Dhruv and Ansh are partners in a firm sharing profits and losses: Dhruv 75% and Ansh 25% respectively.

Dhruv and Ansh are partners in a firm sharing profits and losses: Dhruv 75% and Ansh 25% respectively.

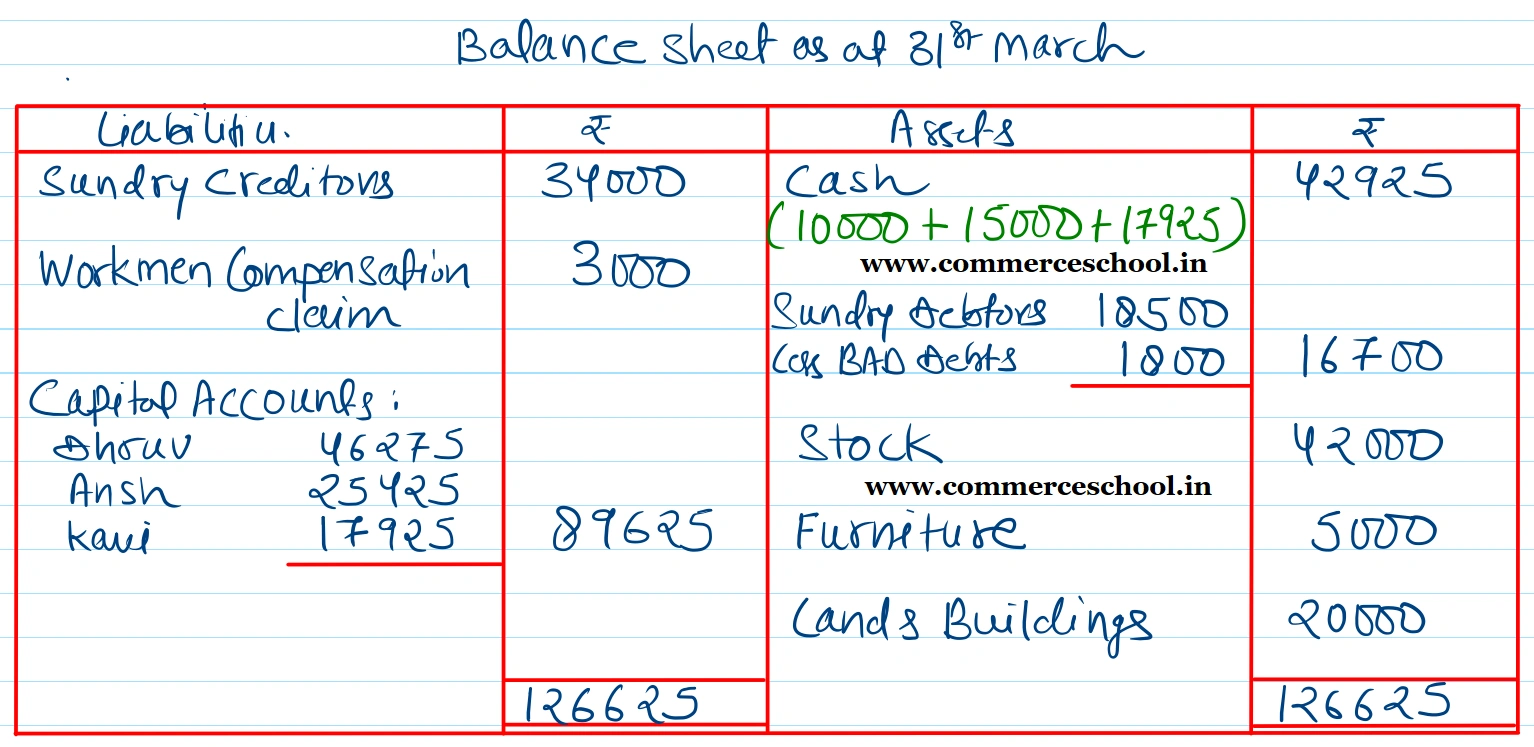

Their Balance Sheet as at 31st March, 2016 is given below:

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 39,000 | Cash | 10,000 |

| Workmen Compensation Reserve | 5,000 |

Sundry Debtors 18,500 Less PDD (1,500) |

17,000 |

| Profit & Loss Account | 10,000 | Stock | 37,000 |

|

Capital Accounts: Dhruv Ansh |

30,000 20,000 |

Furniture | 5,000 |

| Land & Buildings | 25,000 | ||

| Goodwill | 10,000 | ||

| 1,04,000 | 1,04,000 |

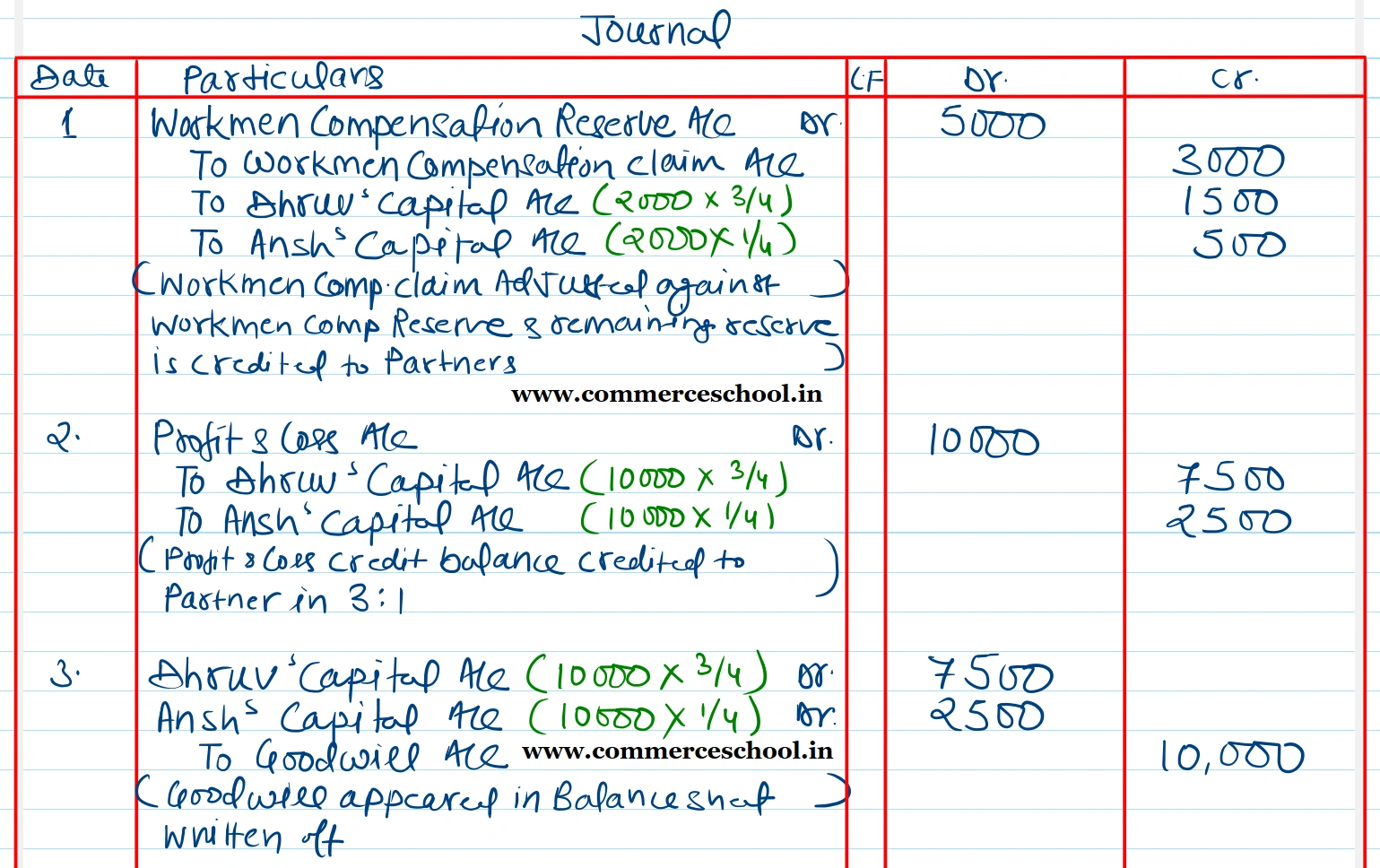

On 1st April, 2016, Kavi is admitted as a new partner on the following terms:

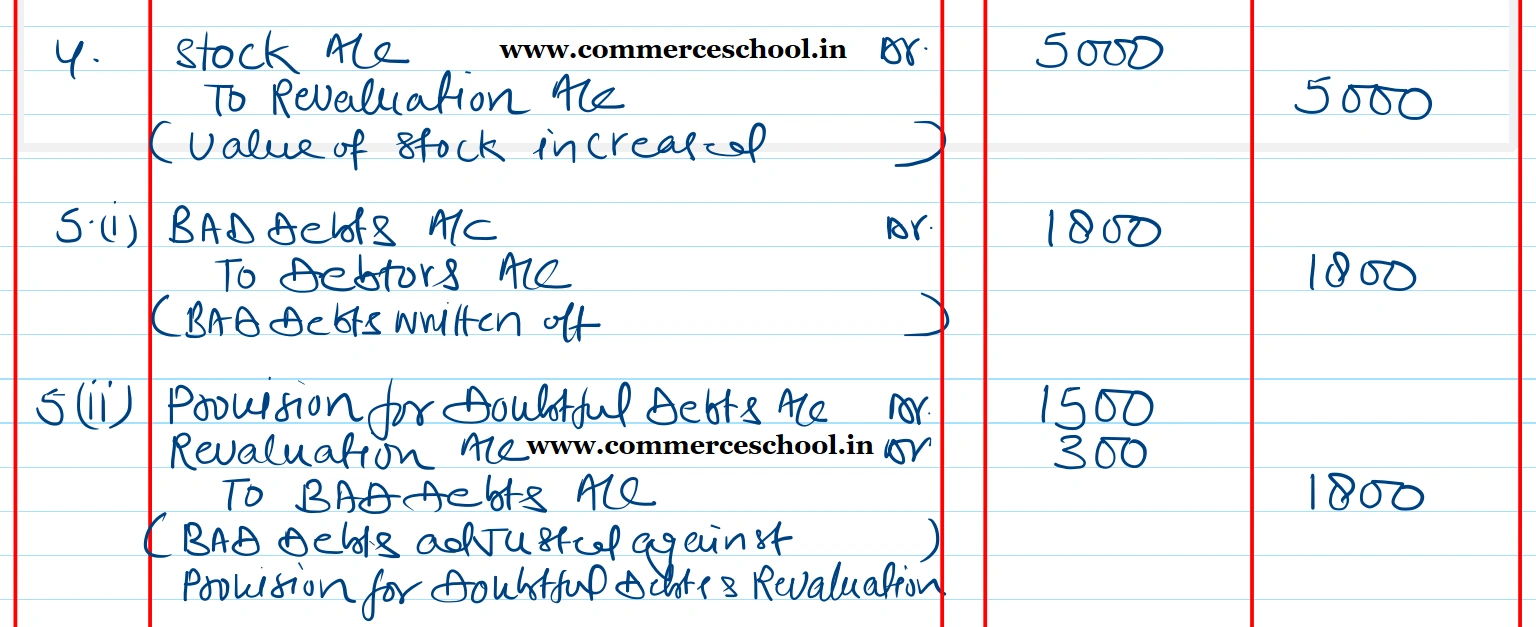

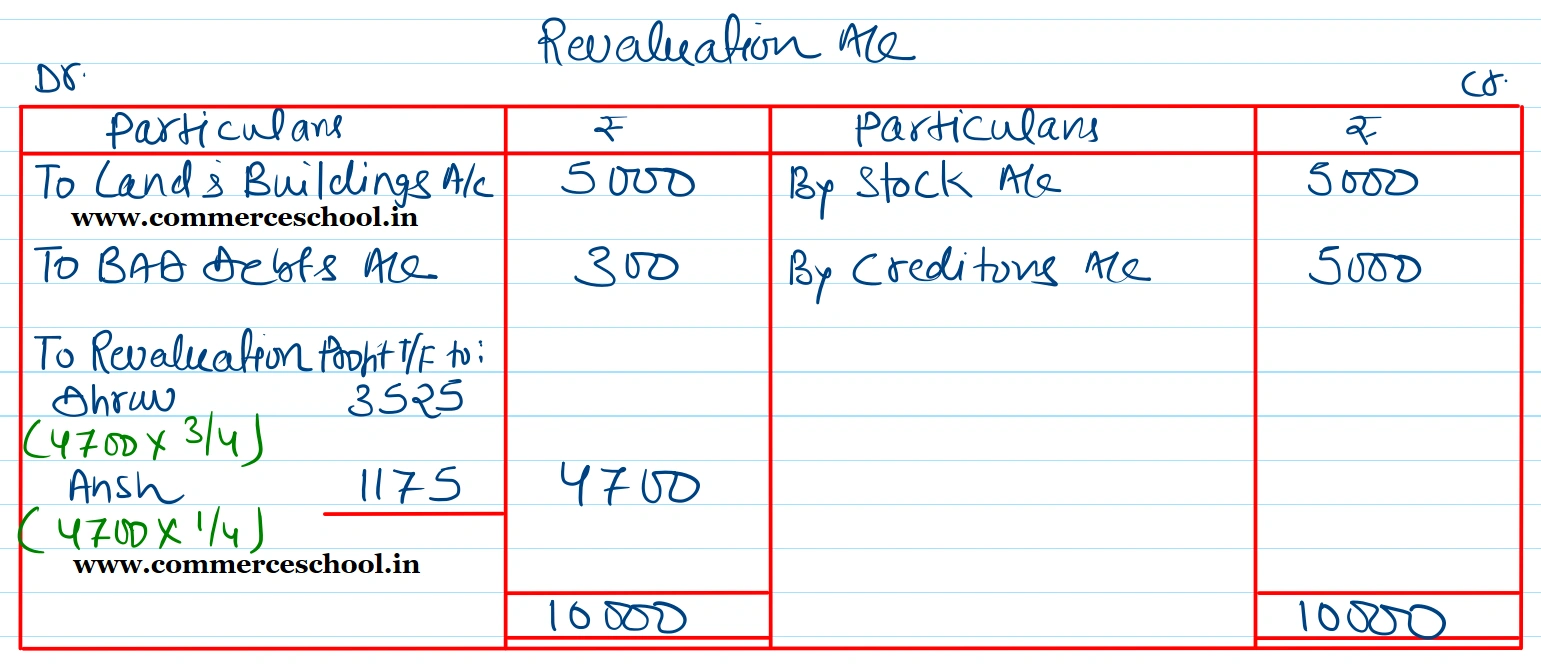

(i) The value of stock is to be increased to ₹ 42,000.

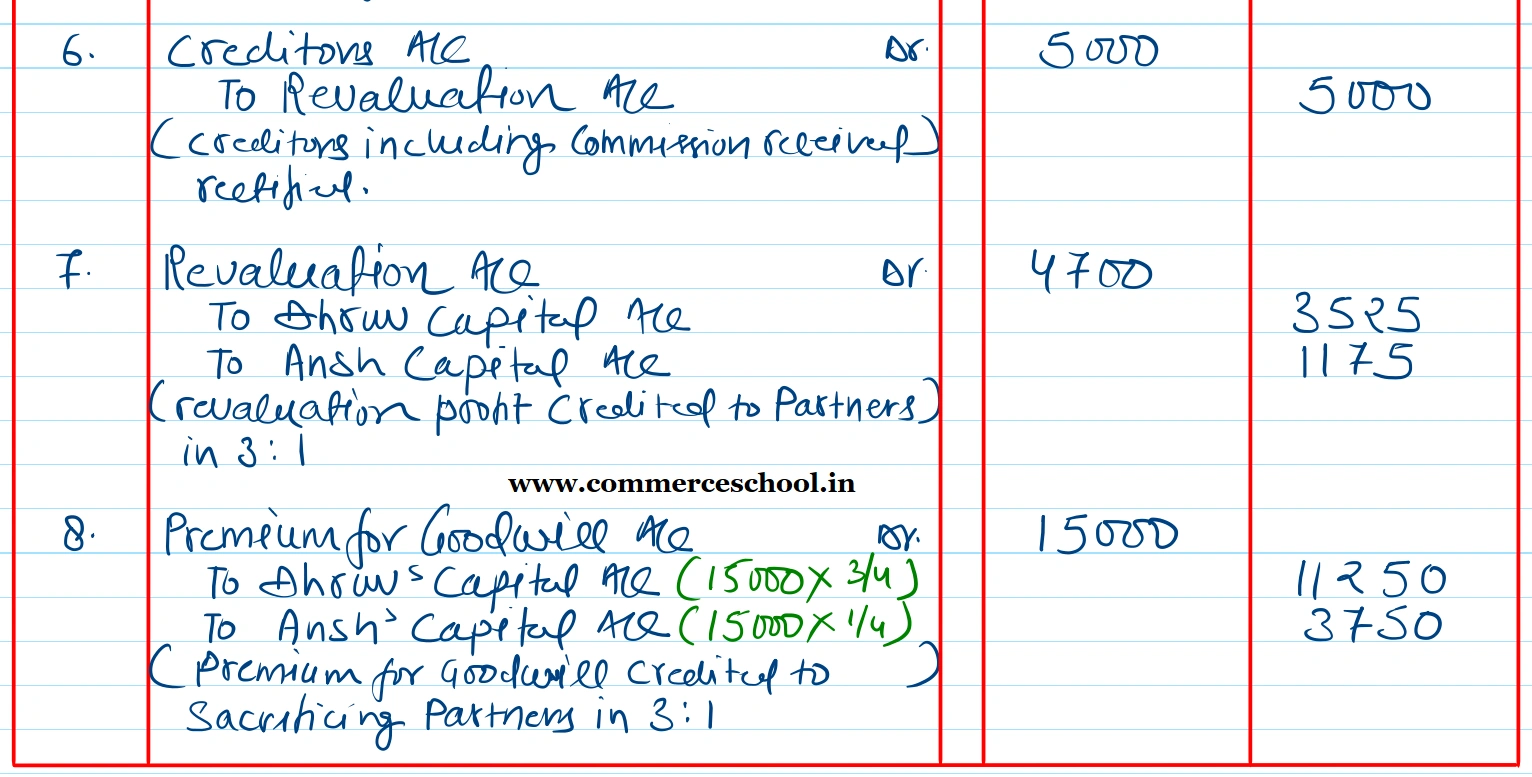

(ii) Land and Building is to be reduced by 20%.

(iii) Bad Debts amounting to ₹ 1,800 are to be written off.

(iv) Creditors include an amount of ₹ 5,000 received as commission from Amar. The necessary adjustment is required to be made.

(v) The liability of Workmen Compensation Reserve is determined at ₹ 3,000.

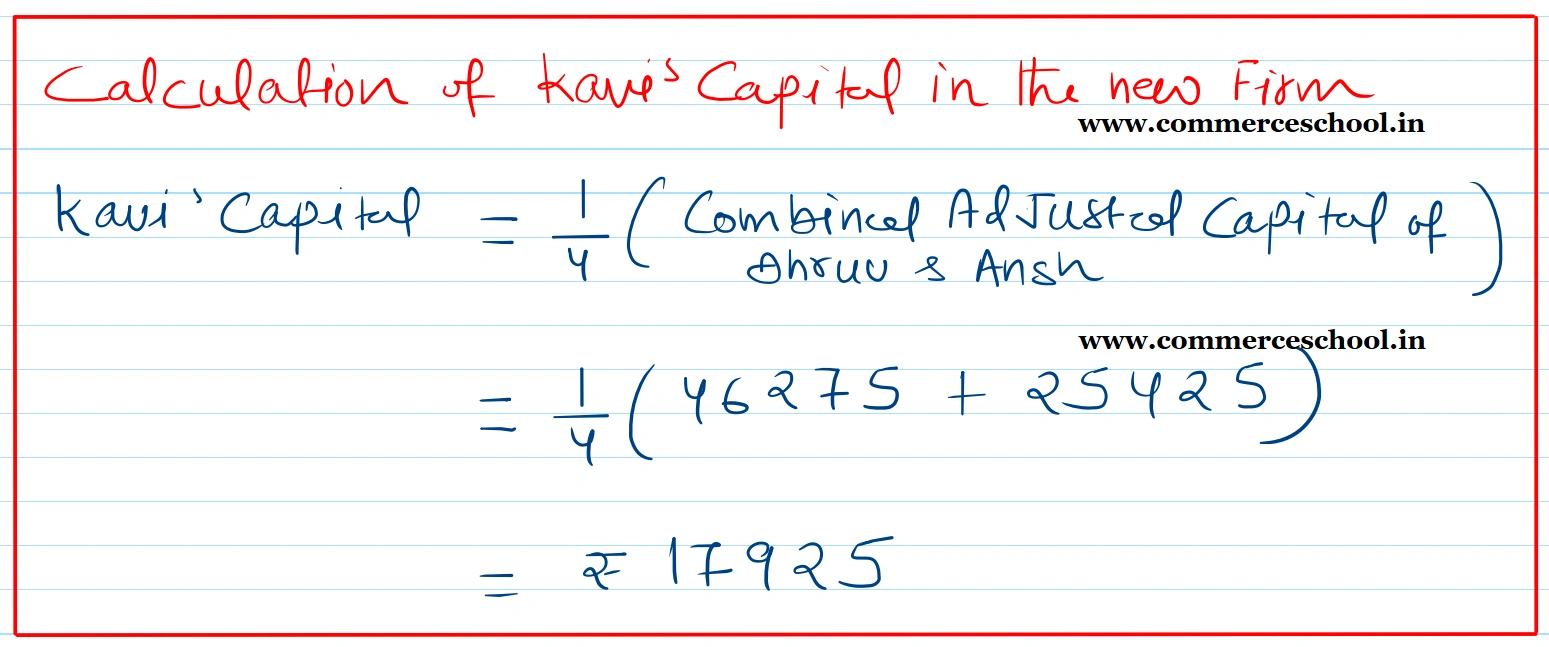

(vi) Kavi is to pay ₹ 15,000 to the existing partners as premium for Goodwill for 20% of the future profits of the firm. He is also to bring in capital equal to 1/4th of the combined capitals of Dhruv and Ansh.

You are required to:

(i) Pass journal entries on the date of Kavi’s admission.

(ii) Prepare the opening Balance sheet of the new firm on the compeltion of the transactions.

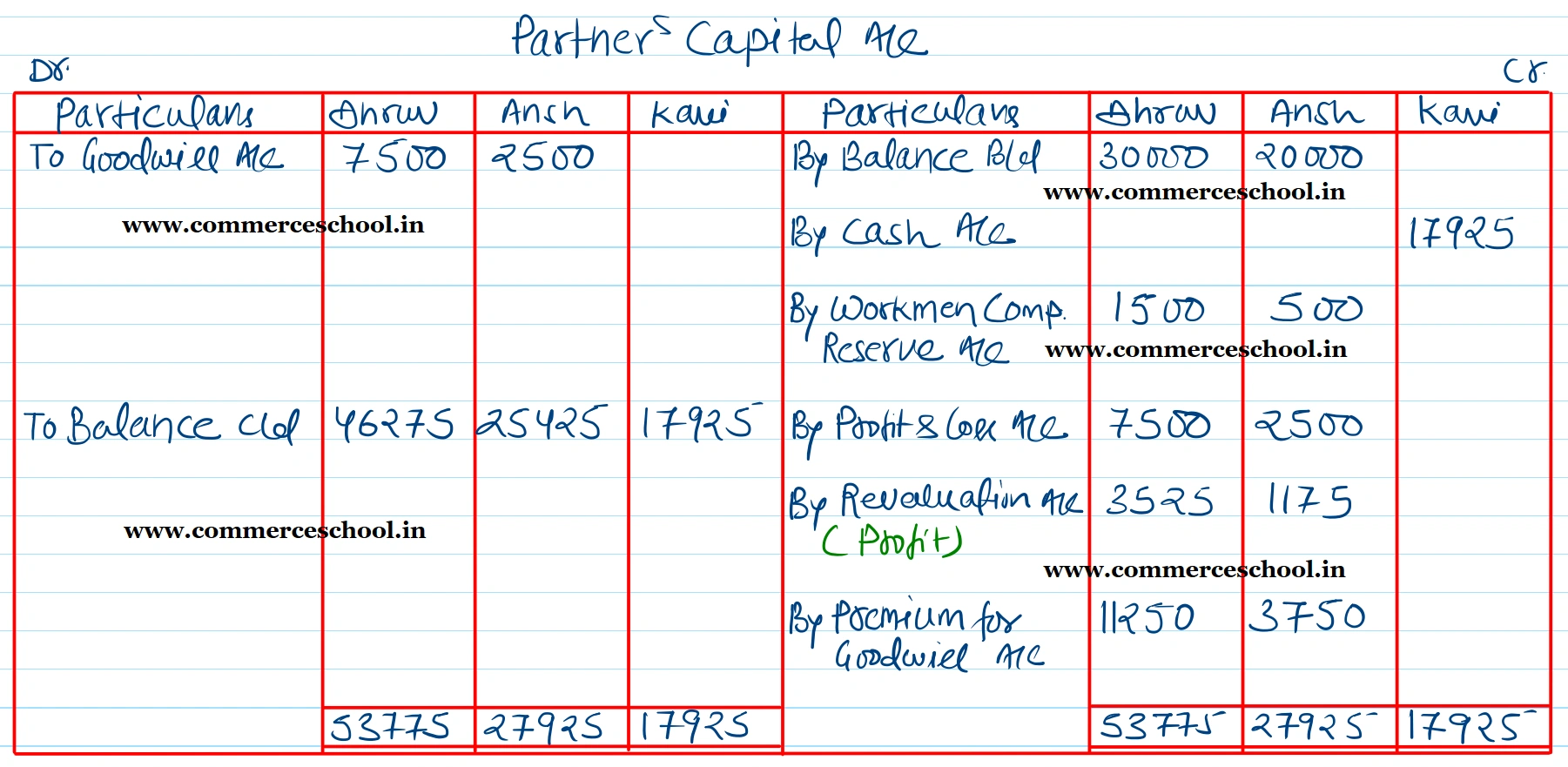

[Ans.: Gain on Revaluation ₹ 4,700; Capital A/cs: Dhruv ₹ 46,275; Ansh ₹ 25,425 and Kavi ₹ 17,925; B/S Total ₹ 1,26,625.]