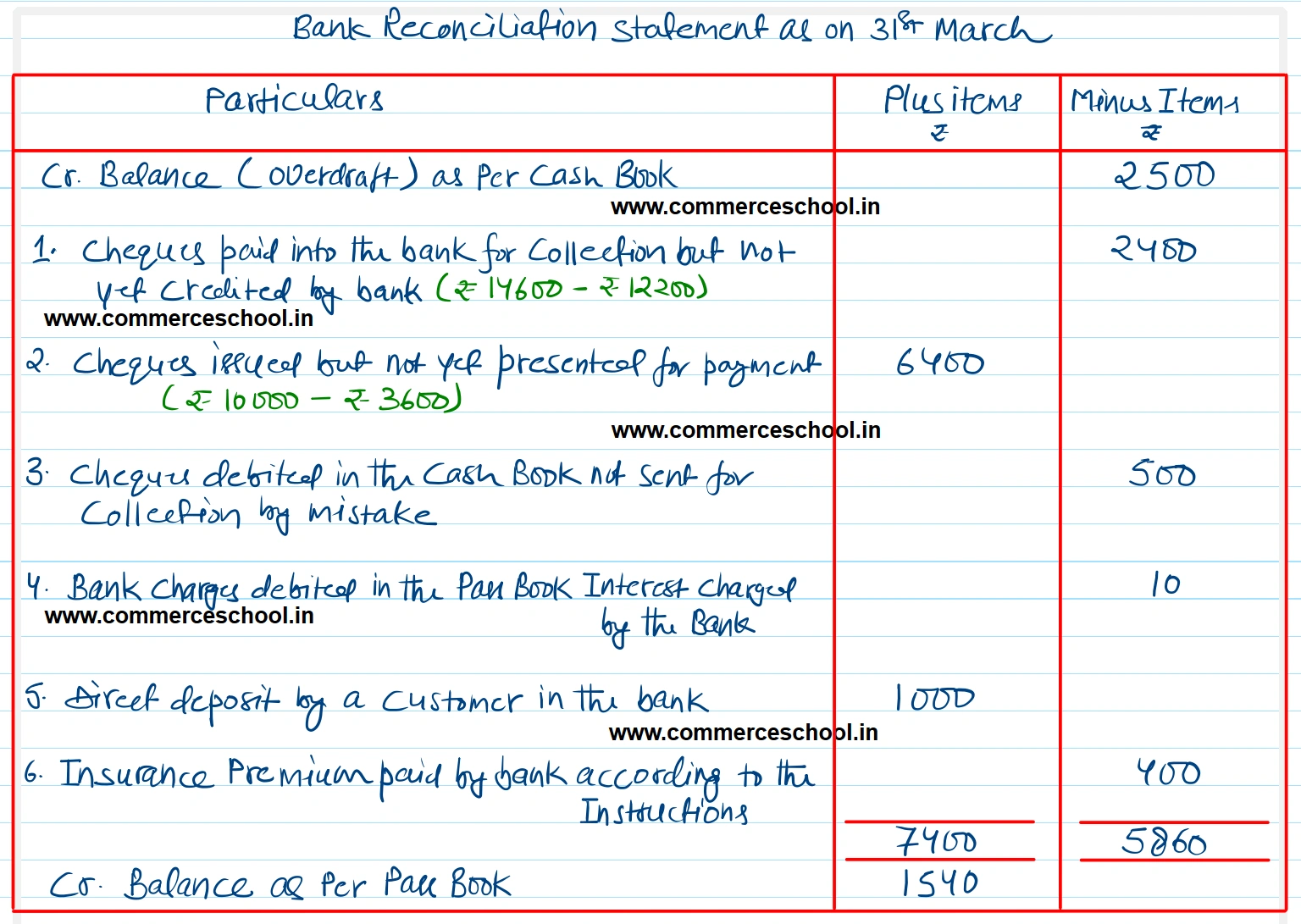

On 30th June 2024, the Cash Book of a trader shows a bank overdraft of ₹ 2,500. Following informations are available:-

On 30th June 2024, the Cash Book of a trader shows a bank overdraft of ₹ 2,500. Following informations are available:-

(1) Cheques amounting to ₹ 14,600 had been paid to the bank, but of these only ₹ 12,200 were credited in the Pass Book, up to 30th June, 2024.

(2) He had also issued cheques amounting to ₹ 10,000, out of which only ₹ 3,600 had been presented for payment.

(3) A Cheque of ₹ 500 which he had debited to the bank account was not sent to bank for collection by mistake.

(4) There is a debit in the Pass Book of ₹ 10 for Bank Charges and ₹ 50 for interest.

(5) A customer directly paid into his bank ₹ 1,000, but it was not shown in the Cash Book.

(6) Bank has paid insurance premium of ₹ 400 according to his instructions, but this is not recorded in the Cash Book.

Prepare a Bank Reconciliation Statement.

[Ans. Credit Balance as per Pass Book ₹ 1,540.]