On 31st March, 2024 the Balance Sheet of W and R who shared profits in 3 : 2 ratio was as follows:

On 31st March, 2024 the Balance Sheet of W and R who shared profits in 3 : 2 ratio was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 20,000 | Cash | 5,000 |

| Profit and Loss Account | 15,000 |

Sundry Debtors 20,000 Less: Provision 700 |

19,300 |

|

Capital Accounts: W R |

40,000 30,000 |

Stock | 25,000 |

| Plant and Machinery | 35,000 | ||

| Plants | 20,700 | ||

| 1,05,000 | 1,05,000 |

On 1st April, 2024 B was admitted as a partner on the following conditions:

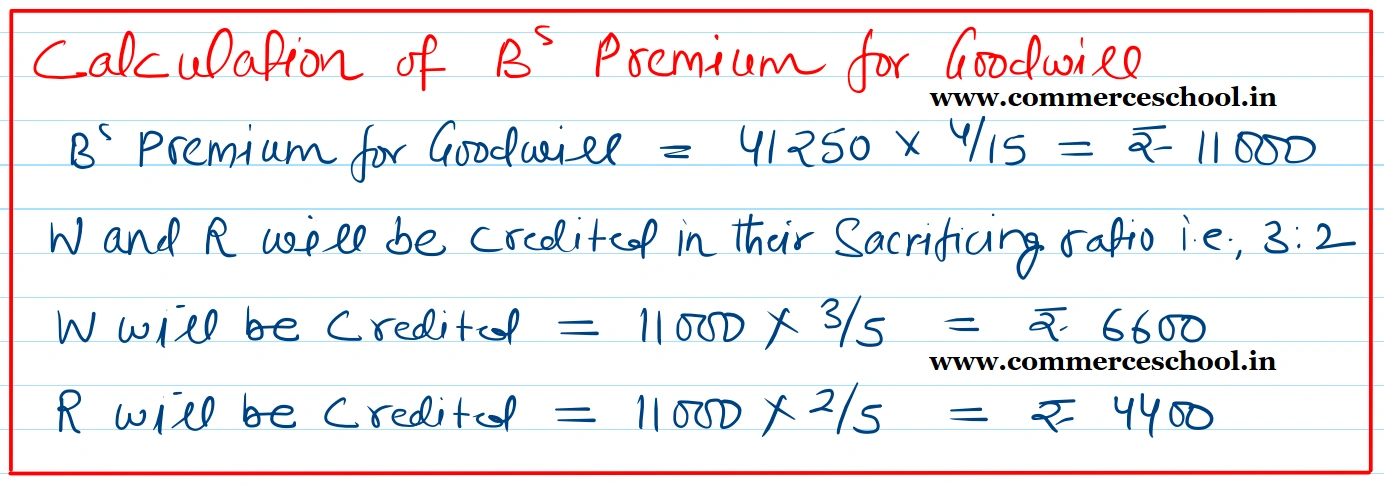

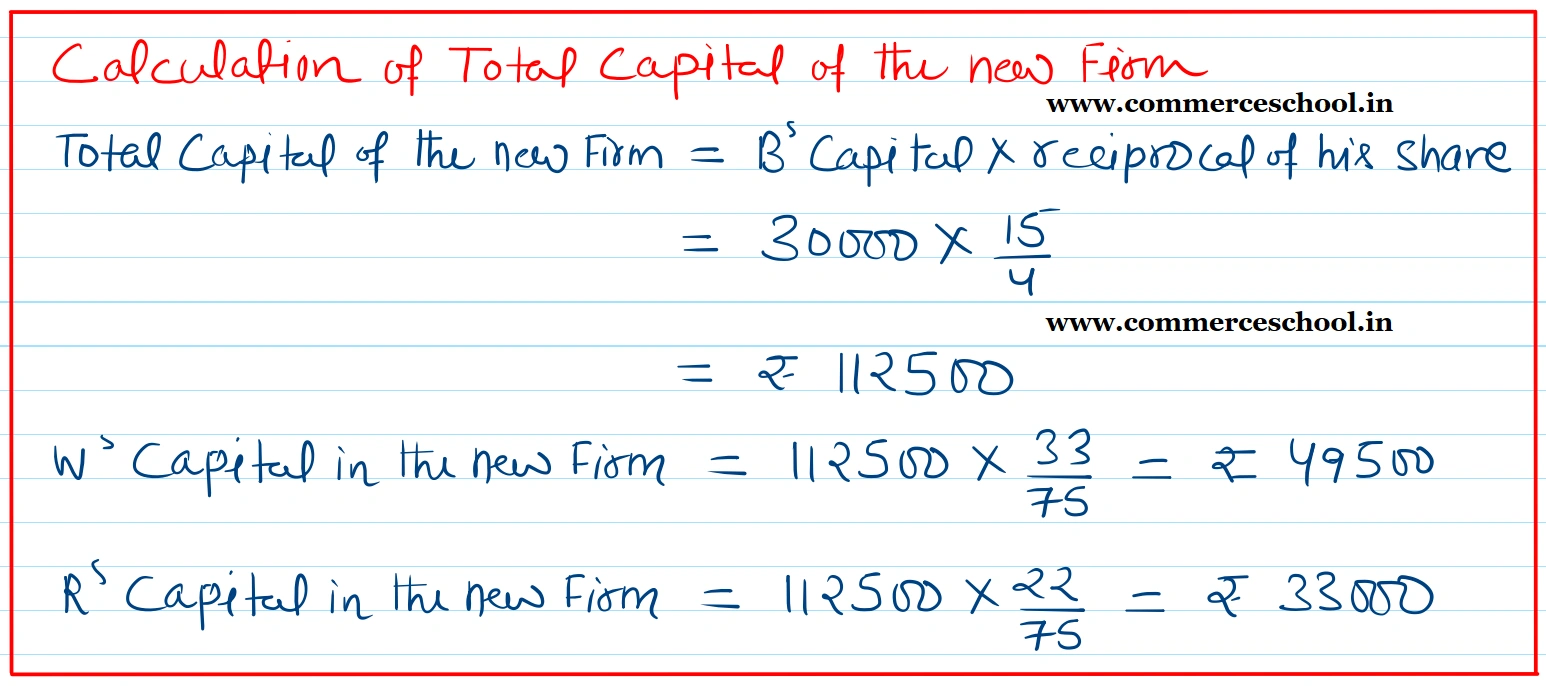

(a) B will get 4/15th share of profits.

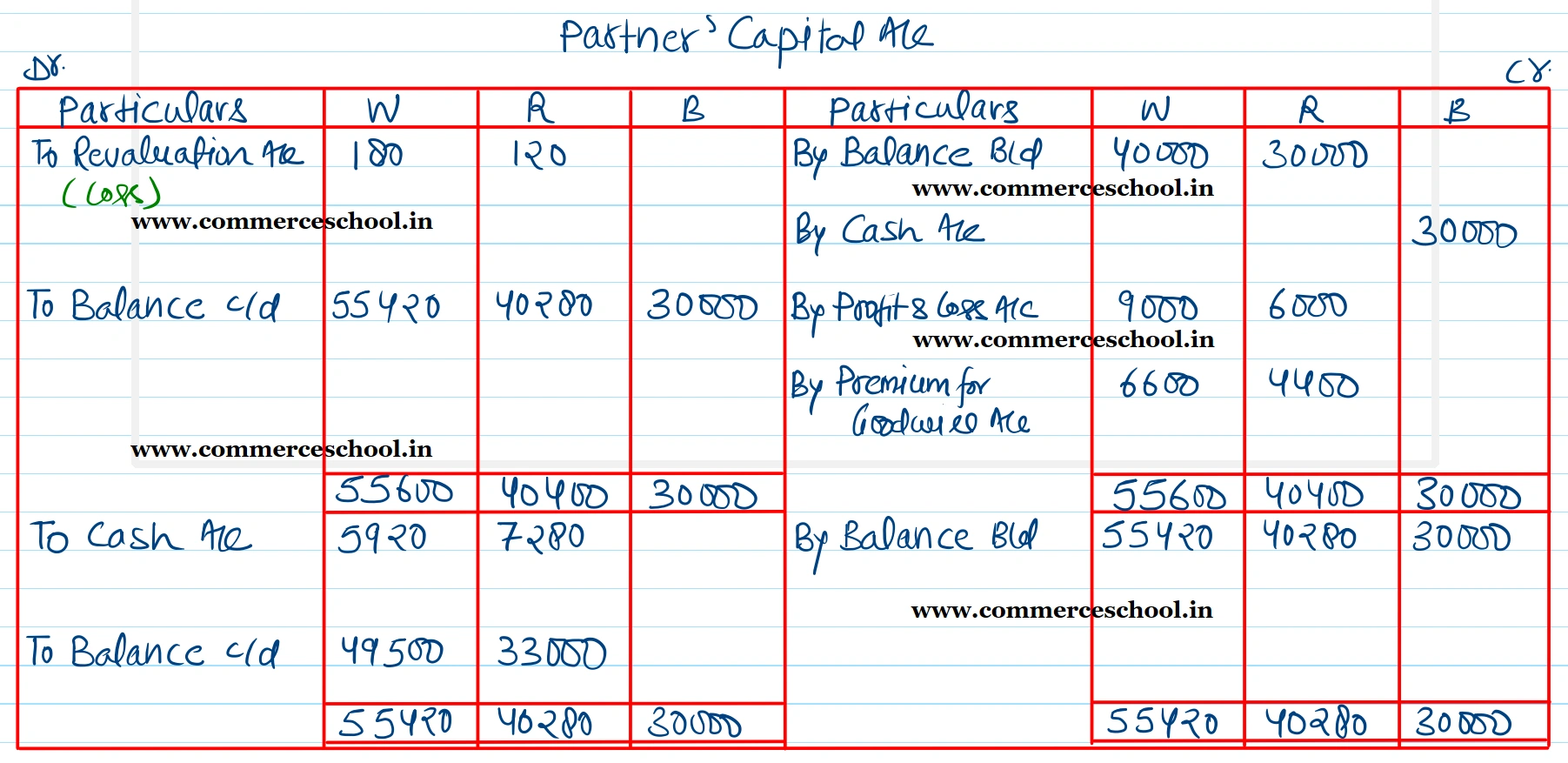

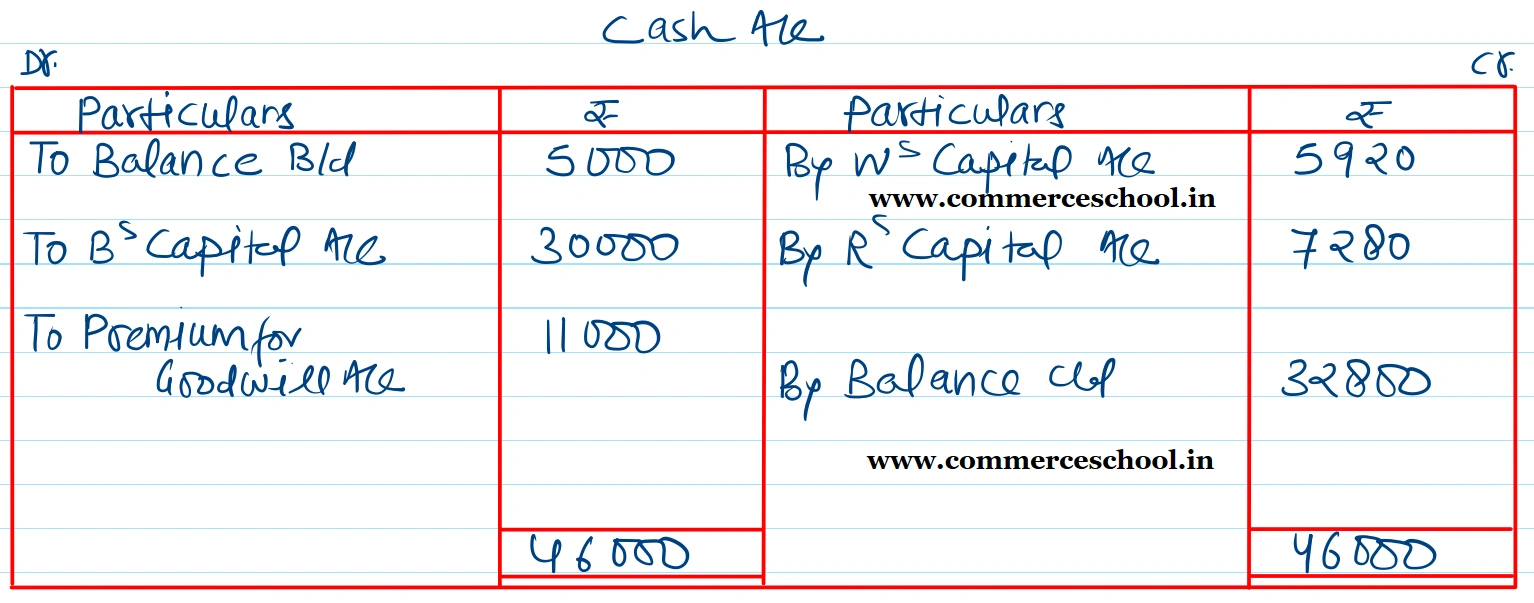

(b) B had to bring ₹ 30,000 as his capital to which amount other Partners capitals shall have to be adjusted.

(c) He would pay cash for his share of goodwill which would be based on 21/2 years purchase of average profits of past 4 years.

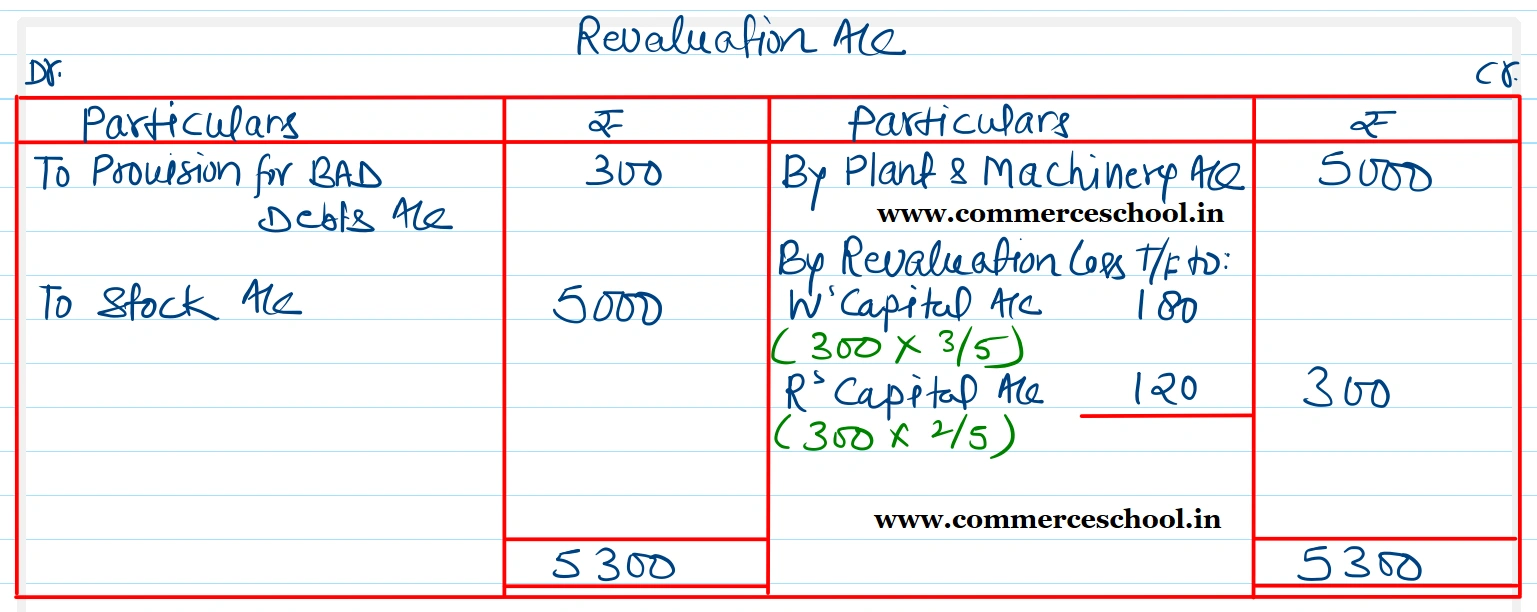

(d) The assets would be revalued as under:

Sundry debtors at book value less 5% provision for bad debts. Stock at ₹ 20,000, Plant and Machinery at ₹ 40,000.

(e) The profits of the firm for the years 2021, 2022 and 2023 were ₹ 20,000; ₹ 14,000 and ₹ 17,000 respectively.

Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of the new firm.

[Ans. Loss on Revaluation ₹ 300; New Ratio 33 : 22 : 20; Capital Accounts : W ₹ 49,500, R ₹ 33,000 and B ₹ 30,000; Cash Balance ₹ 32,800; B/S Total ₹ 1,32,500; W withdraws ₹ 5,920 and R withdraws ₹ 7,280.]