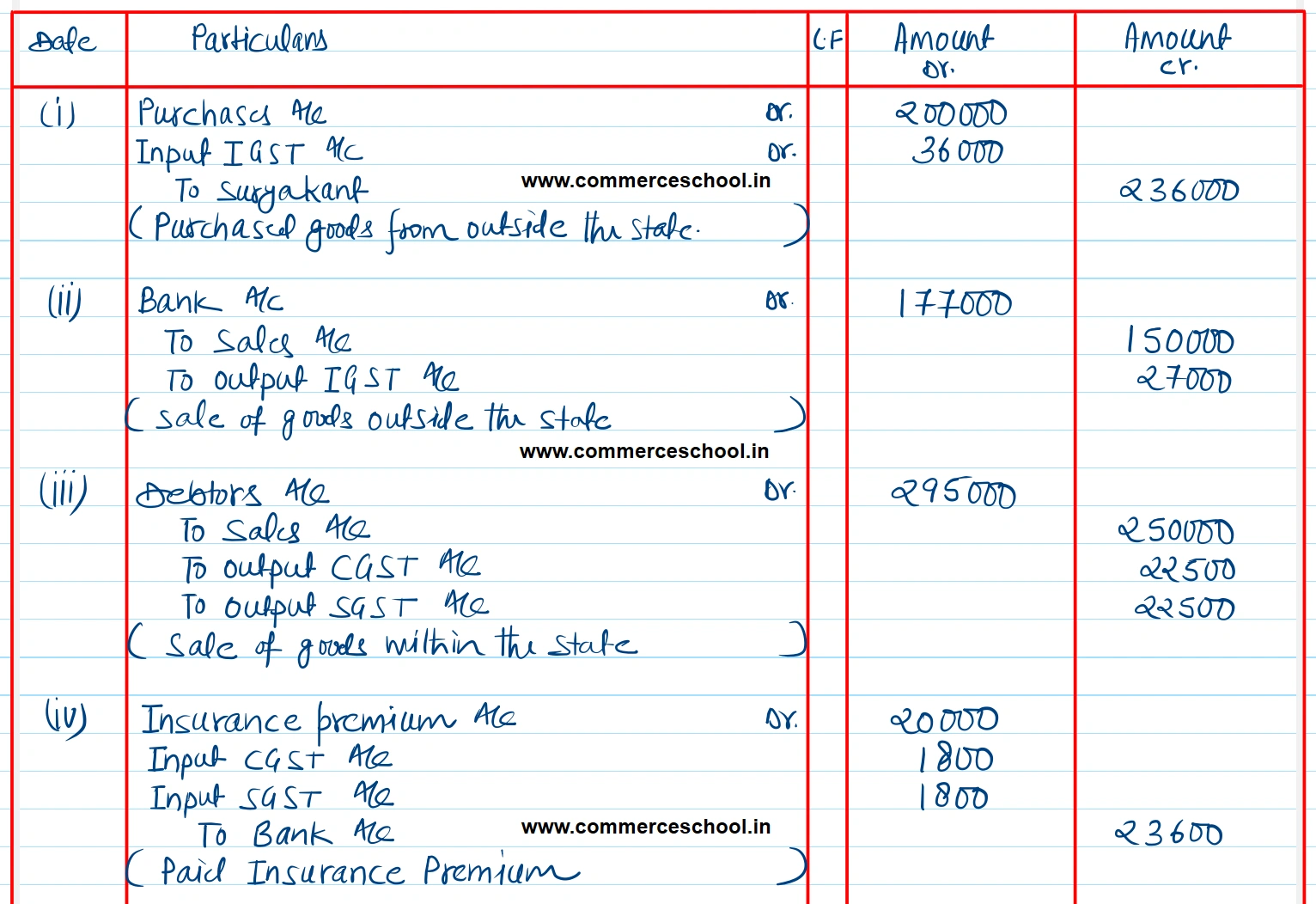

Pass entries in the books of Mr. Roopani of Gujarat assuming CGST @ 9% and SGST @ 9%. Purchased goods for ₹ 2,00,000 from Suryakant of Jaipur (Rajasthan) on Credit.

Pass entries in the books of Mr. Roopani of Gujarat assuming CGST @ 9% and SGST @ 9%.

[Ans. Total ₹ 8,74,400]

| (i) | Purchased goods for ₹ 2,00,000 from Suryakant of Jaipur (Rajasthan) on Credit. |

| (ii) | Sold goods for ₹ 1,50,000 to Mr. Pawar of Mumbai (Maharashtra) and the cheque received was sent to bank. |

| (iii) | Sold goods for ₹ 2,50,000 within the state on credit. |

| (iv) | Paid insurance premium of 20,000 by cheque. |

| (v) | Purchased furniture for office for ₹ 60,000 by cheque. |

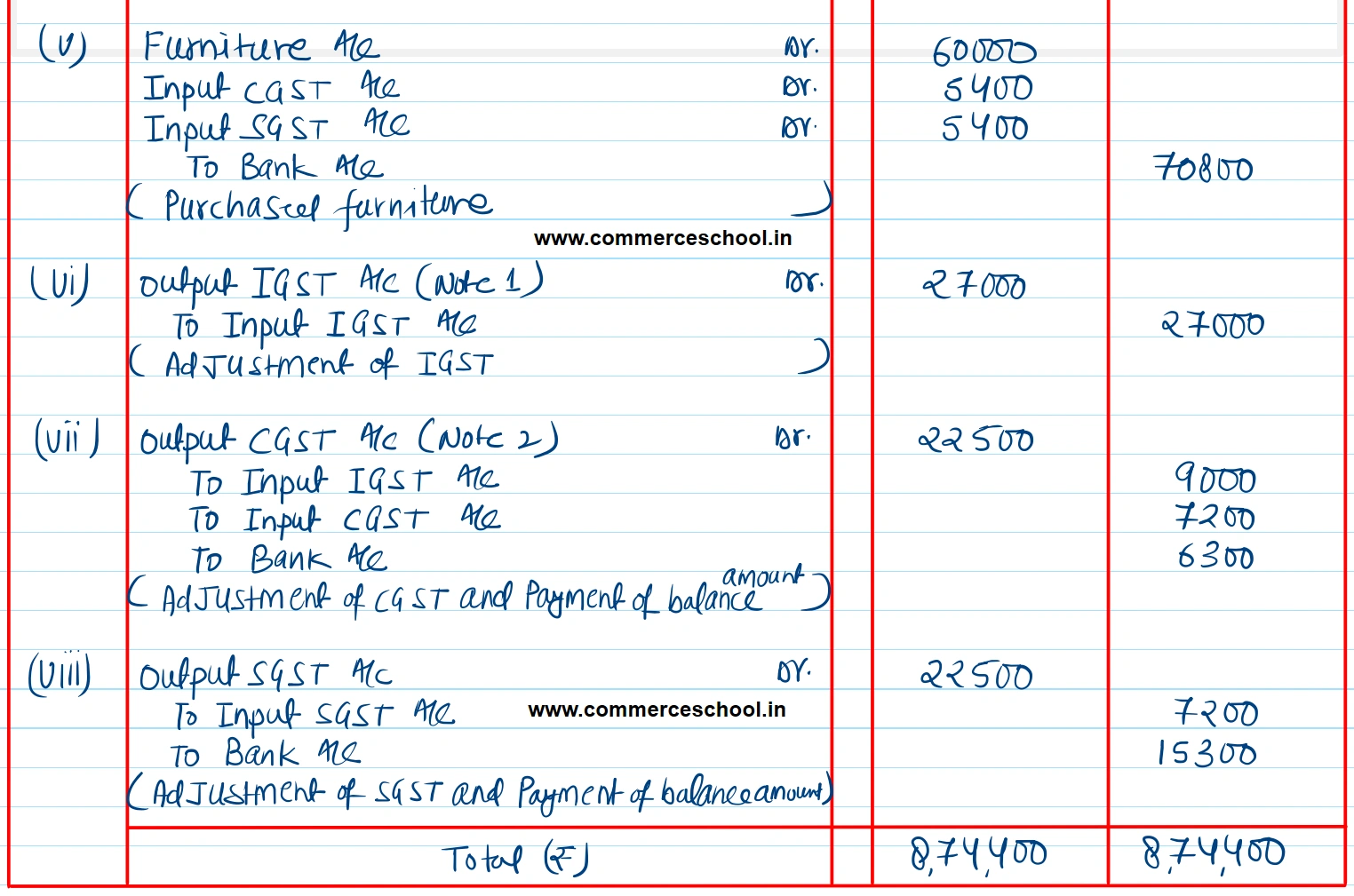

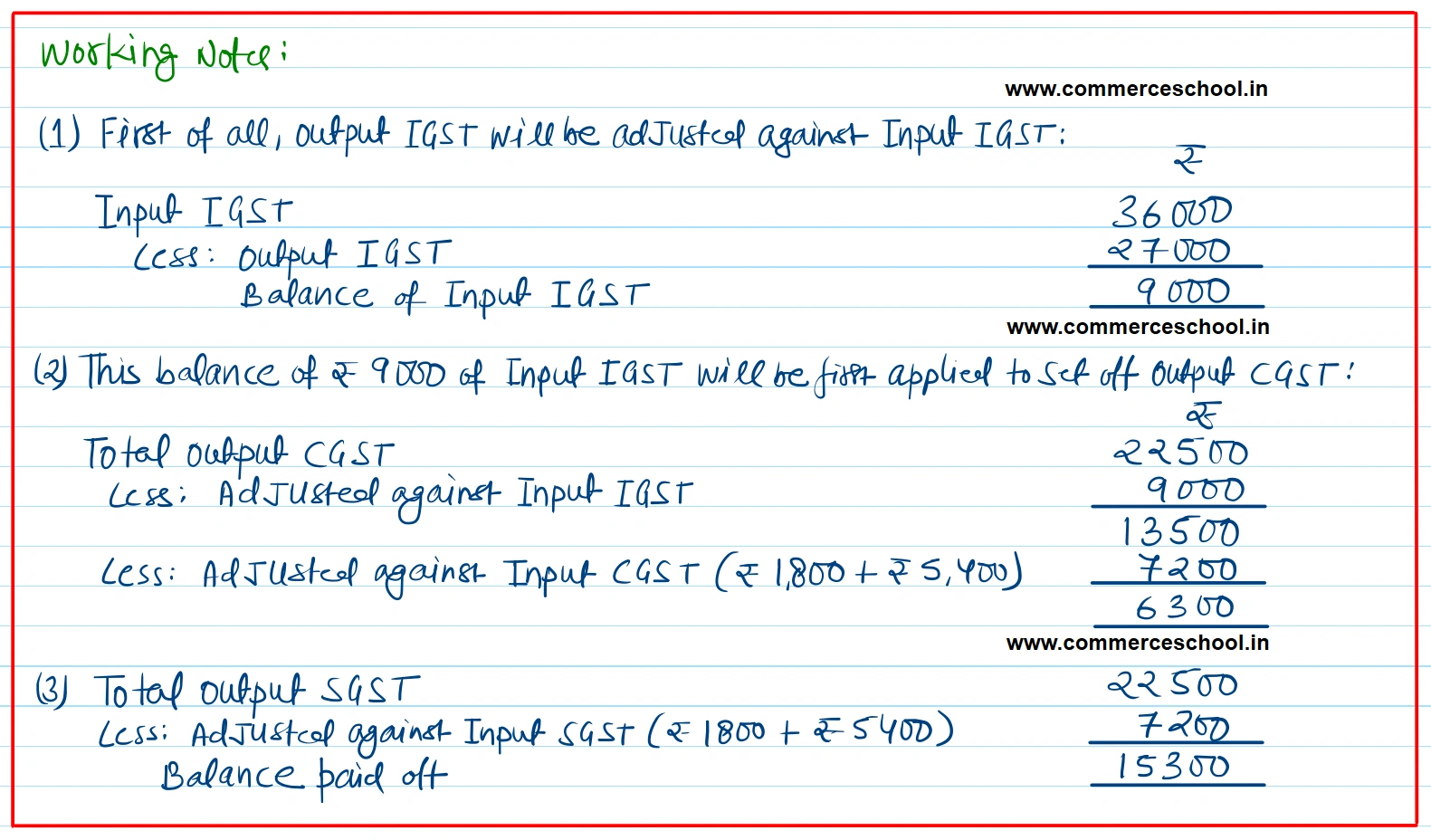

| (vi) | Payment made of balance amount of GST |

Anurag Pathak Answered question