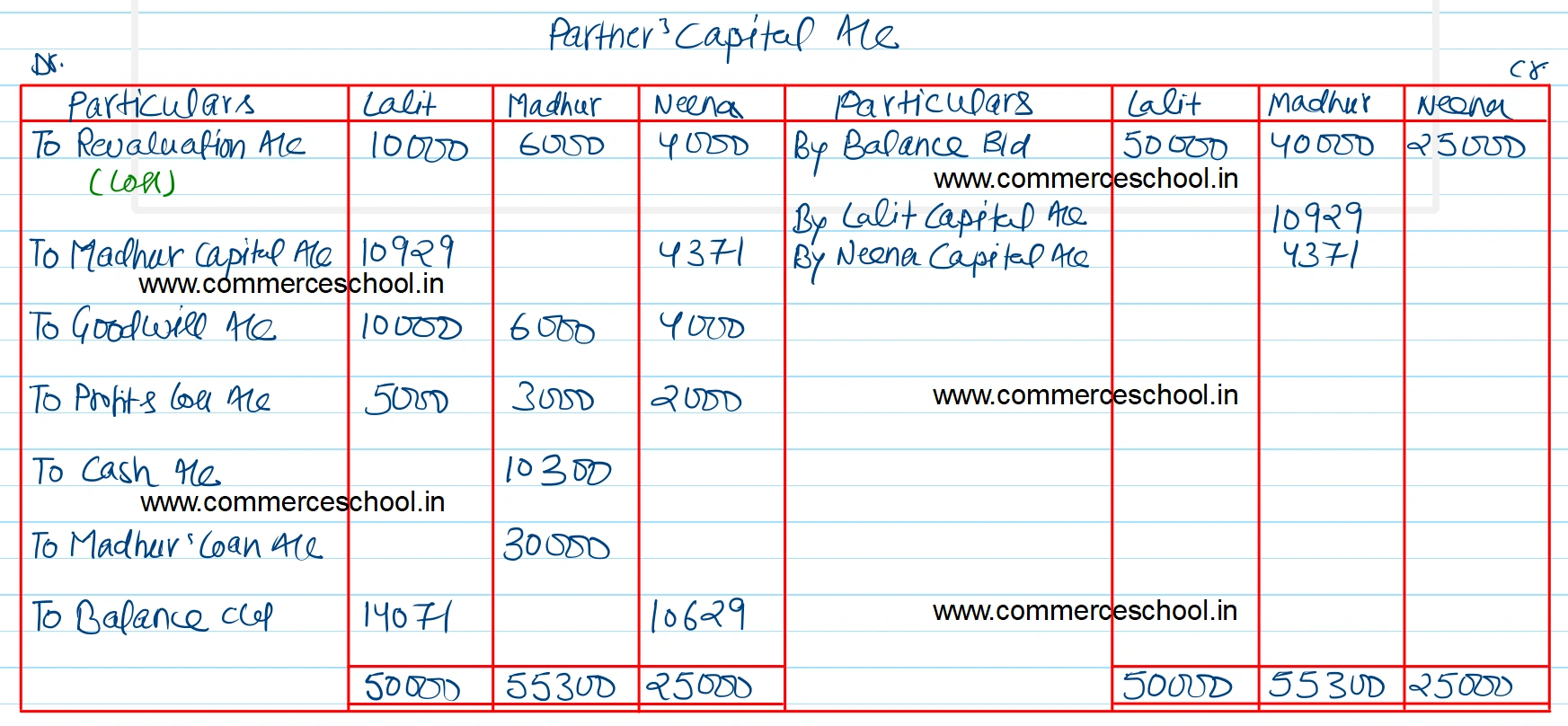

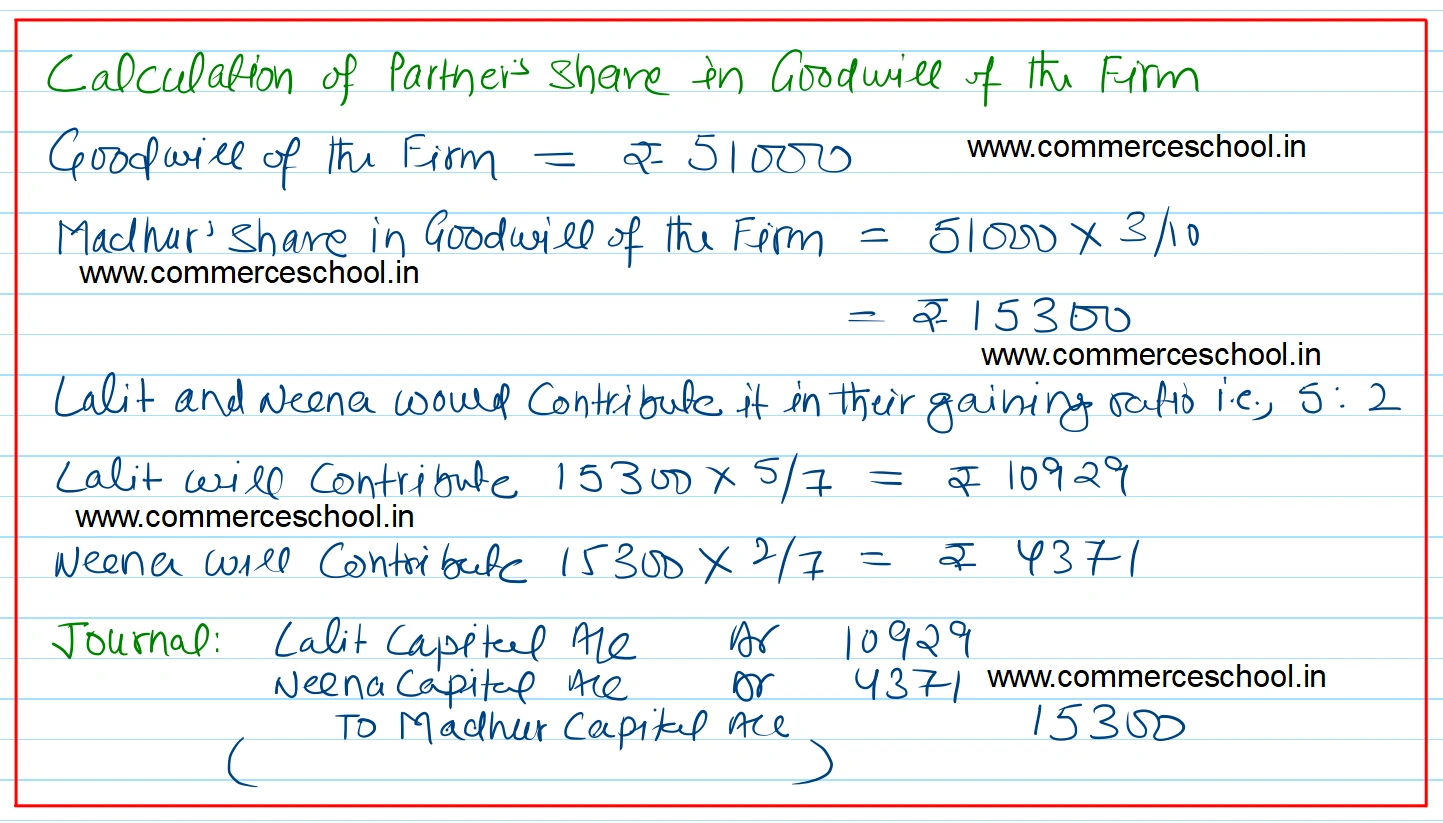

(a) The goodwill of the firm was valued at ₹ 51,000.

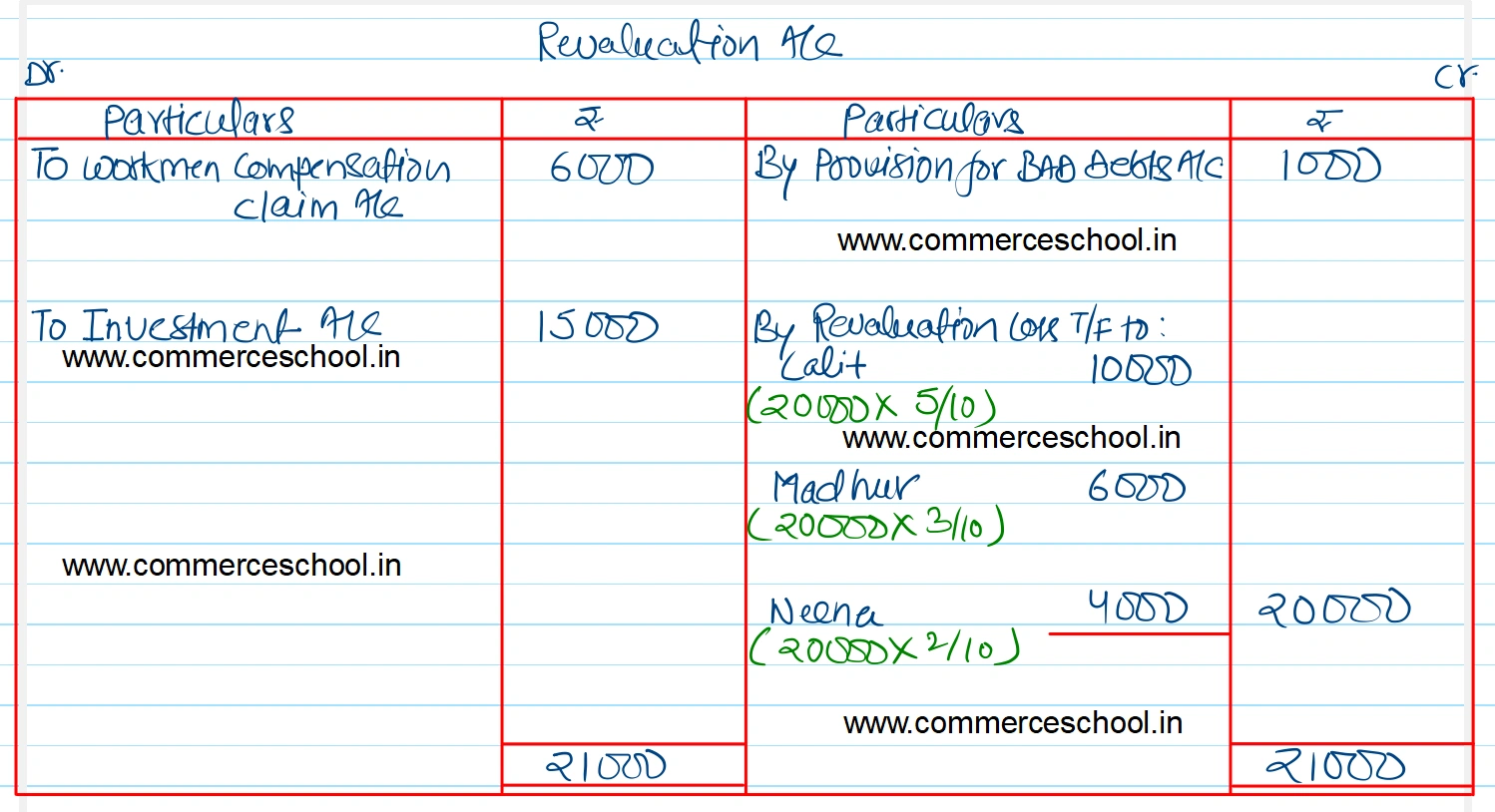

(b) There was a claim for Workmen’s Compensation to the extent of ₹ 6,000.

(c) Investment were brought down to ₹ 15,000.

(d) Provision for bad debts was reduced by ₹ 1,000.

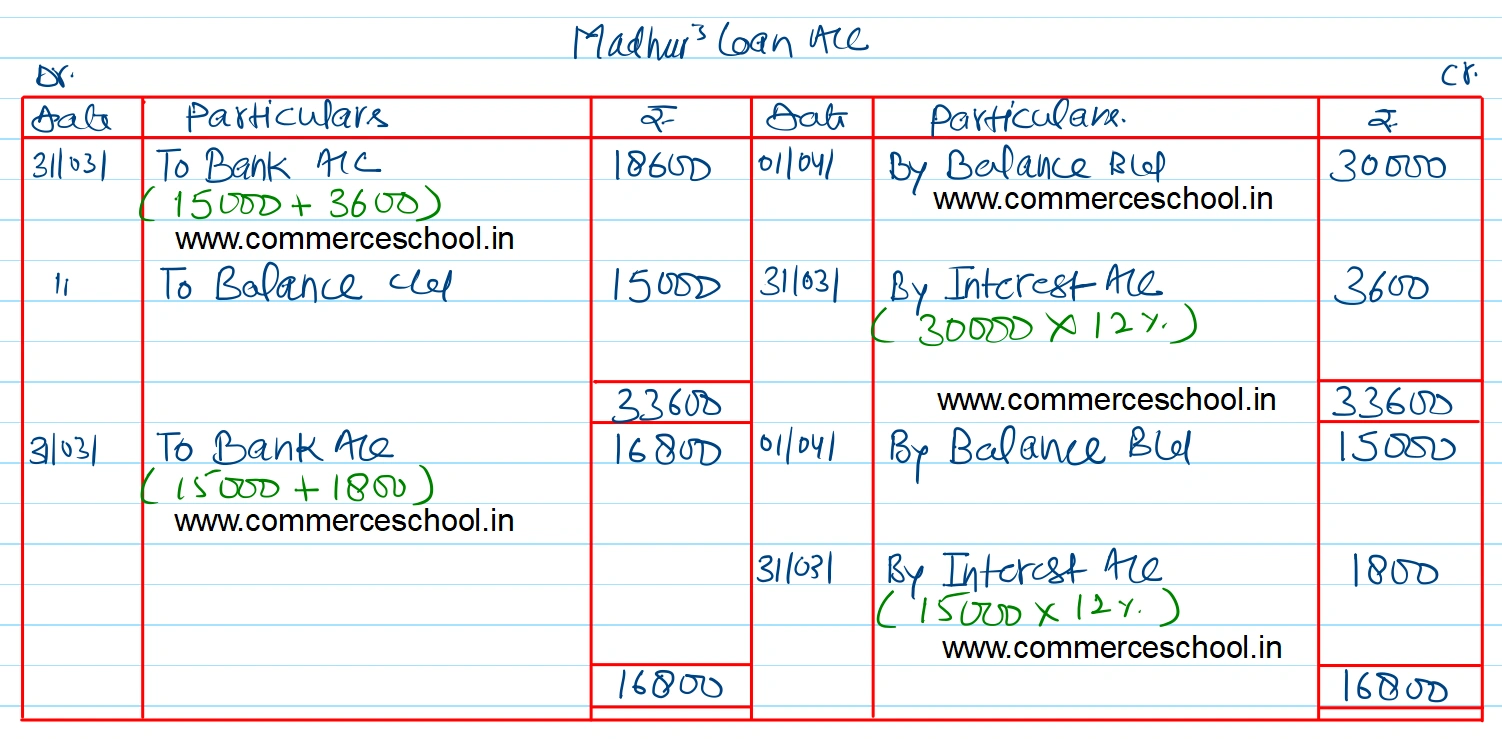

(e) Madhur was paid ₹ 10,300 in cash and the balance was transferred to his loan account payable in two equal instalments together with interest @ 12% p.a.

Prepare Revaluation Account, Partner’s Capital Accounts and Madhur’s Loan Account till the loan is finally paid off.

[Ans. Loss on Revaluation ₹ 20,000; Madhur’s Loan A/c ₹ 30,000; Capital A/cs: Lalit ₹ 14,071 and Neena ₹ 10,629.]

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 28,000 | Cash | 34,000 |

| Provident Fund | 10,000 | Debtors 47,000 Less: Provision for Doubtful Debts 3,000 | 44,000 |

| Investment Fluctuation Fund | 10,000 | Stock | 15,000 |

| Capital A/cs: Lalit Madhur Neena | 50,000 40,000 25,000 | Investment | 40,000 |

| 1,63,000 | Goodwill | 20,000 | |

| Profit and Loss A/c | 10,000 | ||

| 1,63,000 | 1,63,000 |

Anurag Pathak Answered question