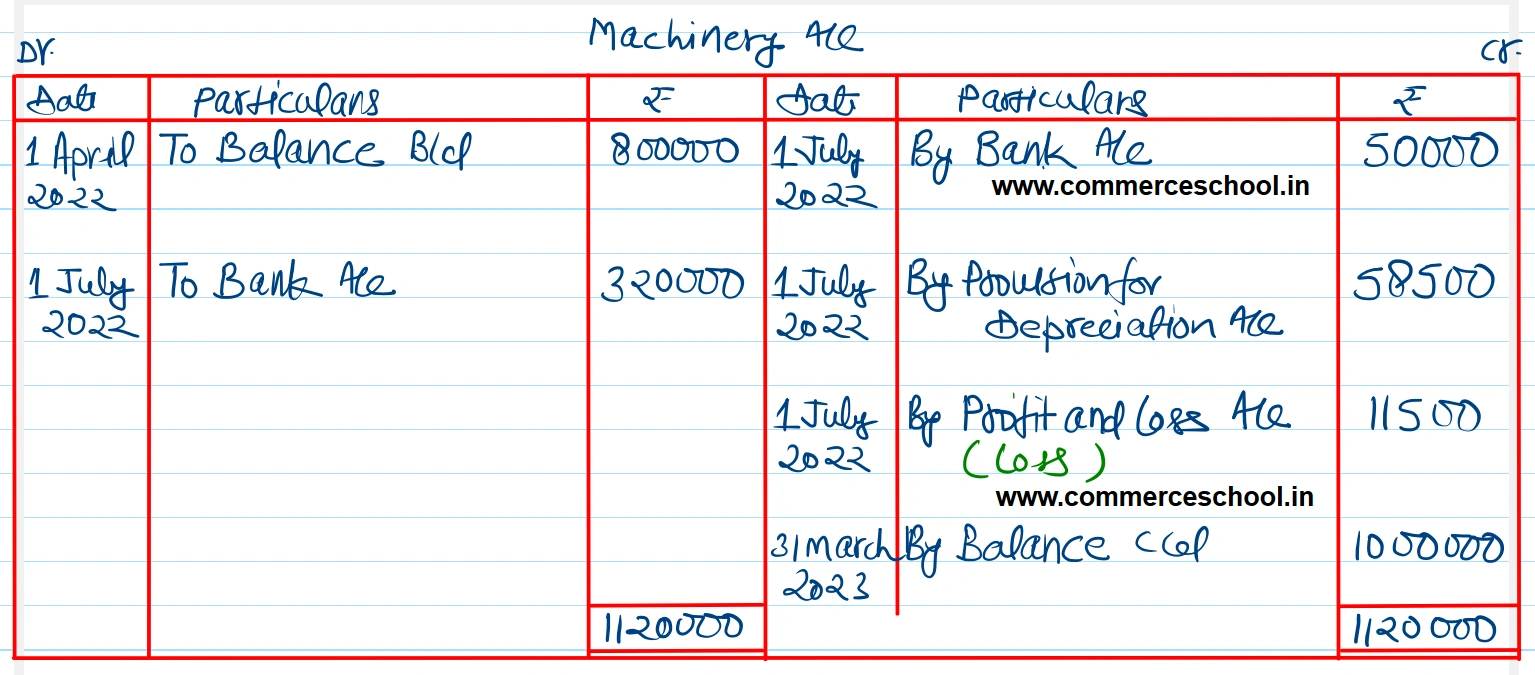

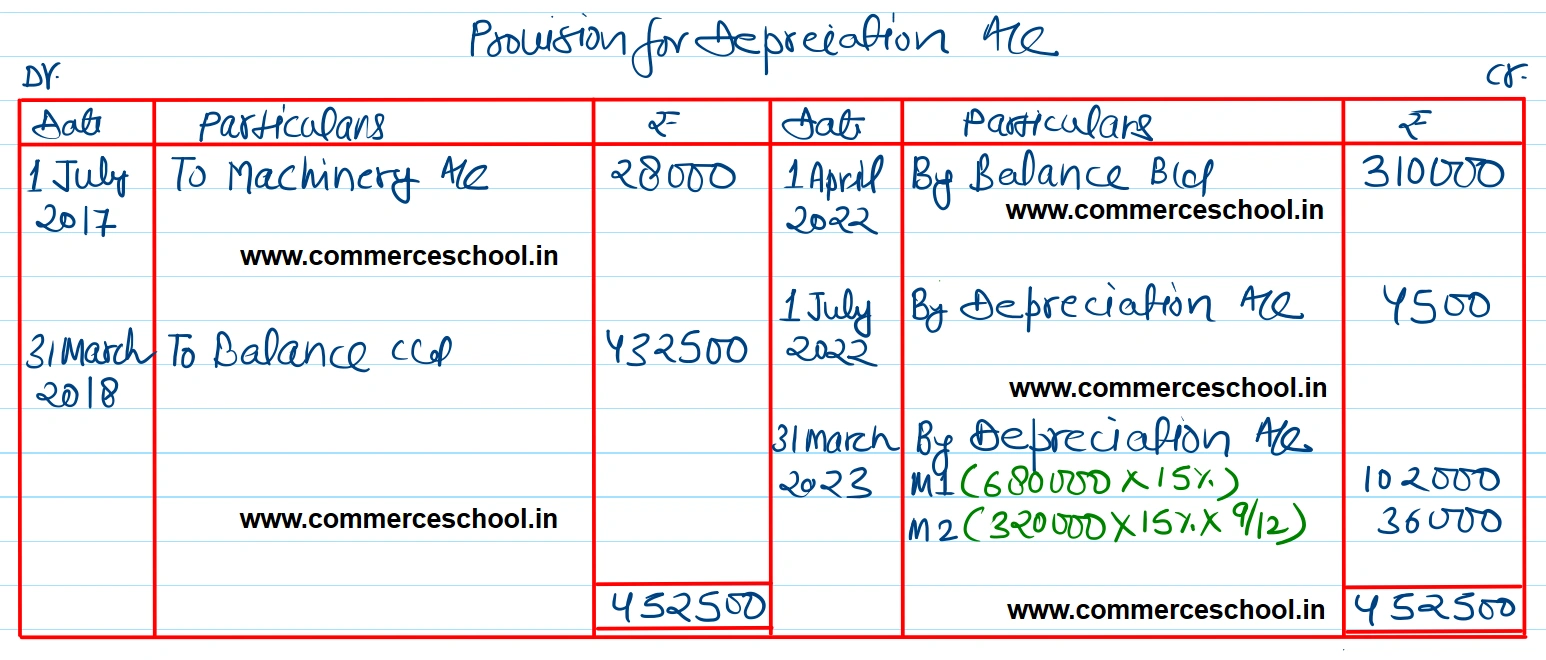

The following balances appear in the books of Y Ltd.: Machinery A/c as on 1-4-2022 ₹ 8,00,000 Provision for Depreciation A/c as on 1-4-2022 ₹ 3,10,000

The following balances appear in the books of Y Ltd.:

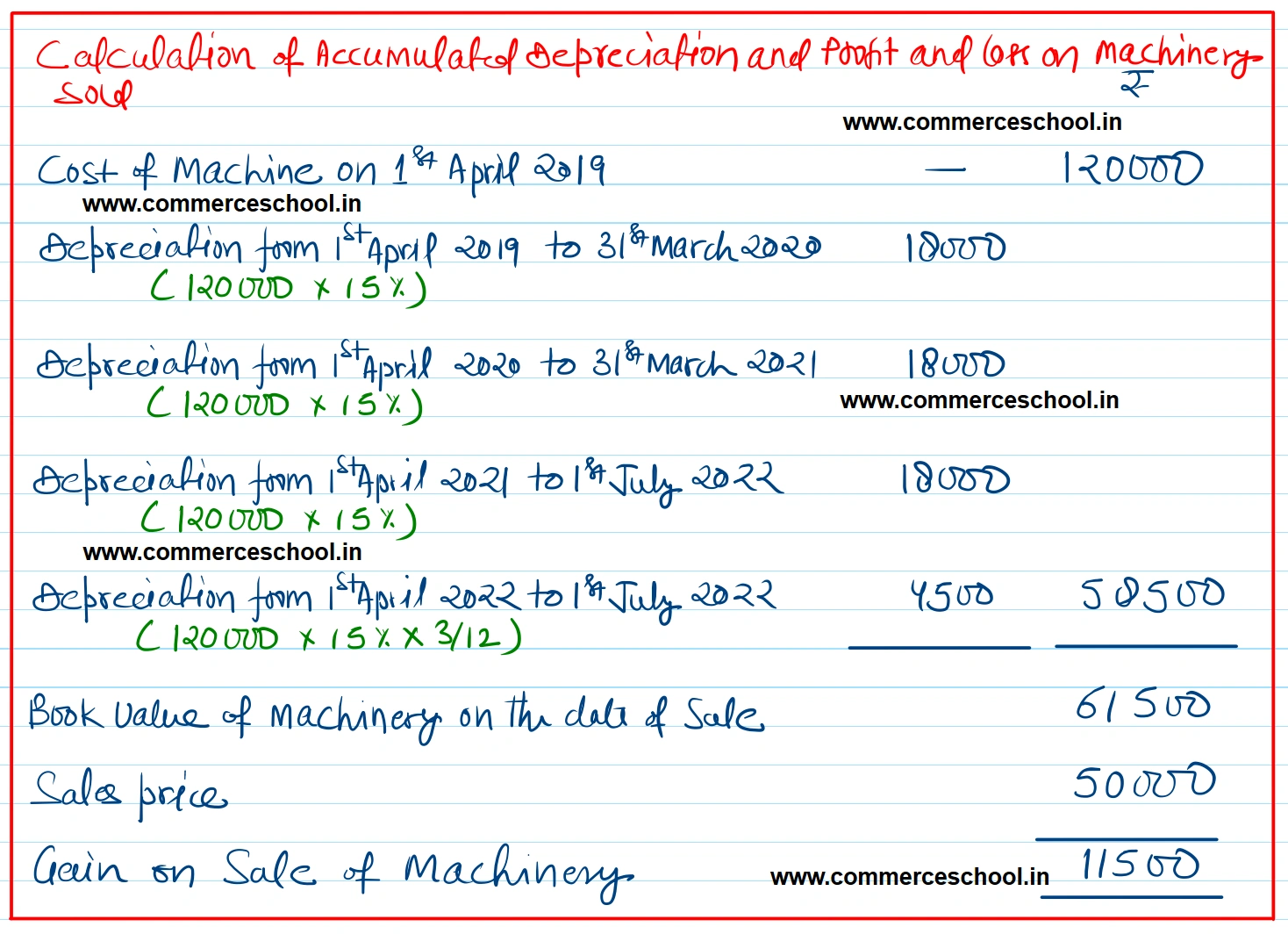

On 1-7-2022, a machinery which was purchased on 1-4-2019 for ₹ 1,20,000 was sold for ₹ 50,000 and on the same date another machinery was purchased for ₹ 3,20,000.

The firm has been charging depreciation at 15% p.a. on Original Cost Method and closes its books on 31st March every year. Prepare the Machinery A/c and Provision for Depreciation A/c for the year ending 31st March 2023.

[Ans. Balance of Machinery A/c on 31st March 2023 ₹ 10,00,000; Balance of Provision for Depreciation A/c on 31st March 2023 ₹ 3,94,000; Loss on sale of Machinery ₹ 11,500.]

| ₹ | |

| Machinery A/c as on 1-4-2022 | 8,00,000 |

| Provision for Depreciation A/c as on 1-4-2022 | 3,10,000 |

Anurag Pathak Answered question