On 31st March, 2023 the bank column of the Cash Book of Mr. Rajesh showed a debit balance of ₹ 5,200. On examining the Pass Book you find that:

On 31st March, 2023 the bank column of the Cash Book of Mr. Rajesh showed a debit balance of ₹ 5,200. On examining the Pass Book you find that:

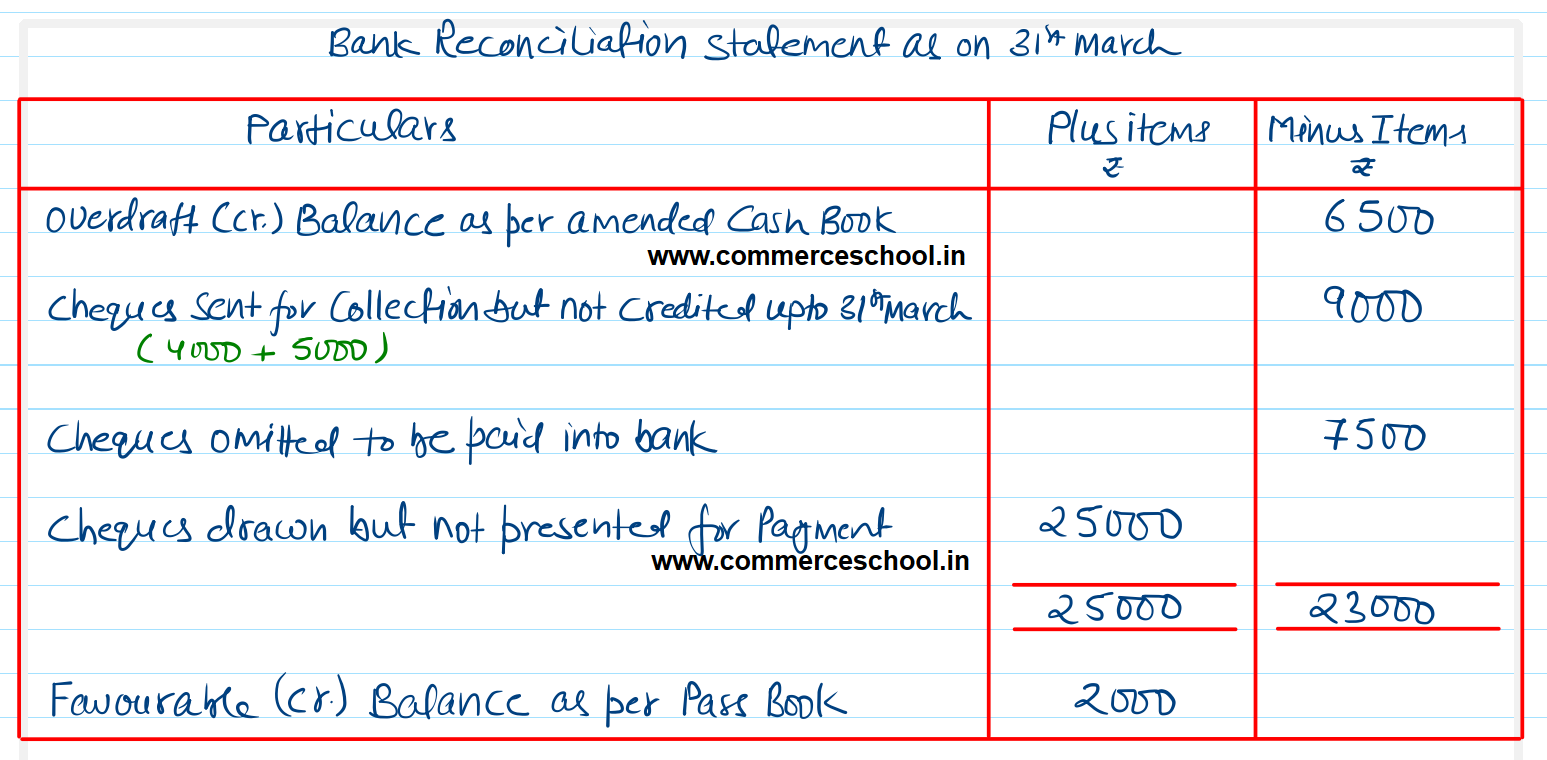

(i) Cheques of ₹ 20,000 were sent to bank for collection; Out of these cheques of ₹ 4,000 and of ₹ 5,000 were credited respectively on 5th April and 6th April respectively and the remaining cheques were credited before 31st March.

(ii) A cheque for ₹ 7,500 received from a customer although entered in the bank column of the Cash Book, was omitted to be paid into the bank.

(iii) Cheques drawn for ₹ 25,000 were not presented for payment.

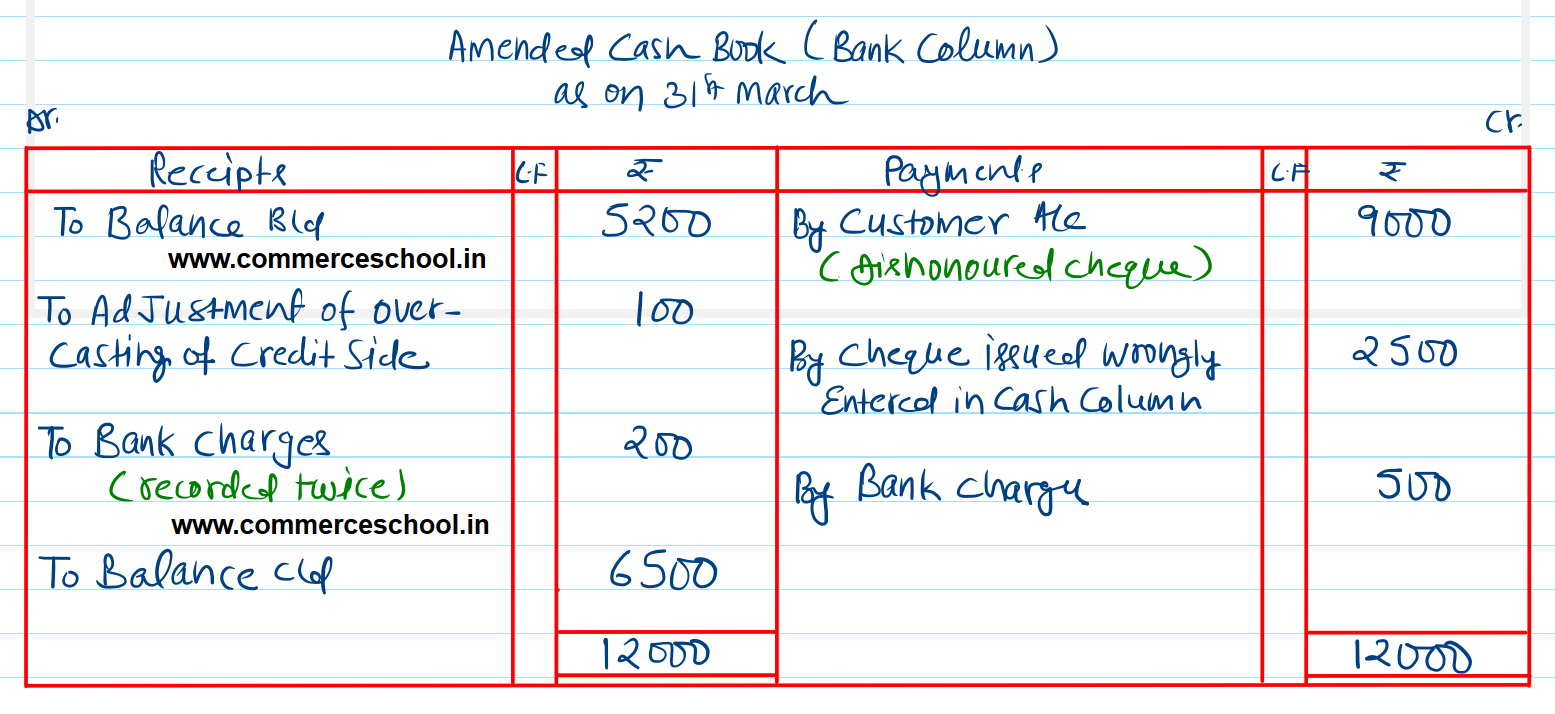

(iv) Credit side of the bank column of the Cash Book was overcast by ₹ 100.

(v) No entry has been made in the Cash Book to record the dishonour on 28th March 2023, of a cheque for ₹ 9,000 received from a customer.

(vi) A cheque for ₹ 2,500 issued to a creditor was wrongly entered in the cash column of the Cash Book.

(vii) In the Cash Book, bank charges of ₹ 200 were entered twice while another bank charge of ₹ 500 was not recorded at all.

You are required to show the necessary corrections in the Cash Book and to prepare a statement reconciling the amended cash balance with the shown in bank Pass Book.

[Ans. Amended balance as per Cash Book (Cr.) ₹ 6,500; Pass Book Cr. Balance ₹ 2,000.]