A Company purchased a machinery for ₹ 50,000 on 1st Oct., 2016. Another machinery costing ₹ 10,000 was purchased on 1st Dec., 2017. On 31st March, 2019, the machinery purchased in 2016 was sold at a loss of ₹ 5,000

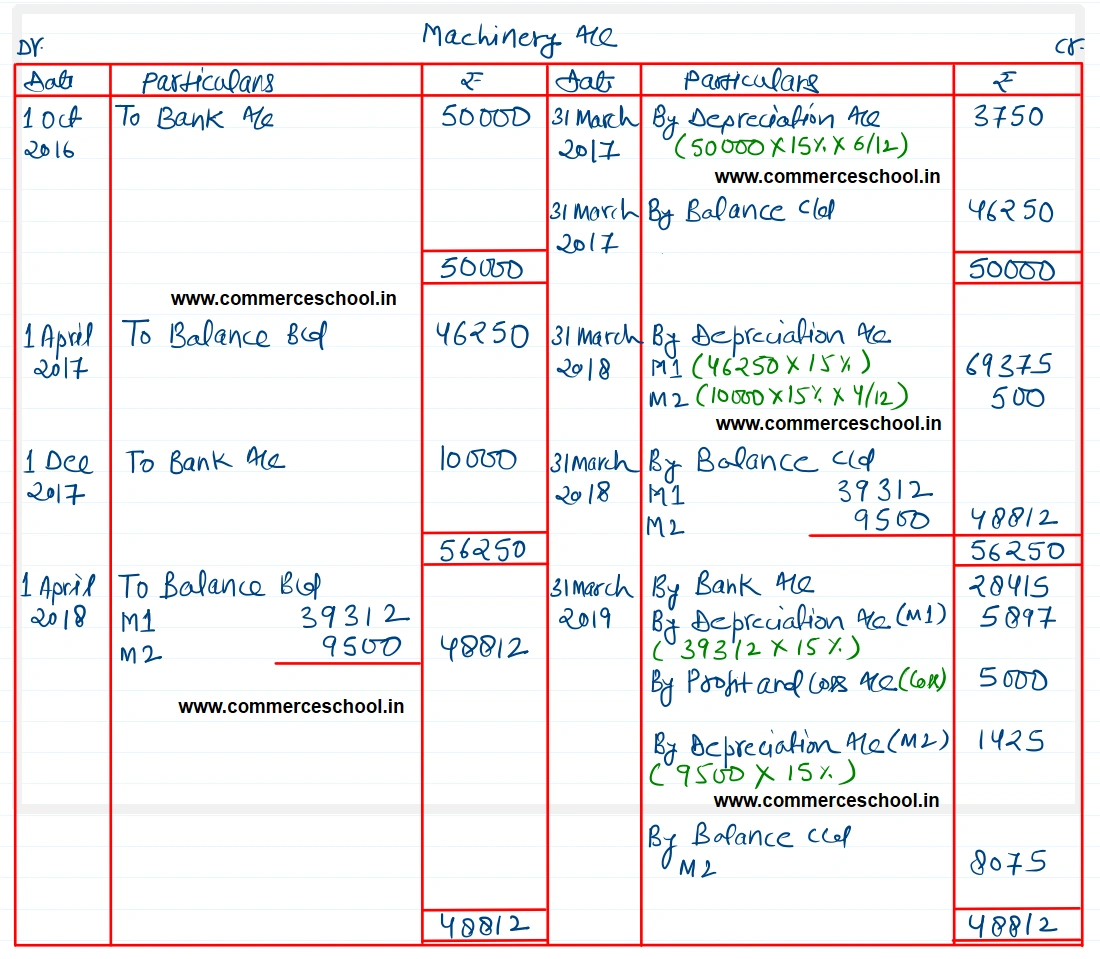

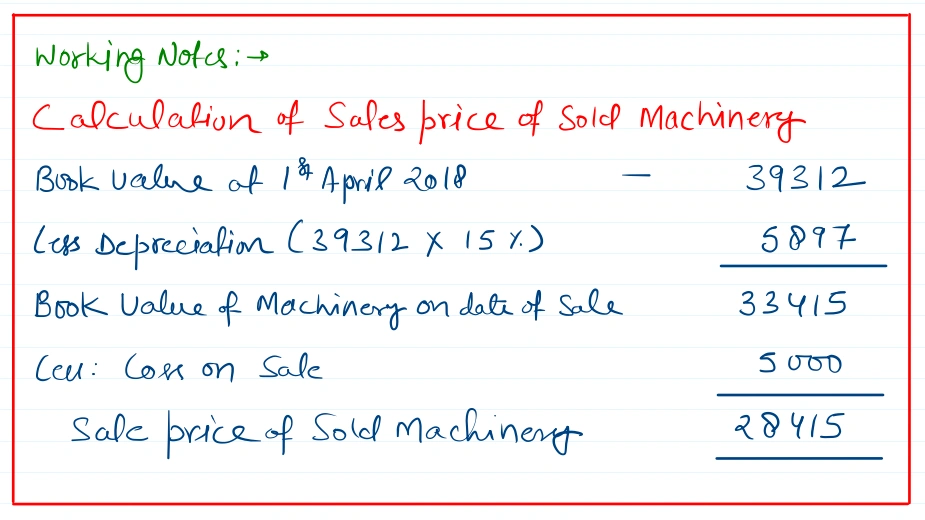

A Company purchased a machinery for ₹ 50,000 on 1st Oct., 2016. Another machinery costing ₹ 10,000 was purchased on 1st Dec., 2017. On 31st March, 2019, the machinery purchased in 2016 was sold at a loss of ₹ 5,000. The company charges depreciation at the rate of 15% p.a. on Diminishing Balance Method. Accounts are closed on 31st March every year.

Prepare Machinery account for 3 years.

[Ans. Sale price of Machinery ₹ 28,415; Balance of Machinery A/c on 31st March, 2019 ₹ 8,075.]

Anurag Pathak Answered question