Binny Textiles Ltd. which depreciates its machinery at 20% p.a. on diminishing balance method, purchased a machine for ₹ 6,00,000 on 1st October, 2020

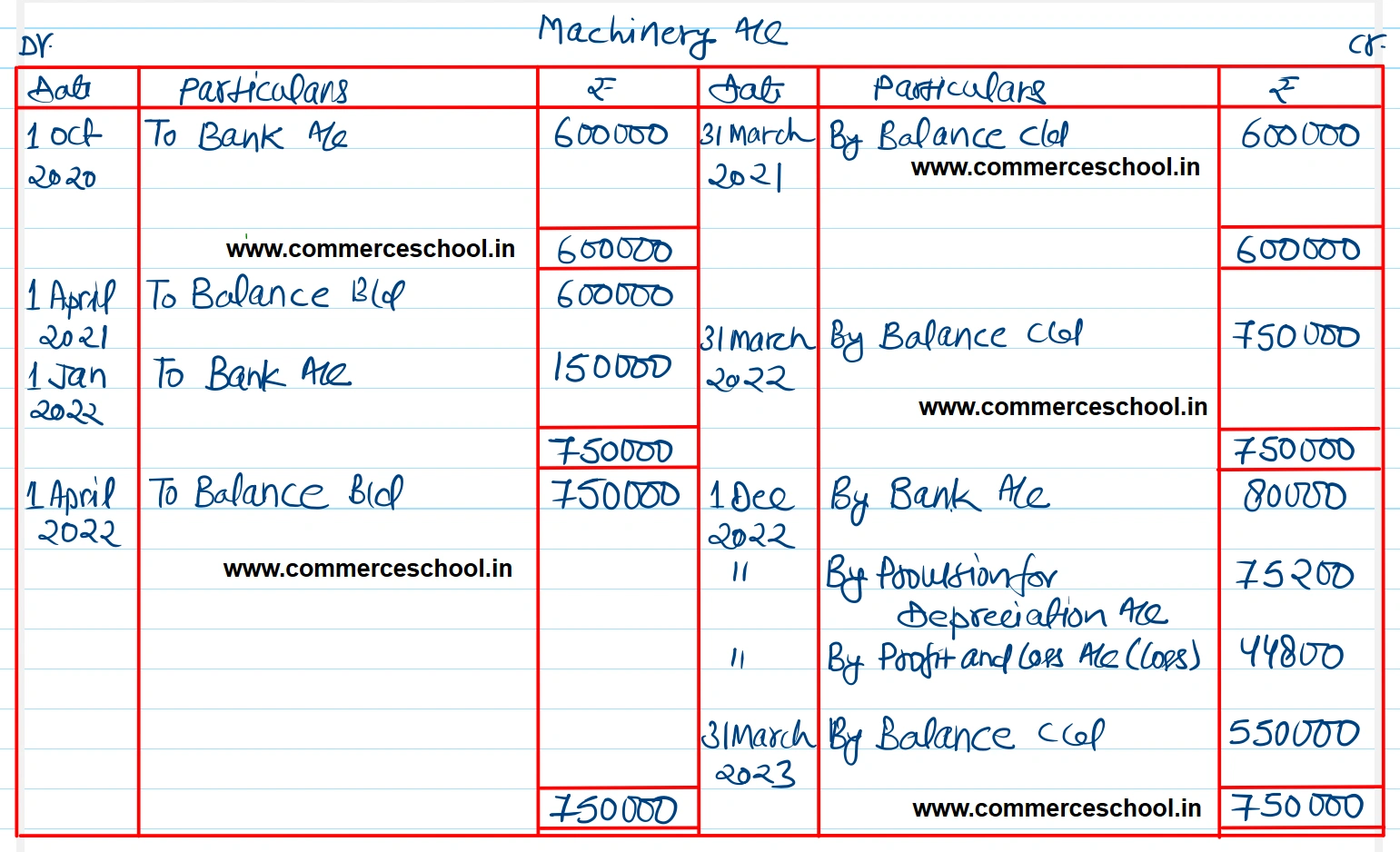

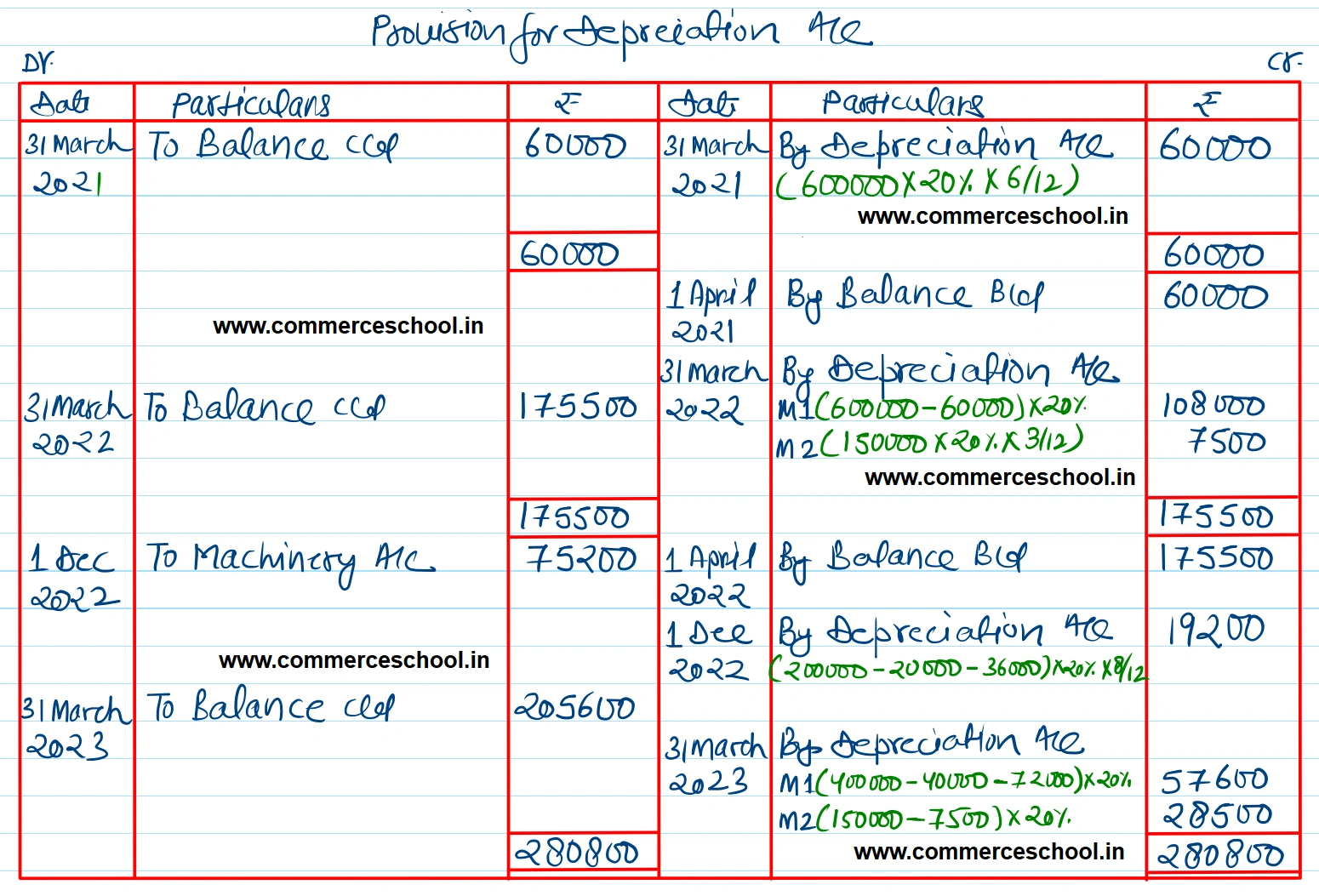

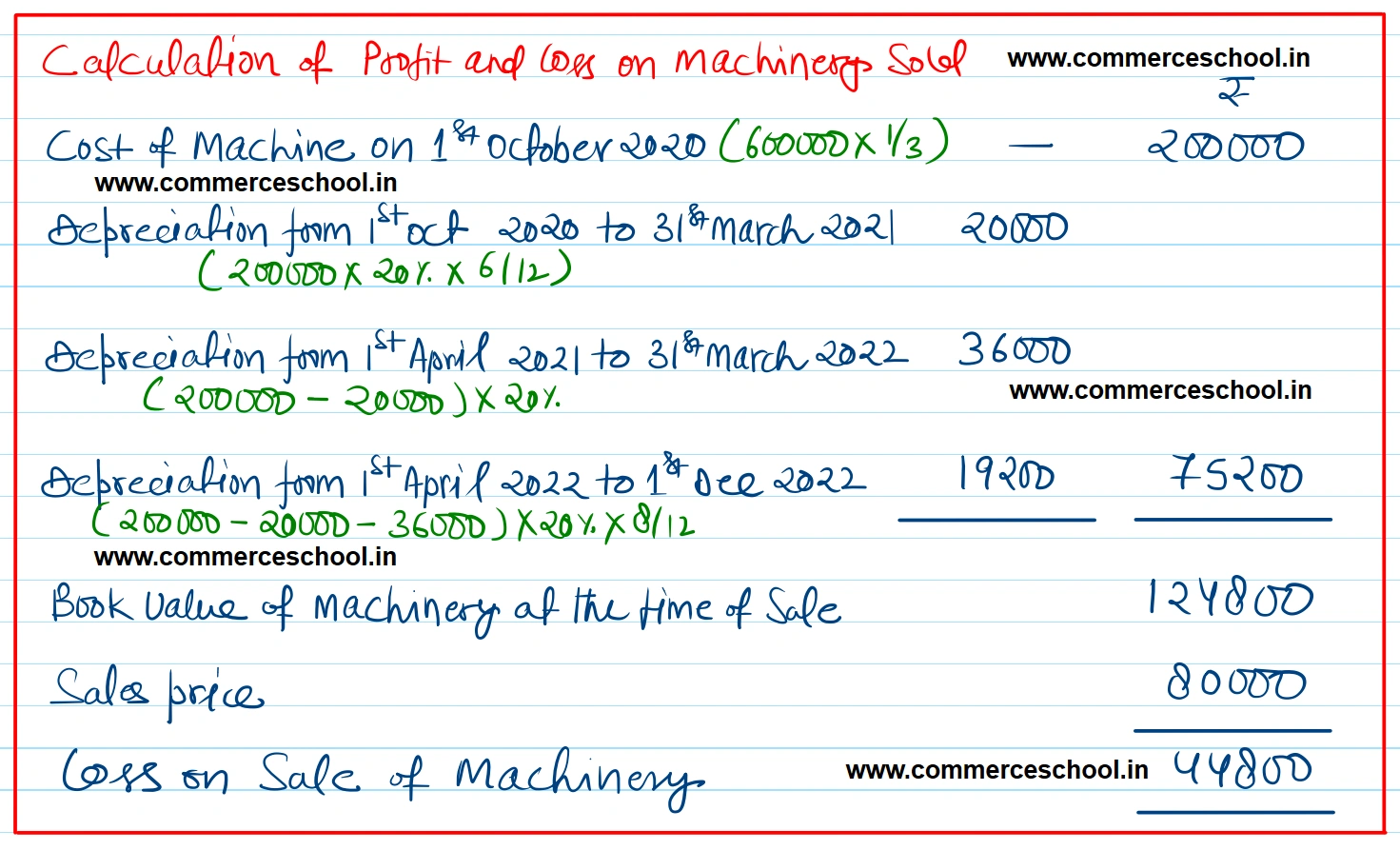

Binny Textiles Ltd. which depreciates its machinery at 20% p.a. on diminishing balance method, purchased a machine for ₹ 6,00,000 on 1st October, 2020. It closes its books on 31st March every year. ON 1st January, 2022, it purchased another machine for ₹ 1,50,000. On 1st December, 2022, one-third of the machinery purchased on 1st October, 2020 was sold for ₹ 80,000.

You are required to prepare Machinery A/c and Provision for Depreciation A/c for the relevant years.

[Ans. Balance of Machinery A/c on 31st March, 2023 ₹ 5,50,000; Balance of Provision for Depreciation A/c on 31st March, 2023 ₹ 2,05,600; Loss on sale of Machinery ₹ 44,800.]

Anurag Pathak Answered question