A limited company purchased on 01-01-2022 a plant for ₹ 38,000 and spent ₹ 2,000 for carriage and brokerage. On 01-04-2023 it purchased additional plant costing ₹ 20,000

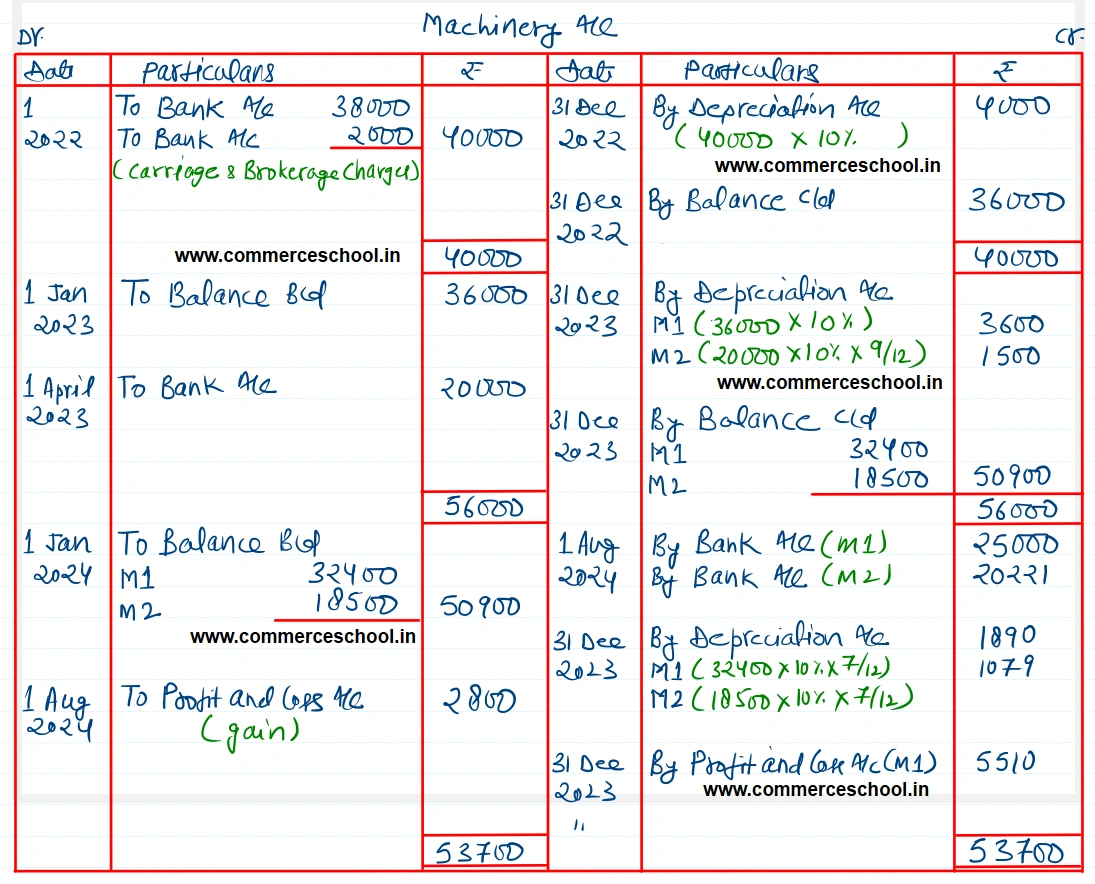

A limited company purchased on 01-01-2022 a plant for ₹ 38,000 and spent ₹ 2,000 for carriage and brokerage. On 01-04-2023 it purchased additional plant costing ₹ 20,000. On 01-08-2024 the plant purchased on 01-01-2022 was sold for ₹ 25,000. On the same date, the plant purchased on 01-04-2023 was sold at a profit of ₹ 2,800. Depreciation is provided @ 10% per annum on diminishing balance method every year.

Accounts are closed on 31st December every year. Show the plant A/c for 3 years.

[Ans. Loss on Sale of Plant ₹ 5,510; Sale of IInd Plant ₹ 20,220.]

Anurag Pathak Answered question