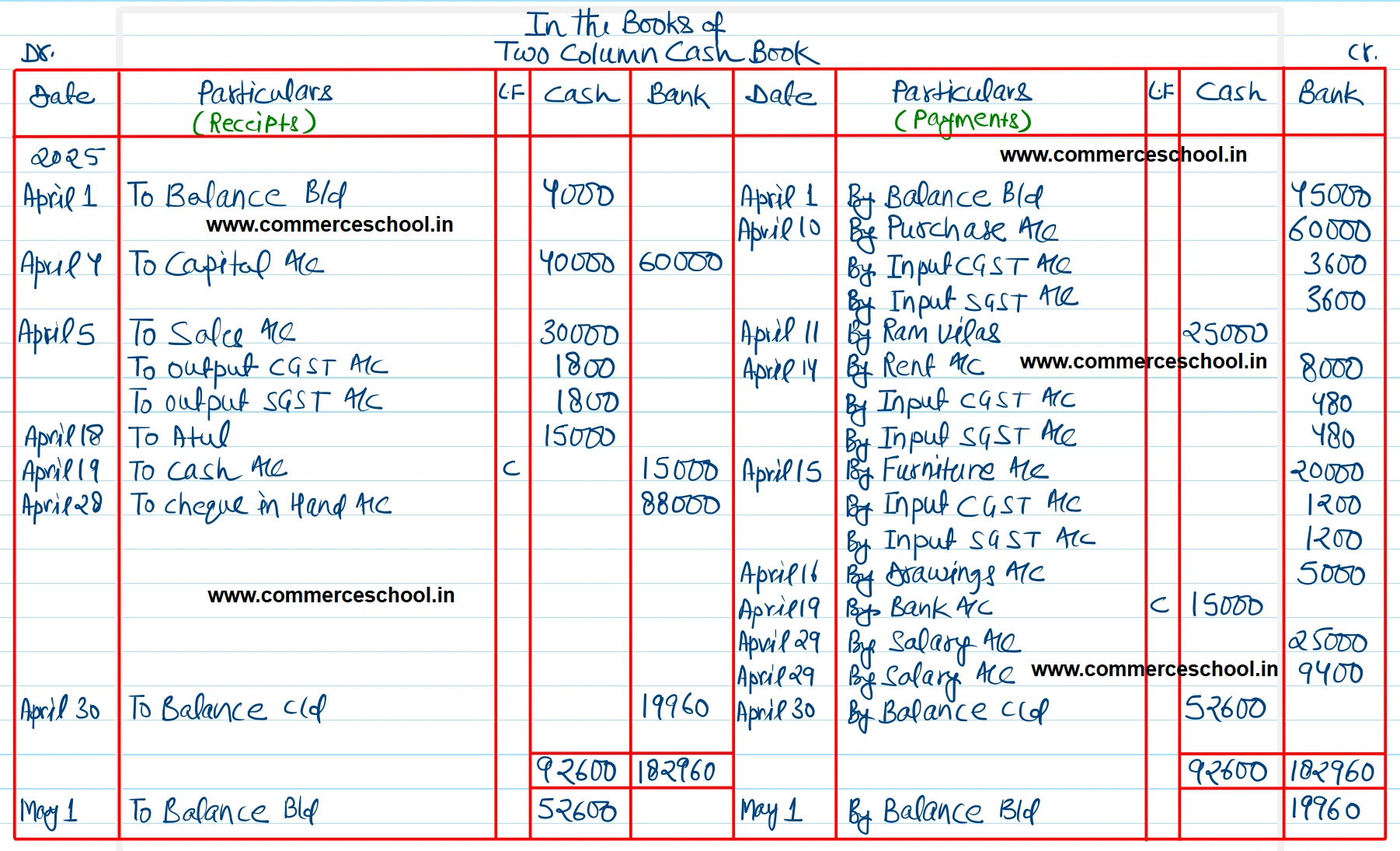

Enter the following transactions in the Cash Book with Cash and Bank Columns: alance of Cash in hand ₹ 4,000, overdraft at Bank ₹ 45,000

Enter the following transactions in the Cash Book with Cash and Bank Columns:-

| 2025 | |

| April 1 | Balance of Cash in hand ₹ 4,000, overdraft at Bank ₹ 45,000 |

| 4 | Invested further capital ₹ 1,00,000 out of which ₹ 60,000 deposited into the bank |

| 5 | Sold goods for cash ₹ 30,000 plus CGST and SGST @ 6% each |

| 10 | Purchased goods ₹ 60,000 plus CGST and SGST @ 6% each and issued a cheque for the same |

| 11 | Paid to Ram Vilas, out creditor ₹ 25,000; discount allowed by him ₹ 1,000 |

| 14 | Rent of ₹ 8,000 plus CGST and SGST @ 6% each paid by cheque |

| 15 | Office Furniture purchased and a cheque of ₹ 22,400 issued for the same including CGST and SGST @ 6% each |

| 16 | Drew cheque for personal use ₹ 5,000 |

| 18 | Collection from Atul ₹ 15,000, deposited in the bank on 19th April |

| 20 | Goods sold to Amritraj for ₹ 80,000 plus CGST and SGST @ 6% each |

| 25 | Received a cheque of ₹ 88,000 from Amritraj in full settlement of his account; deposited into bank on 28th April |

| 29 | Drew from the bank for salary of the office staff ₹ 25,000. |

| 29 | Paid salary of the manager by cheque ₹ 9,400 |

[Ans. Cash Balance (Dr.) ₹ 52,600; Bank Balance (Cr.) ₹ 19,960.]

Anurag Pathak Answered question