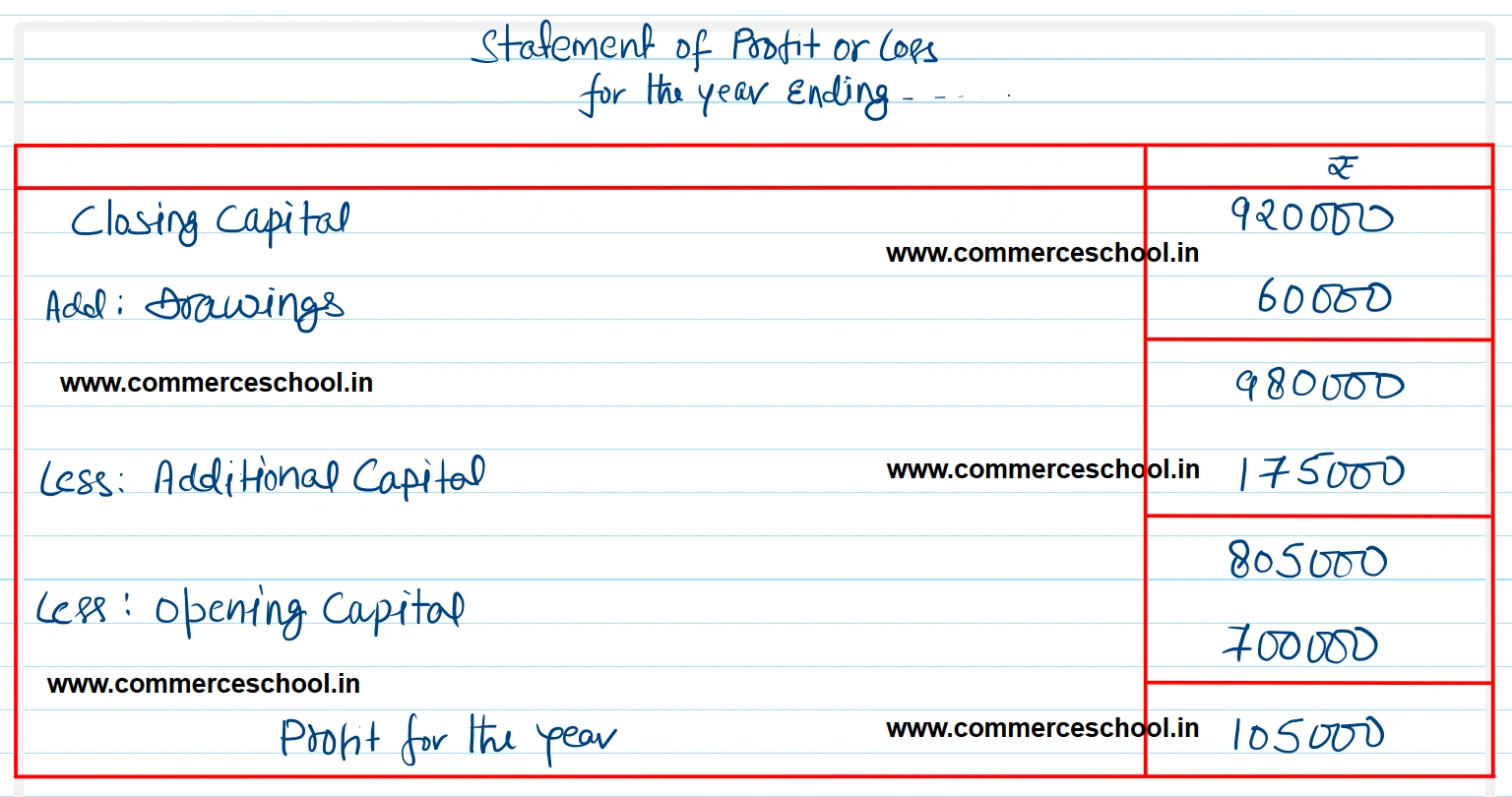

Mr. Samrat does not keep proper books of accounts. He gives you the following information: Opening Capital ₹ 7,00,000

Mr. Samrat does not keep proper books of accounts. He gives you the following information:

You are required to calculate profit or loss during the year by statement of affairs method.

[Ans. Profit ₹ 1,05,000]

| ₹ | |

| Opening Capital | 7,00,000 |

| Additional Capital introduced during the year | 1,75,000 |

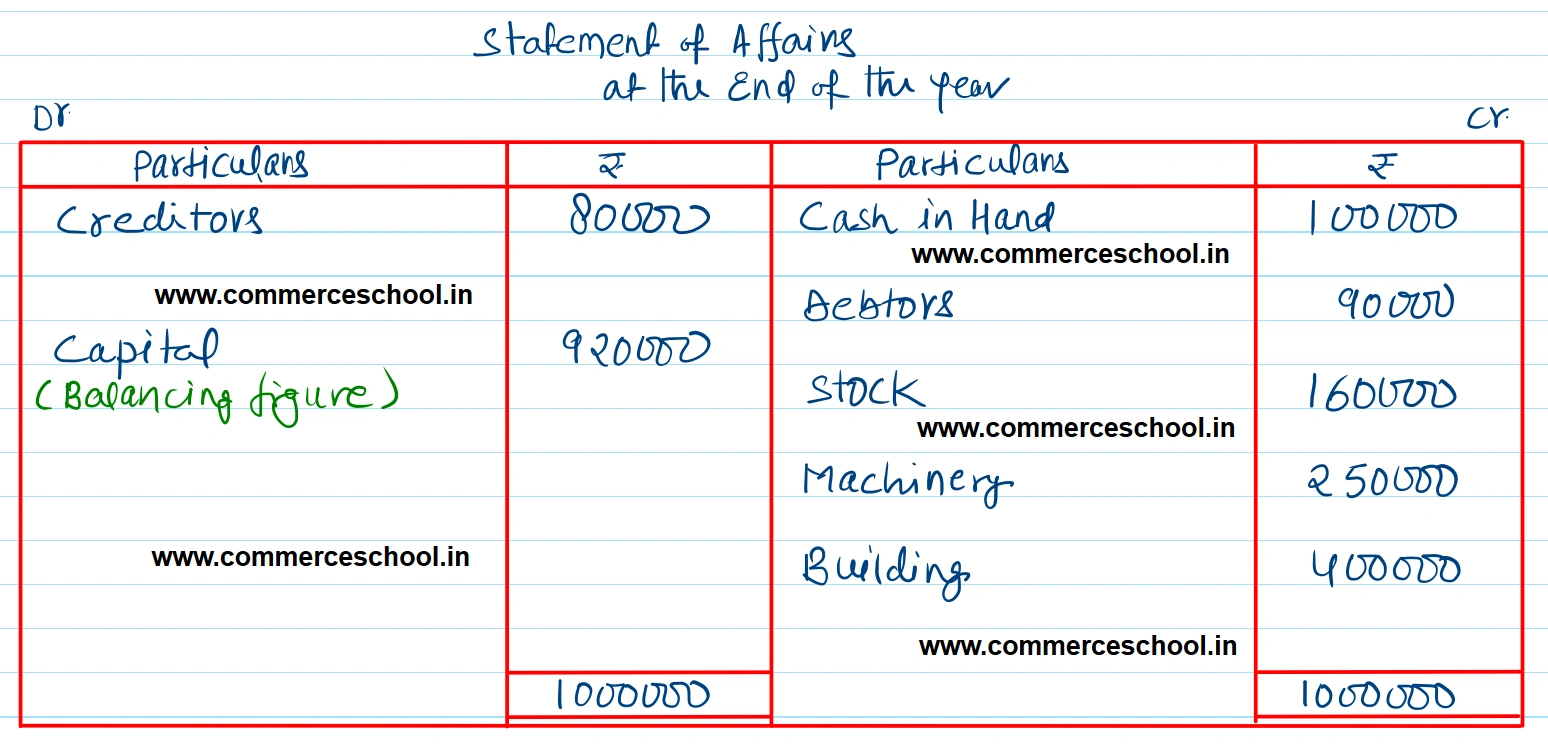

| Closing assets and liabilities | |

| Stock | 1,60,000 |

| Debtors | 90,000 |

| Building | 4,00,000 |

| Machinery | 2,50,000 |

| Cash in Hand | 1,00,000 |

| Creditors | 80,000 |

| Drawings during the year | 60,000 |

Anurag Pathak Answered question