A and B are partners in a firm sharing profits and losses as 5 : 3. The position of the firm as at 31st March, 2022 was as follows:

A and B are partners in a firm sharing profits and losses as 5 : 3. The position of the firm as at 31st March, 2022 was as follows:

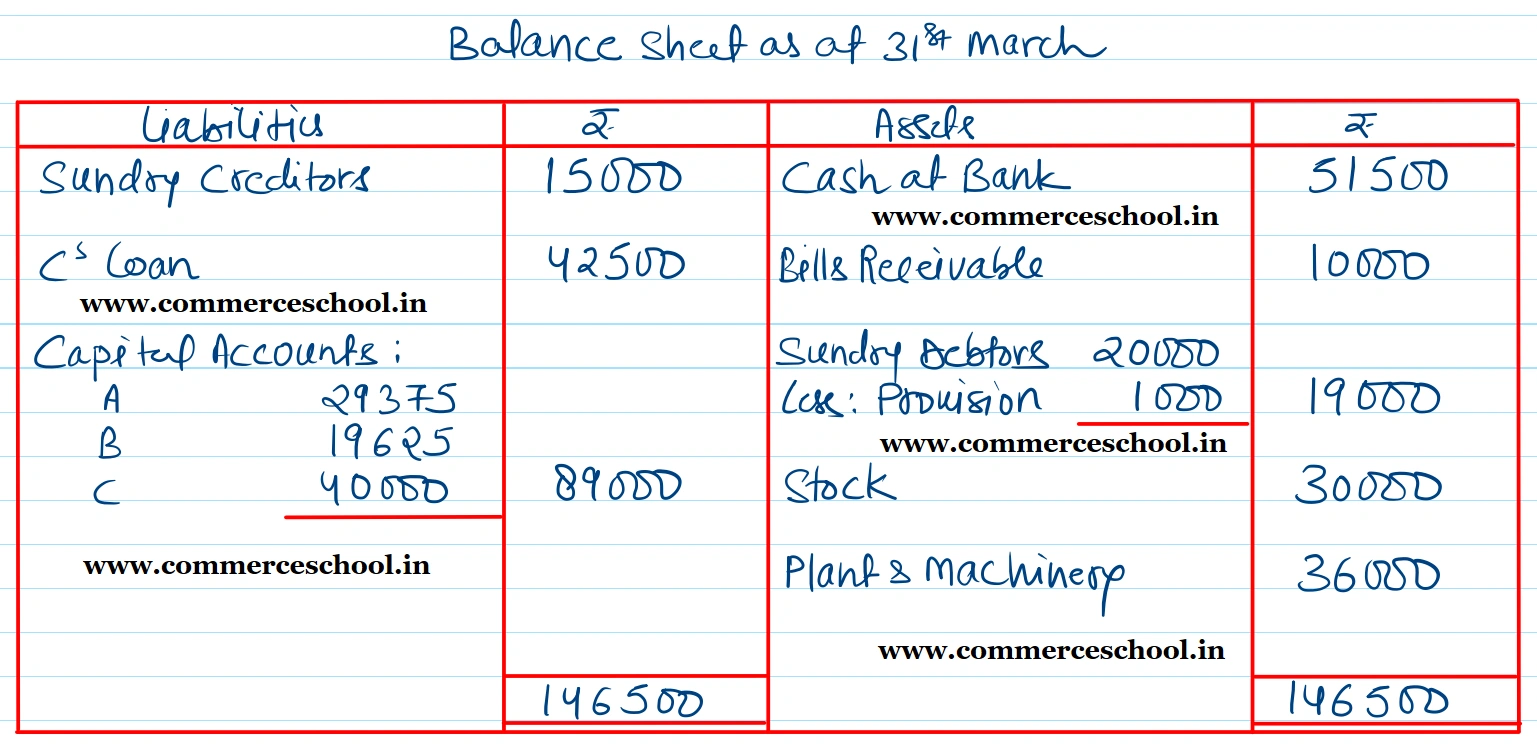

| Liabilities | ₹ | Assets | ₹ |

|

Capital Accounts: A B |

30,000 20,000 |

Plant and Machinery | 40,000 |

| Sundry Creditors | 15,000 | Stock | 30,000 |

| Bank Overdraft | 42,500 | Sundry Debtors | 20,000 |

| Bills Receivable | 10,000 | ||

| Cash at Bank | 7,500 | ||

| 1,07,500 | 1,07,500 |

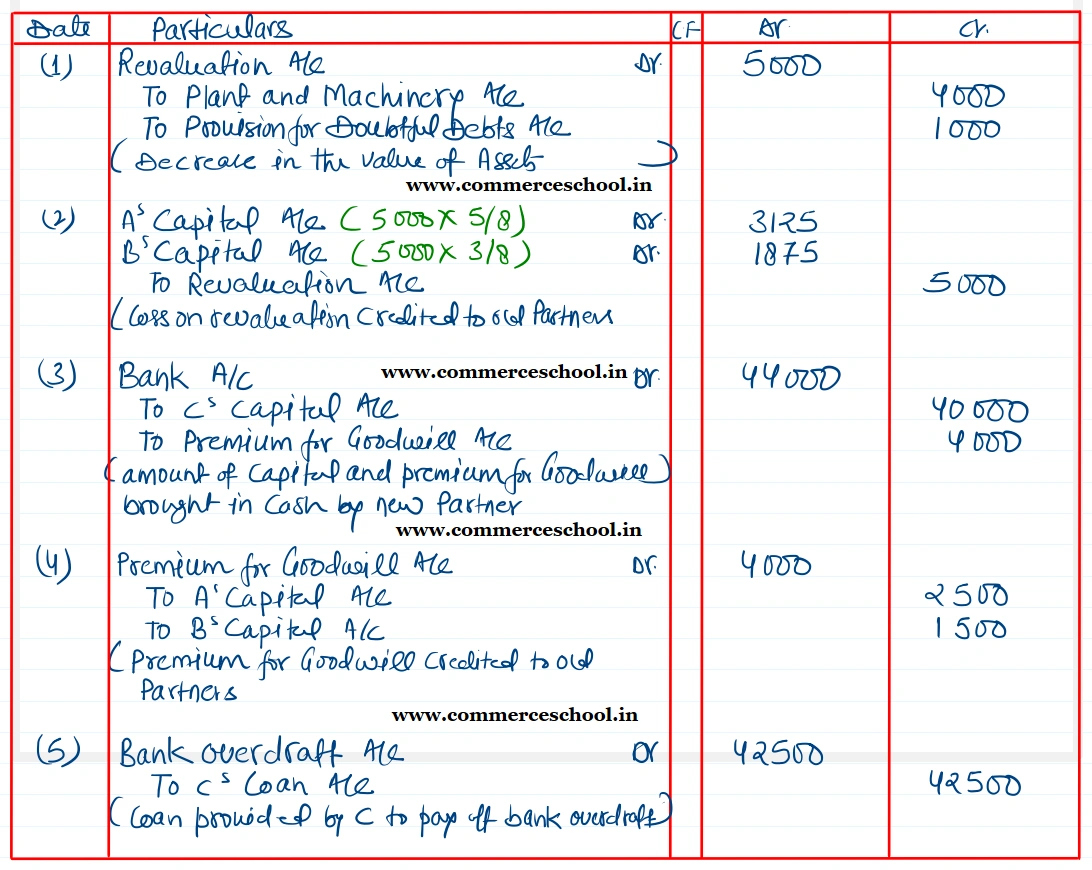

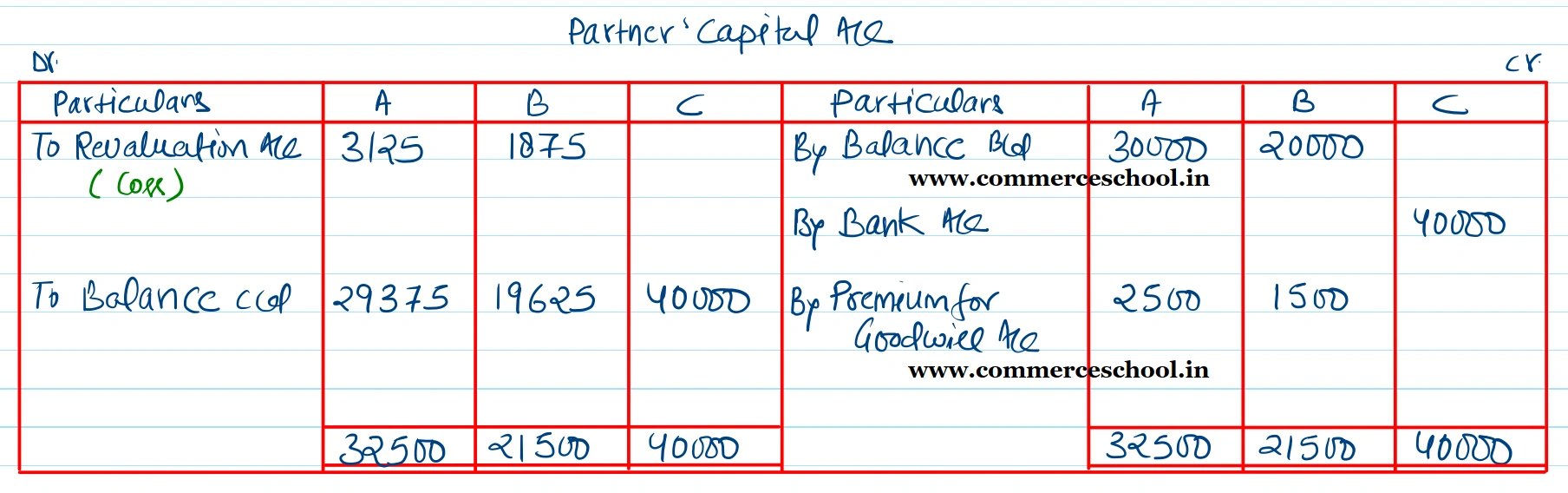

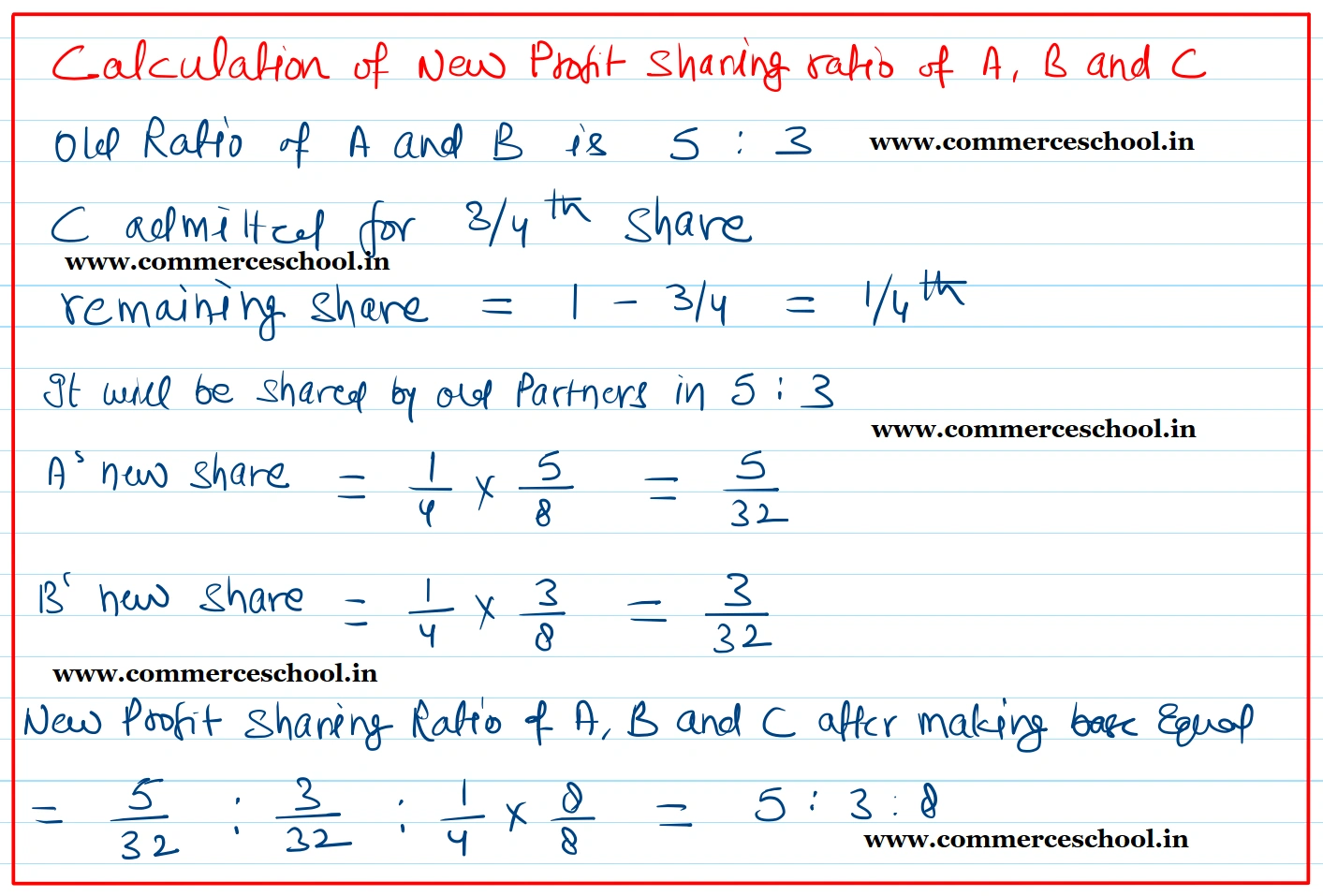

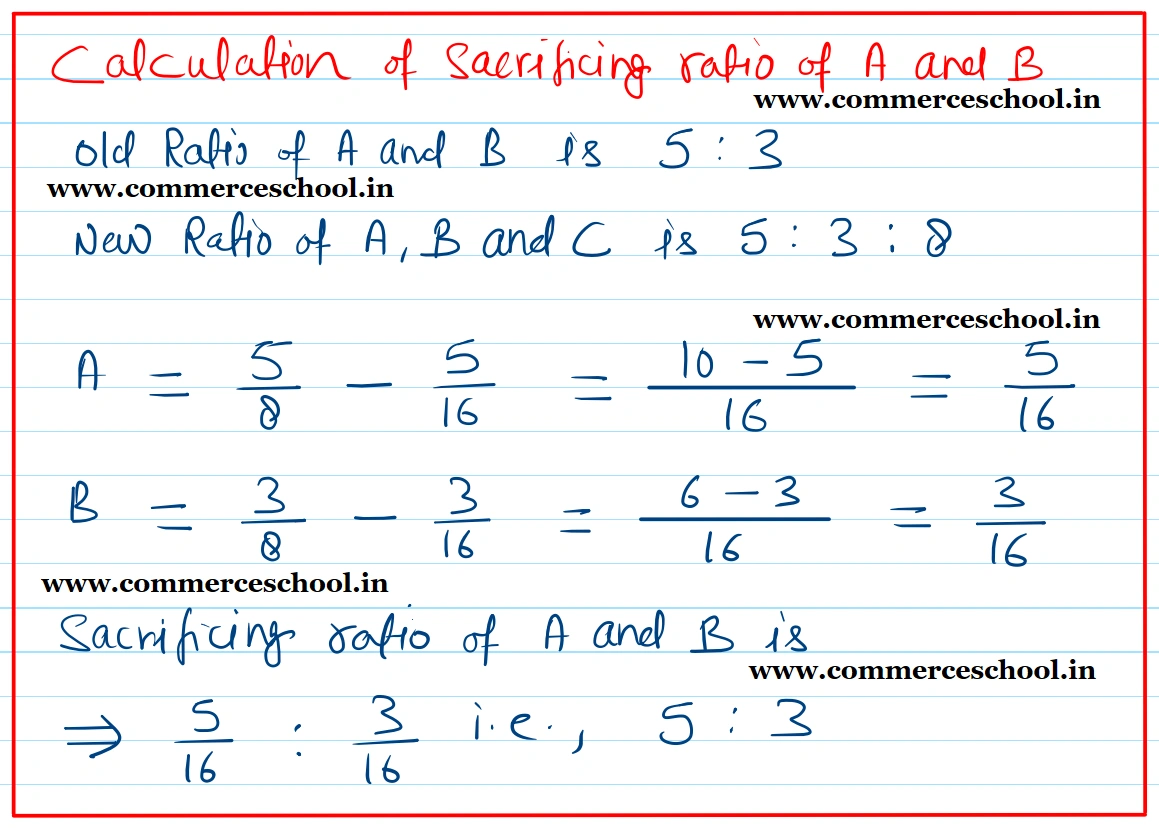

On 1st April, 2022, C joins them on condition that he will share 3/4th of the future profits, the balance of profits being shared by A and B as 5 : 3. He introduces ₹ 40,000 by way of capital and further ₹ 4,000 by way of premium for goodwill. He also provides loan to the firm to pay off bank overdraft. A and B agree to depreciate Plant by 10% and to raise a reserve against Sundry Debtors @ 5%.

You are asked to journalise the entries in the books of the firm and show the resultant Balance Sheet. How will the partners share future profits?

[Ans. Revaluation Loss ₹ 5,000; Capitals : A ₹ 29,375; B ₹ 19,625; C ₹ 40,000; Balance Sheet Total ₹ 1,46,500. New Ratio 5 : 3 : 24.]