A, B and C are partners in a firm sharing profits in the ratio of 3 : 2 : 1. On 31st March 2022 C retired. Following balances were disclosed by the Firm’s Balance Sheet on this date:

A, B and C are partners in a firm sharing profits in the ratio of 3 : 2 : 1. On 31st March 2022 C retired. Following balances were disclosed by the Firm’s Balance Sheet on this date:

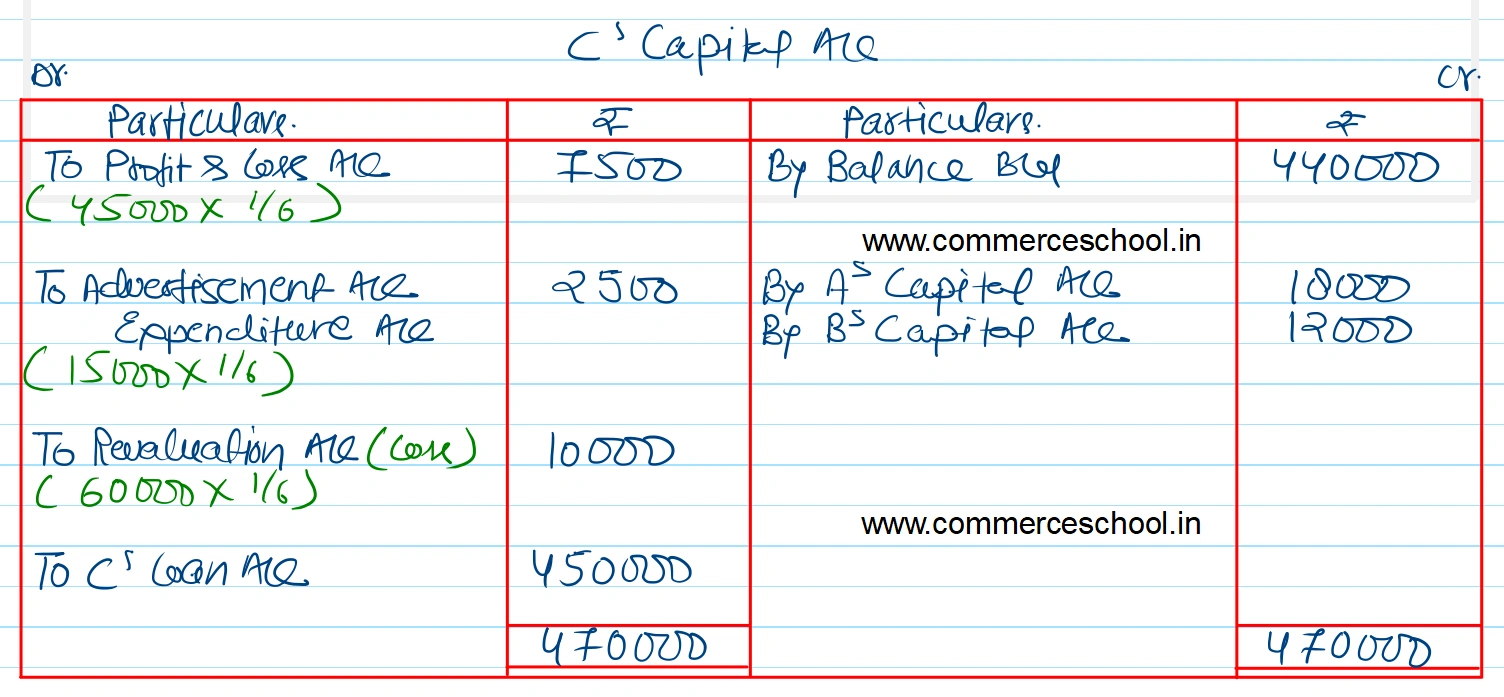

(I) Capitals A ₹ 10,00,000; B ₹ 6,00,000 and C ₹ 4,40,000.

(ii) Profit & Loss (Dr. Balance) ₹ 45,000.

(iii) Advertisement Expenditure ₹ 15,000.

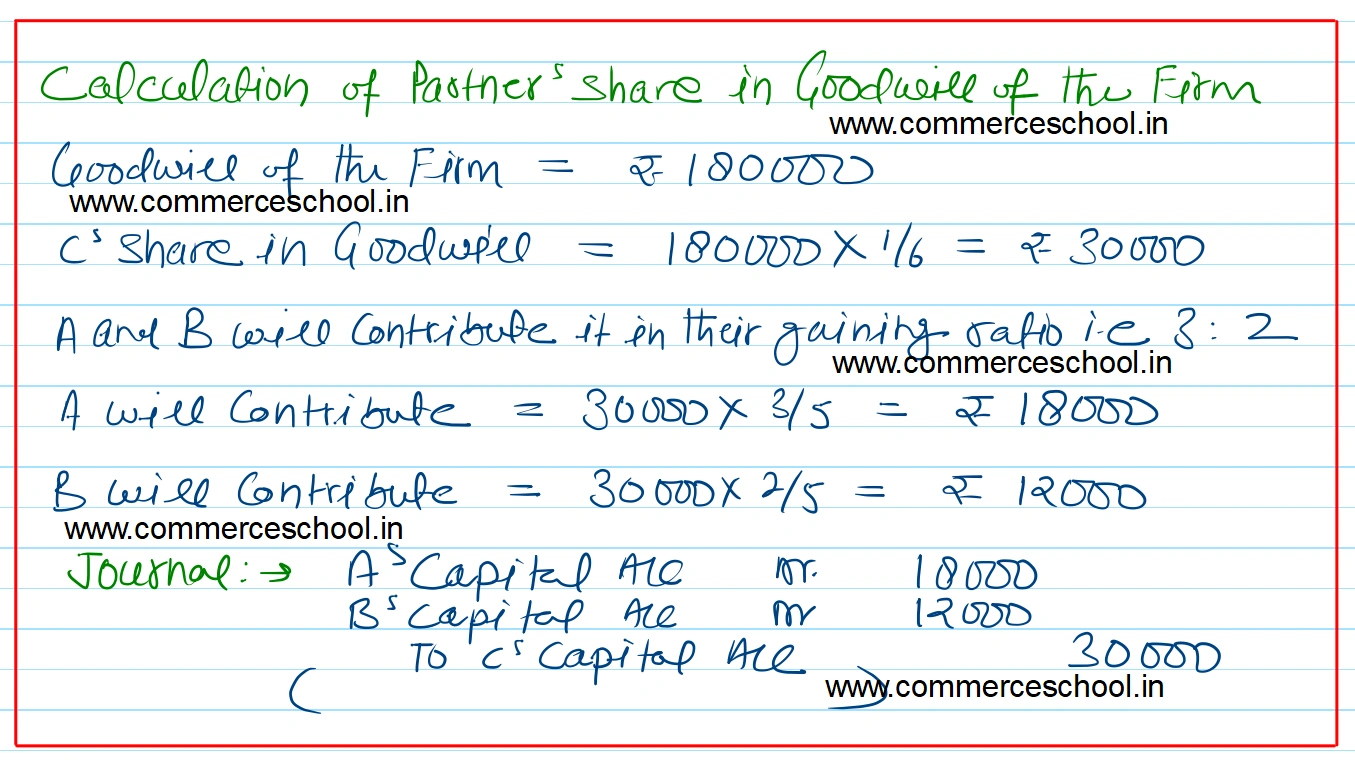

Revaluation of Assets and re-assessment of liabilities resulted in a loss of ₹ 60,000. On the retirement of C, goodwill is valued at ₹ 1,80,000.

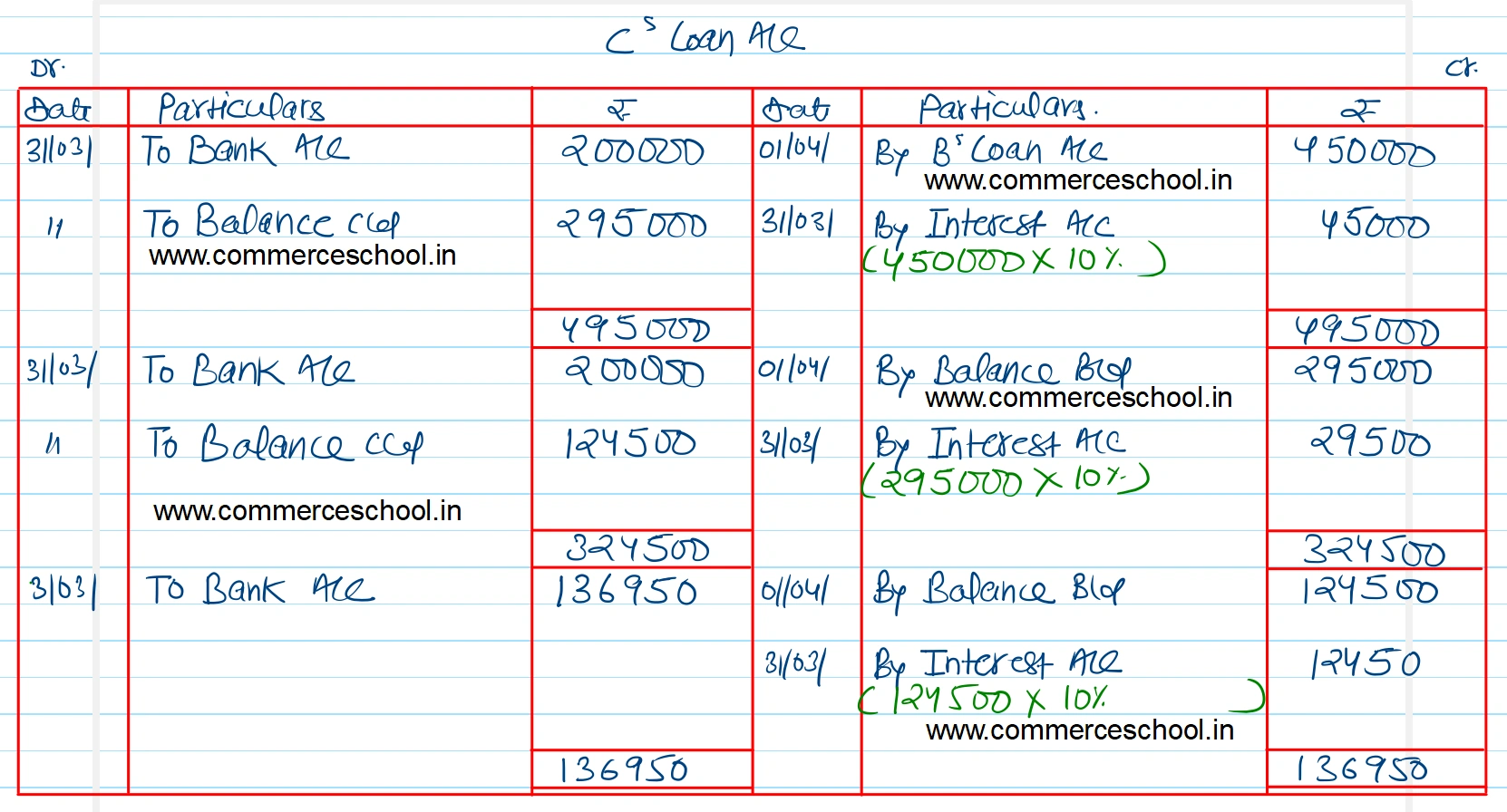

The amount payable to C is agreed to be paid in two yearly instalments of ₹ 2,00,000 each including interest @ 10% p.a. on the outstanding balance during the first two years and the balance including interest in the third year. Books are closed on 31st March every year.

Prepare C’s Loan Account till it is finally paid.

[Ans. Net amount payable to C ₹ 4,50,000; Payment made in third Year ₹ 1,36,950 (including interest)]