Following is the Balance Sheet of G, K & W as at 31st March, 2019 who share profits in the ratio of 3 : 2 : 1.

Following is the Balance Sheet of G, K & W as at 31st March, 2019 who share profits in the ratio of 3 : 2 : 1.

| Liabilities | ₹ | Assets | ₹ |

|

Capital Accounts: G K W |

22,000 13,000 9,000 |

Goodwill | 7,500 |

| Sundry Creditors | 10,000 | Stock | 12,500 |

| Bills Payable | 4,000 | Sundry Debtors | 12,000 |

| General Reserve | 12,000 | Land and Buildings | 15,000 |

| Plant and Machinery | 18,000 | ||

| Motor Vehicle | 5,000 | ||

| 70,000 | 70,000 |

On 1st April, 2019, G retired and the following arrangements were agreed upon:

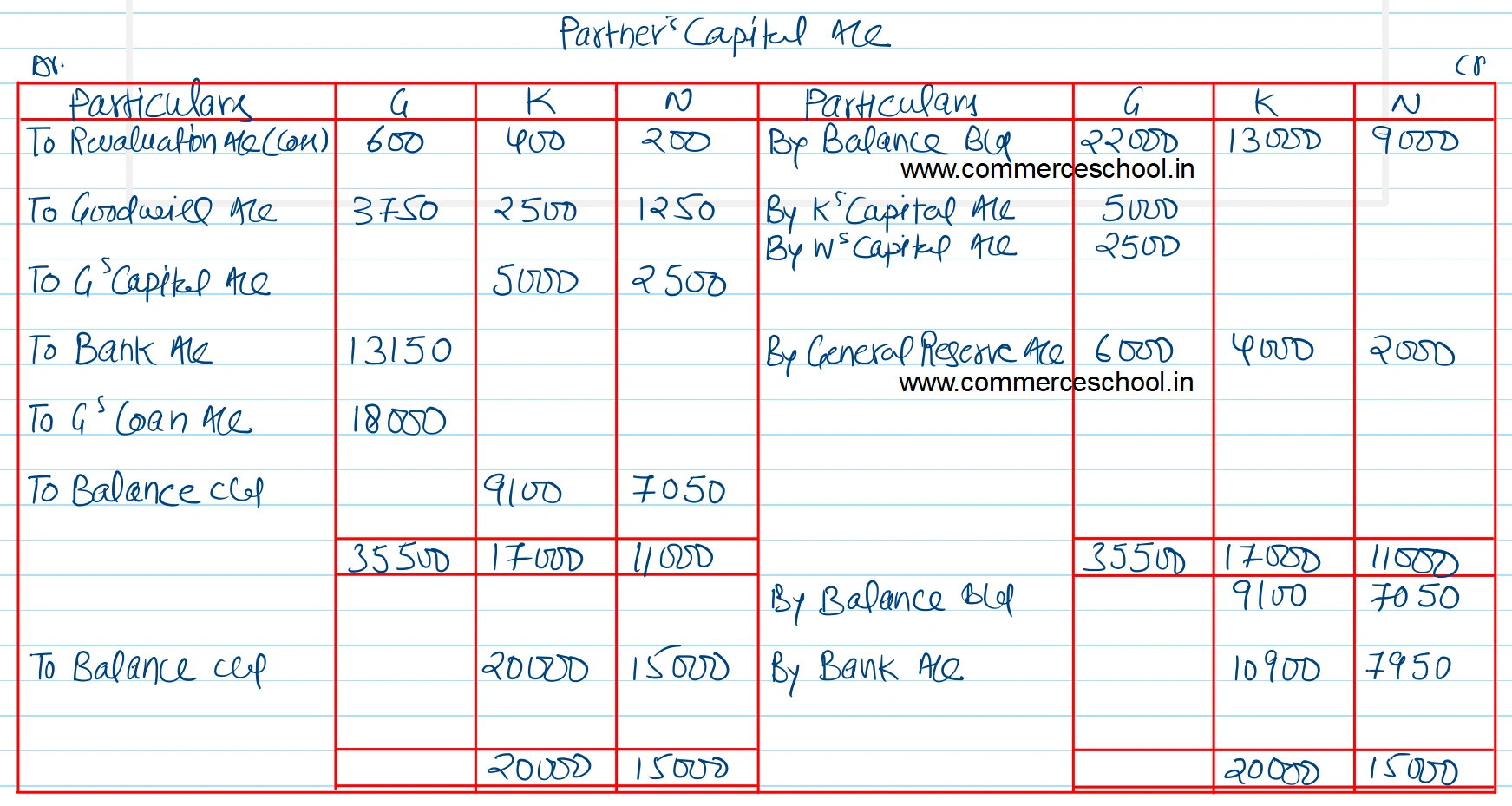

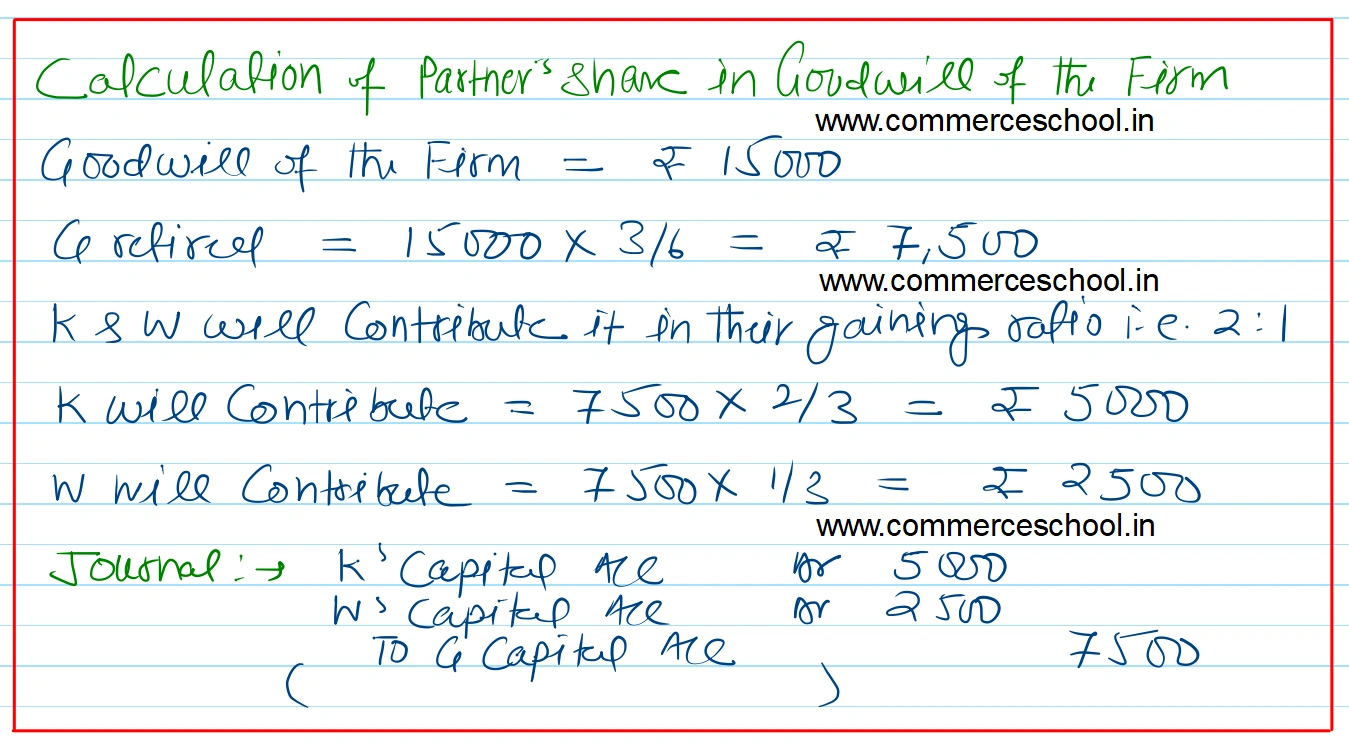

(1) Goodwill of the firm is to be valued at ₹ 15,000.

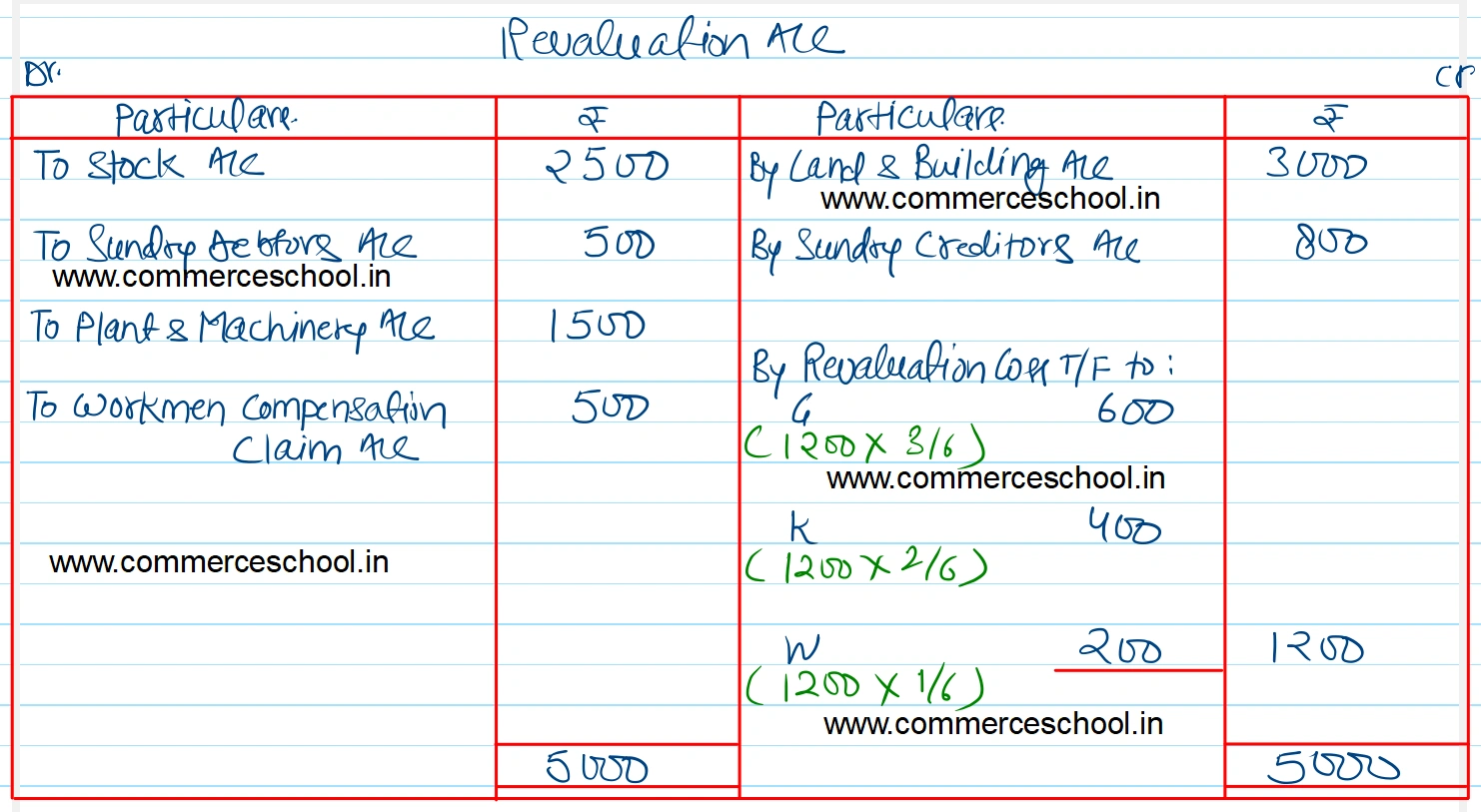

(2) The assets and liabilities are to be valued as under; Stock ₹ 10,000; Sundry Debtors ₹ 11,500; Land and Buildings ₹ 18,000; Plant and Machinery ₹ 16,500; and Sundry Creditors ₹ 9,200.

(3) Liability for Workmen’s Compensation amounting to ₹ 500 is to be brought into the books.

(4) The entire capital of the firm as newly constituted be fixed at ₹ 35,000 between K and W in the proportion of 4 : 3 and the actual cash to be paid off or to be brought in by continuing partners as the case may be.

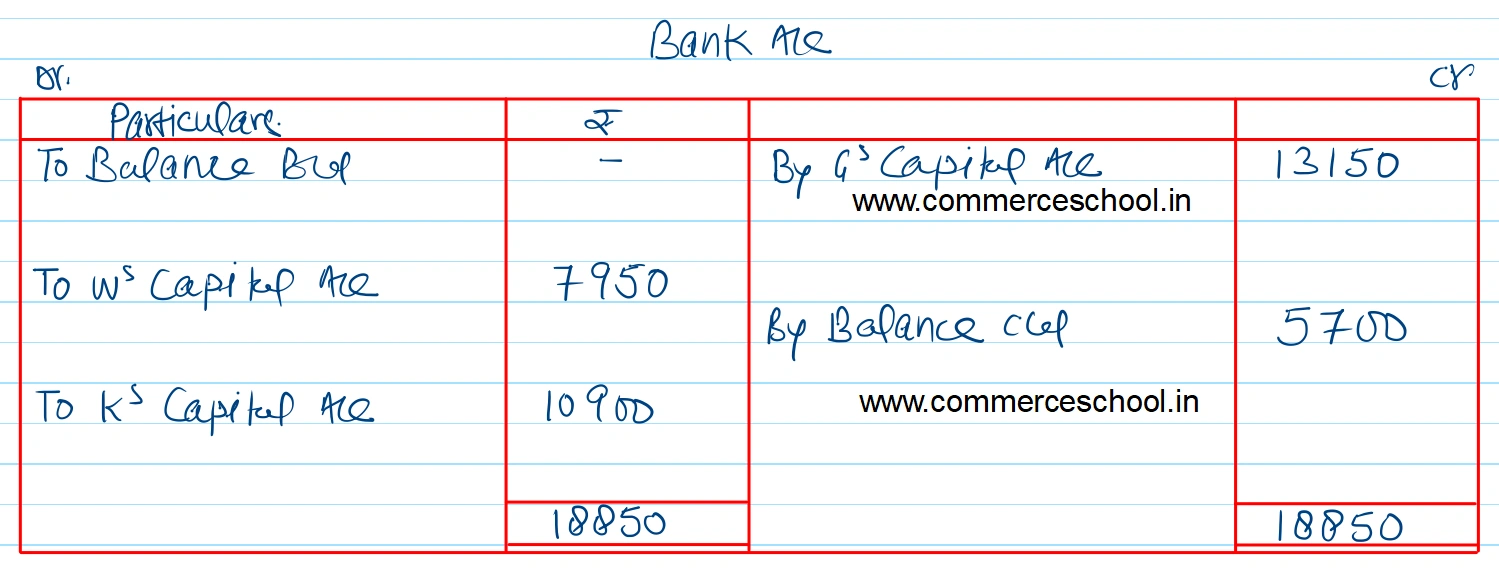

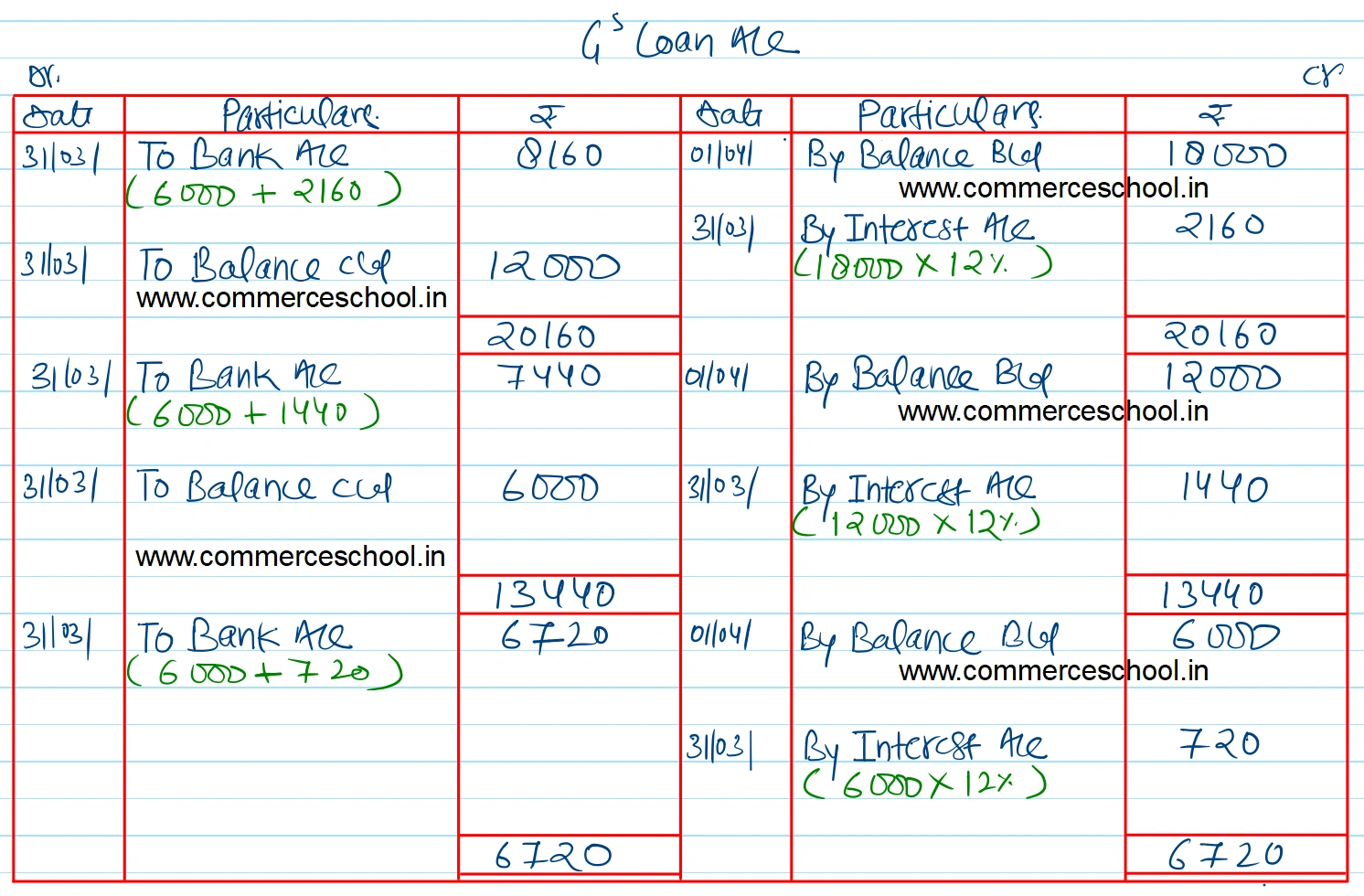

(5) ₹ 13,150 were paid to G. The balance due to him was to be paid in three equal installments annually together with interest @ 12% per annum.

Give necessary ledger accounts, the Balance Sheet of the firm after G’s retirement and G’s Loan Account till it is finally paid off.

[Ans. Loss on Revaluation ₹ 1,200; Balance of G’s Loan A/c on 1st April, 2019 ₹ 18,000; Capital Accounts : K ₹ 20,000 and W ₹ 15,000; Cash brought in by K ₹ 10,900 and W ₹ 7,950; Cash Balance ₹ 5,700; B/S Total ₹ 66,700.]