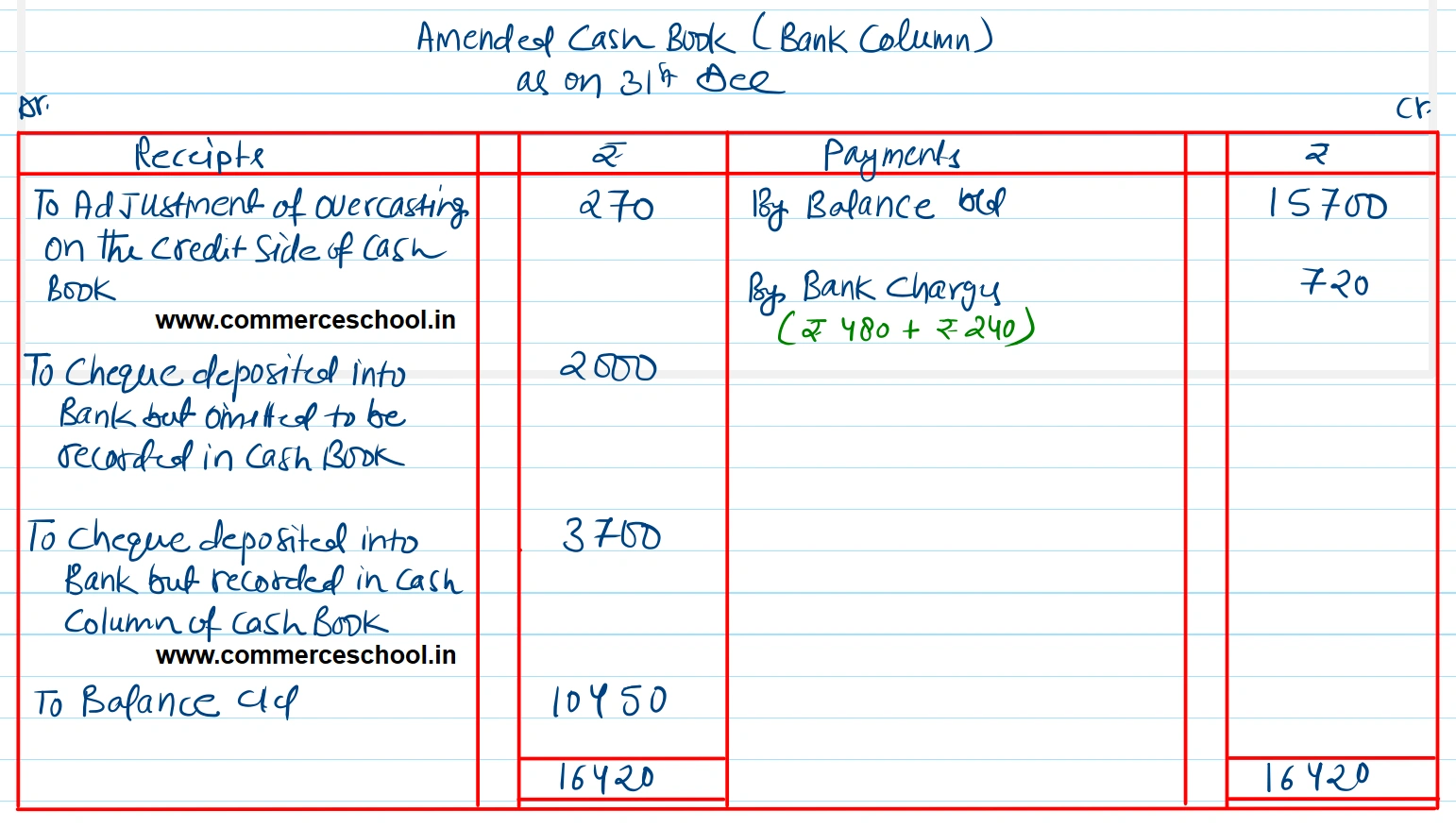

The Cash Book of a merchant showed a overdraft balance of ₹ 15,700 on 31st December 2024. On comparing it with the Pass Book, the following differences were noted:

The Cash Book of a merchant showed a overdraft balance of ₹ 15,700 on 31st December 2024. On comparing it with the Pass Book, the following differences were noted:

(i) Cheques amounting to ₹ 12,250 were deposited into the bank, out of which cheques for ₹ 8,200 have been credited in the Pass Book on 2nd January, 2025.

(ii) Cheques were issued amounting to ₹ 8,300 of which cheques for ₹ 2,000 have been cashed upto 31st Dec.

(iii) A cheque of ₹ 4,250 issued to a creditor, has been entered in the Cash Book as ₹ 4,520.

(iv) Bank charges of ₹ 480 on 30th November 2024 and ₹ 240 on 30th December 2024 have not been entered in the Cash Book.

(v) A cheque for ₹2,000 deposited into the bank appear in the Pass Book, but not recorded in the Cash Book.

(vi) A cheque for ₹ 3,700 deposited into the bank appear in the Pass Book, was recorded in the cash column of the Cash Book.

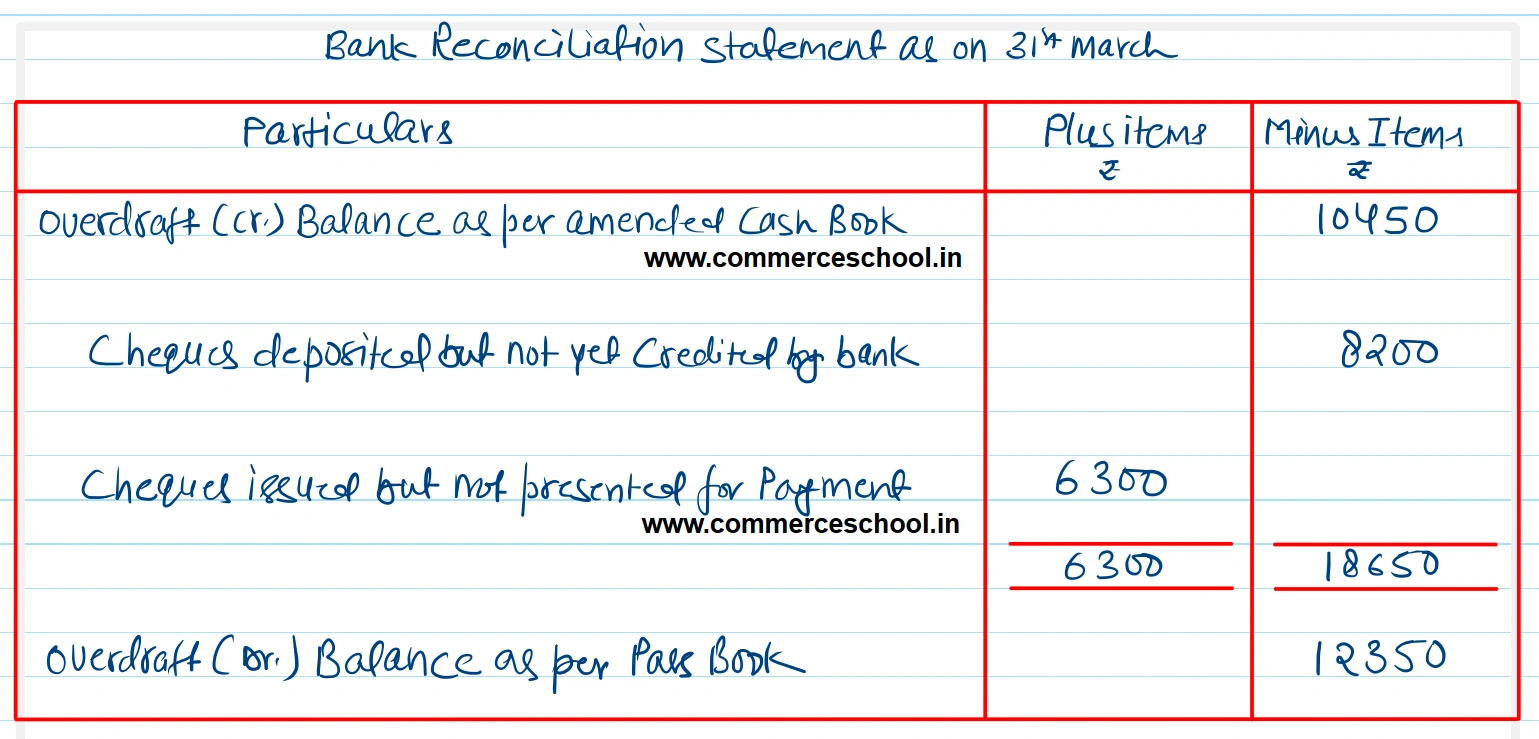

You are required:

(i) to make appropriate adjustments in the cash book, bringing down the correct balance, and

(ii) to prepare a bank reconciliation statement with the adjusted balance.

[Ans. (i) Corrected balance of the Cash Book (Cr.) ₹ 10,450; (ii) Bank Balance as per Pass Book (Overdraft) ₹ 12,350.]