The following Trial Balance was extracted from the books of Mr. Gupta as at 31st March, 2023: Stock on 1-4-2022 ₹ 65,000 Purchases ₹ 7,10,000

The following Trial Balance was extracted from the books of Mr. Gupta as at 31st March, 2023:

Adjustments:-

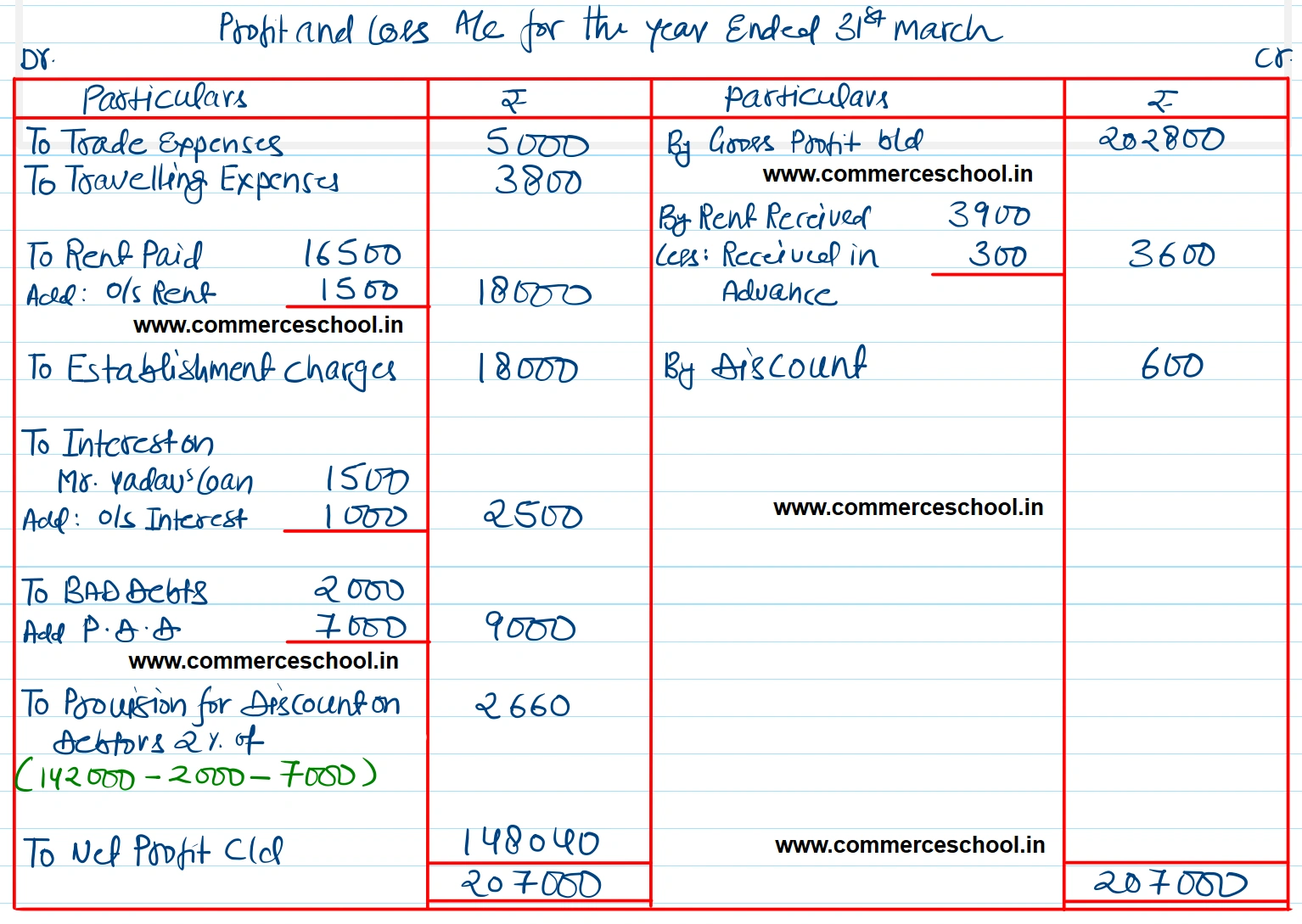

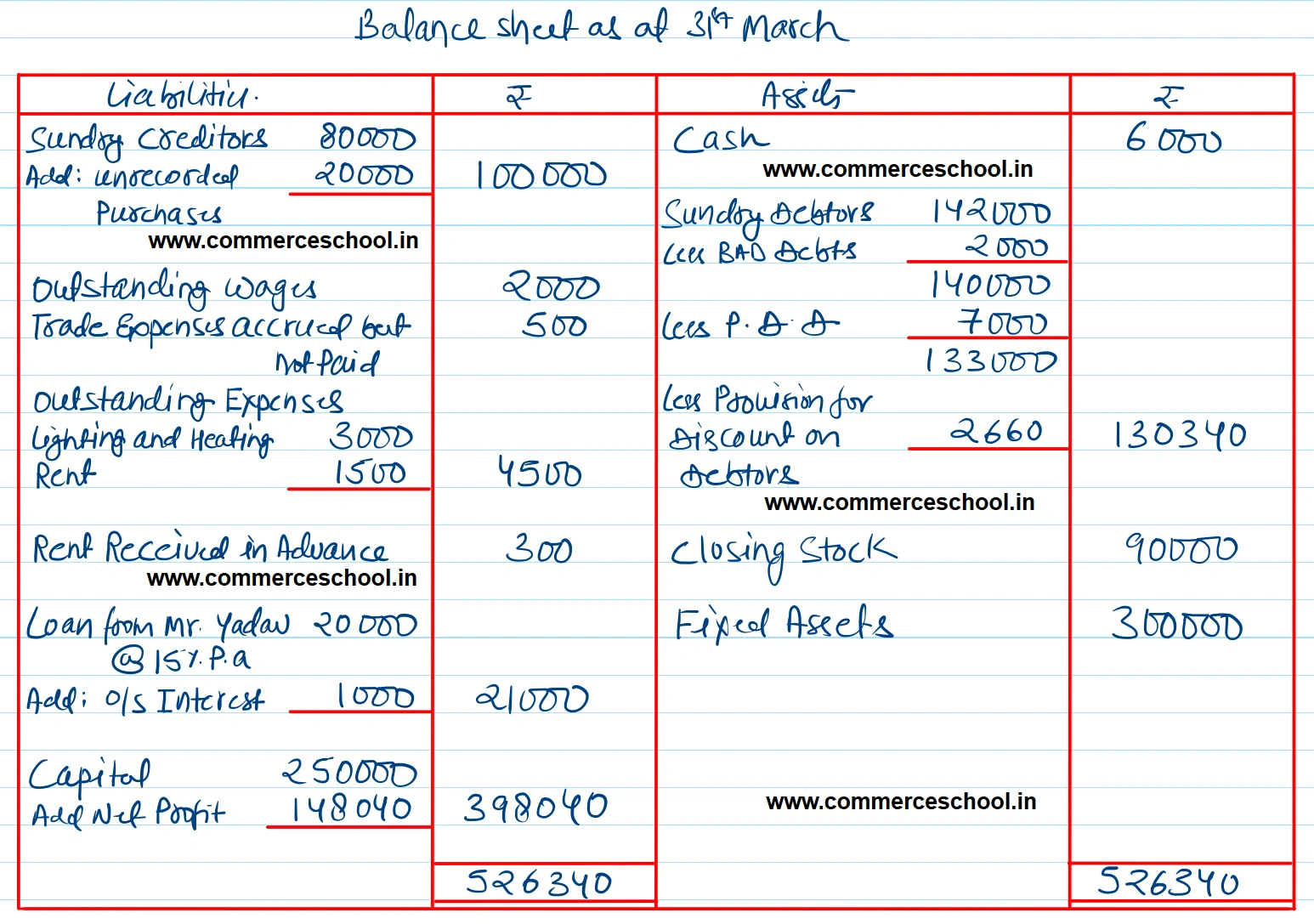

(i) Goods costing ₹ 20,000 were purchased and included into stock but not entry was passed to record the purchase.

(ii) Loan from Mr. Yadav was taken on 1st June, 2022.

(iii) Sundry Debtors include an amount of ₹ 2,000 due from a customer who has become insolvent and nothing is recoverable from his estate.

(iv) Create a provision of 5% for Doubtful Debts and 2% for discount on Debtors.

(v) Three months lighting and heating bill due but not paid ₹ 3,000.

(vi) Rent is paid for 11 months but is received for 13 months.

(vii) Stock amounted to ₹ 90,000 on 31st March, 2023.

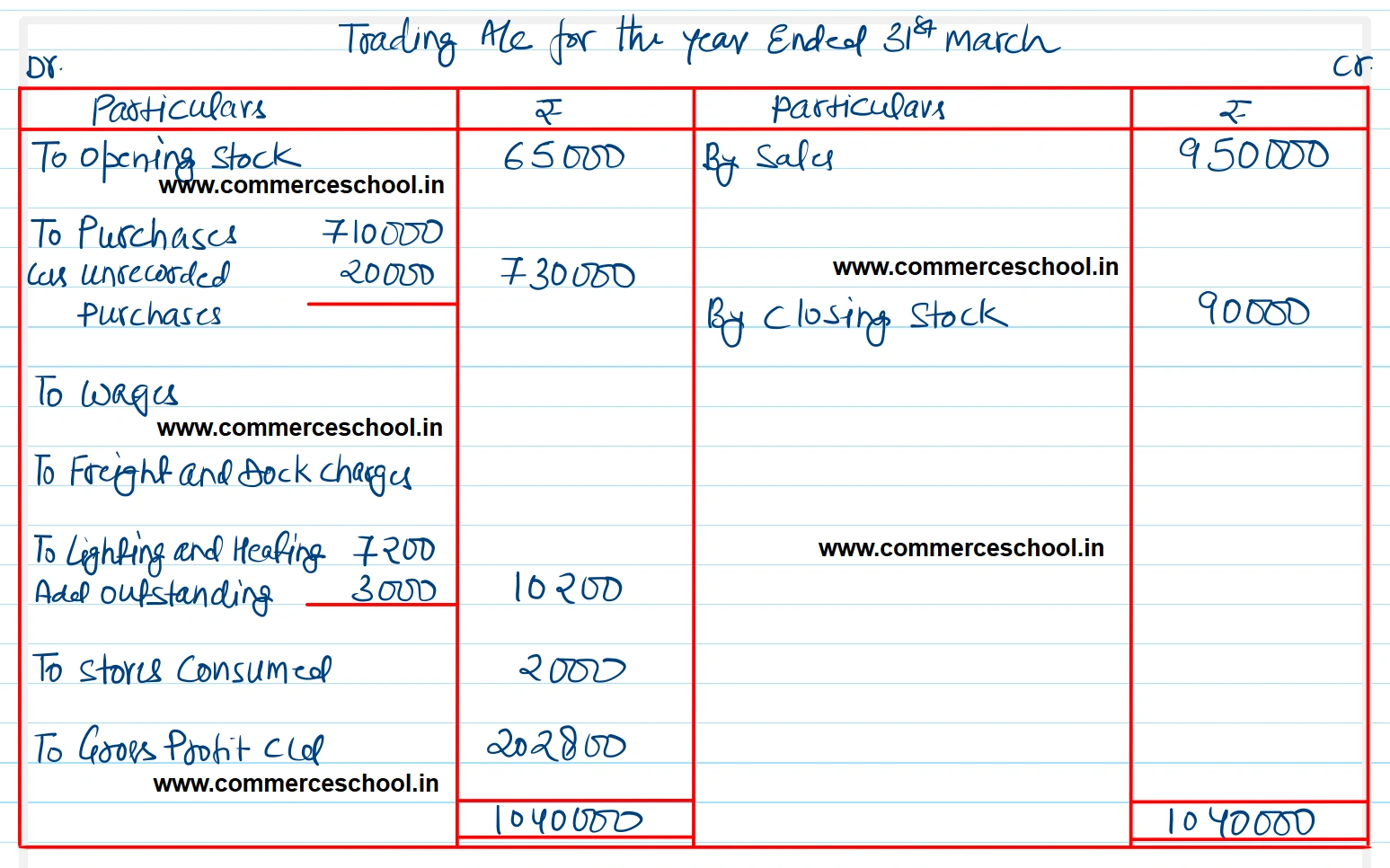

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and a Balance Sheet as at that date.

[Ans. G.P., ₹ 2,02,800; N.P. ₹ 1,48,040; Balance Sheet Total ₹ 5,26,340.]

Solution:-

| Dr. Balances | ₹ | Cr. Balances | ₹ |

| Stock on 1-4-2022 | 65,000 | Capital | 2,50,000 |

| Purchases | 7,10,000 | Rent Received | 3,900 |

| Wages | 22,000 | Loan from Mr. Yadav @ 15% p.a. | 20,000 |

| Trade Expenses | 5,000 | Sales | 9,50,000 |

| Freight and Dock Charges | 8,000 | Discount | 600 |

| Travelling Expenses | 3,800 | Outstanding Wages | 2,000 |

| Lighting and Heating (Factory) | 7,200 | Trade Expenses accrued but not paid | 500 |

| Stores Consumed | 2,000 | Sundry Creditors | 80,000 |

| Rent Paid | 16,500 | ||

| Establishment Charges | 18,000 | ||

| Interest on Mr. Yadav’s Loan | 1,500 | ||

| Sundry Debtors | 1,42,000 | ||

| Cash | 6,000 | ||

| Fixed Assets | 3,00,000 |

Anurag Pathak Answered question