P, Q and R are partners in a firm. R retires from the firm. On the date of retirement, ₹ 3,00,000 is due to him. It is agreed to pay him in instalments every year at the end of the year

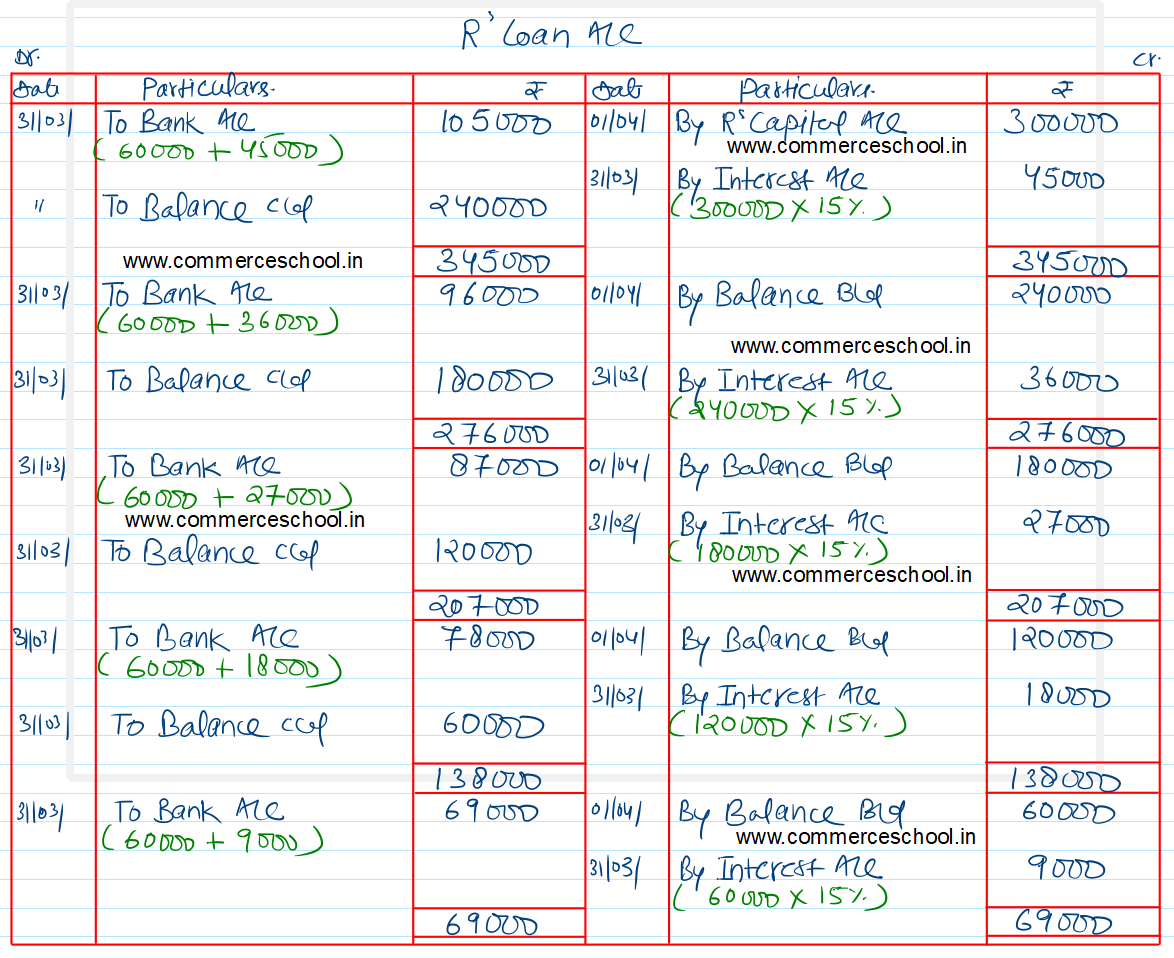

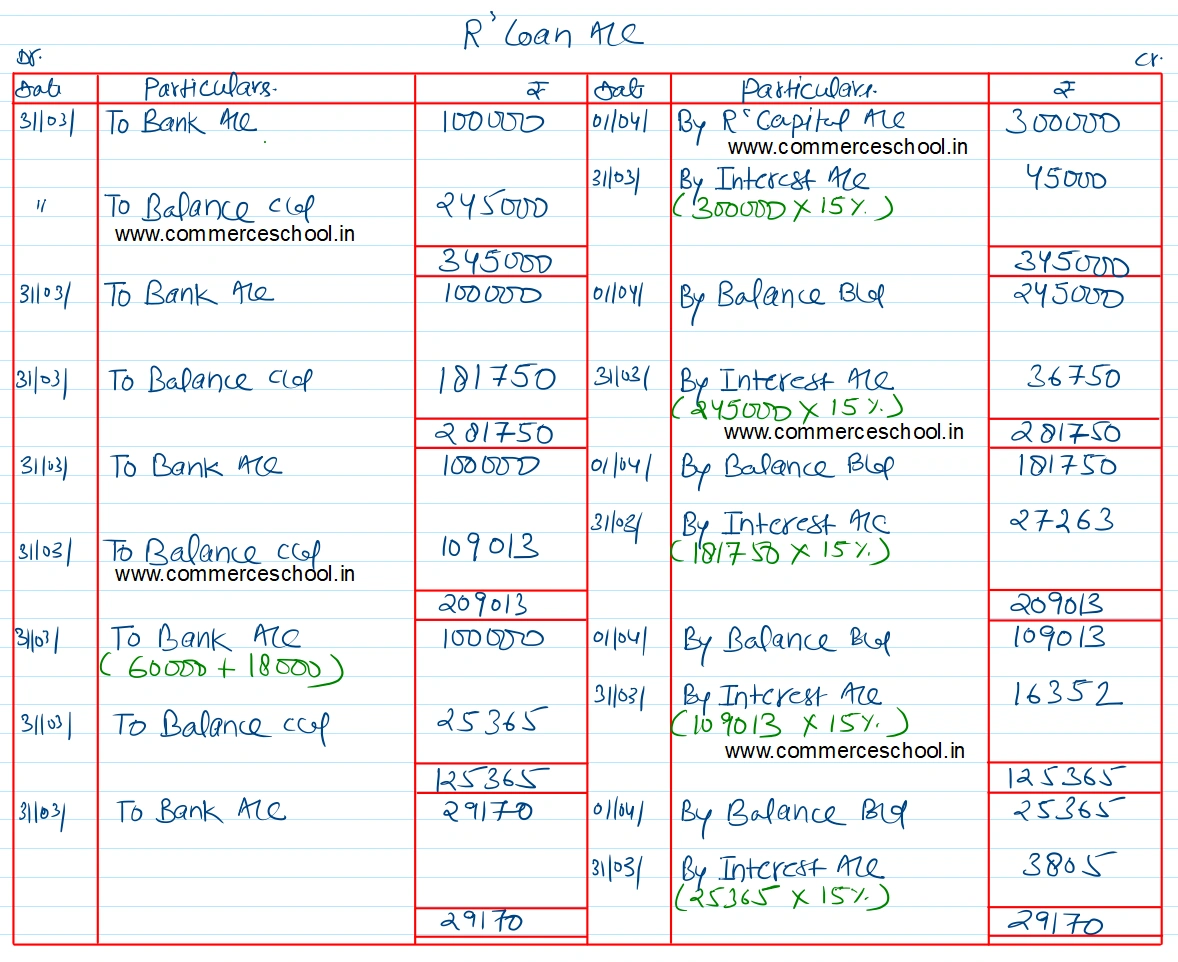

P, Q and R are partners in a firm. R retires from the firm. On the date of retirement, ₹ 3,00,000 is due to him. It is agreed to pay him in instalments every year at the end of the year. Prepare R’s Loan Account in the following cases:

(i) Five yearly instalments plus interest @ 15% p.a.

(ii) Instalments of ₹ 1,00,000 which already includes interest @ 15% p.a. on the outstanding balance for the first four years and the balance including interest in the fifth year.

[Ans. First Method: Interest : 1st Year ₹ 45,000; 2nd Year ₹ 36,000; 3rd Year ₹ 27,000; 4th Year ₹ 18,000; 5th Year ₹ 9,000;

Second Method: Interest : 1st Year ₹ 45,000; 2nd Year ₹ 36,750; 3rd Year ₹ 27,263; 4th Year ₹ 16,352; 5th Year ₹ 3,805; Final Payment ₹ 29,170]