Following incomplete information is available from records maintained by Mr. X:

Following incomplete information is available from records maintained by Mr. X:

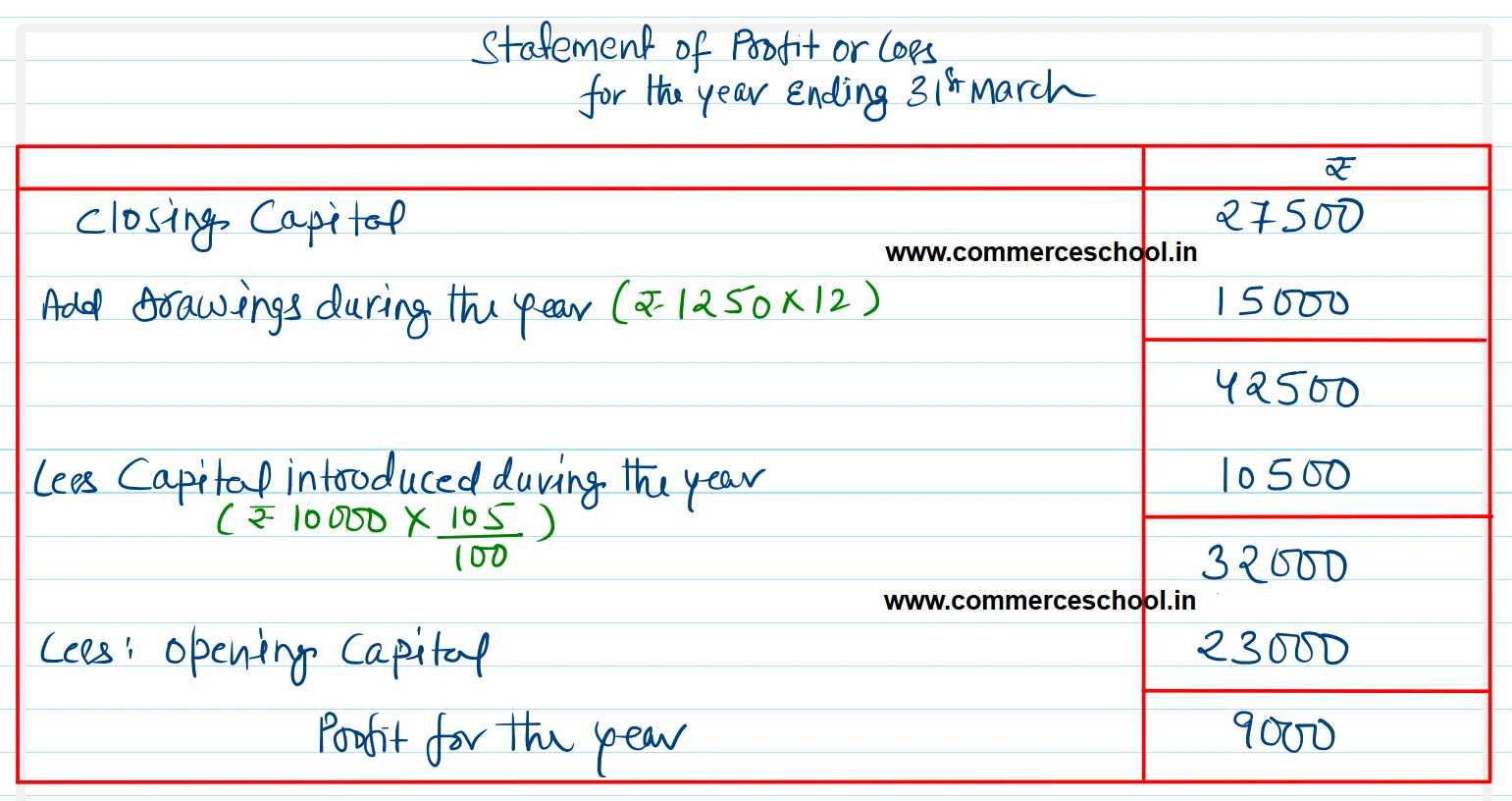

During the year Mr. X introduced in the business the amount realised on sale of ₹ 10,000 investments at the premium of 5%. Personal expenses of Mr. X paid from business account amounted to ₹ 1,250 per month. Prepare a statement to calculate Profit (or Loss) during the year.

[Ans. Opening Capital ₹ 23,000; Closing Capital ₹ 27,500; Profit ₹ 9,000.]

Solution:-

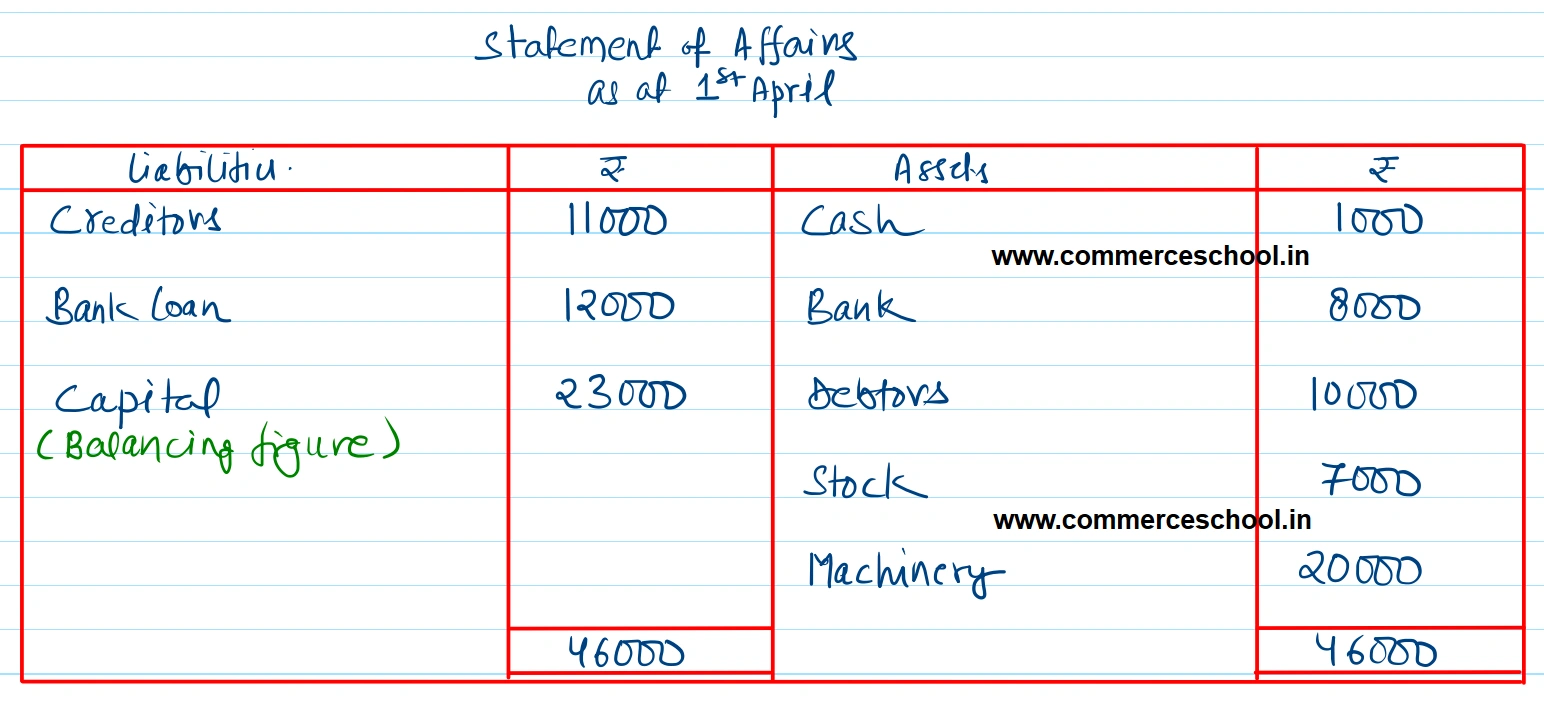

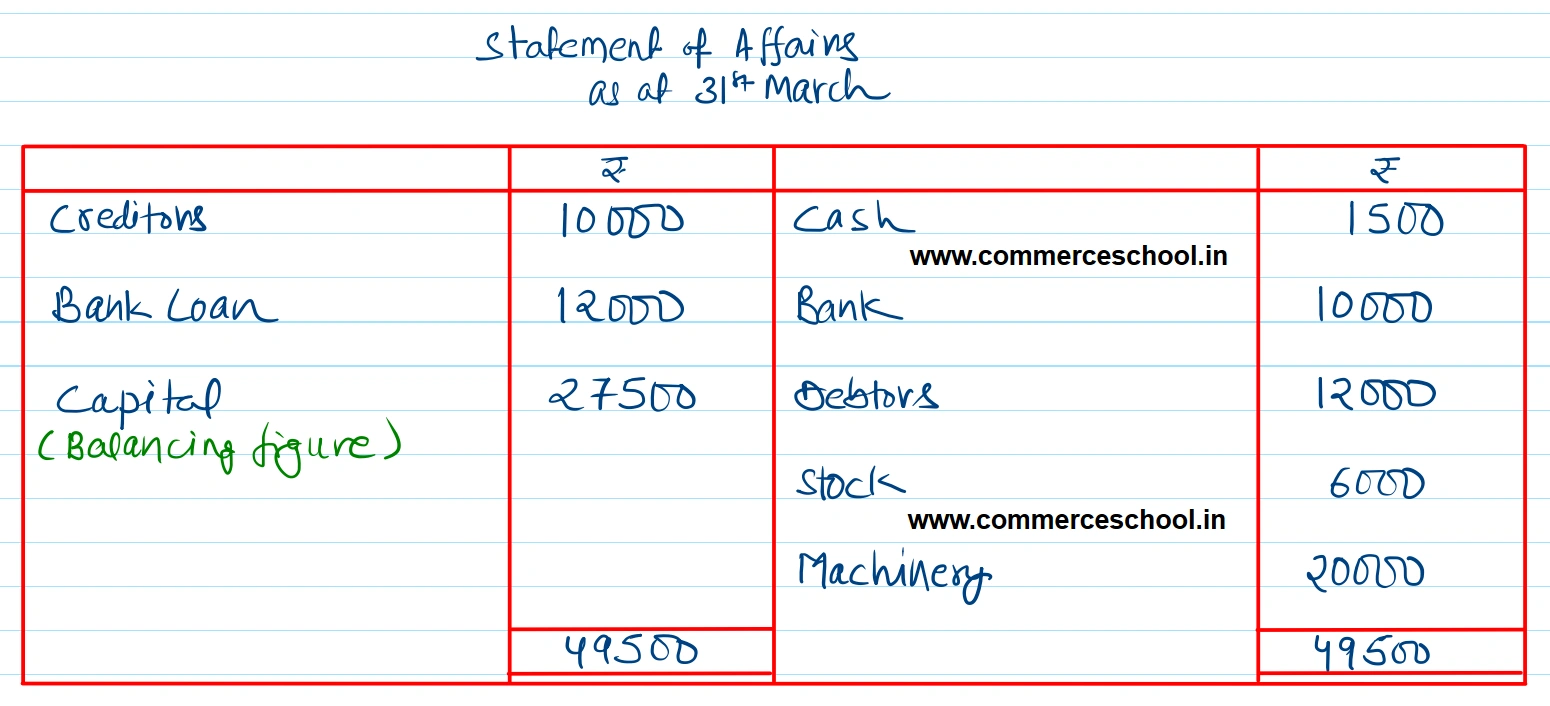

| 1-4-2022 (₹) | 31-3-2023 (₹) | |

| Cash | 1,000 | 1,500 |

| Bank | 8,000 | 10,000 |

| Debtors | 10,000 | 12,000 |

| Stock | 7,000 | 6,000 |

| Machinery | 20,000 | 20,000 |

| Creditors | 11,000 | 10,000 |

| Bank Loan | 12,000 | 12,000 |

Anurag Pathak Answered question