A Company purchased a second-hand machine on 1st April, 2022, for ₹ 30,000 and immediately spent ₹ 4,000 on its repair and ₹ 1,000 on its installation

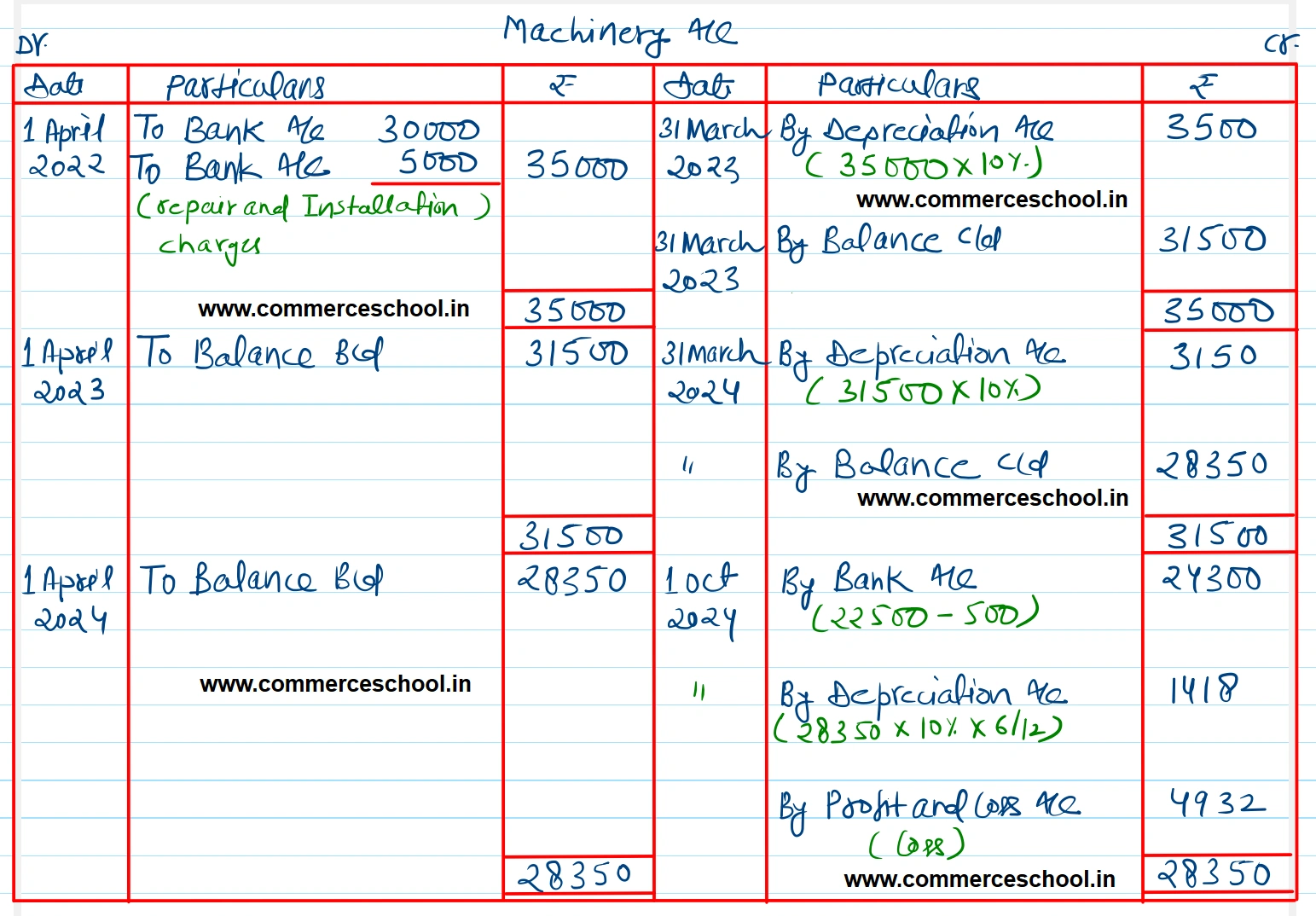

A Company purchased a second-hand machine on 1st April, 2022, for ₹ 30,000 and immediately spent ₹ 4,000 on its repair and ₹ 1,000 on its installation. On Oct. 1, 2024, the machine was sold for ₹ 22,500 and ₹ 500 were paid to commission agent for sale of machine.

Prepare Machine Account after charging depreciation @ 10% p.a. by diminishing balance method, assuming that the books are closed on 31st March every year. IGST was charged @ 12% on purchase and sale of machine.

[Ans. Loss on sale of machine ₹ 4,932.]

Anurag Pathak Answered question