From the following Trial Balance of Mr. Tarun Ghosh, prepare Trading and Profit and Loss A/c for the year ending 31st March, 2020 and a Balance Sheet as at that date:

From the following Trial Balance of Mr. Tarun Ghosh, prepare Trading and Profit and Loss A/c for the year ending 31st March, 2020 and a Balance Sheet as at that date:

Adjustments:-

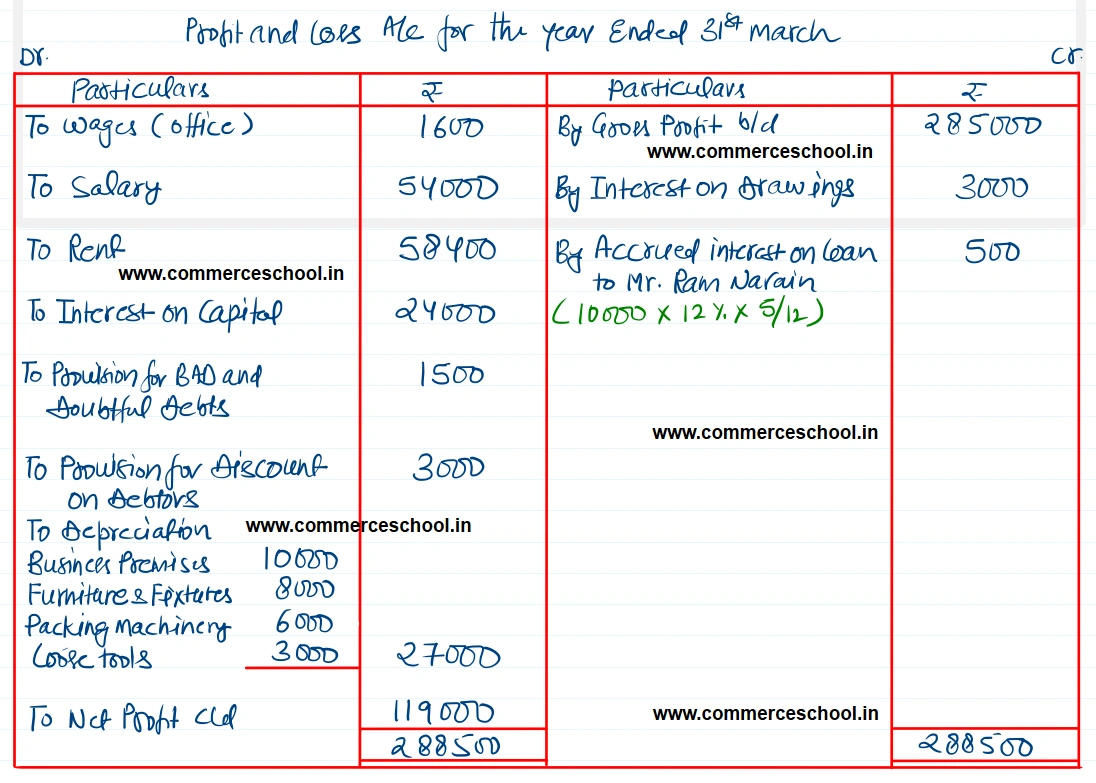

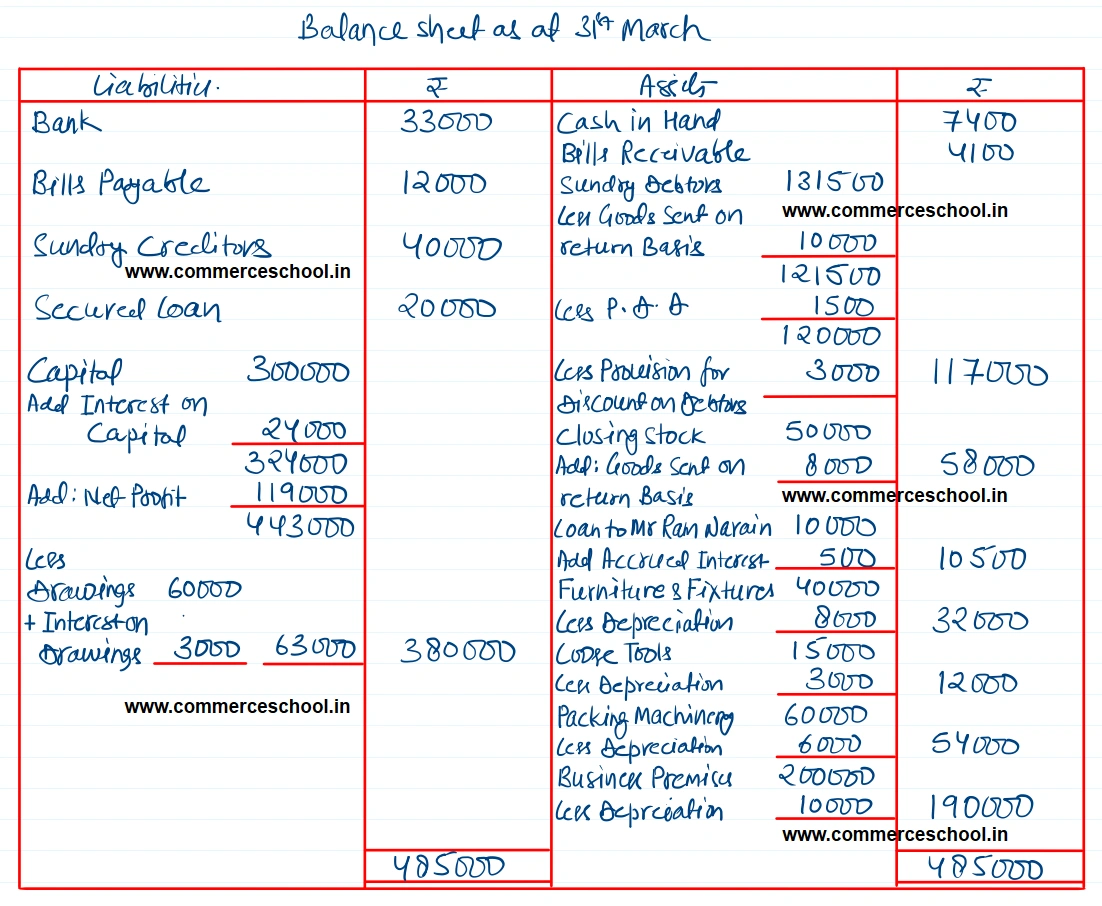

(1) Closing Stock amounted to ₹ 50,000.

(2) Goods costing ₹8,000 were sent to a customer on sale or return basis for ₹ 10,000 on 30th March, 2020 and had been recorded in the books as actual sales.

(3) Allow 8% interest on Capital and charge ₹ 3,000 as interest on drawings.

(4) Depreciate: Business premises by 5%; Furniture and Fixtures by 20% and Packing Machinery by 10%. Tools are to be revalued at ₹ 12,000.

(5) 21/2% for discounts is to be provided on Debtors.

(6) ₹ 1,500 is to be provided for Bad and Doubtful Debts.

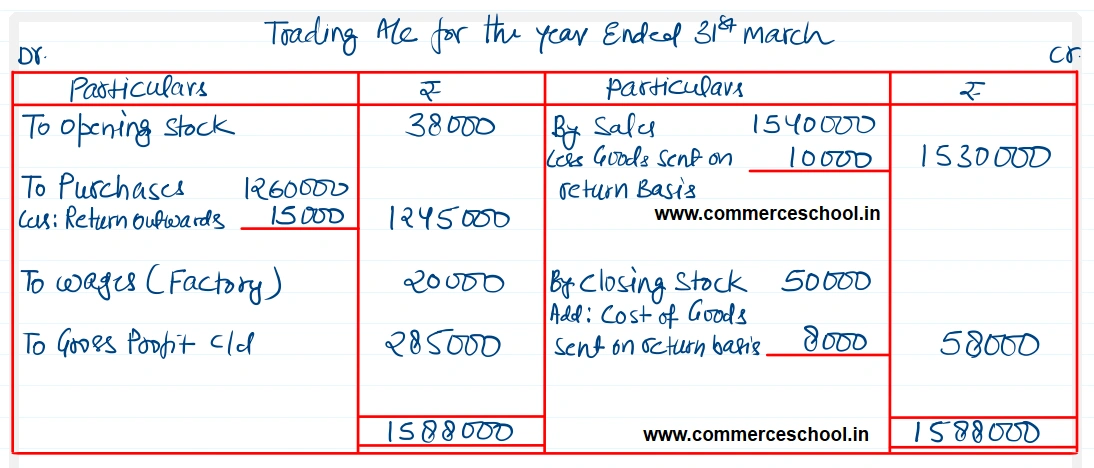

[Ans. Gross Profit ₹ 2,85,000; Net Profit ₹ 1,19,000; Balance Sheet Total ₹ 4,85,000.]

| Dr. Balances | ₹ | Cr. Balances | ₹ |

| Opening Stock | 38,000 | Capital | 3,00,000 |

| Purchases | 12,60,000 | Secured Loan | 20,000 |

| Wages: Factory Office | 20,000 1,600 | Sales | 15,40,000 |

| Salary | 54,000 | Sundry Creditors | 40,000 |

| Business Premises | 2,00,000 | Returns Outwards | 15,000 |

| Furniture and Fixtures | 40,000 | Bills Payable | 12,000 |

| Packing Machinery | 60,000 | Bank | 33,000 |

| Tools | 15,000 | ||

| Rent | 58,400 | ||

| Loan to Mr. Ram Narain on 1st November, 2019 @ 12% p.a. | 10,000 | ||

| Sundry Debtors | 1,31,500 | ||

| Cash in Hand | 7,400 | ||

| Drawings | 60,000 | ||

| Bills Receivable | 4,100 | ||

| 19,60,000 |

Anurag Pathak Answered question