From the following Trial Balance of Geeta, you are required to prepare: Trading and Profit and Loss Account for the year ended on 31st March, 2019, and Balance Sheet as at that date

From the following Trial Balance of Geeta, you are required to prepare:

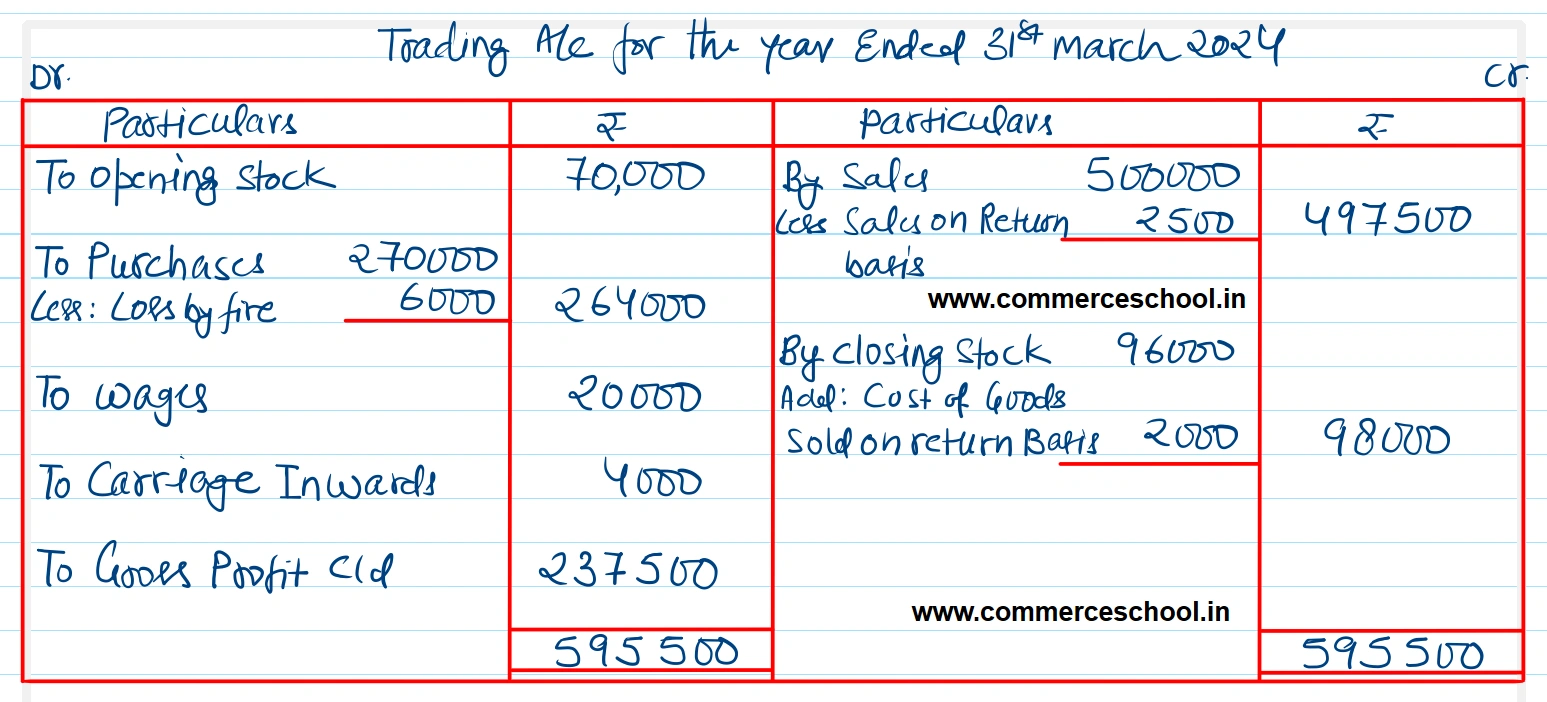

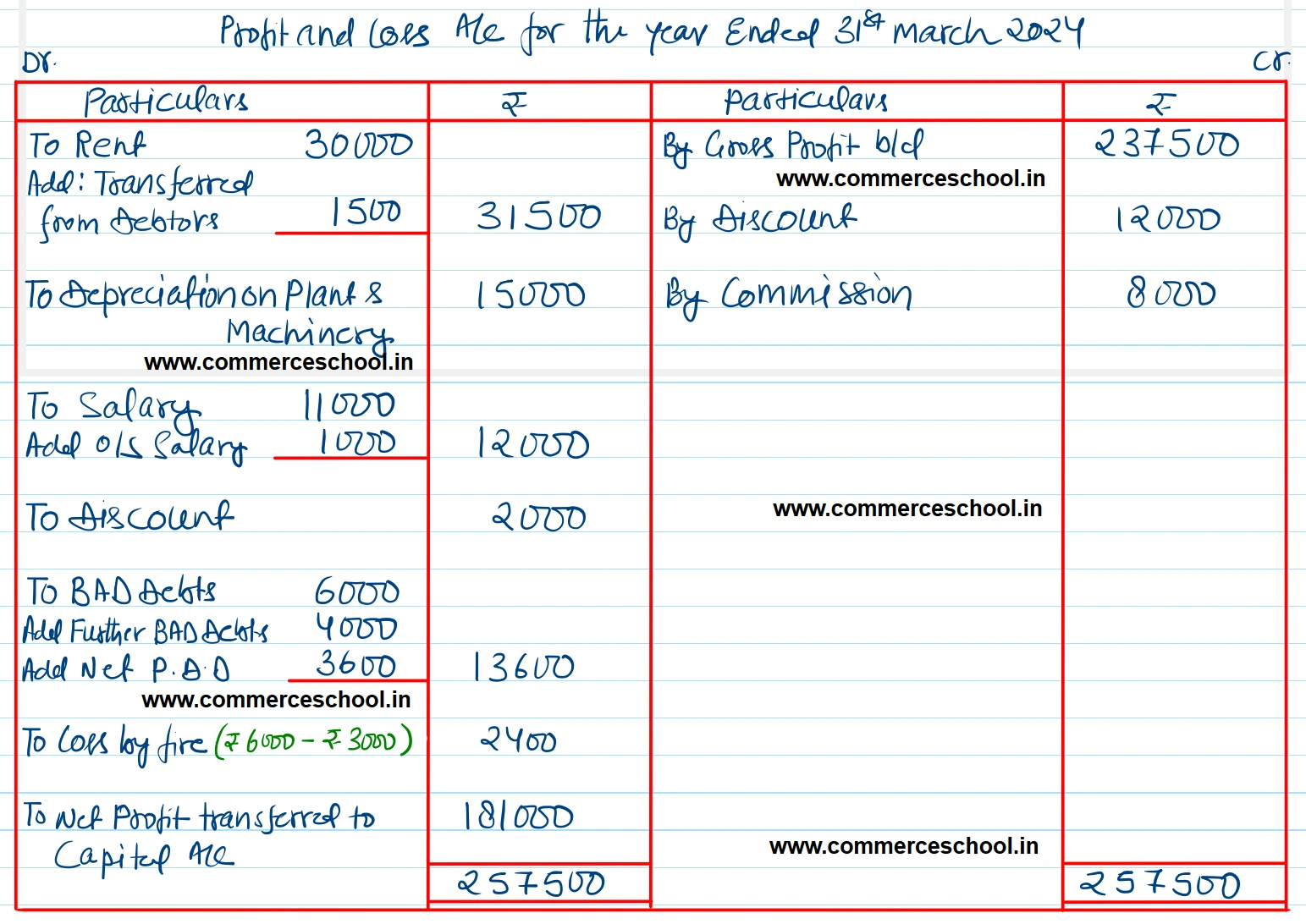

(i) Trading and Profit and Loss Account for the year ended on 31st March, 2019, and

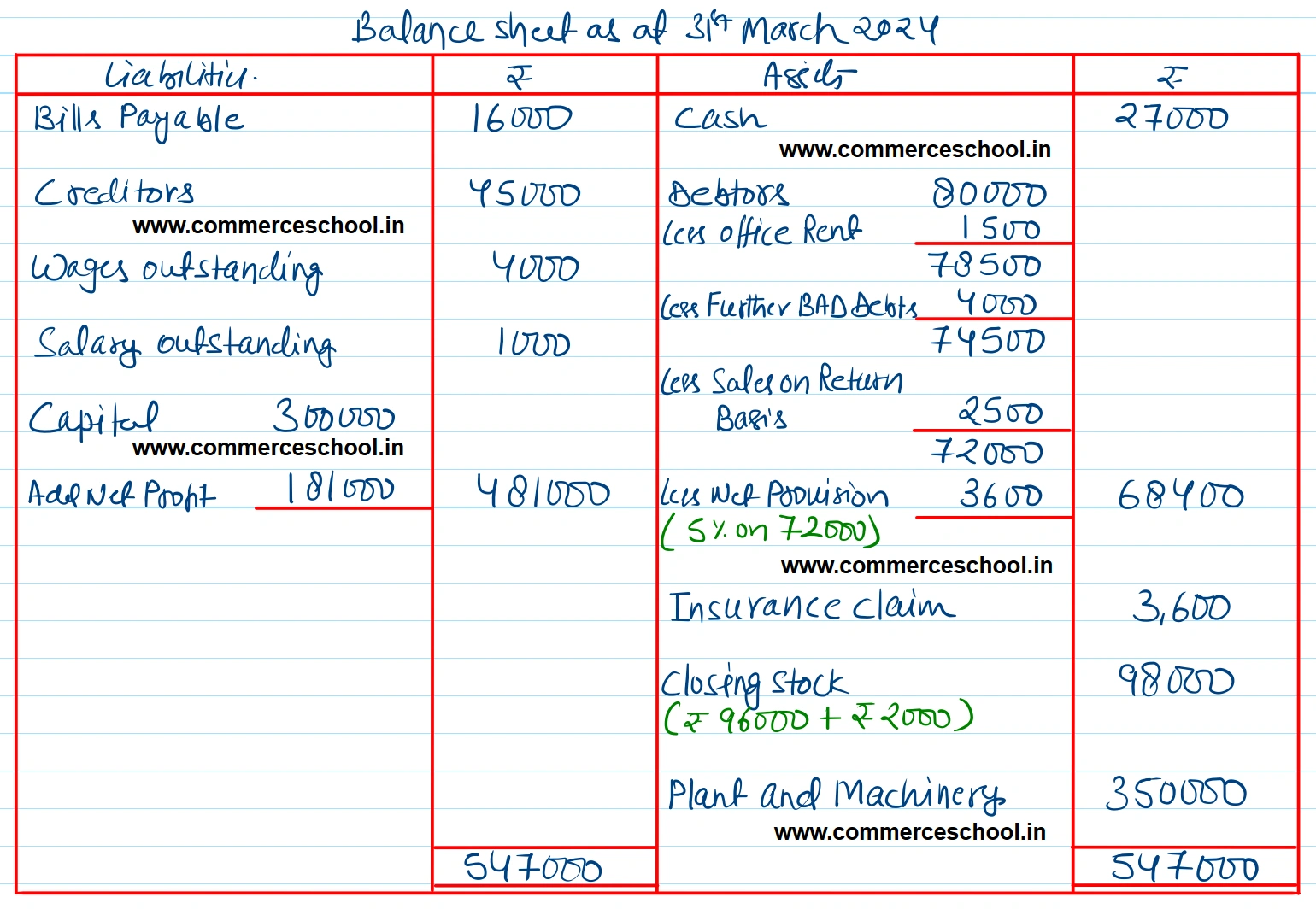

(ii) Balance Sheet as at that date.

Adjustments:

(i) Stock on 31st March, 2019 was ₹ 96,000.

(ii) Stock destroyed by fire was ₹ 6,000 and the Insurance Company accepted a claim for ₹ 3,600.

(iii) ₹ 1,500 paid as rent of the office was debited to Landlord’s account (included in Debtors).

(iv) Write off further bad debts ₹ 4,000.

(v) Sales include sales on return basis. Approval for sale of ₹ 2,500 has not been received till 31.03.2019. The rate of gross profit on this sale was 25% on cost.

(vi) Create a provision for Doubtful Debts on Debtors 5%.

[Ans. Gross Profit ₹ 2,37,500; Net Profit ₹ 1,81,000; Balance Sheet total ₹ 5,47,000.]

| Debit Balances | ₹ | Credit Balances | ₹ |

| Stock on 01.04.2018 | 70,000 | Capital | 3,00,000 |

| Plant and Machinery | 3,50,000 | Wages Outstanding | 4,000 |

| Rent | 30,000 | Sales | 5,00,000 |

| Depreciation on Plant and Machinery | 15,000 | Creditors | 45,000 |

| Wages | 20,000 | Bills Payables | 16,000 |

| Salary for 11 months | 11,000 | Discount | 12,000 |

| Cash | 27,000 | Commission | 8,000 |

| Purchases | 2,70,000 | ||

| Debtors | 80,000 | ||

| Discount | 2,000 | ||

| Carriage Inwards | 4,000 | ||

| Bad Debts | 6,000 | ||

| 8,85,000 | 8,85,000 |

Anurag Pathak Answered question