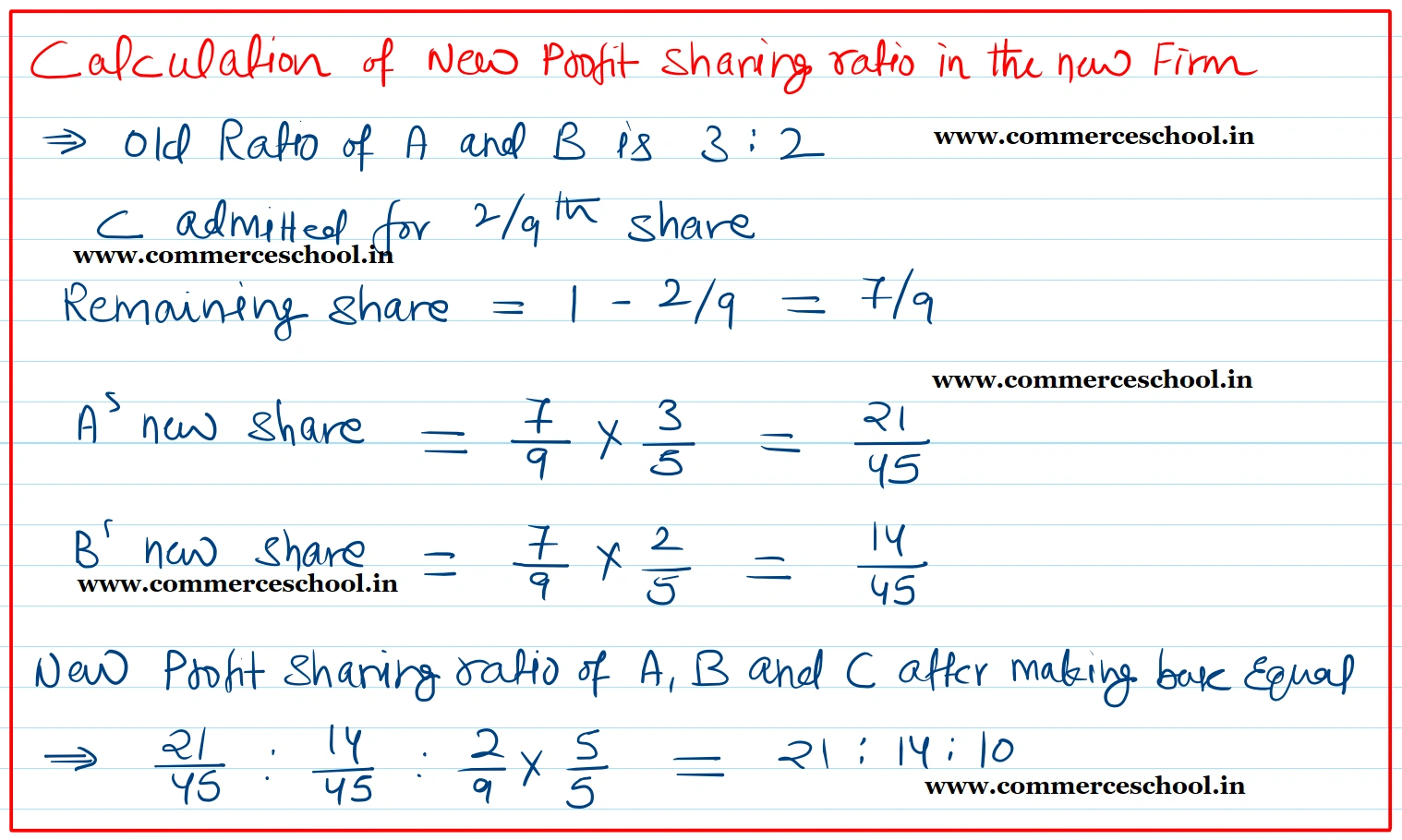

A and B sharing profits in the ratio of 3 : 2 have capitals of ₹ 1,00,000 and ₹ 45,000, respectively. They admit a new partner C with 2/9th share of profits

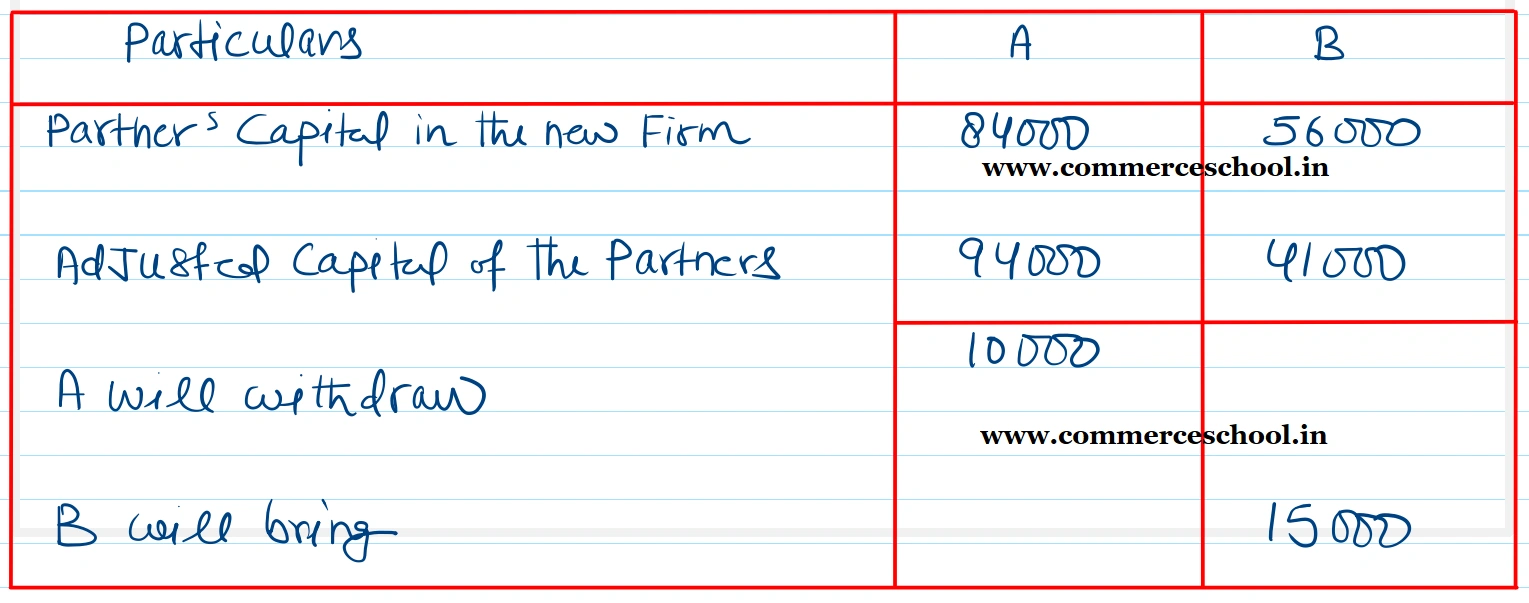

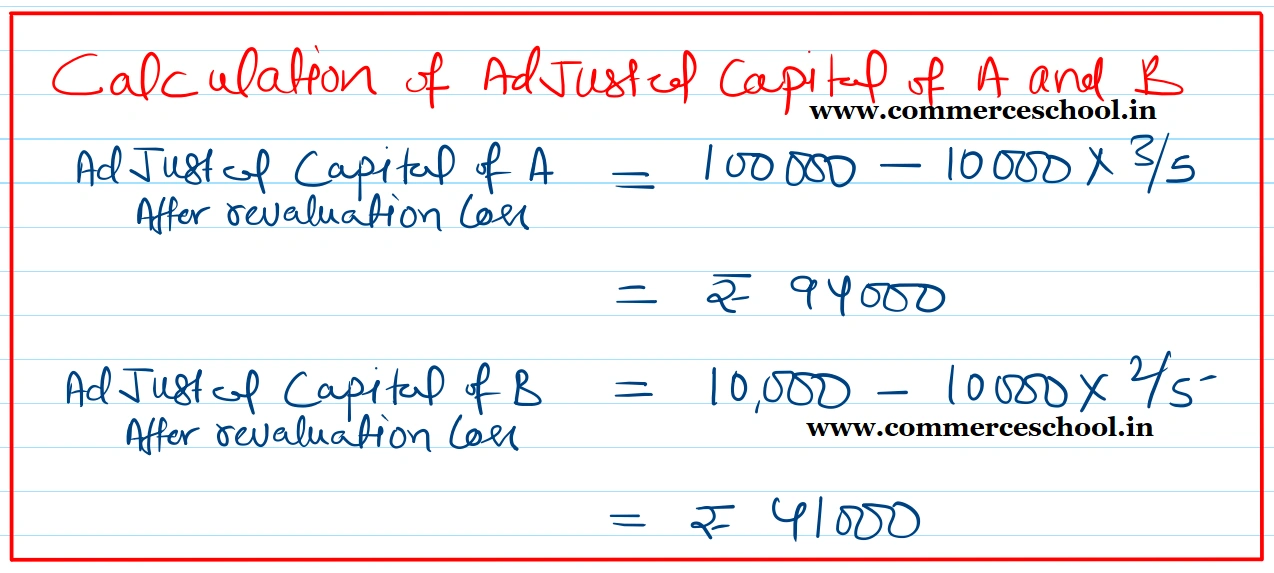

A and B sharing profits in the ratio of 3 : 2 have capitals of ₹ 1,00,000 and ₹ 45,000, respectively. They admit a new partner C with 2/9th share of profits. C is required to bring ₹ 40,000 as capital. The loss on revaluation of assets and liabilities is ₹ 10,000. It is agreed that capitals of partners should be in the new profit-sharing ratio. Any excess or deficit amount should be transferred to their current accounts. Pass a suitable adjusting entry or entries.

Anurag Pathak Answered question