A and B are partners sharing profits in the ratio of 2 : 3. Their Balance Sheet as at 31st March, 2024 was as follows:

A and B are partners sharing profits in the ratio of 2 : 3. Their Balance Sheet as at 31st March, 2024 was as follows:

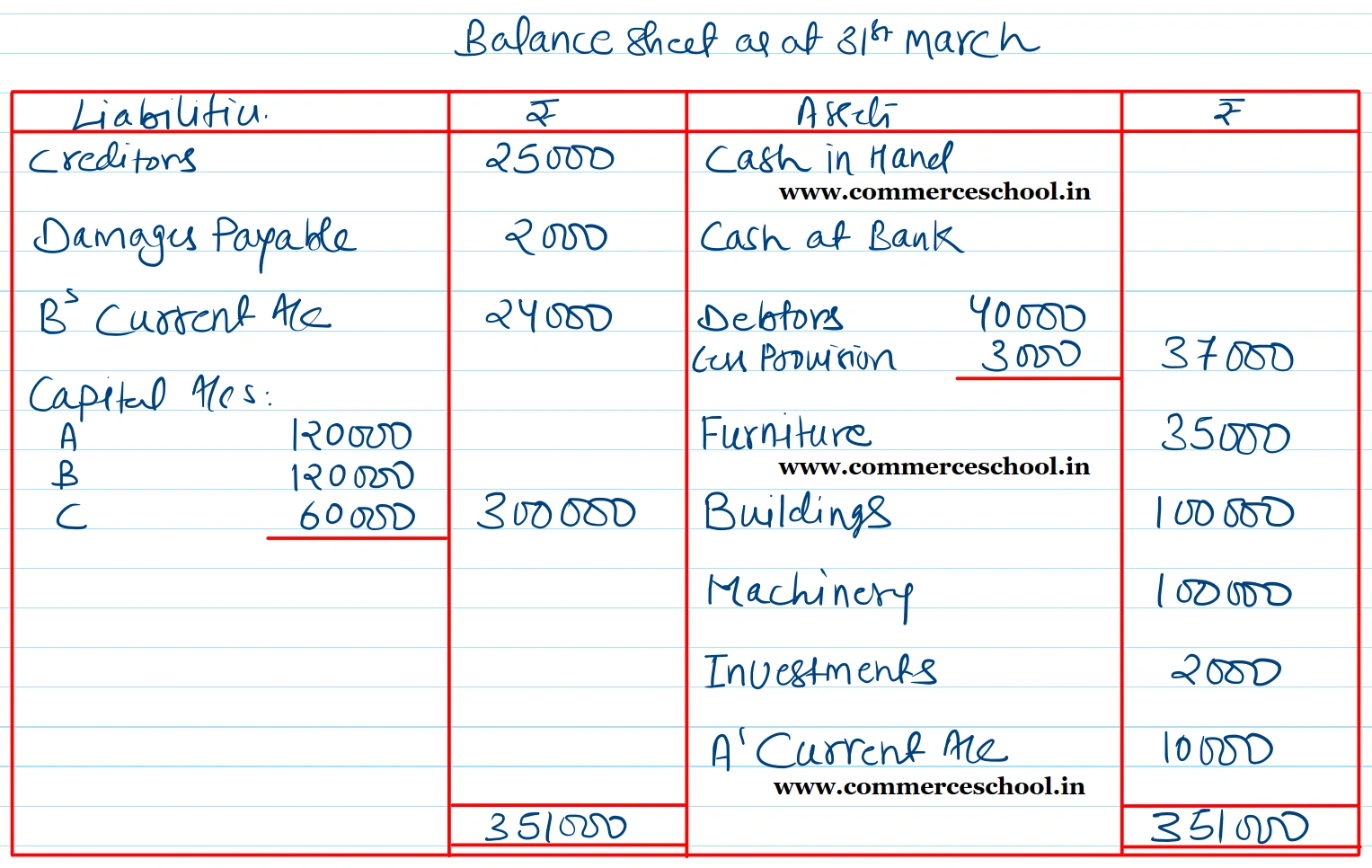

| Liabilities | ₹ | Assets | ₹ |

| Bank Overdraft | 32,000 | Cash in Hand | 3,000 |

| Creditors | 25,000 | Cash at Bank | 12,000 |

| P & L Account | 10,000 |

Debtors 40,000 Less: Provision 5,000 |

35,000 |

|

Capitals: A B |

1,00,000 1,05,000 |

Furniture | 40,000 |

| Building | 80,000 | ||

| Machinery | 1,00,000 | ||

| Investments | 2,000 | ||

| 2,72,000 | 2,72,000 |

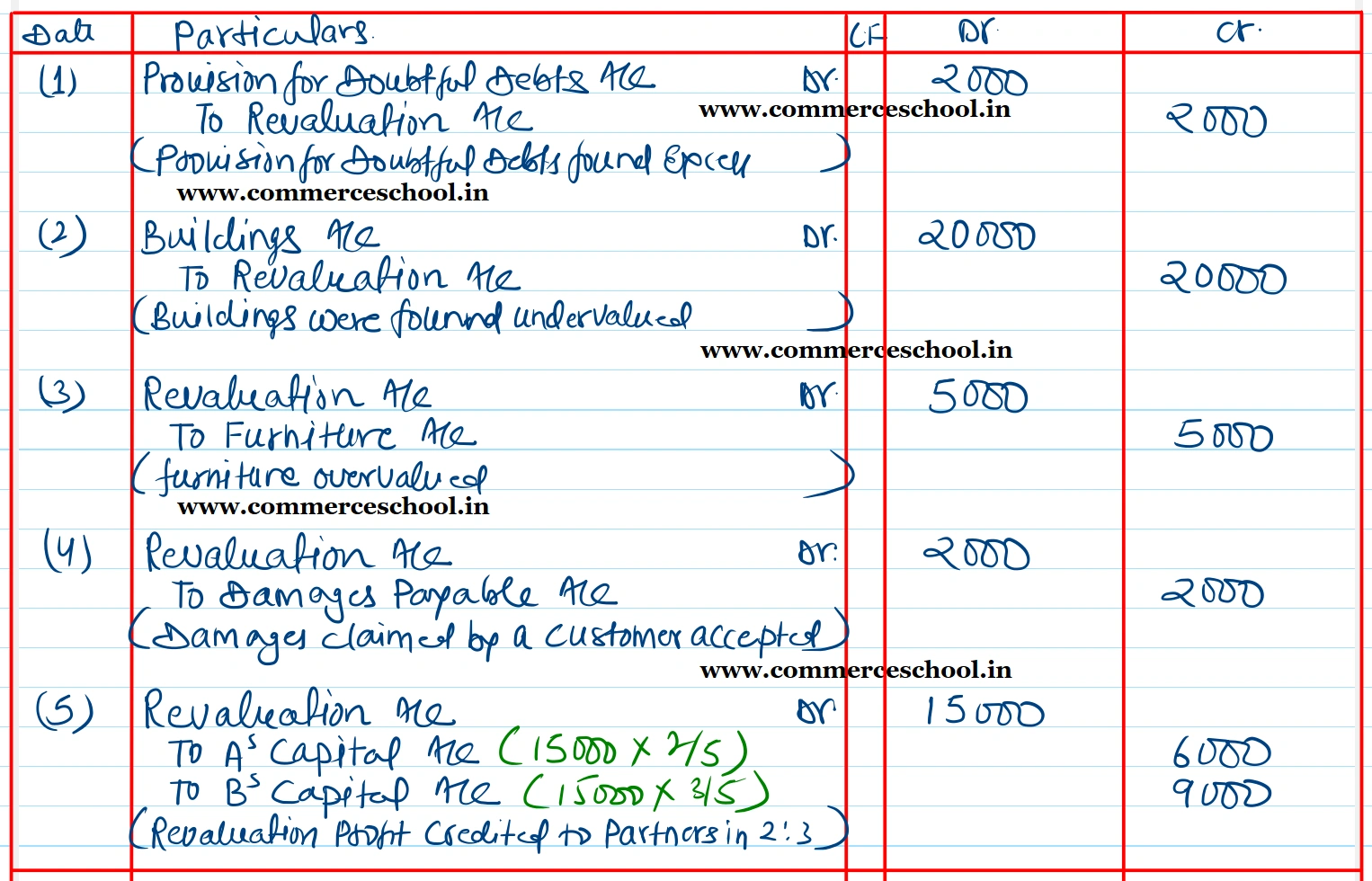

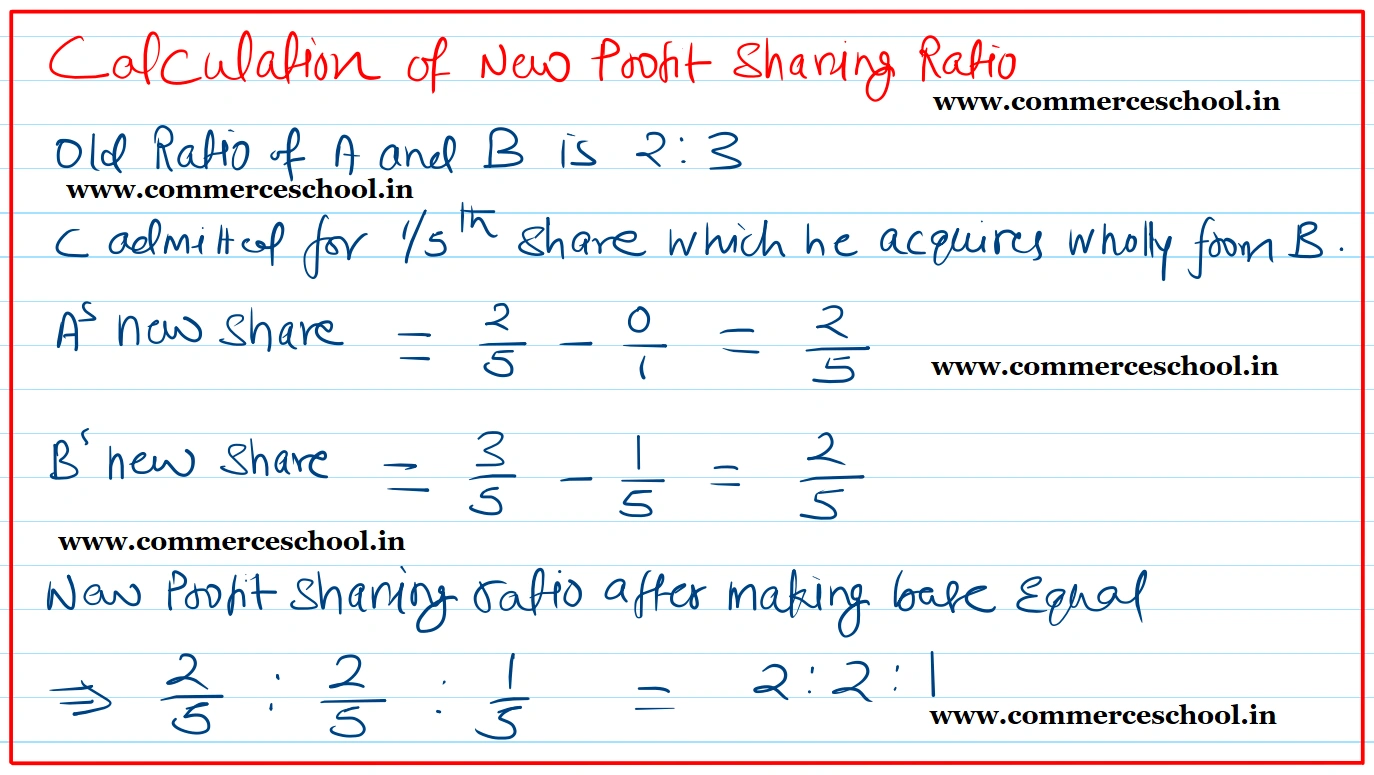

On 1st April, 2024 they admitted C for 1/5 share in profits which he acquires wholly from B. The other terms of agreement were:

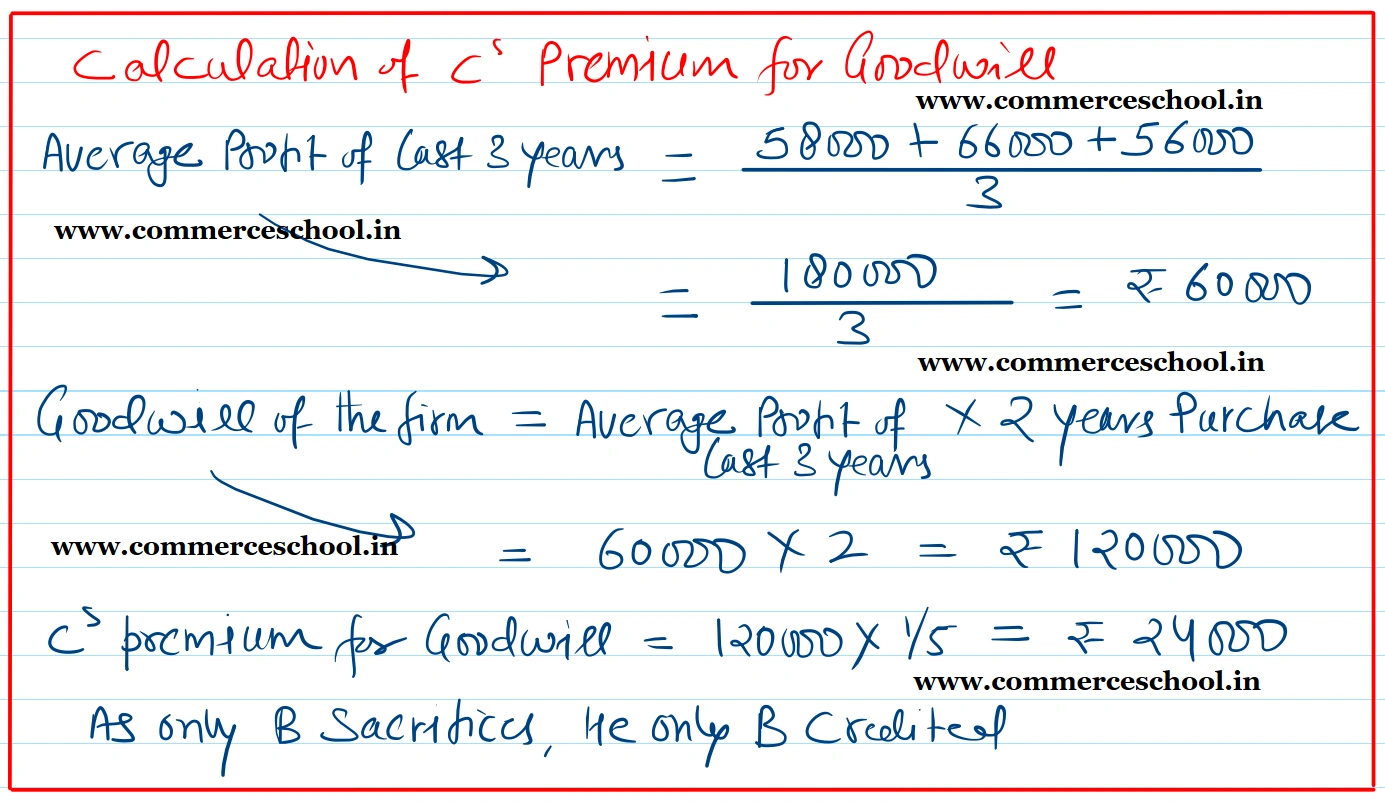

(i) Goodwill of the firm ws to be valued at two year’s purchase of the average of the last 3 year’s profits. The profit for the last 3 years were ₹ 58,000; ₹ 66,000; and ₹ 56,000 respectively.

(ii) Provision for Doubtful debts was found in excess by ₹ 2,000.

(iii) Buildings were found undervalued by ₹ 20,000 and furniture overvalued by ₹ 5,000.

(iv) ₹ 5,000 for damages claimed by a customer had been disputed by the firm. It was agreed to ₹ 2,000 by a compromise between the customer and the firm.

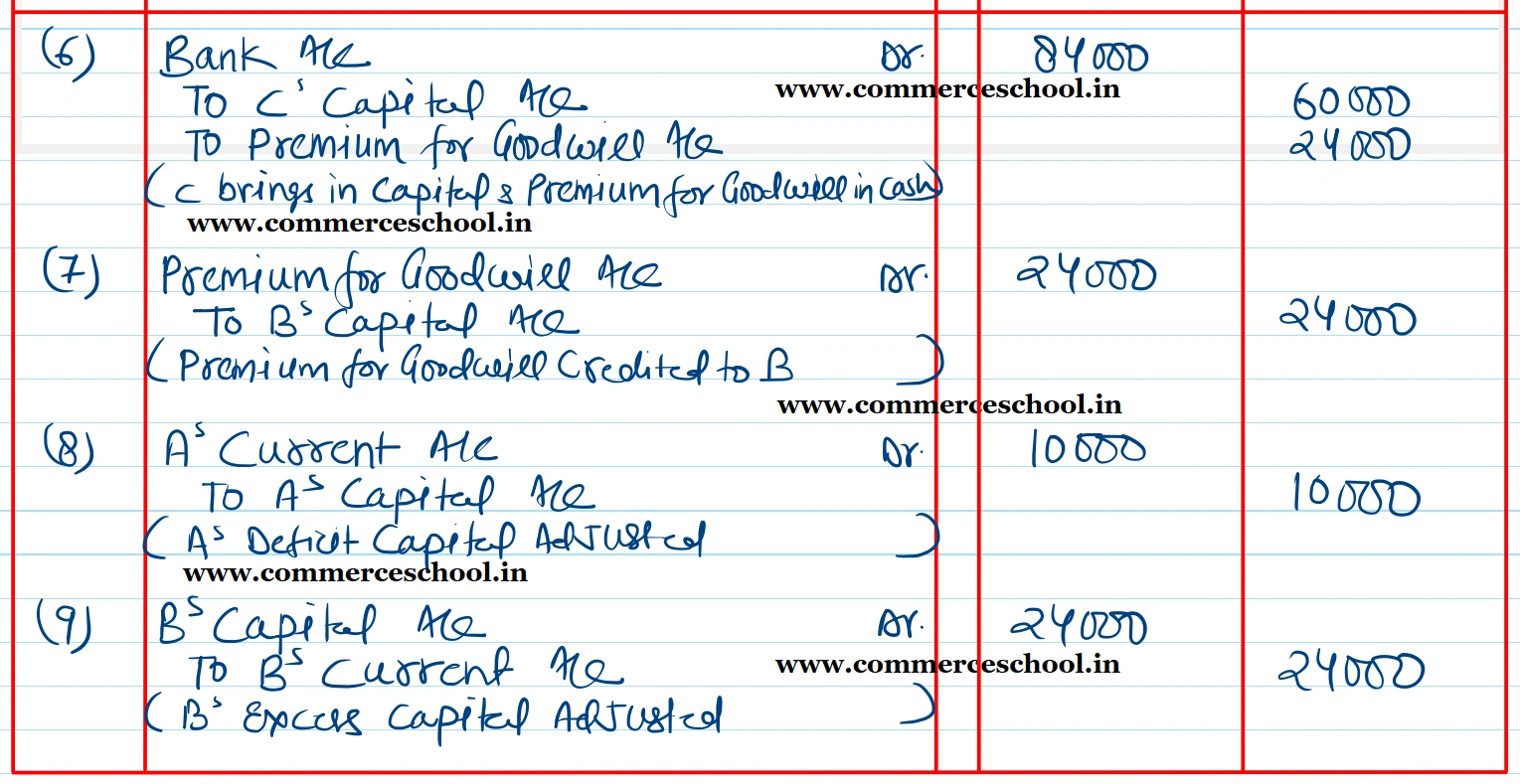

(v) C was to bring in ₹ 60,000 as his capital and the necessary amount for his share of goodwill.

(vi) Capitals of A and B were to be adjusted in the new profit sharing ratio by opening necessary current accounts.

Prepare journal entries, capital accounts and the opening balance sheet.

[Ans. Gain on Revaluation ₹ 15,000; Capital A ₹ 1,20,000; B ₹ 1,20,000 and C ₹ 60,000; Cash in Hand ₹ 3,000; Cash at Bank (after deducting bank overdraft) ₹ 64,000. B/S Total ₹ 3,51,000; New Ratio 2 : 2 : 1; A’s Current A/c ₹ 10,000 (Dr.); B’s Current A/c ₹ 24,000 (Cr.).]