X Ltd. purchased a plant on 1st July, 2020 costing ₹ 5,00,000. It purchased another plant on 1st September, 2020 costing ₹ 3,00,000. On 31st December, 2022

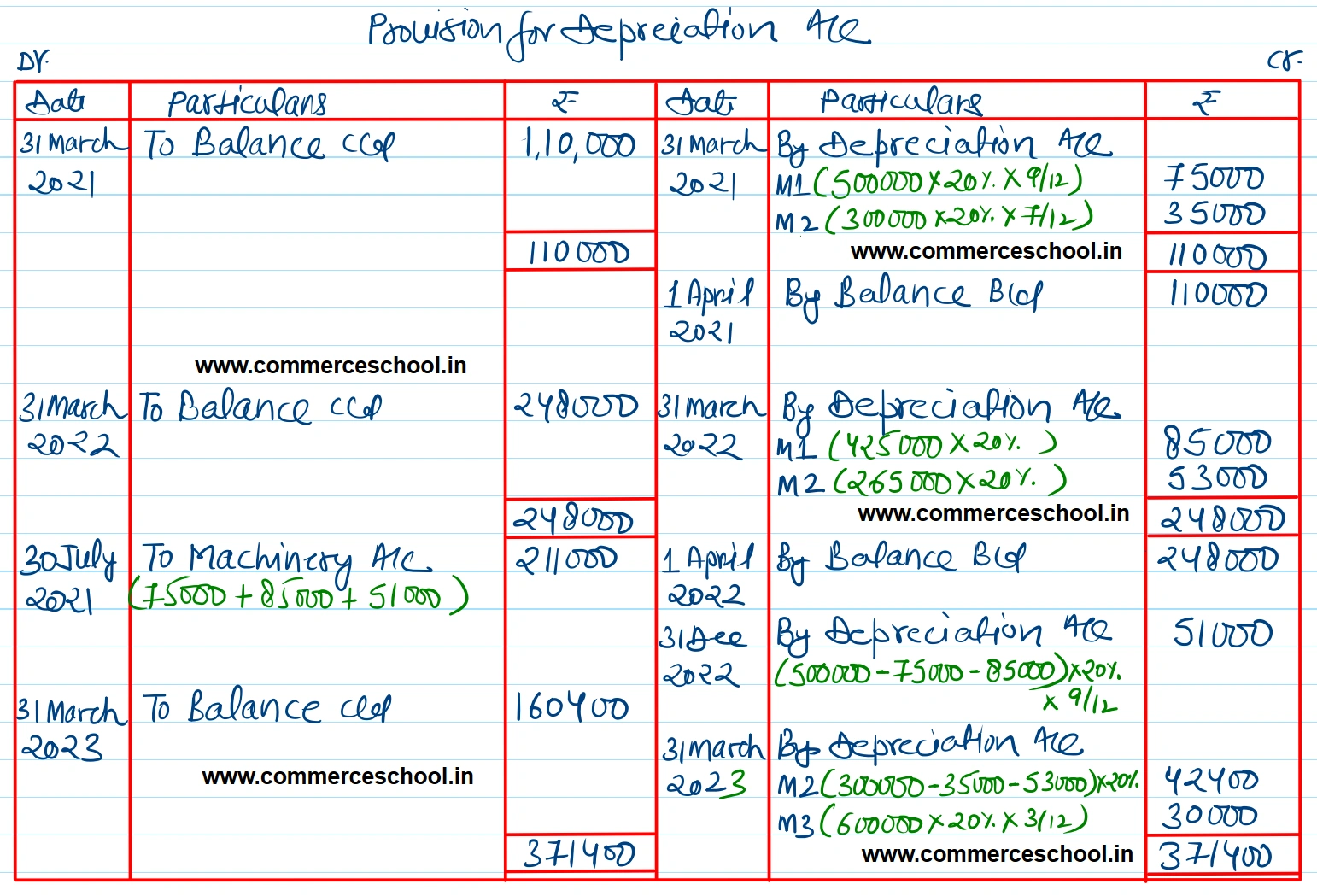

X Ltd. purchased a plant on 1st July, 2020 costing ₹ 5,00,000. It purchased another plant on 1st September, 2020 costing ₹ 3,00,000. On 31st December, 2022, the plant purchased on 1st July, 2020 out out of order and was sold for ₹ 2,15,000. Another plant was purchased to replace the same for ₹ 6,00,000. Depreciation is to be provided at 20% p.a. according to Written Down Value Method. The accounts are closed every year on 31st March.

Show the Plant Account and Provision for Depreciation Account.

[Ans. Balance of Plant A/c on 31st March, 2023 ₹ 9,00,000; Balance of Provision for Depreciation A/c on 31st March, 2023 ₹ 1,60,400; Loss on sale of Plant ₹ 74,000.]

Anurag Pathak Answered question