On 1st September 2021, Gopal Ltd. purchased a plant for ₹ 10,20,000. On 1st July 2022 another plant was purchased for ₹ 6,00,000

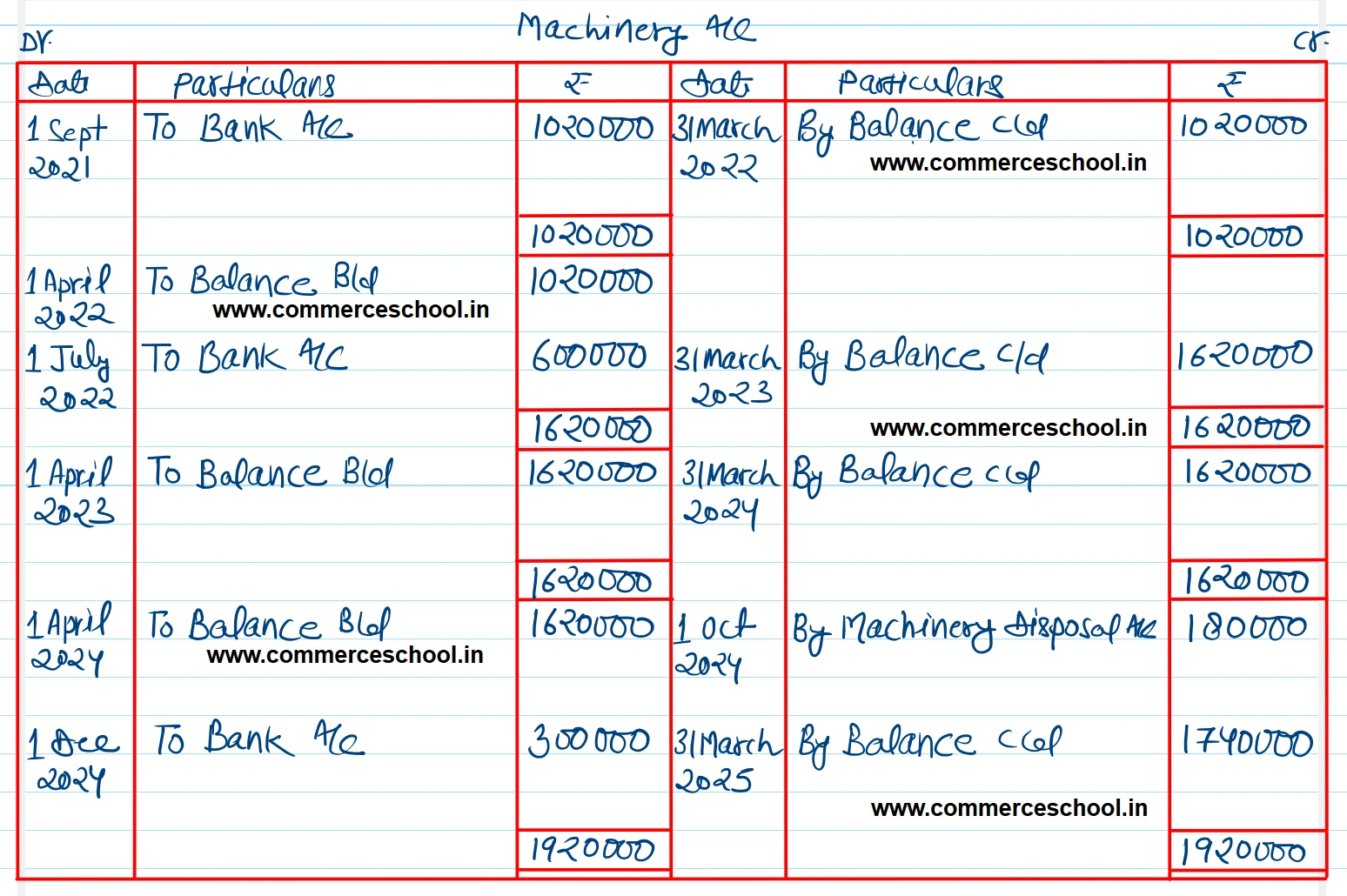

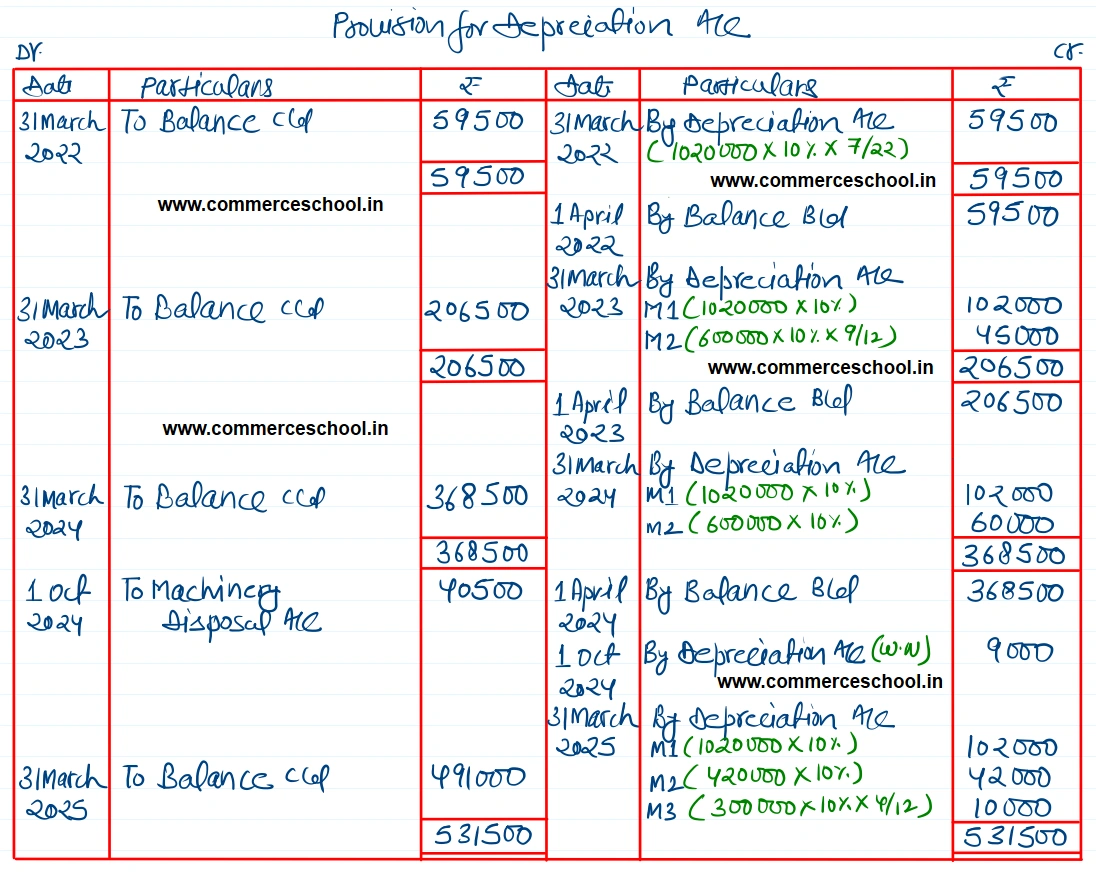

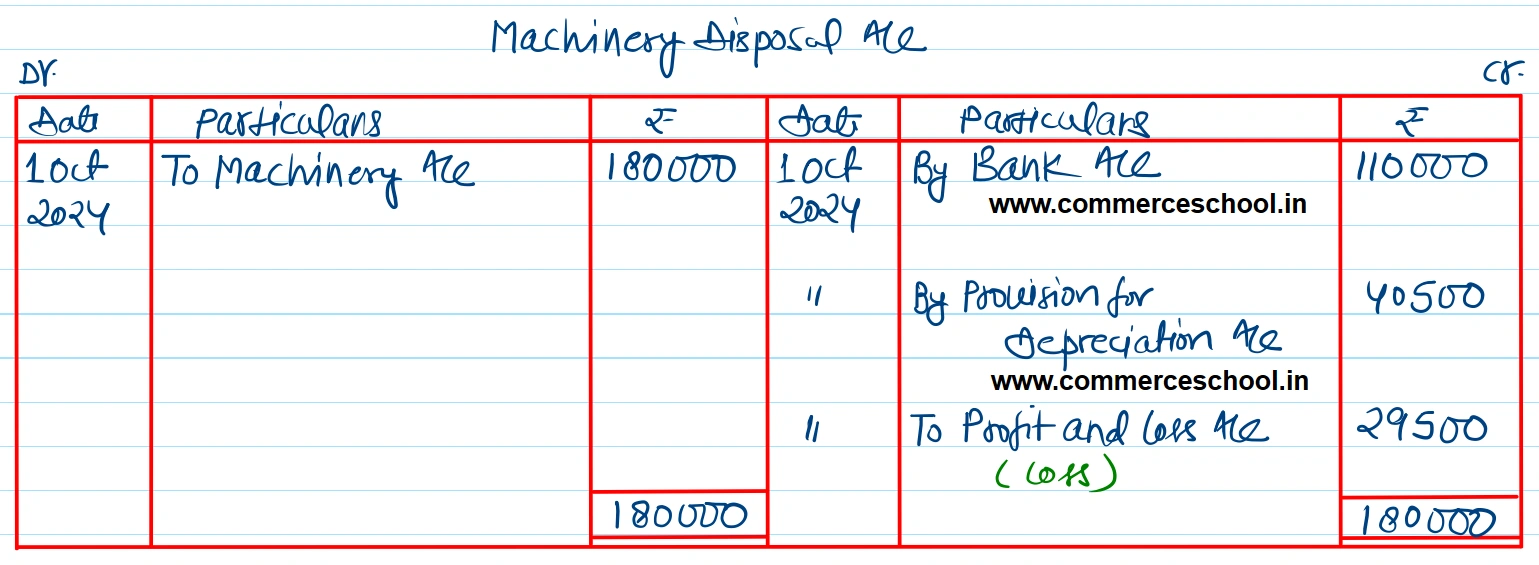

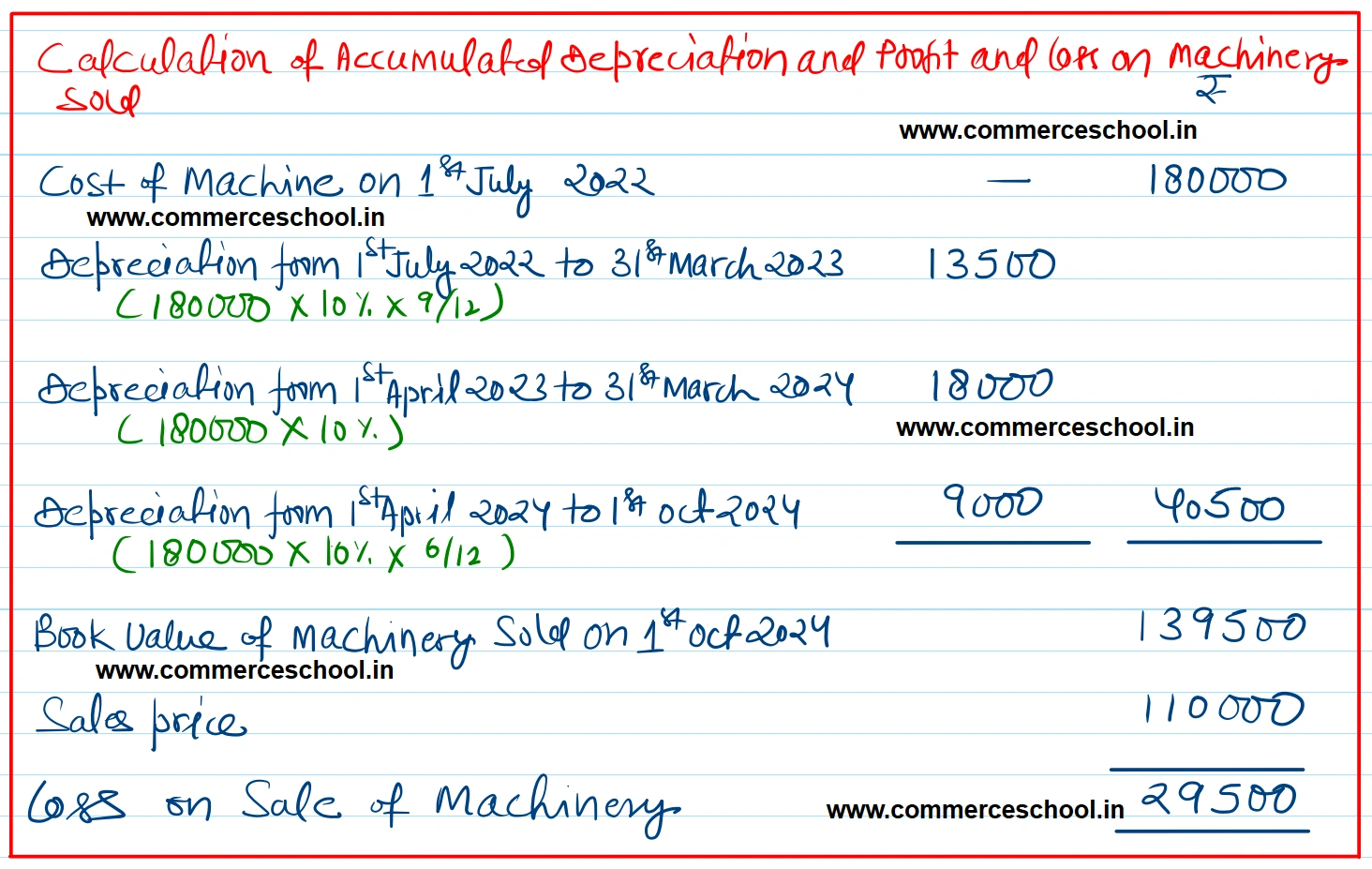

On 1st September 2021, Gopal Ltd. purchased a plant for ₹ 10,20,000. On 1st July 2022 another plant was purchased for ₹ 6,00,000. The firm writes off depreciation @ 10% p.a. on original cost and its accounts are closed every year on 31st March. On 1st October 2024, a part of the second plant purchased on 1st July 2022 for ₹ 1,80,000 was sold for ₹ 1,10,000. On 1st December 2024, another plant was purchased for ₹ 3,00,000.

Prepare Plant Account, Provision for Depreciation Account and Plant Disposal Account.

[Ans. Balance of Plant A/c on 31st March 2025 ₹ 17,40,000; Balance of Provision for Depreciation A/c on 31st March 2025 ₹ 4,91,000; Loss on sale of Plant ₹ 29,500.]

Anurag Pathak Answered question