Brown and Smith are partners. The partnership deed provides: (i) That the Accounts be balanced on 31st December each year.

Brown and Smith are partners. The partnership deed provides:

(i) That the Accounts be balanced on 31st December each year.

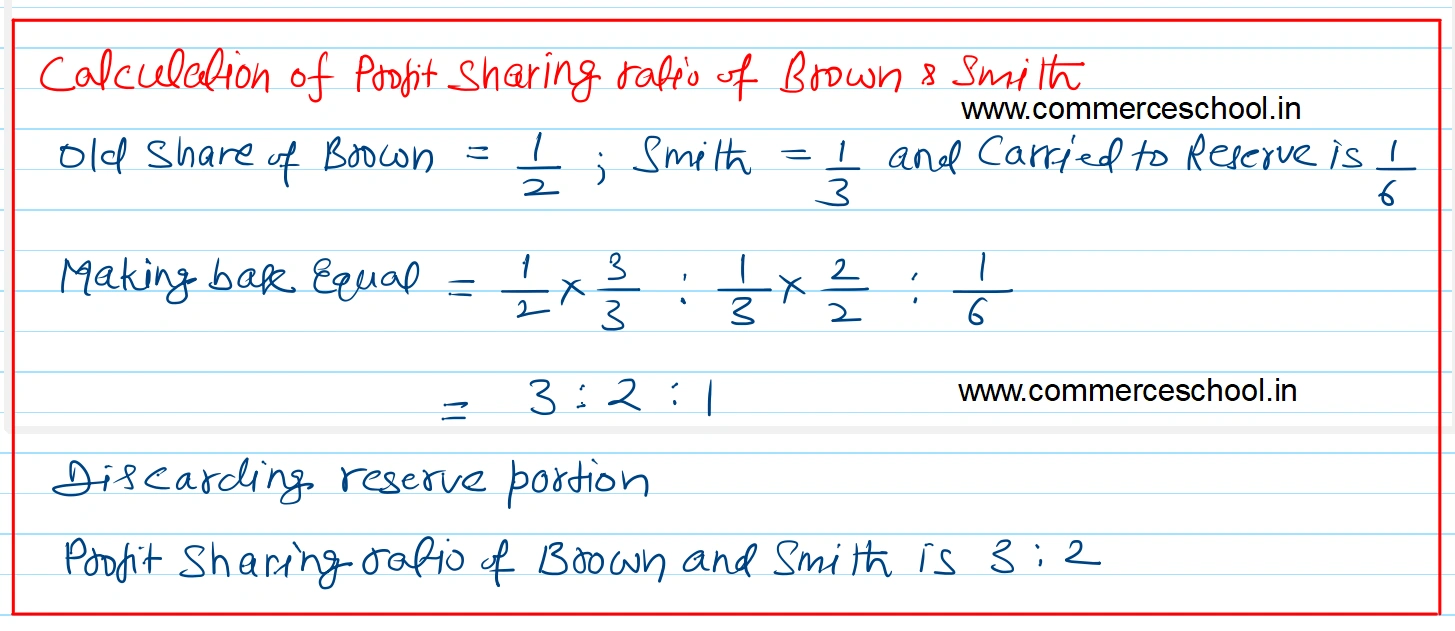

(ii) That the profits be divided as follows: Brown 1/2; Smith 1/3 and carried to a Reserve account 1/6.

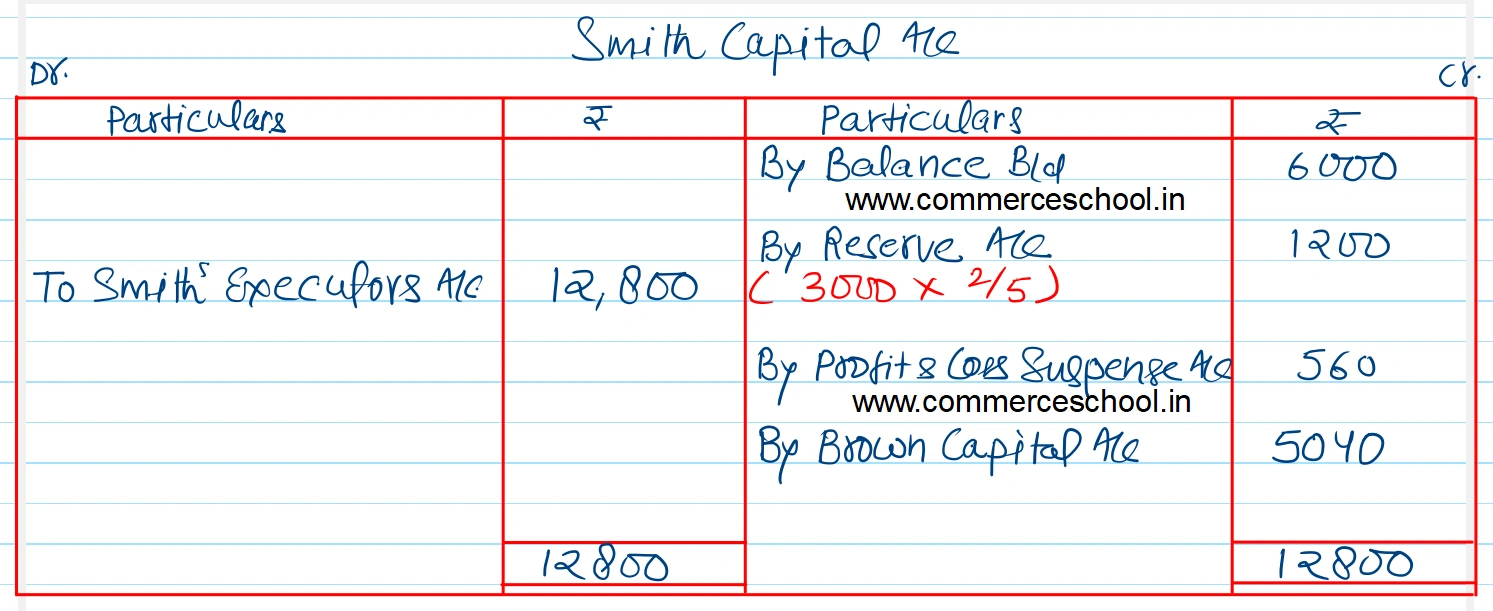

(iii) That in the event of the death of a partner, his executors be entitled to be paid out:

(a) The Capital to his credit at the date of death.

(b) His proportion of Reserve at the date of last Balance Sheet.

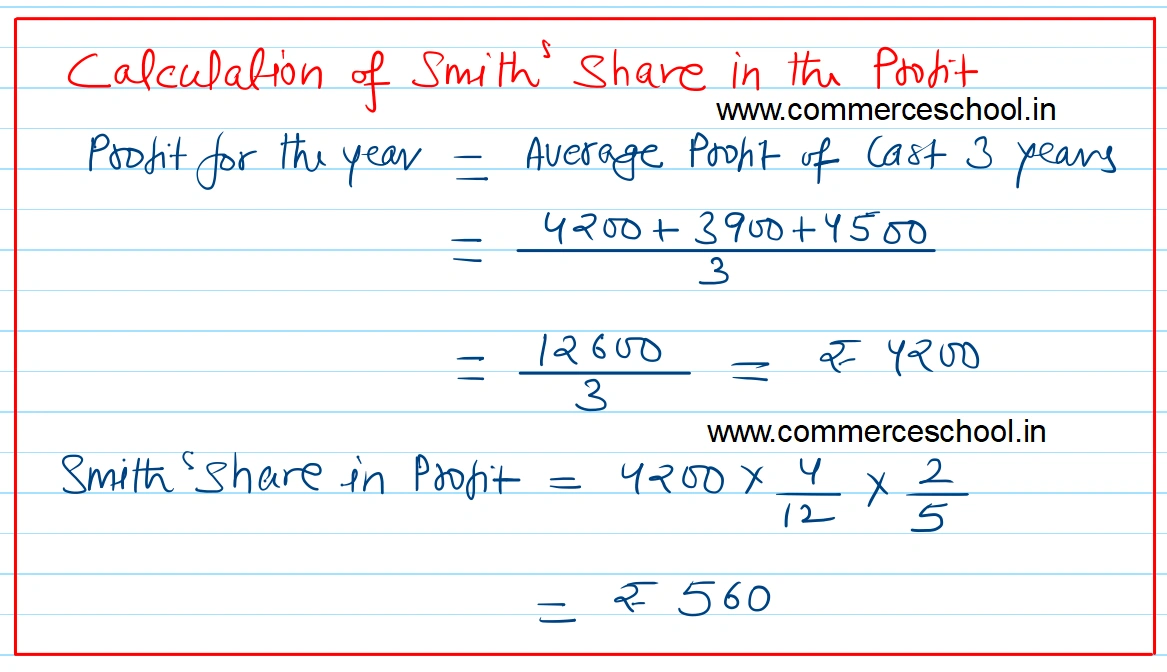

(c) His proportion of profit to date of death based on the average profits of the last three completed years.

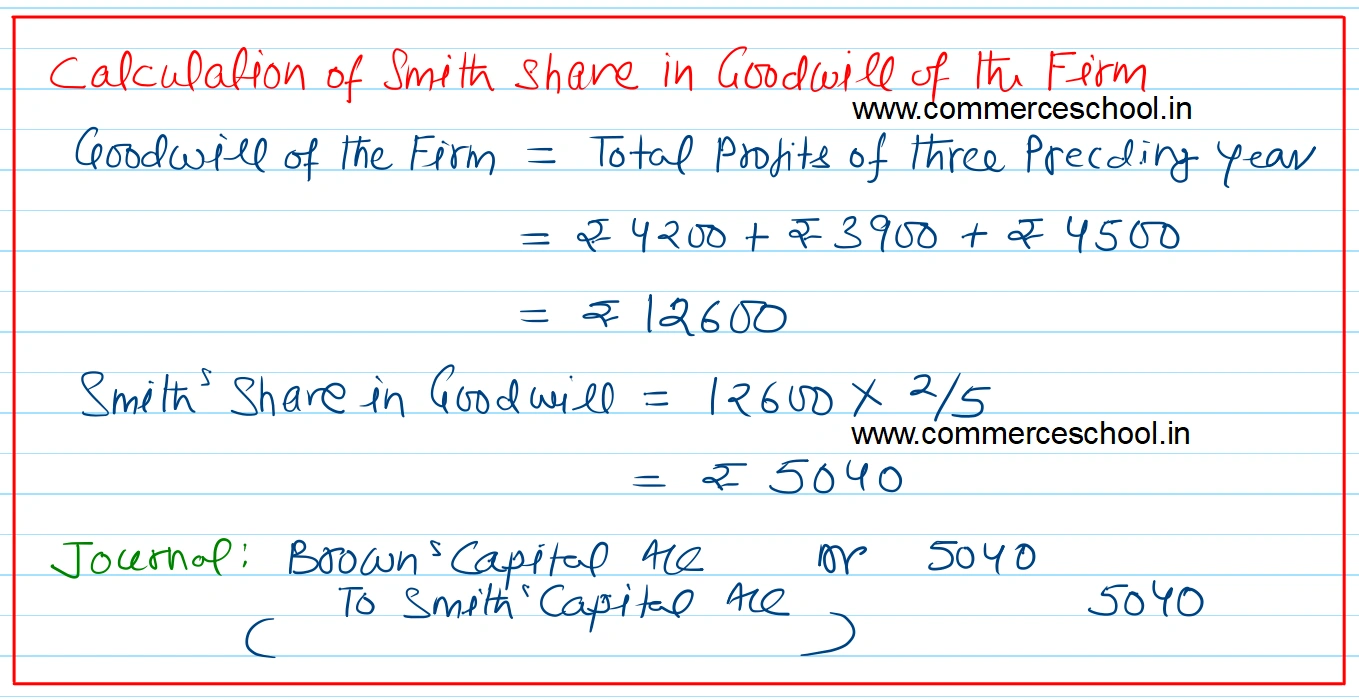

(d) By way of goodwill his proportion of the total profits for the three preceding years.

On 31st December, 2023, the ledger balances were:

The profits for three years were:

2021 ₹ 4,200; 2022 ₹ 3,900; 2023 ₹ 4,500. Smith died on 1st May, 2024. Show the accounts as between the firm’s and Smith’s executors as on May 1st, 2024.

[Ans. Balance due to Smith’s Executors ₹ 12,800.]

| ₹ | ₹ | |

| Brown’s Capital | 9,000 | |

| Smith’s Capital | 6,000 | |

| Reserve | 3,000 | |

| Creditors | 3,000 | |

| Bills Receivable | 2,000 | |

| Investments | 5,000 | |

| Cash | 14,000 | |

| 21,000 | 21,000 |

Anurag Pathak Answered question