Ashish and Nimish were partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2019 their Balance Sheet was as follows:

Ashish and Nimish were partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2019 their Balance Sheet was as follows:

Balance Sheet of Ashish and Nimish as at 31st March, 2019

| Liabilities | ₹ | Assets | ₹ |

| Capitals: Ashish Nimish | 3,10,000 2,90,000 | Plant and Machinery | 2,90,000 |

| General Reserve | 50,000 | Furniture | 2,20,000 |

| Workmen’s Compensation Reserve | 20,000 |

Sundry Debtors 90,000 Less: PDD 1,000 |

89,000 |

| Creditors | 1,10,000 | Stock | 1,40,000 |

| Cash | 41,000 | ||

| 7,80,000 | 7,80,000 |

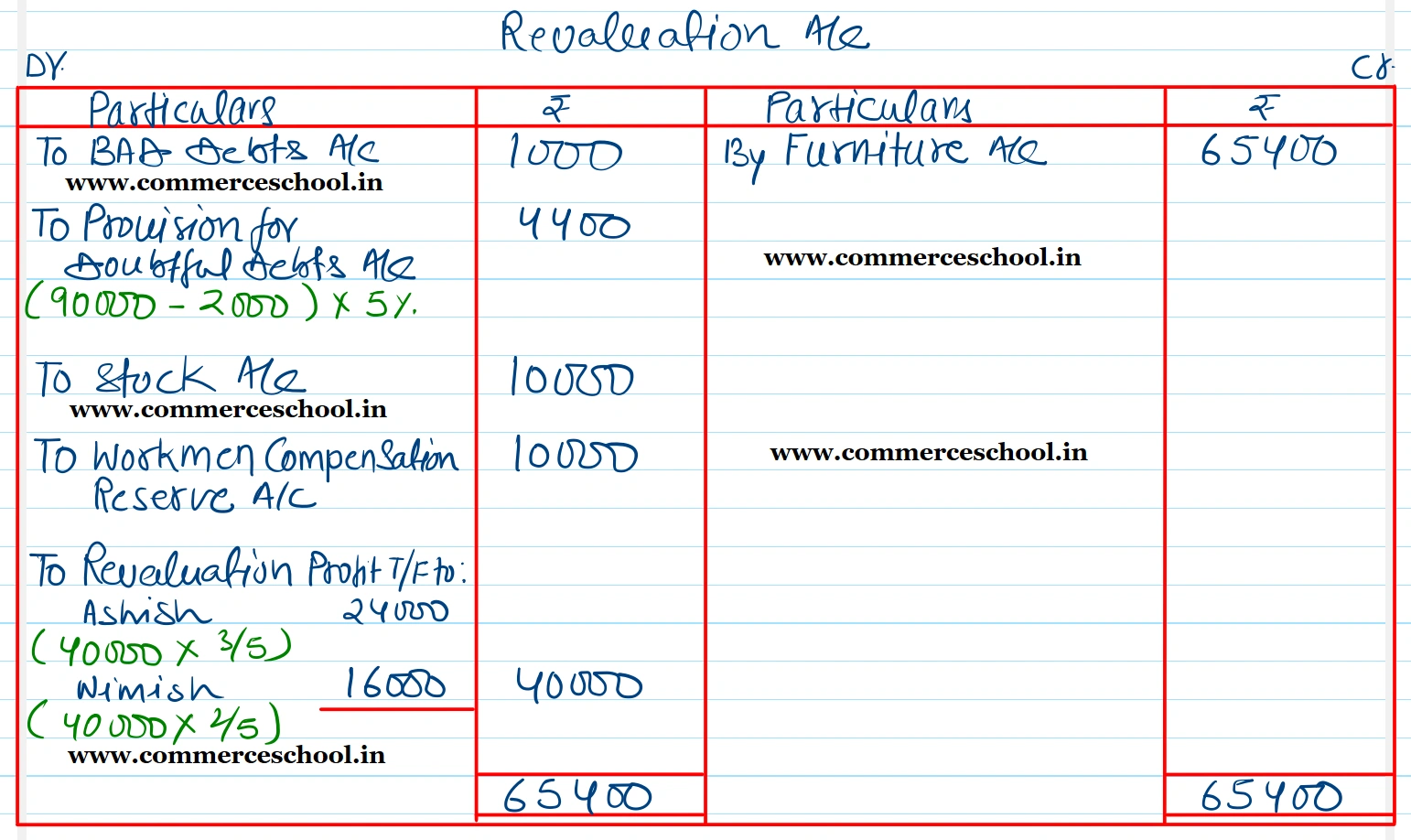

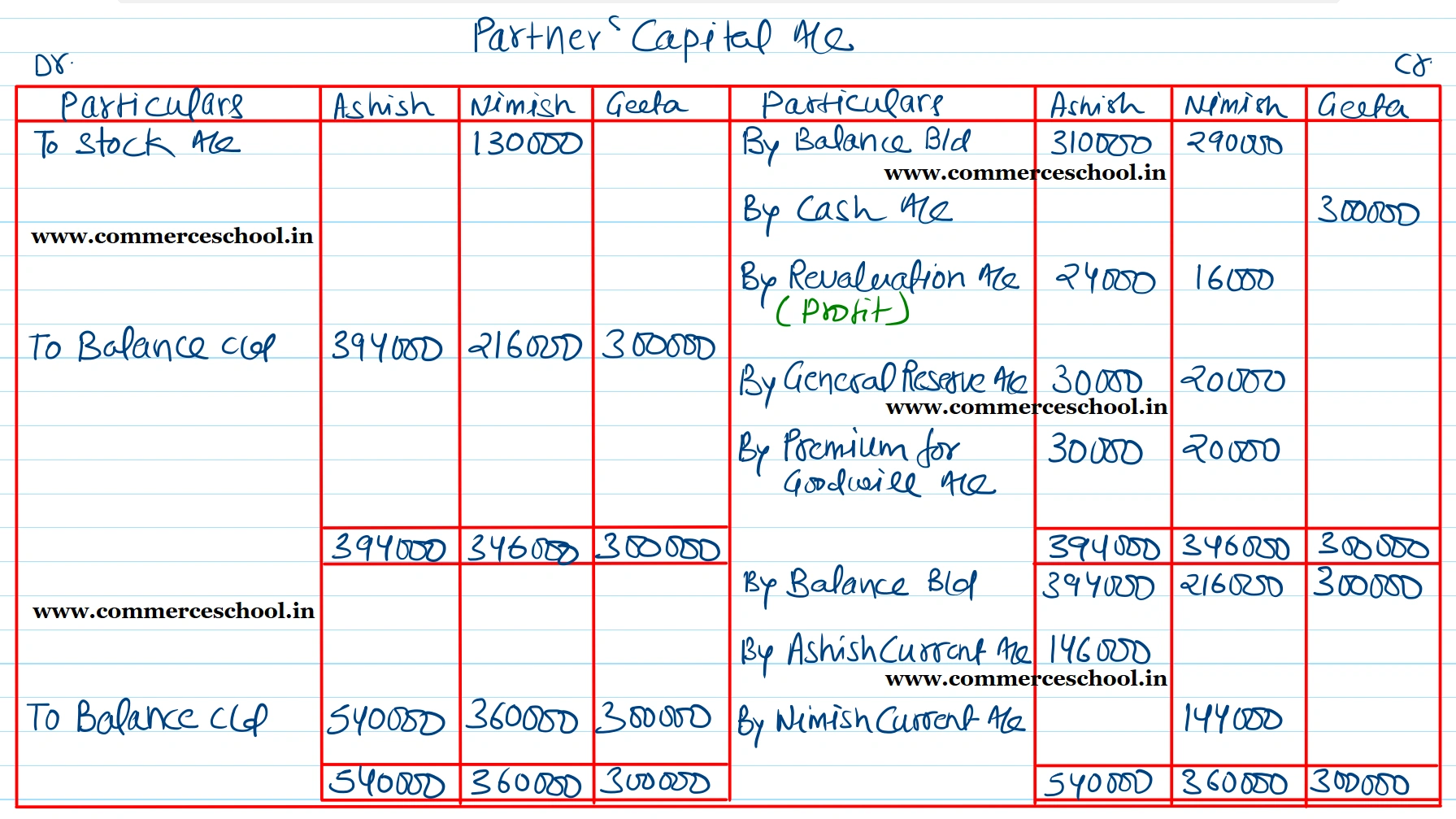

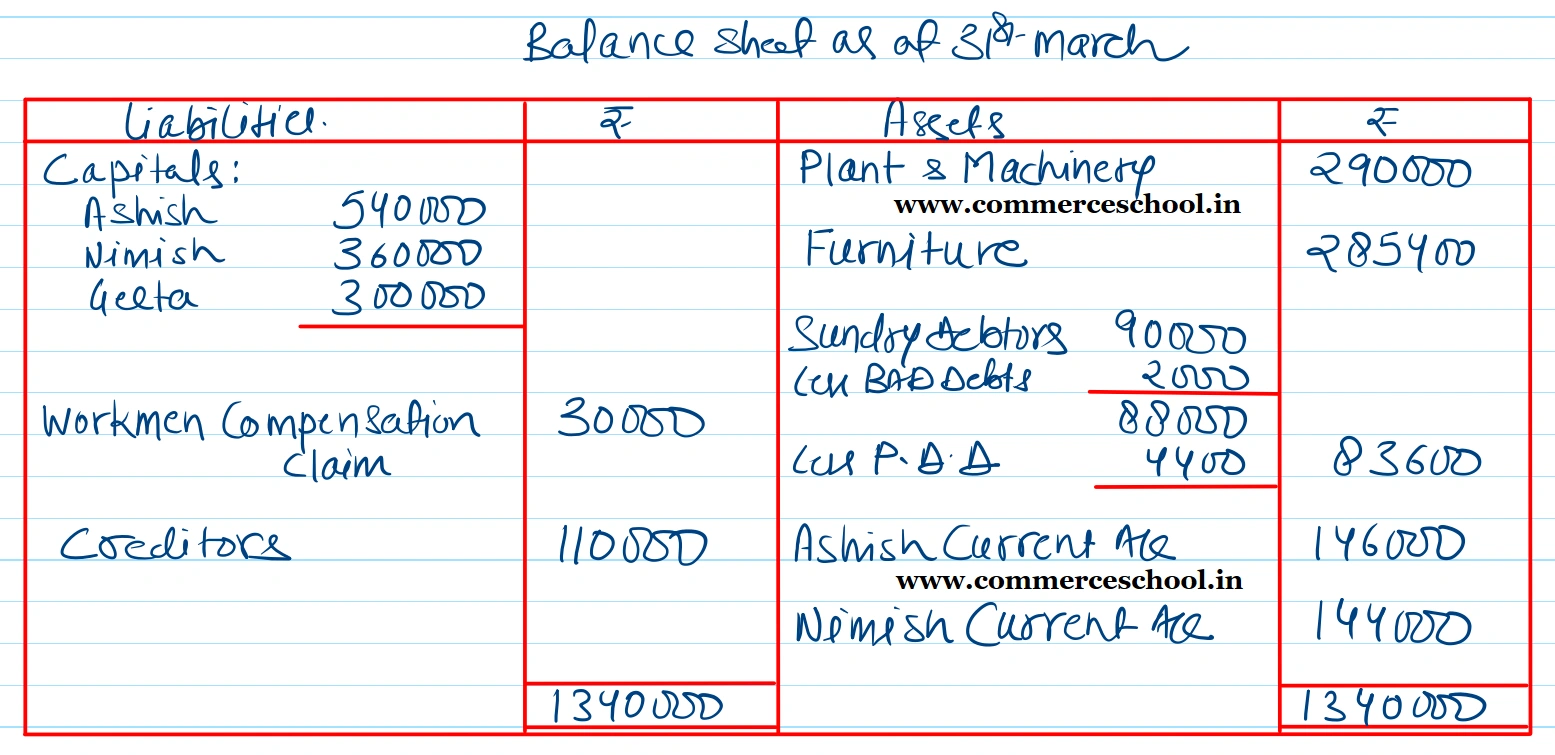

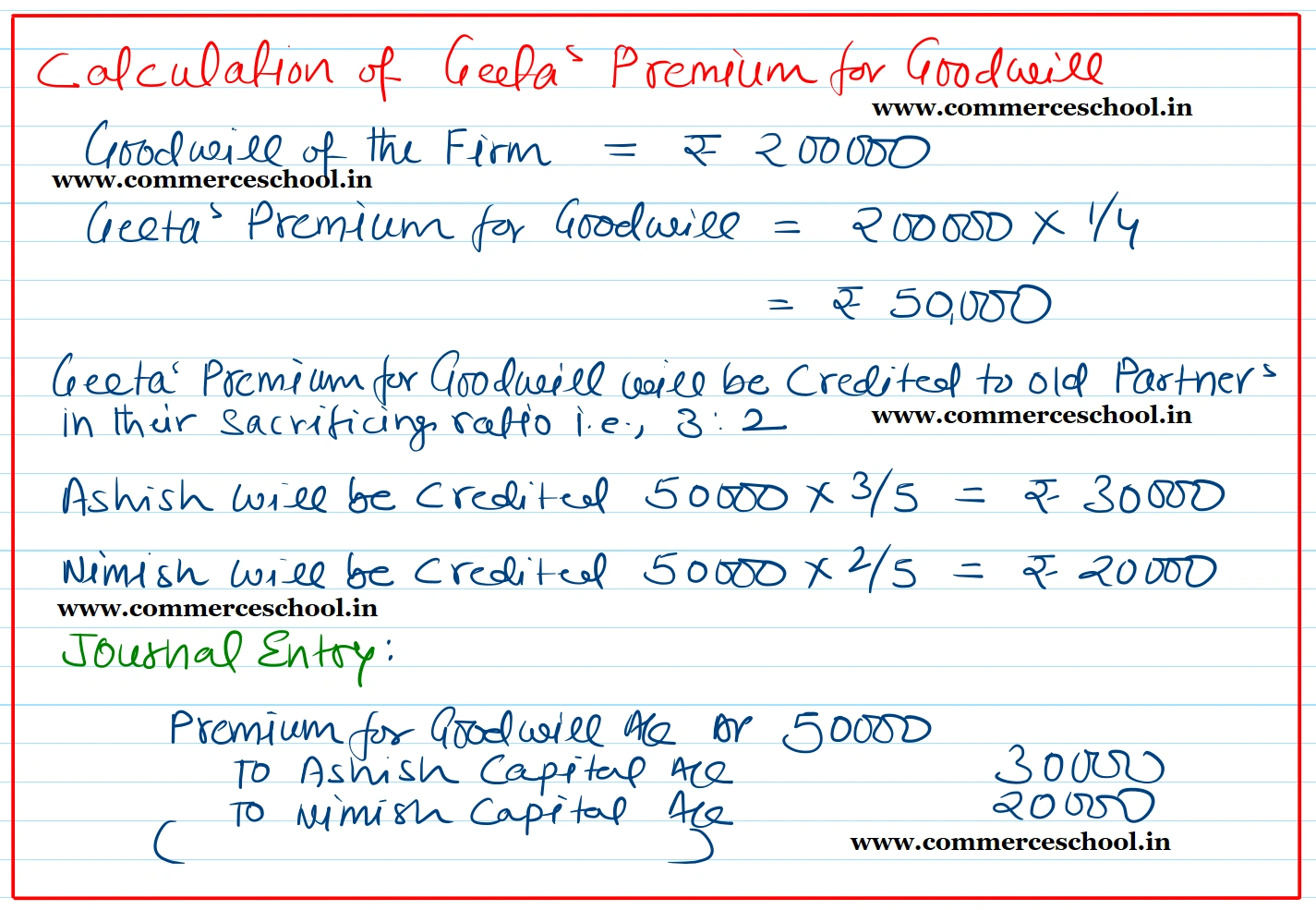

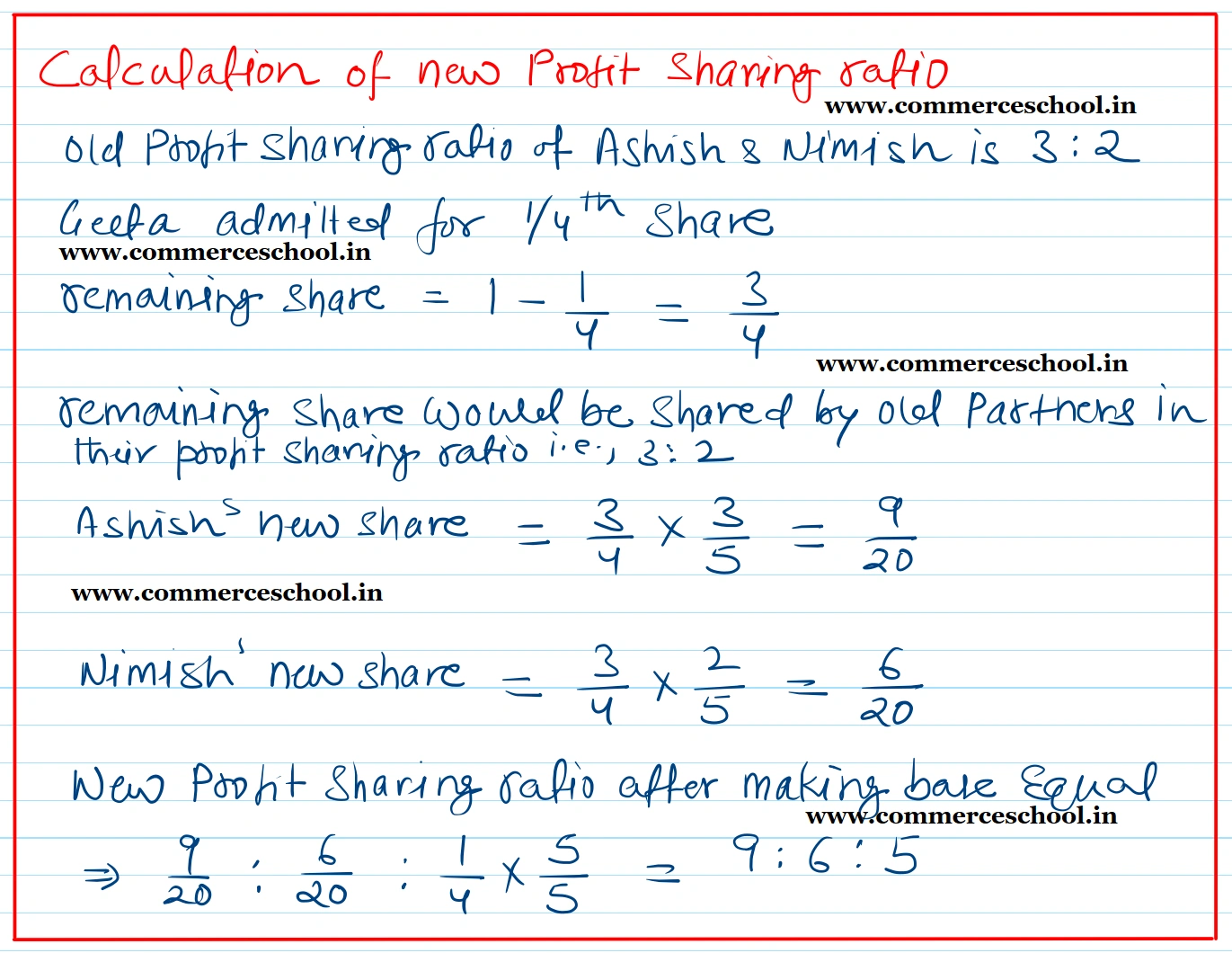

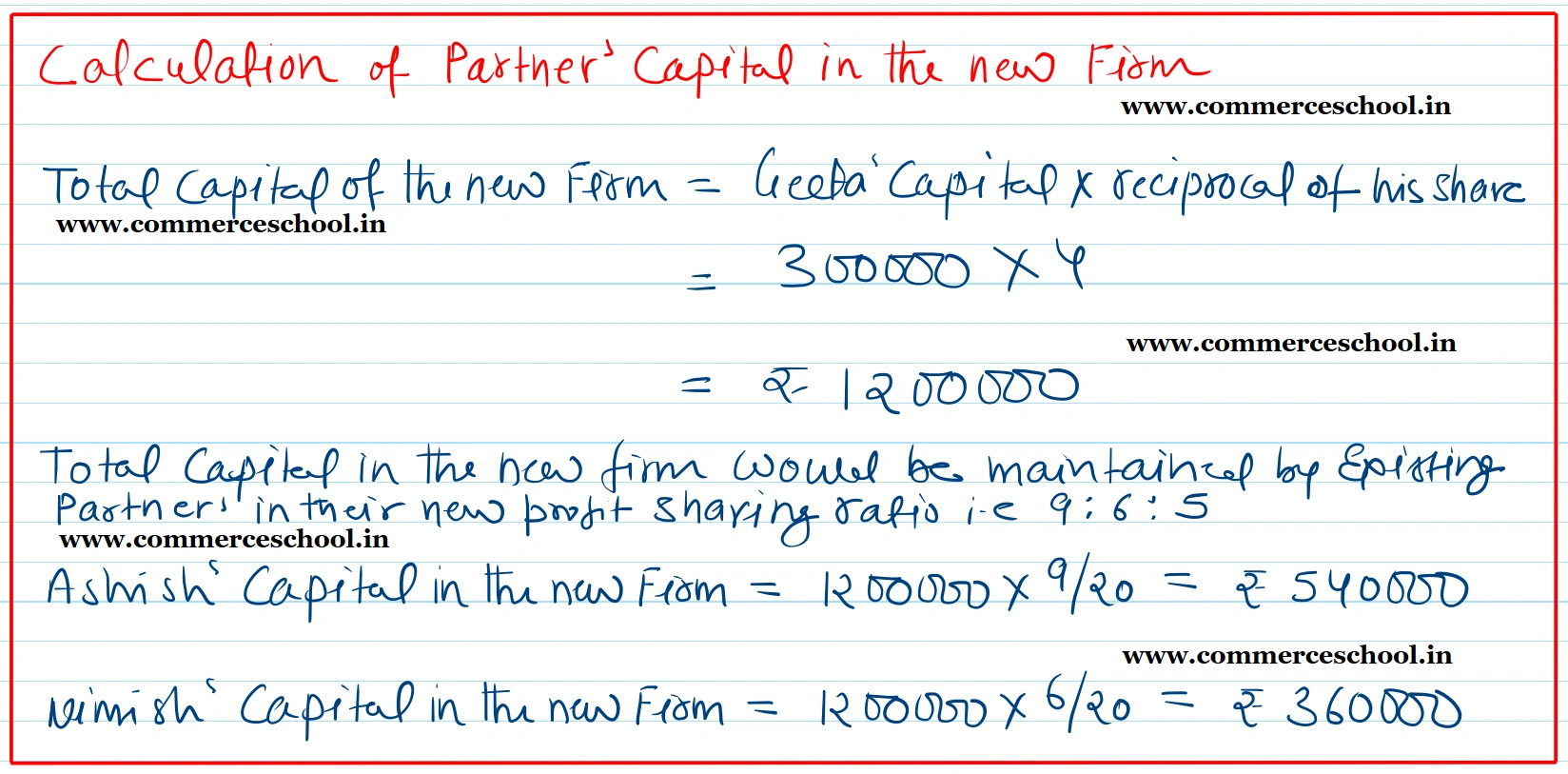

On 1st April, 2019, Geeta was admitted into the partnership for 1/4th share in the profits on the following terms: (i) Goodwill of the firm was valued at ₹ 2,00,000. (ii) Geeta brought ₹ 3,00,000 as her capital and her share of goodwill premium in cash. (iii) Bad debts amounted to ₹ 2,000. Create a provisoin for doubtful debts @ 5% on Sundry Debtors. (iv) Furniture was found undervalued by ₹ 65,400. (v) Stock was taken over by Nimish for ₹ 1,30,000. (vi) The liability against workmen’s compensation reserve was determined at ₹ 30,000. (vii) After the above adjustments, the capitals of Ashish and Nimish were to be adjusted taking Geeta’s capital as the base. Excess or shortage was to be adjusted by opening current accounts. Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of the firm after Geeta’s admission. [Ans. Gain on Revaluation ₹ 40,000; Capital Accounts : Ashish ₹ 5,40,000; Nimish ₹ 3,60,000 and Geeta ₹ 3,00,000; Current Accounts : Ashish (Dr.) ₹ 1,46,000 and Nimish (Dr.) ₹ 1,44,000. Balance Sheet Total ₹ 13,40,000.]