Gopal keeps incomplete records. On 1st April, 2022, his position was as follows: Bank Overdraft ₹ 7,500

Gopal keeps incomplete records. On 1st April, 2022, his position was as follows:

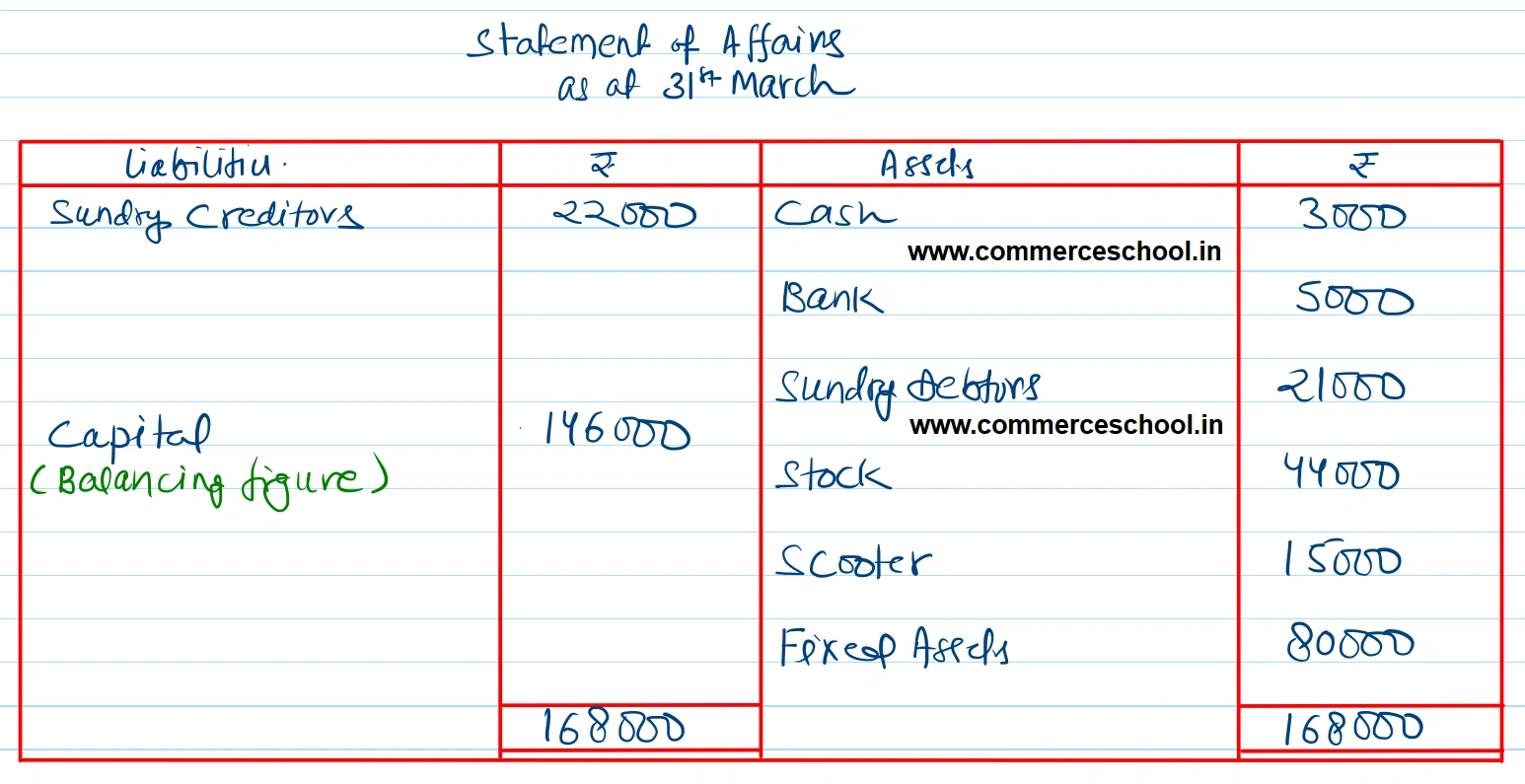

His position on 31st March, 2023 was as follows:

Cash in hand ₹ 3,000; Cash at Bank ₹ 5,000; Stock ₹ 44,000; Debtors ₹ 21,000; Fixed Assets ₹ 80,000; Creditors ₹ 22,000.

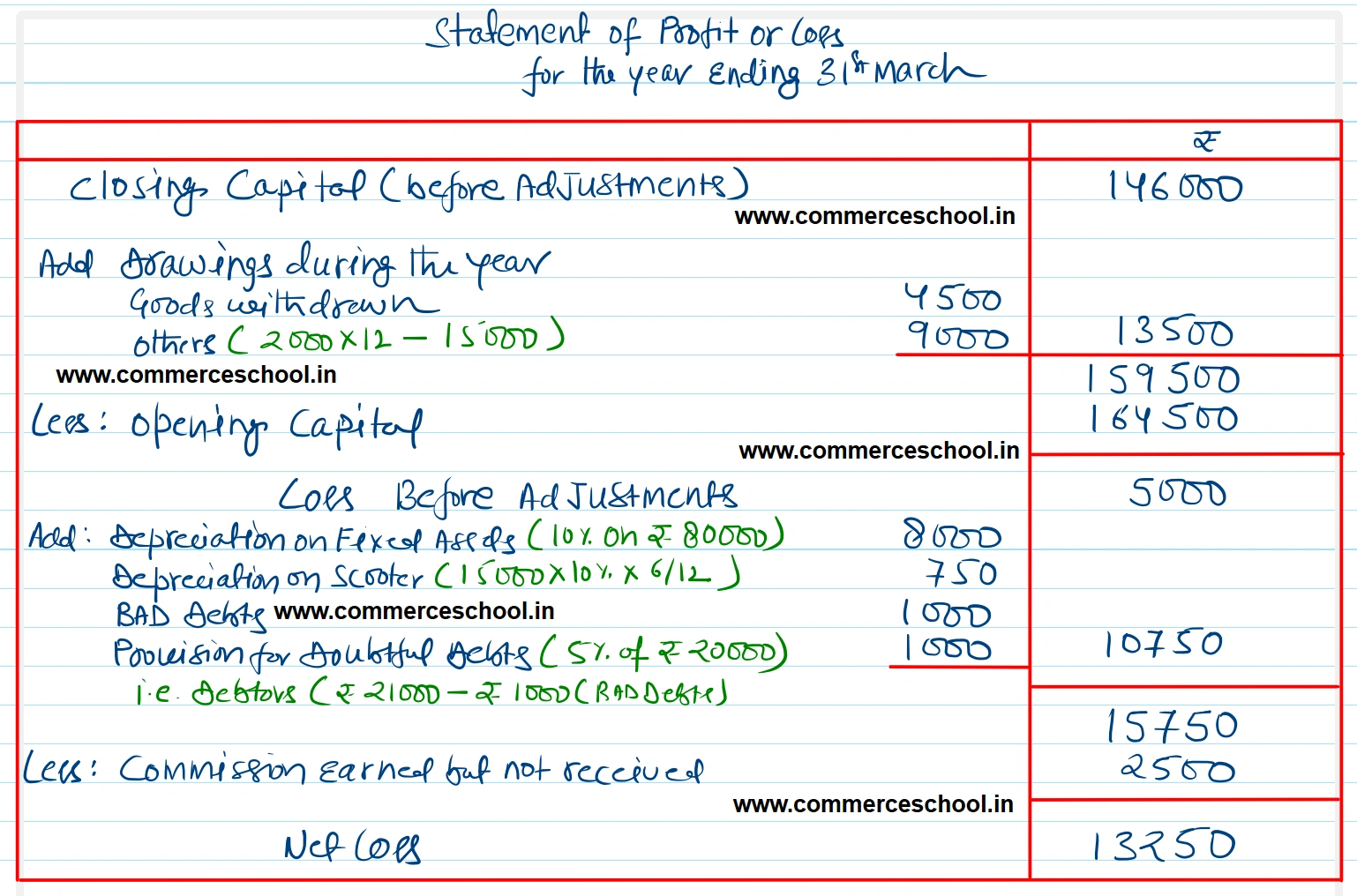

You are informed that Gopal has taken stock worth ₹ 4,500 for his private use and that he has been regularly transferring ₹ 2,000 per month from his business banking account by way of drawings. Out of his drawings, he spent ₹ 15,000 for purchasing a Scooter for the business on 1st October, 2022.

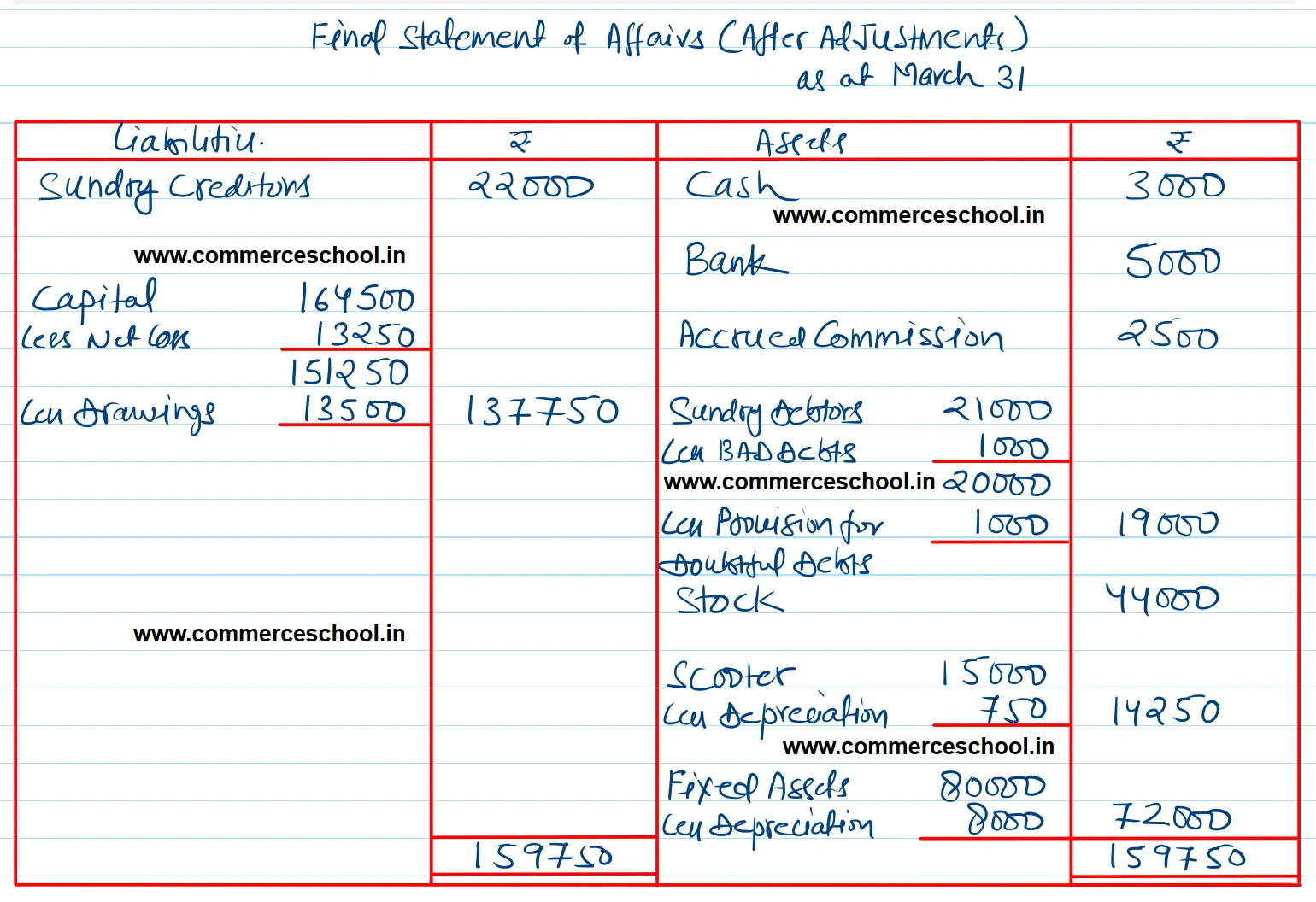

You are requested to find out his profit or loss and to prepare the Statement of Affairs after considering the following:

(1) Depreciate Fixed Assets and Scooter by 10% p.a.

(2) Write off Bad Debts ₹ 1,000 and provide 5% for doubtful debts on Sundry Debtors.

(3) Commission earned but not received by him was ₹ 2,500.

[Ans. Closing Capital ₹ 1,46,000; Net Loss ₹ 13,250 and Total of Final Statement of Affairs ₹ 1,59,750.]

Solution:-

| Liabilities | ₹ | Assets | ₹ |

| Bank Overdraft | 7,500 | Cash | 6,400 |

| Sundry Creditors | 15,000 | Stock | 52,000 |

| Capital | 1,64,500 | Sundry Debtors | 28,000 |

| Fixed Assets | 1,00,000 | ||

| Prepaid Expenses | 600 | ||

| 1,87,000 | 1,87,000 |

Anurag Pathak Answered question