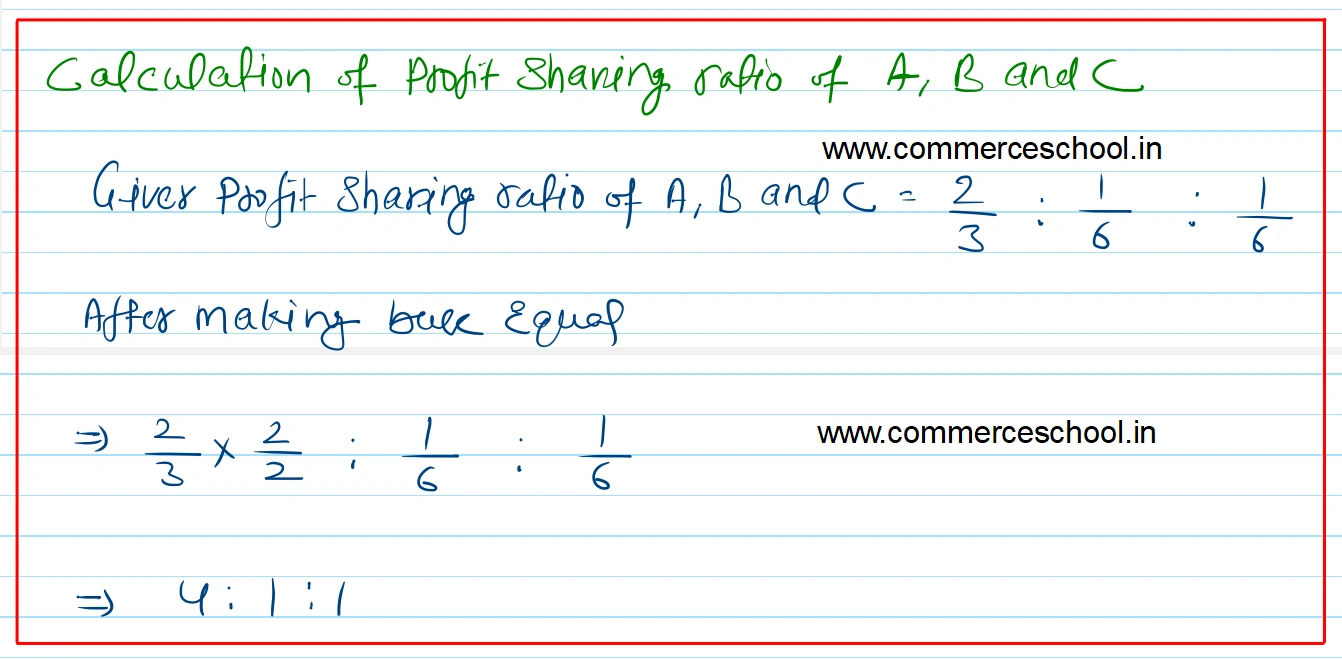

A, B and C are in partnership, sharing profits in the proportion of two-thirds, one-sixth and one-sixth respectively. A died on the 30th June, 2022

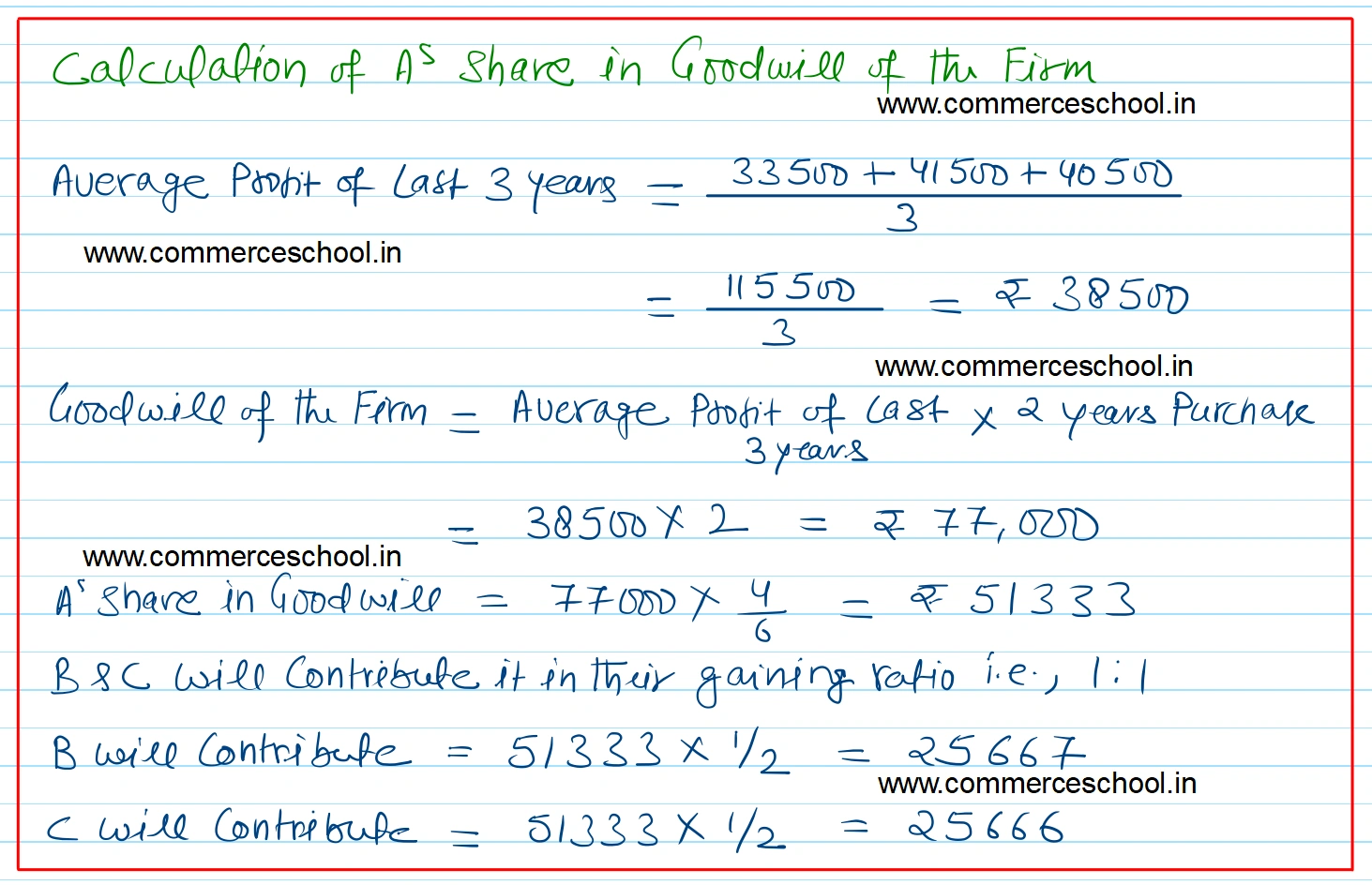

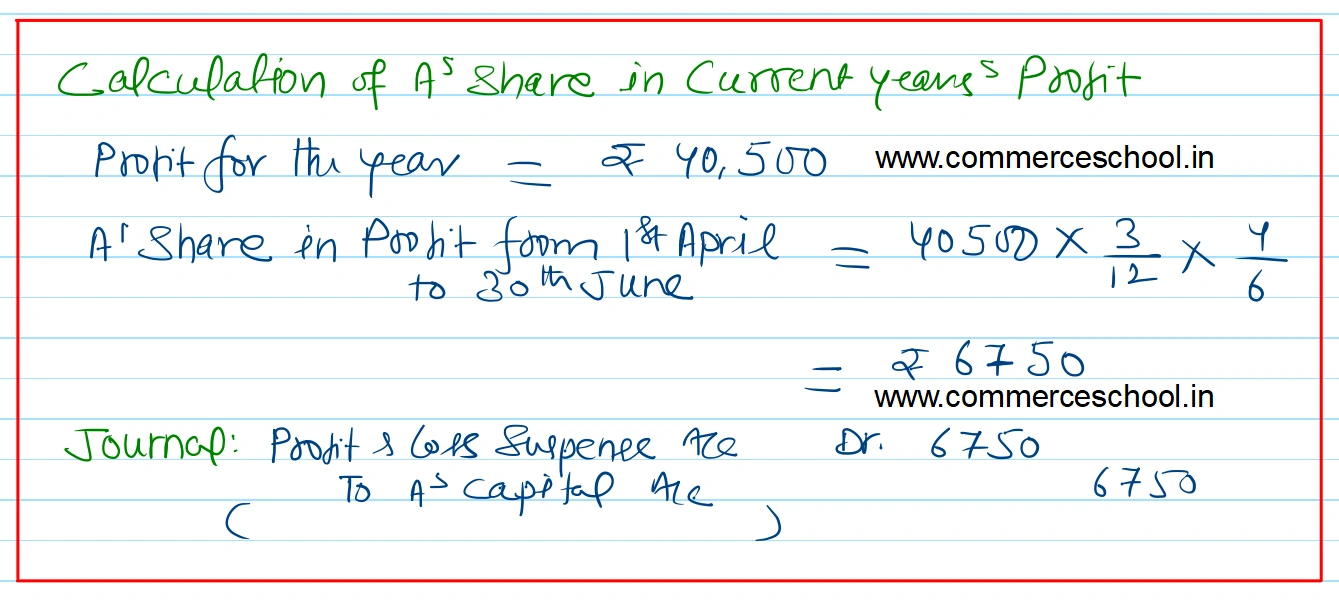

A, B and C are in partnership, sharing profits in the proportion of two-thirds, one-sixth and one-sixth respectively. A died on the 30th June, 2022, three months after the annual accounts had been prepared and in accordance with the partnership agreement, his share of the profits to the date of death was estimated on the basis of the profit for the preceding year. in addition to this, the agreement provided for interest on capital at 5 percent per annum on the balance standing to the credit of the capital account at the date of the last Balance Sheet, and also for goodwill, which was to be brought into account at two year’s purchase of the average profits for the last three years.

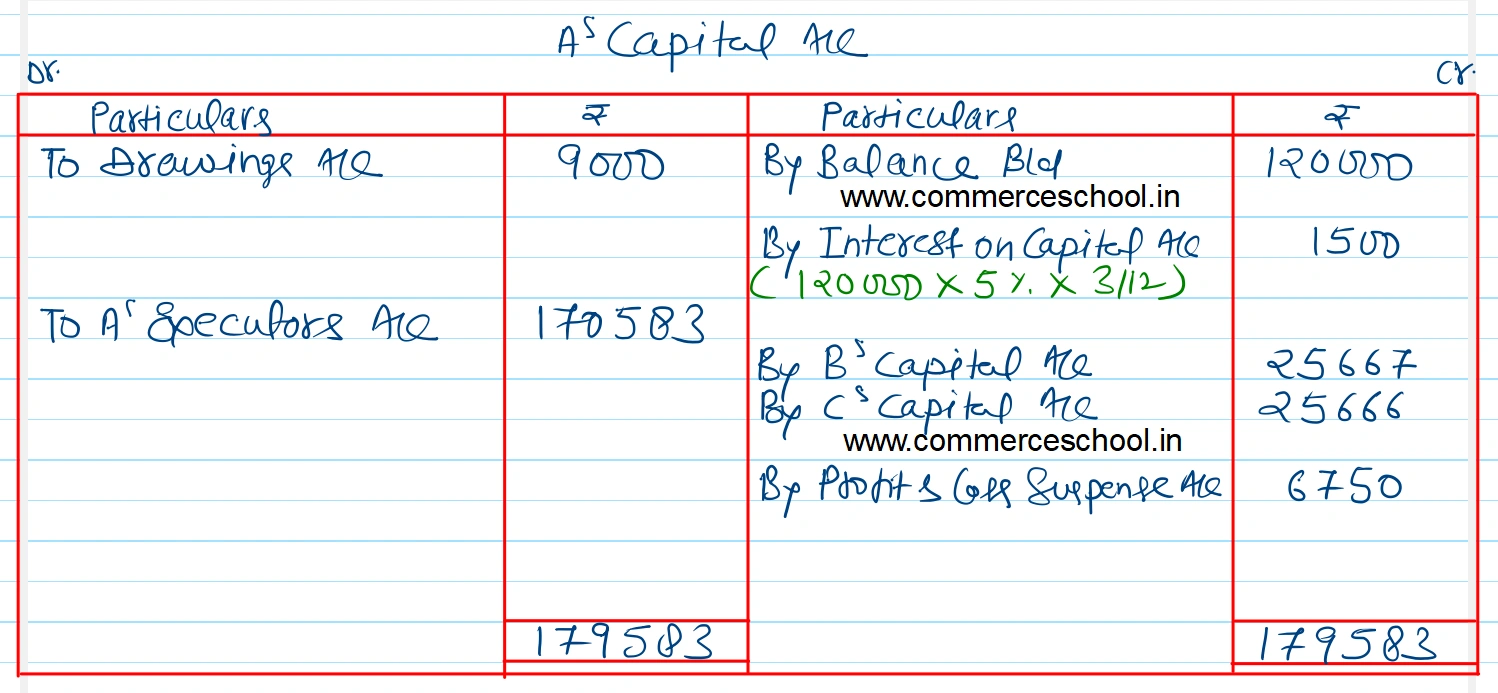

A’s Capital on 31st March, 2022 stood at ₹ 1,20,000, and his drawings from then to the date of death amounted to ₹ 9,000.

The net profits of the business for the three preceding years amounted to ₹ 33,500; ₹ 41,500 and ₹ 40,500, respectively.

You are required to prepare A’s Capital Account as at the date of death, for a settlement with his executors.

[Ans. Amount payable to A’s executors ₹ 1,70,583].