On 31st March, 2025 the following Trial Balance was extracted from the books of Roshan Brothers:-

On 31st March, 2025 the following Trial Balance was extracted from the books of Roshan Brothers:-

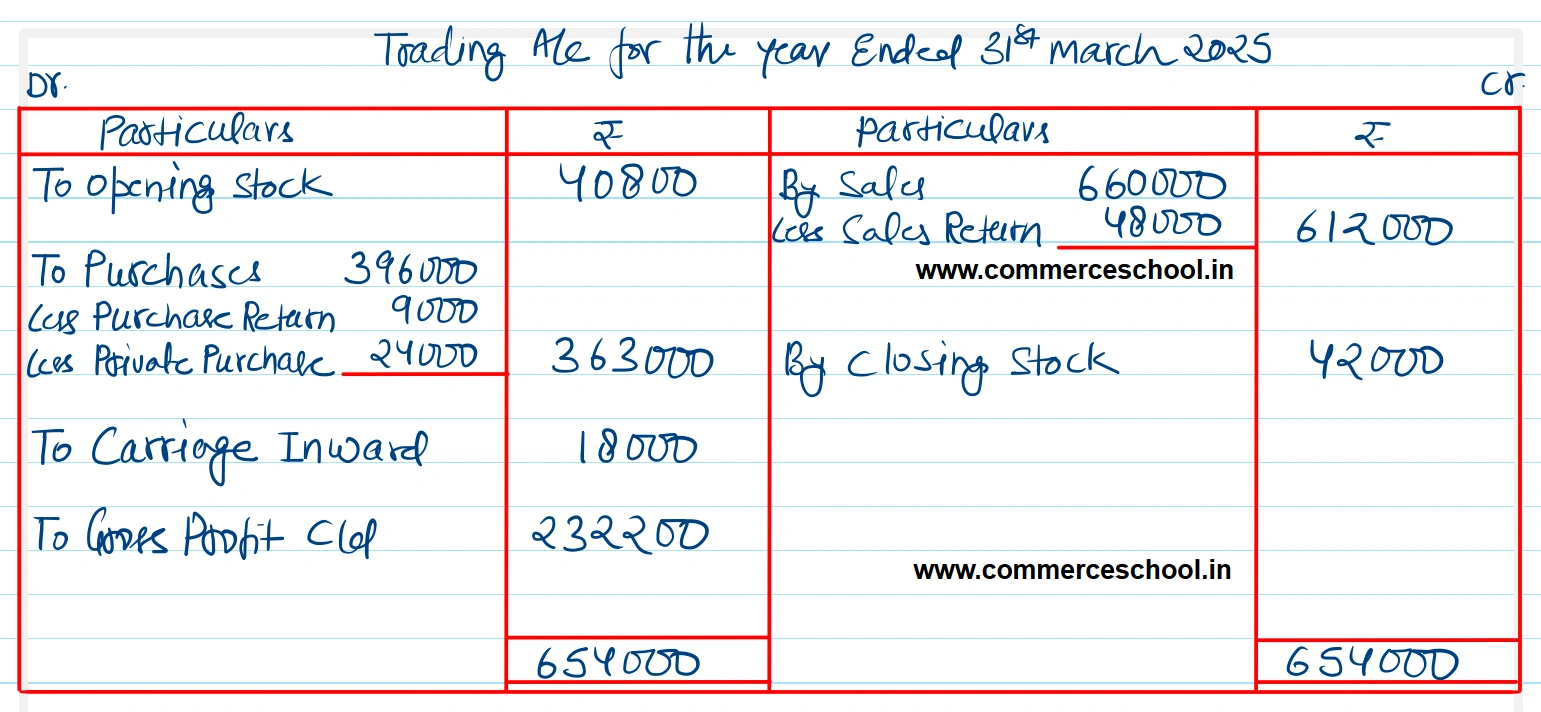

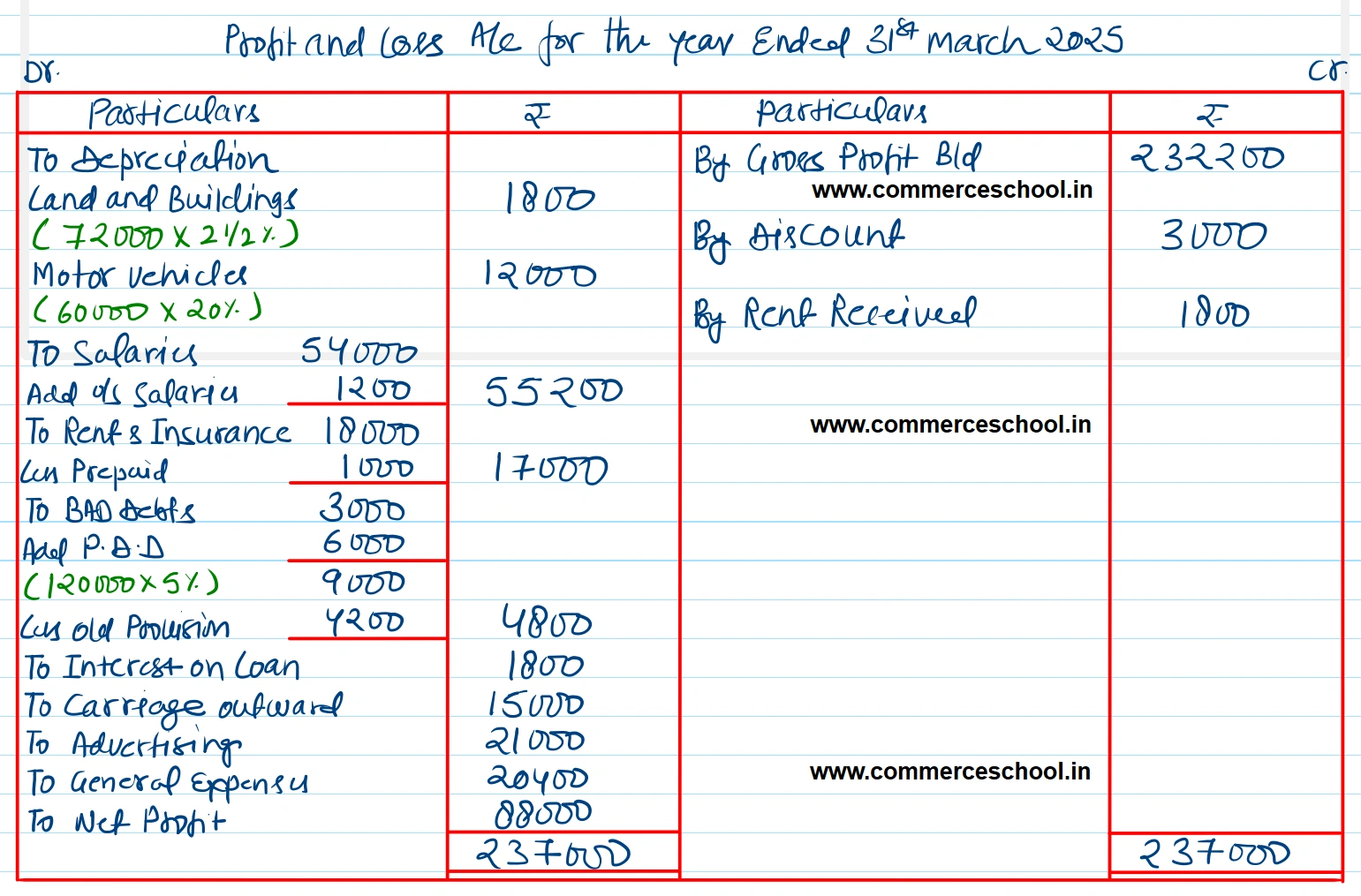

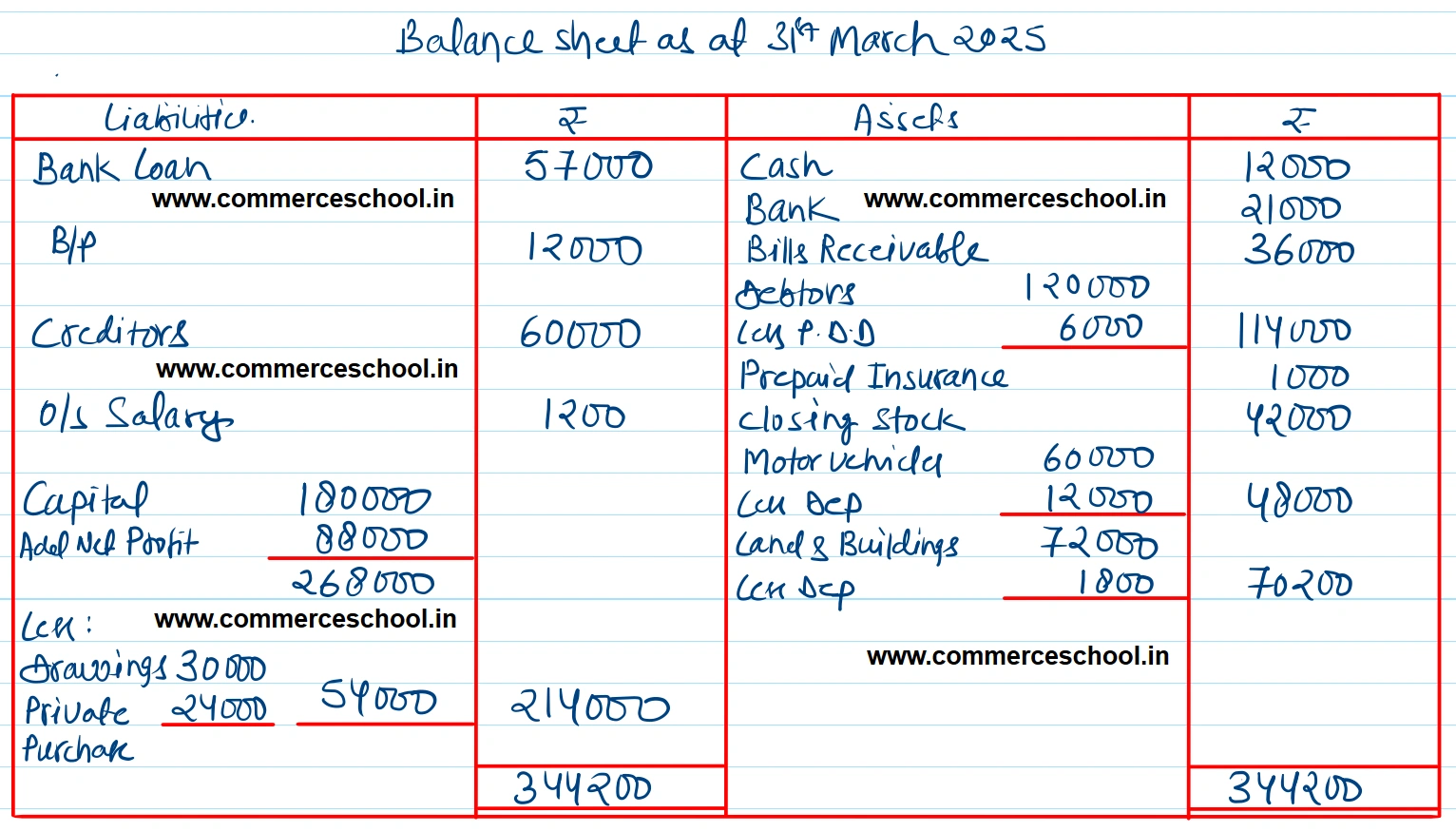

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date after taking into account the following:-

(a) Private purchases amounting to ₹ 24,000 have been debited to Purchases Account.

(b) Depreciate Land and Buildings at 21/2% and Motor Vehicles at 20%

(c) Salaries oustanding ₹ 1,200.

(d) Prepaid Insurance ₹ 1,000.

(e) Provision for Doubtful Debts is to be maintained at 5% on Debtors.

(f) Stock on 31st March, 2025 was valued at ₹ 42,000.

[Ans. G.P. ₹ 2,32,200; N.P. ₹ 88,000 and B/S Total ₹ 3,44,200.]

| Particulars | Dr. (₹) | Cr. (₹) |

| Capital | 1,80,000 | |

| Drawings | 30,000 | |

| Debtors and Creditors | 1,20,000 | 60,000 |

| Bank Loan | 57,000 | |

| Interest on Loan | 1,800 | |

| Cash | 12,000 | |

| Provision for Bad Debts | 4,200 | |

| Stock 1-4-2024 | 40,800 | |

| Motor Vehicles | 60,000 | |

| Bank | 21,000 | |

| Land and Buildings | 72,000 | |

| Bad Debts | 3,000 | |

| Purchases and Sales | 3,96,000 | 6,60,000 |

| Returns | 48,000 | 9,000 |

| Carriage Outward | 15,000 | |

| Carriage Inward | 18,000 | |

| Salaries | 54,000 | |

| Rent and Insurance | 18,000 | |

| Advertising | 21,000 | |

| Discount | 3,000 | |

| General Expenses | 20,400 | |

| B/R and B/P | 36,000 | 12,000 |

| Rent Received | 1,800 | |

| 9,87,000 | 9,87,000 |

Anurag Pathak Answered question

Solution:-

Hint: Returns shown on the Dr. side of Trial Balance will be treated as sales returns and returns shown on the Cr. side will be treated as purchases returns.

Anurag Pathak Changed status to publish