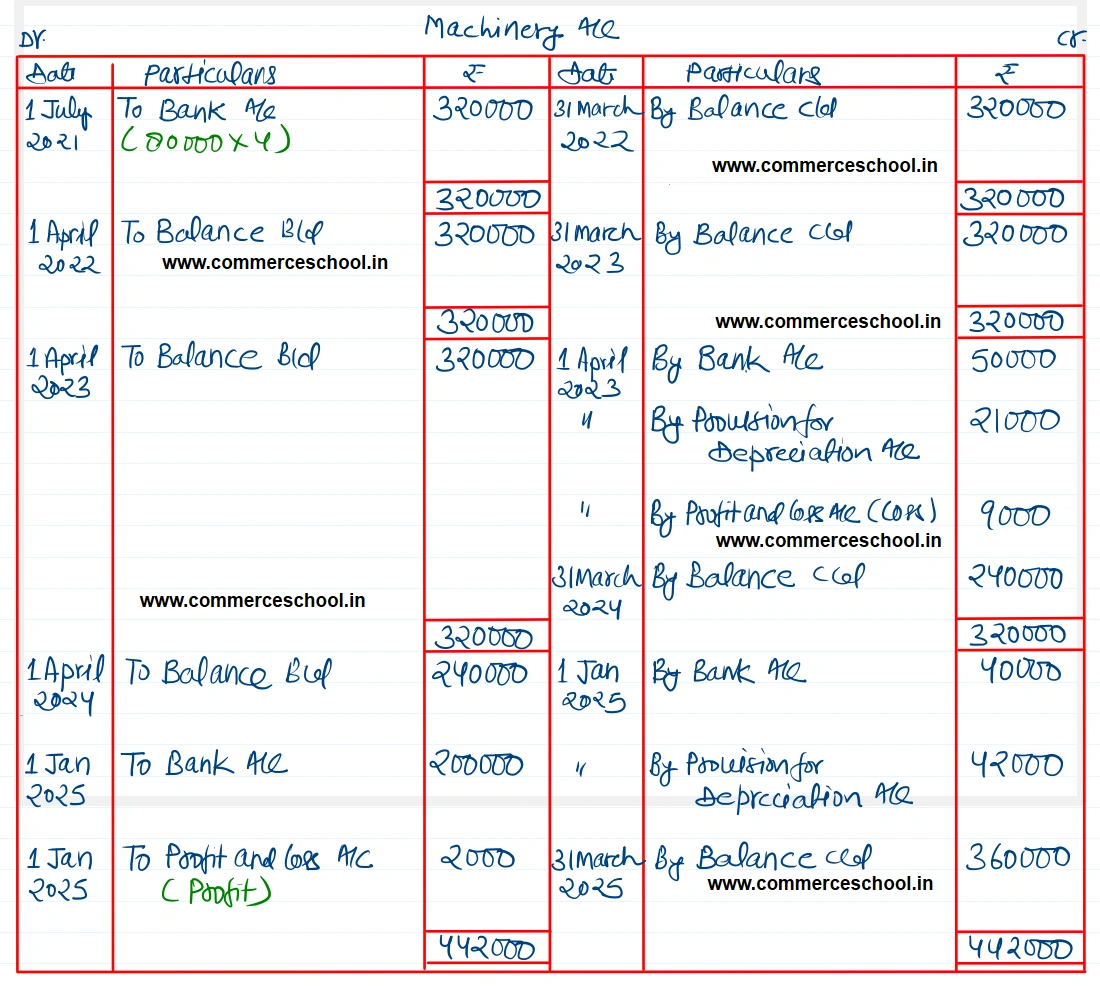

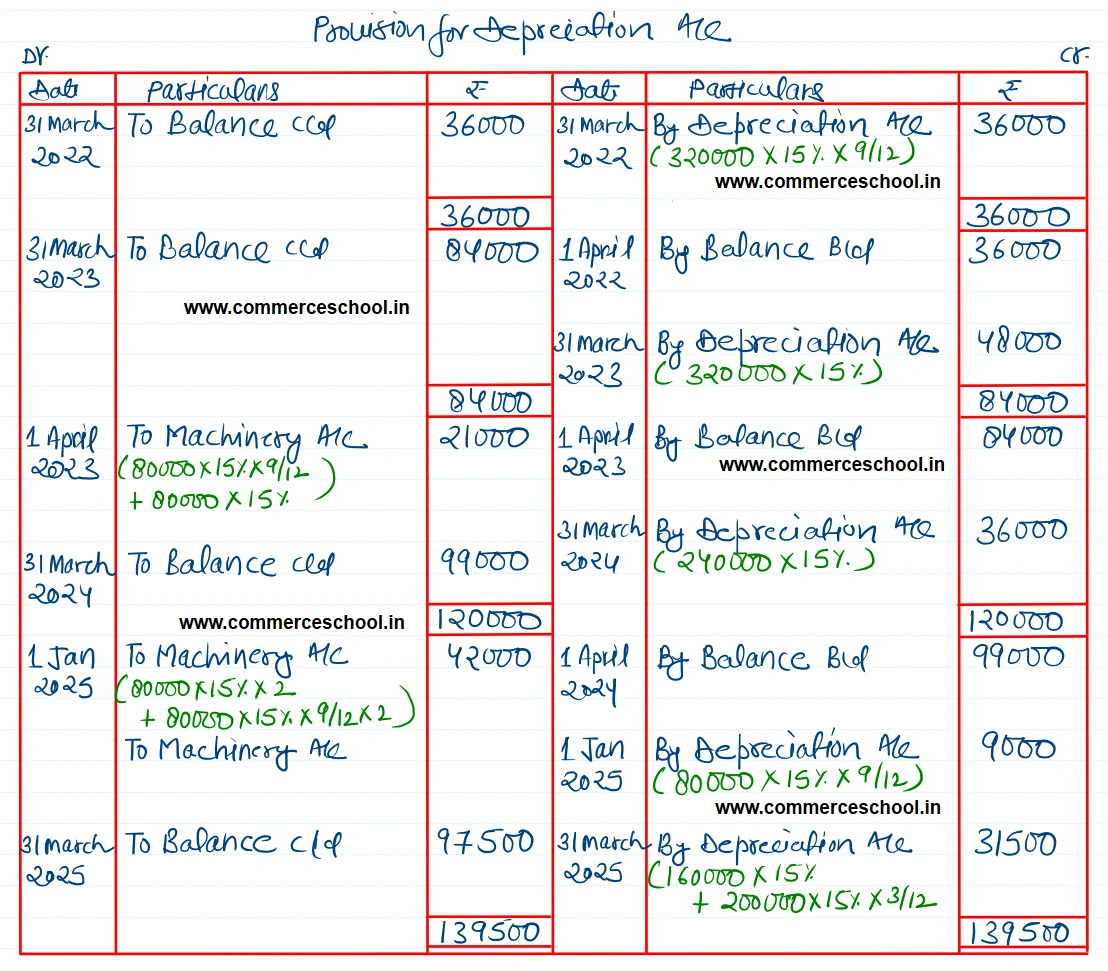

On 1st July 2021, ABC Ltd. purchases 4 machines for ₹ 80,000 each. The accounting year of the company ends on 31st March every year: Depreciation is provided at the rate of 15% p.a on original cost

On 1st July 2021, ABC Ltd. purchases 4 machines for ₹ 80,000 each. The accounting year of the company ends on 31st March every year: Depreciation is provided at the rate of 15% p.a on original cost.

On 1st April, 2023 one machine was sold for ₹ 50,000 and on 1st January, 2025 a second machine was sold for ₹ 40,000. Another machine with a higher capacity which cost ₹ 2,00,000 was purchased on 1st January, 2025.

You are required to show: (i) Machinery Account, (ii) Depreciation Account, and (iii) Provision for Depreciation Account for four years ending 31st March, 2025.

[Ans. Balance of Machinery A/c on 31st March, 2025 ₹ 3,60,000; Balance of Provision for Depreciation A/c on 31st March, 2025 ₹ 97,500; Loss on sale of first Machine ₹ 9,000; Gain on sale of second Machine ₹ 2,000.]