From the following Trial Balance of Sh. Parveen Kumar, prepare Trading and Profit & Loss Account for the year ending 31st March, 2023 and a Balance sheet as at that date:

From the following Trial Balance of Sh. Parveen Kumar, prepare Trading and Profit & Loss Account for the year ending 31st March, 2023 and a Balance sheet as at that date:

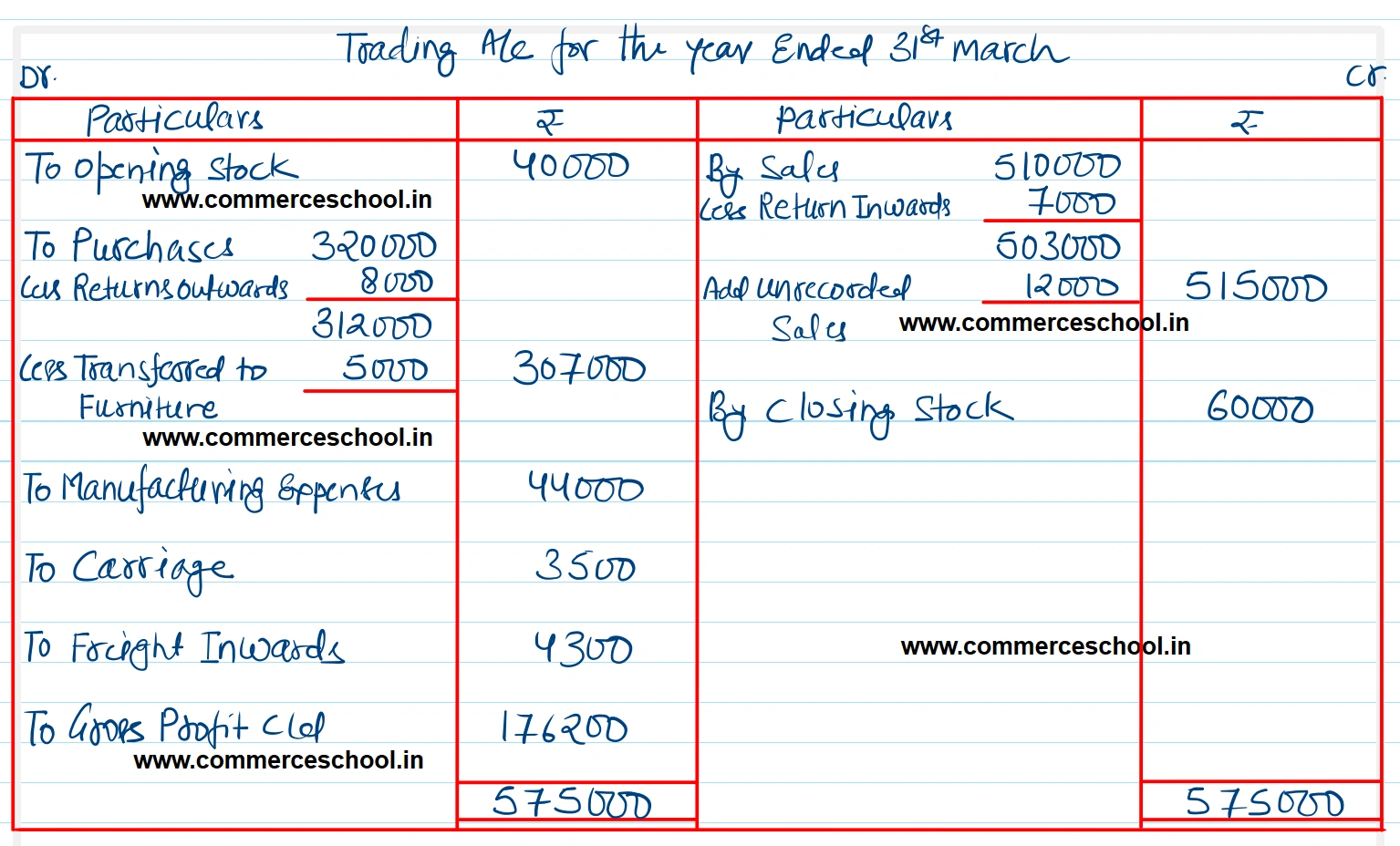

| Dr. Balances | ₹ | Cr. Balances | ₹ |

| Stock at Commencement | 40,000 | Sales | 5,10,000 |

| Purchases | 3,20,000 | Loan from Mr. Naresh @ 15% p.a. | 40,000 |

| Returns Inward | 7,000 | Returns Outwards | 8,000 |

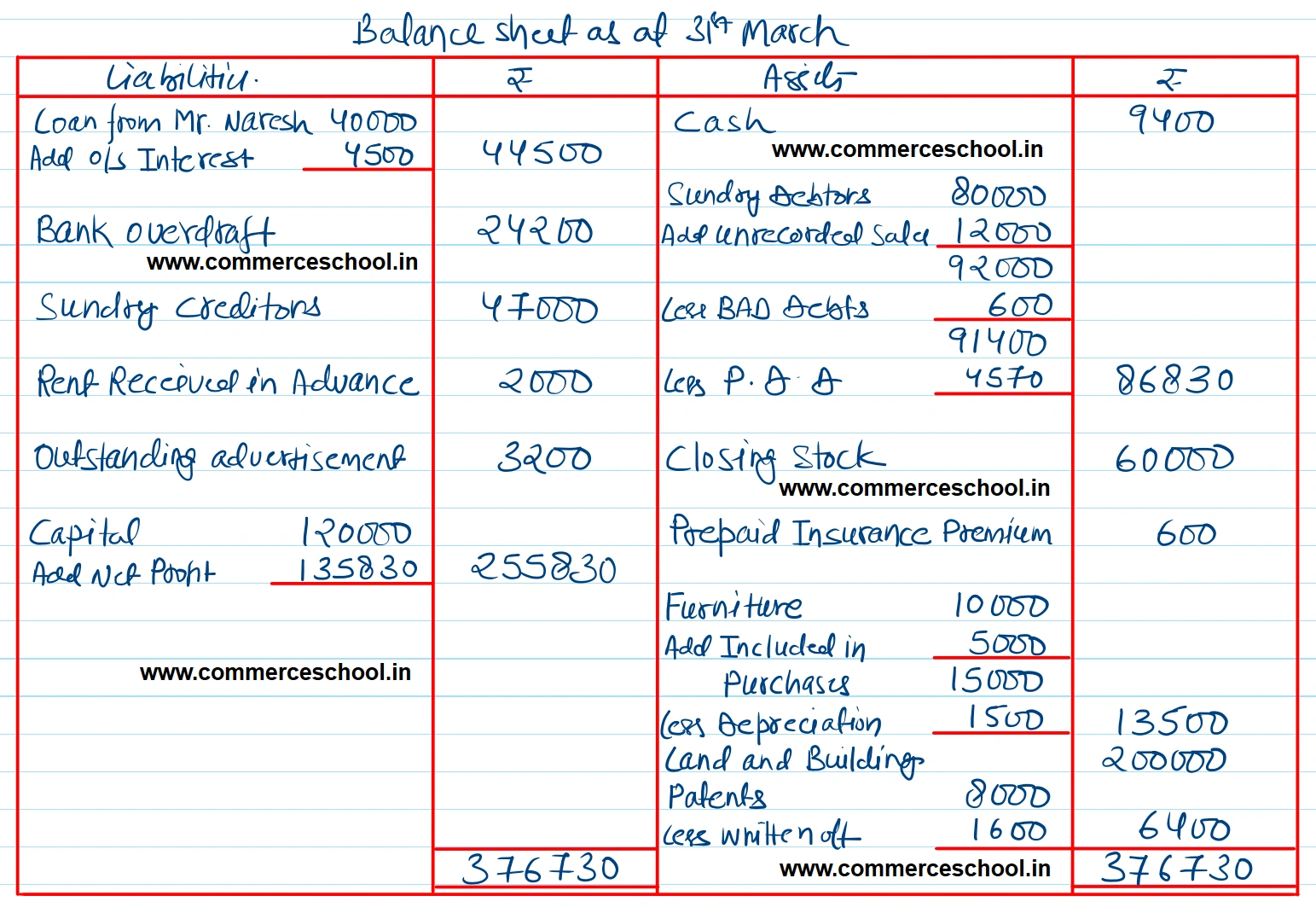

| Sundry Debtors | 80,000 | Bank | 24,200 |

| Cash | 9,400 | Provision for Doubtful Debts | 2,500 |

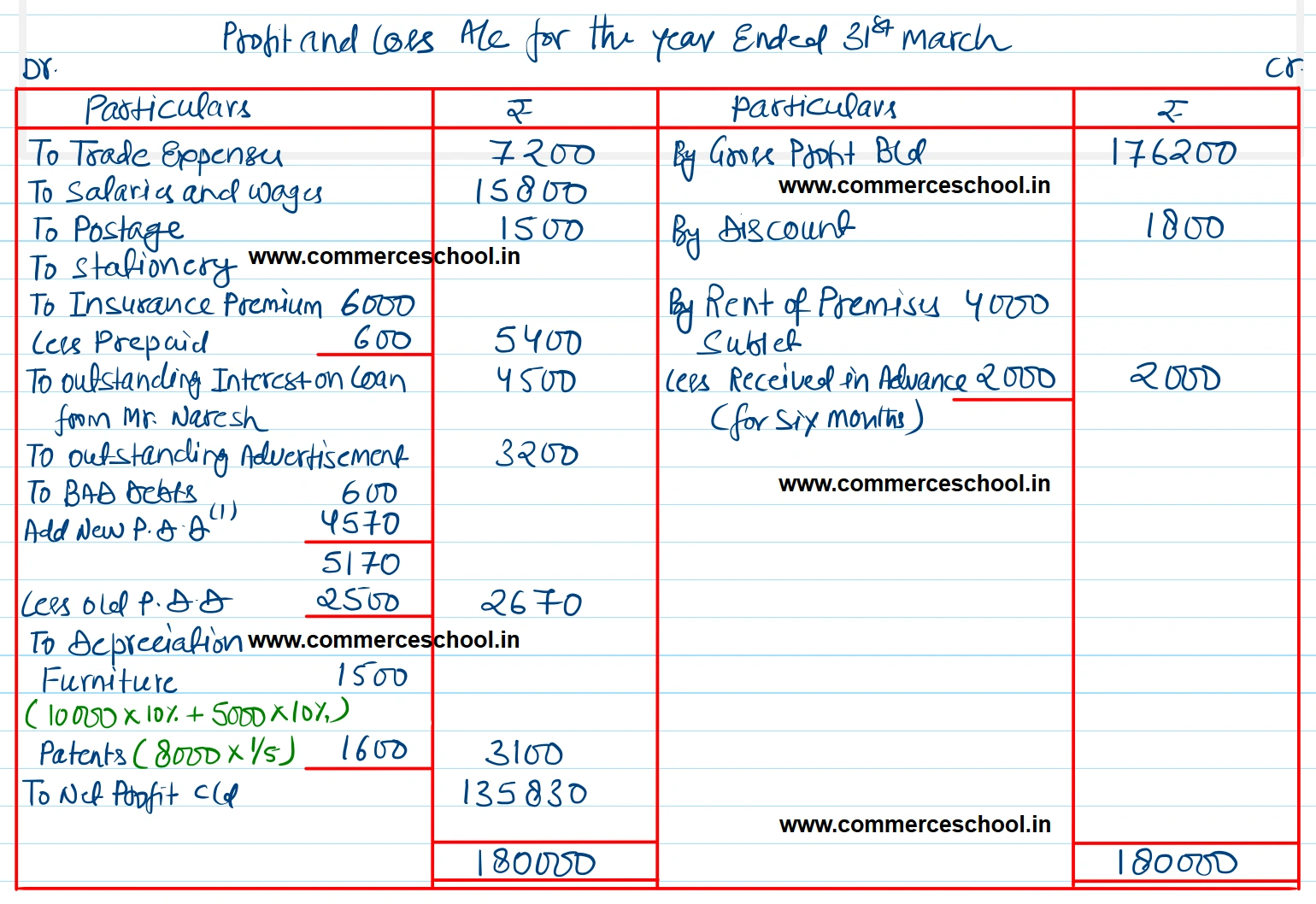

| Manufacturing Expenses | 44,000 | Discount | 1,800 |

| Trade Expenses | 7,200 |

Rent of Premises sublet, for the year to 30th Sept., 2023 |

4,000 |

| Carriage | 3,500 | Capital | 1,20,000 |

| Salaries and Wages | 15,800 | Sundry Creditors | 47,000 |

| Postage | 1,500 | ||

| Stationery | 800 | ||

| Freight Inwards | 4,300 | ||

| Land and Building | 2,00,000 | ||

| Patents | 8,000 | ||

| Furniture | 10,000 | ||

| Insurance Premium | 6,000 | ||

| 7,57,500 | 7,57,500 |

Informations:-

(1) Closting Stock was valued at ₹ 60,000. You are informed that goods valued at ₹ 12,000 were sold and dispatched on 29th March, 2023, but no entry was passed to this effect.

(2) Insurance Premium includes ₹ 1,200 paid on 1st October, 2022 to run for one year from Oct. 1, 2022 to Sept. 30, 2023.

(3) Loan from Mr. Naresh was taken on 1st July, 2022. Interest has not been paid so far.

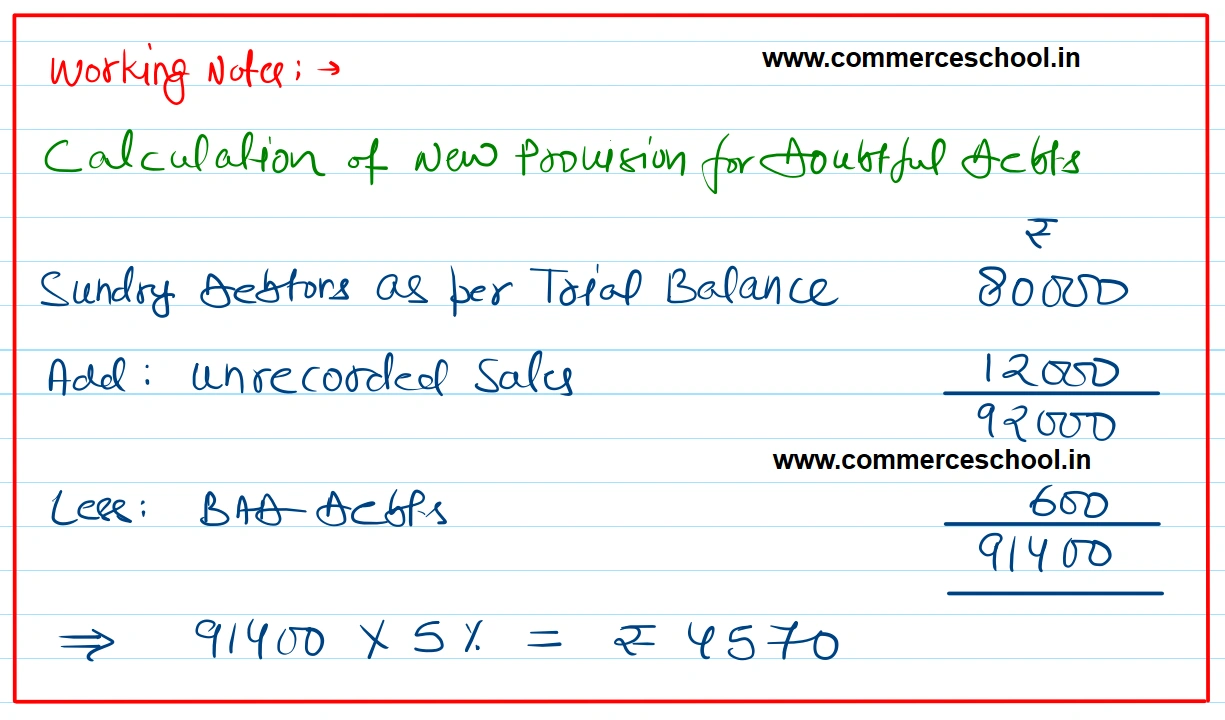

(4) Create provision for Doubtful Debts at 5% on Sundry Debtors after writing off ₹ 600 as Bad Debts during the year.

(5) A bill of ₹ 3,200 for advertisement in the newspaper remained unpaid at the end of the year.

(6) Purchases include Furniture costing ₹ 5,000 purchased on 1st April, 2022.

(7) Charge 10% p.a. depreciation on Furniture and write off 1/5the of patents.

[Ans. G.P. ₹ 1,76,200; N.P. ₹ 1,35,830; B/S Total ₹ 3,76,730.]

Solution:-