A, B and C are partners in a firm sharing profits in the ratio of 5 : 3 : 2 respectively. Their Balance Sheet as at 31st March, 2023 was as follow:

A, B and C are partners in a firm sharing profits in the ratio of 5 : 3 : 2 respectively. Their Balance Sheet as at 31st March, 2023 was as follow:

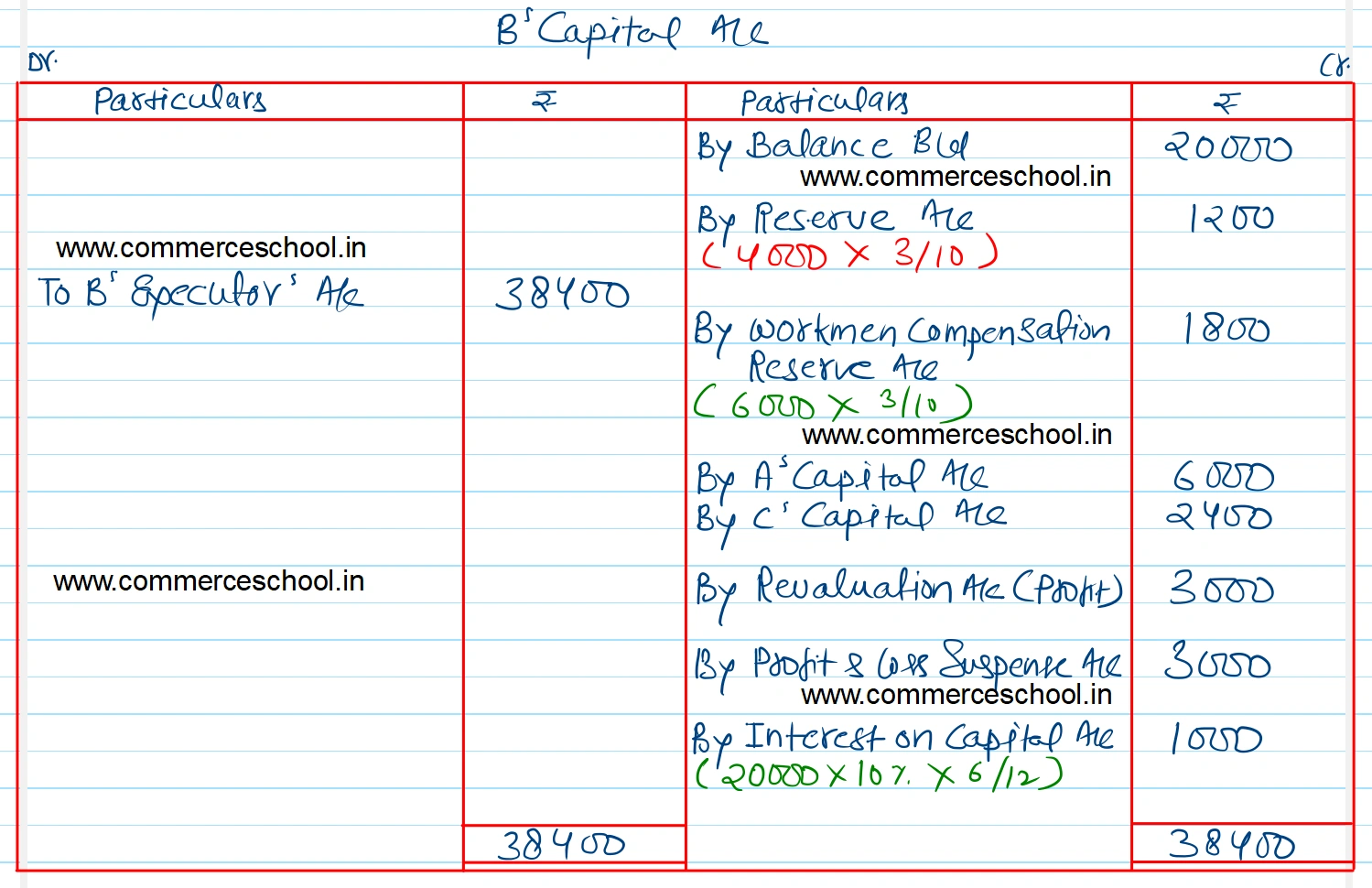

On 1st October, 2023, due to illness B died, AS per the agreement:

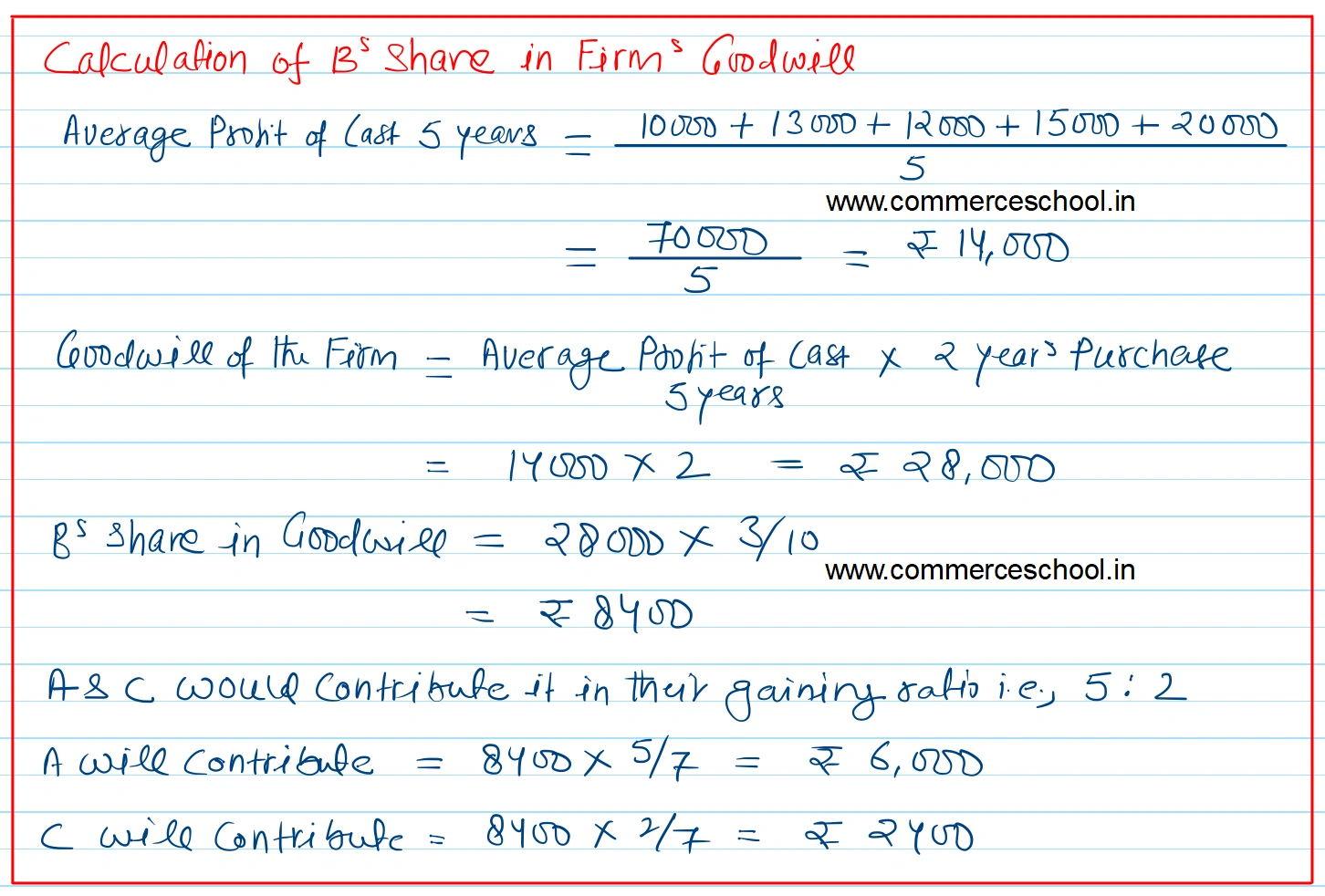

(i) Goodwill is to be valued at two year’s purchase of the average profits of previous five years, which were : 2019 – ₹ 10,000; 2020 – ₹ 13,000; 2021 – ₹ 12,000; 2022 – ₹ 15,000 and 2023 – ₹ 20,000.

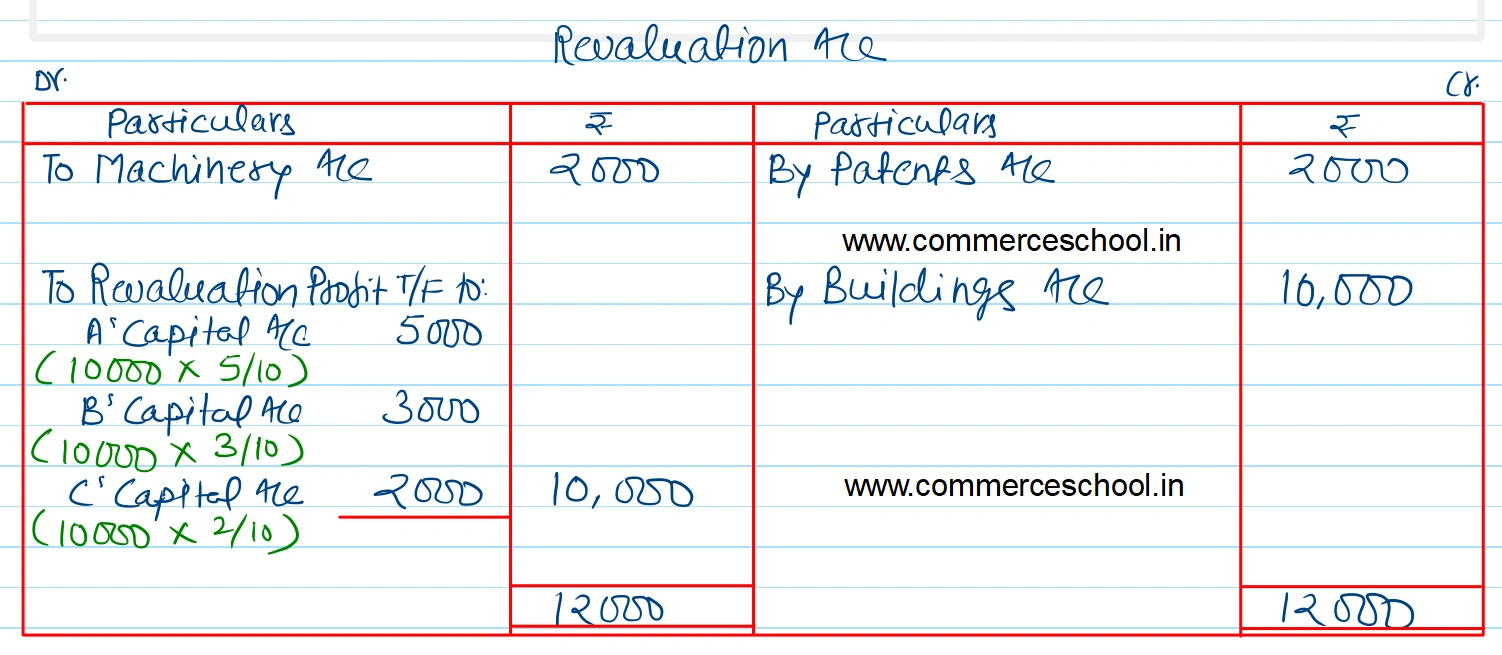

(ii) Patents were valued at ₹ 8,000; Machinery at ₹ 28,000 and Buildings at ₹ 30,000.

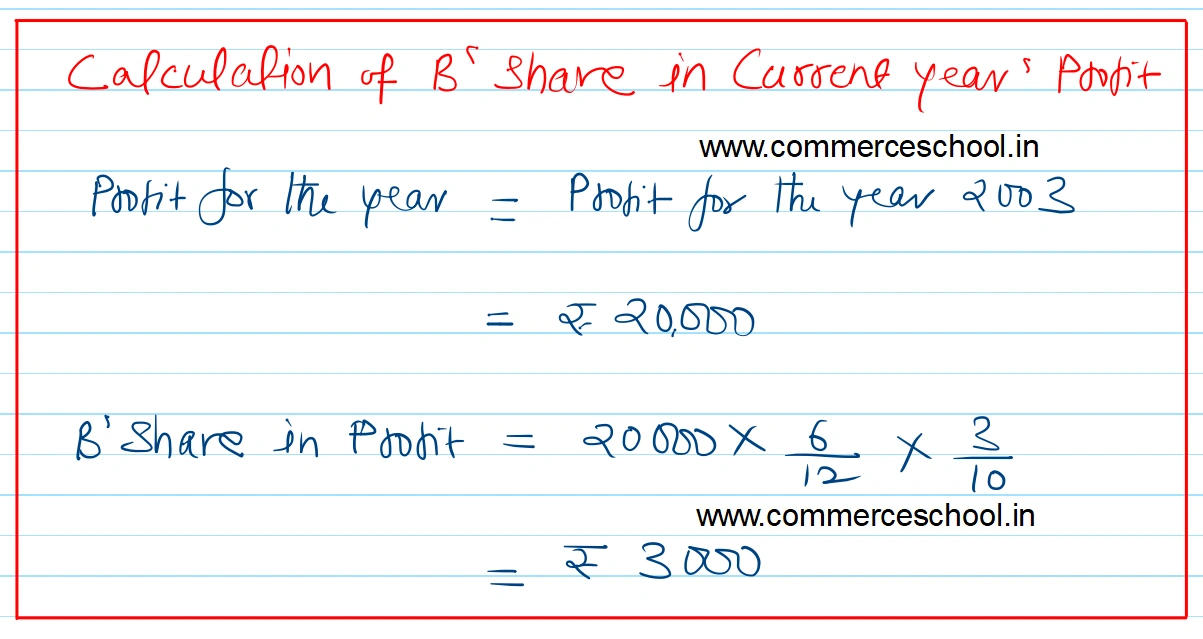

(iii) B’s share of profit till the date of his death will be calculated on the basis of profit of the year 2023.

(iv) Interest on capital will be provided at 10% p.a.

(v) Amount due to B’s executors will be transferred to Charity Account.

Prepare B’s Capital Account to be presented to his executors.

[Ans. Amount due to B’s Executors ₹ 38,400.]

Balance Sheet as at 31st March, 2023

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 12,000 | Cash | 13,000 |

| Reserves | 4,000 | Debtors | 8,000 |

| Workmen Compensation Reserve | 6,000 | Stock | 10,000 |

| Capitals: A B C | 30,000 20,000 15,000 | Machinery | 30,000 |

| Buildings | 20,000 | ||

| Patents | 6,000 | ||

| 87,000 | 87,000 |

Anurag Pathak Answered question