The Balance Sheet of A and B as at 31st March, 2022 is given below: A’s Capital ₹ 60,000 B’s Capital ₹ 30,000

The Balance Sheet of A and B as at 31st March, 2022 is given below:

A and B share profits and losses in the ratio of 2 : 1. They agree to admit P into the firm subject to the following terms and conditions:

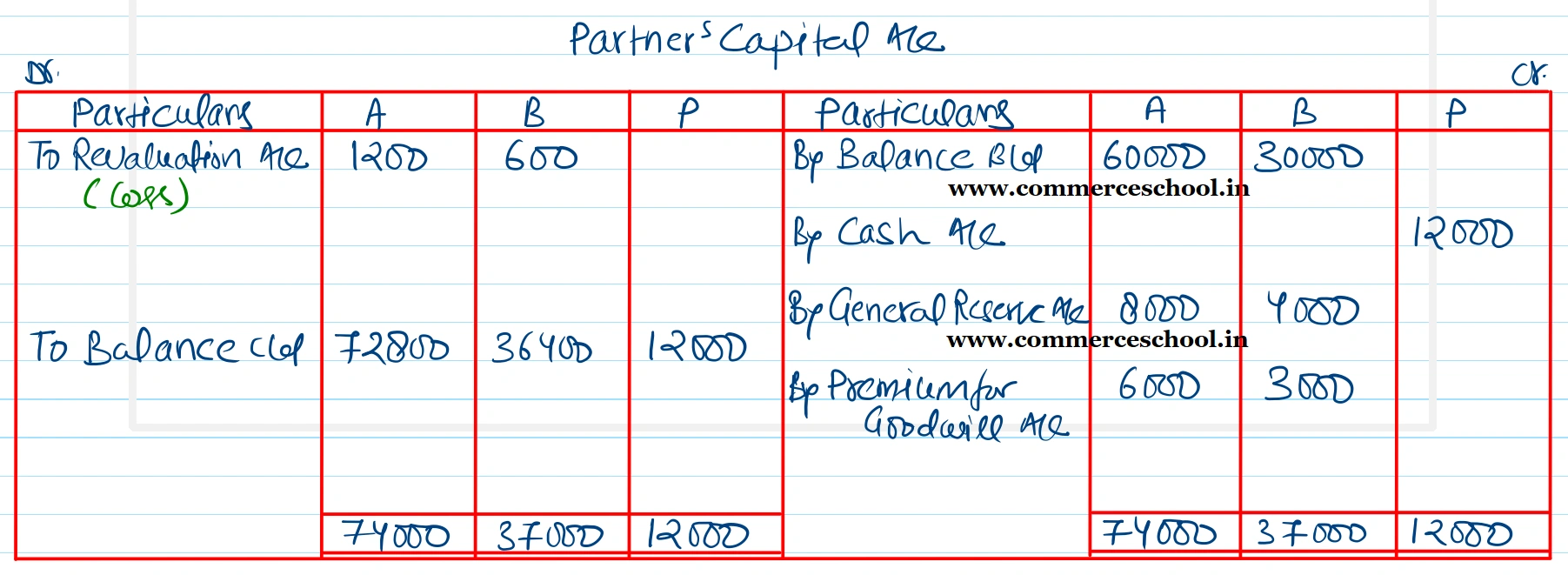

(a) P will bring in ₹ 21,000 of which ₹ 9,000 will be treated as his share of Goodwill to be retained in the business.

(b) P will be entitled to 1/4 share of profits of the firm.

(c) 50% of the General Reserve is to remain as a provision for bad and doubtful debts.

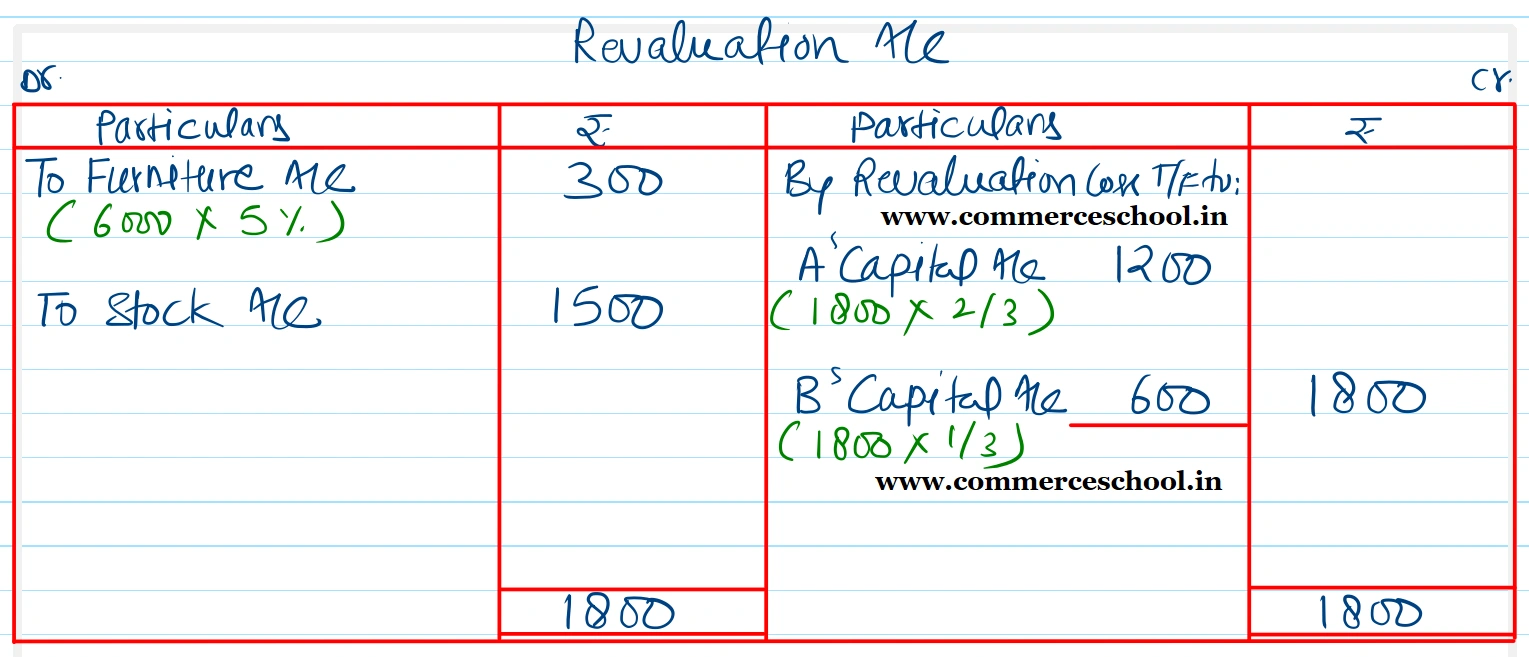

(d) Furniture is to be depreciated by 5%.

(e) Stock is to be revalued at ₹ 10,500.

Prepare Revaluation Account, Capital Accounts and Opening Balance Sheet of the new firm.

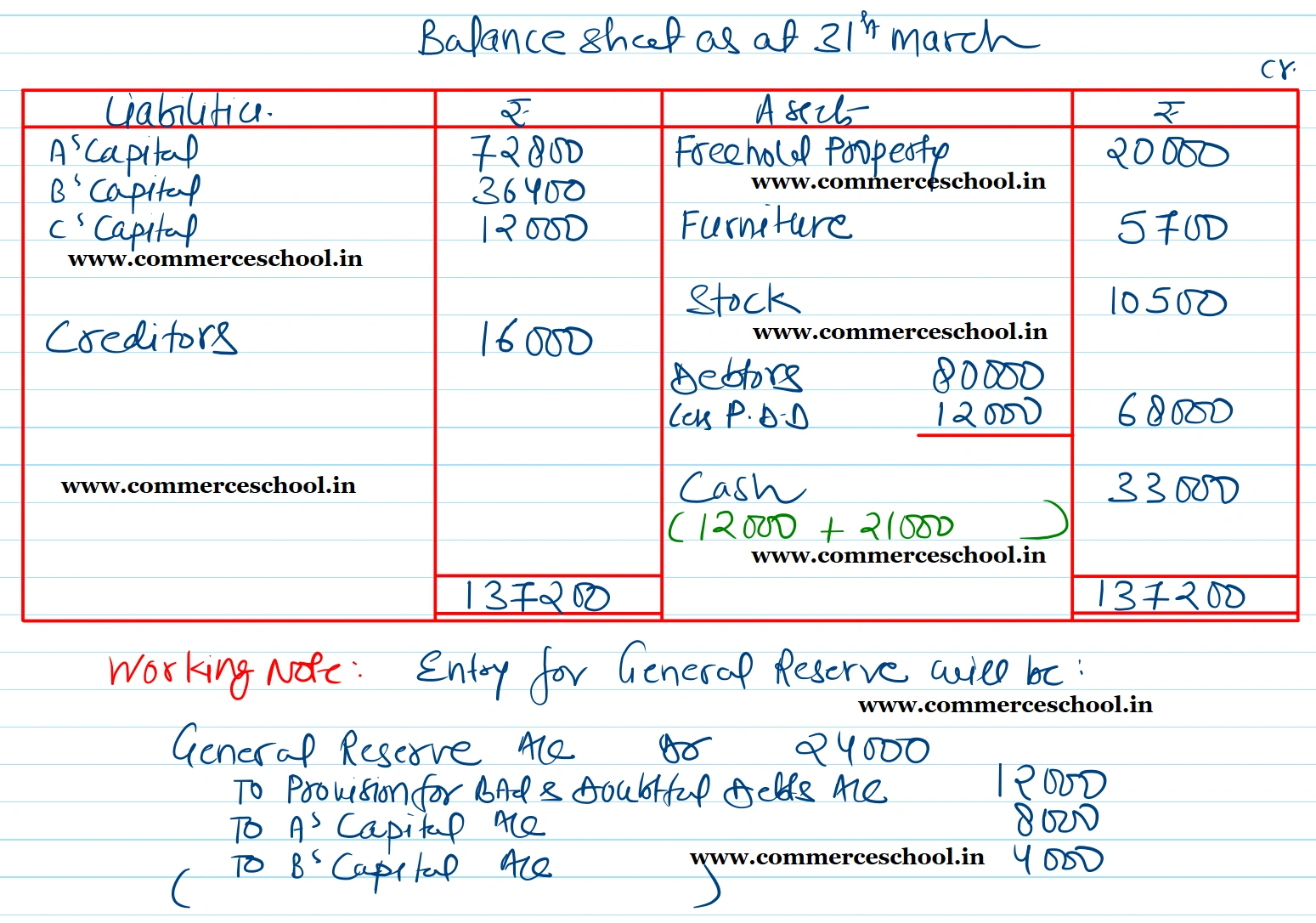

[Ans. Loss on Revaluation ₹ 1,800; Capital Balances : A ₹ 72,800; B ₹ 36,400; P ₹ 12,000; Cash Balance ₹ 33,000; B/S Total ₹ 1,37,200.]

| Liabilities | ₹ | Assets | ₹ |

| A’s Capital | 60,000 | Freehold Property | 20,000 |

| B’s Capital | 30,000 | Furniture | 6,000 |

| General Reserve | 24,000 | Stock | 12,000 |

| Creditors | 16,000 | Debtors | 80,000 |

| Cash | 12,000 | ||

| 1,30,000 | 1,30,000 |

Anurag Pathak Answered question