From the following information, Calculate cash Flow from Operating Activities and Investing Activities:

From the following information, Calculate cash Flow from Operating Activities and Investing Activities:

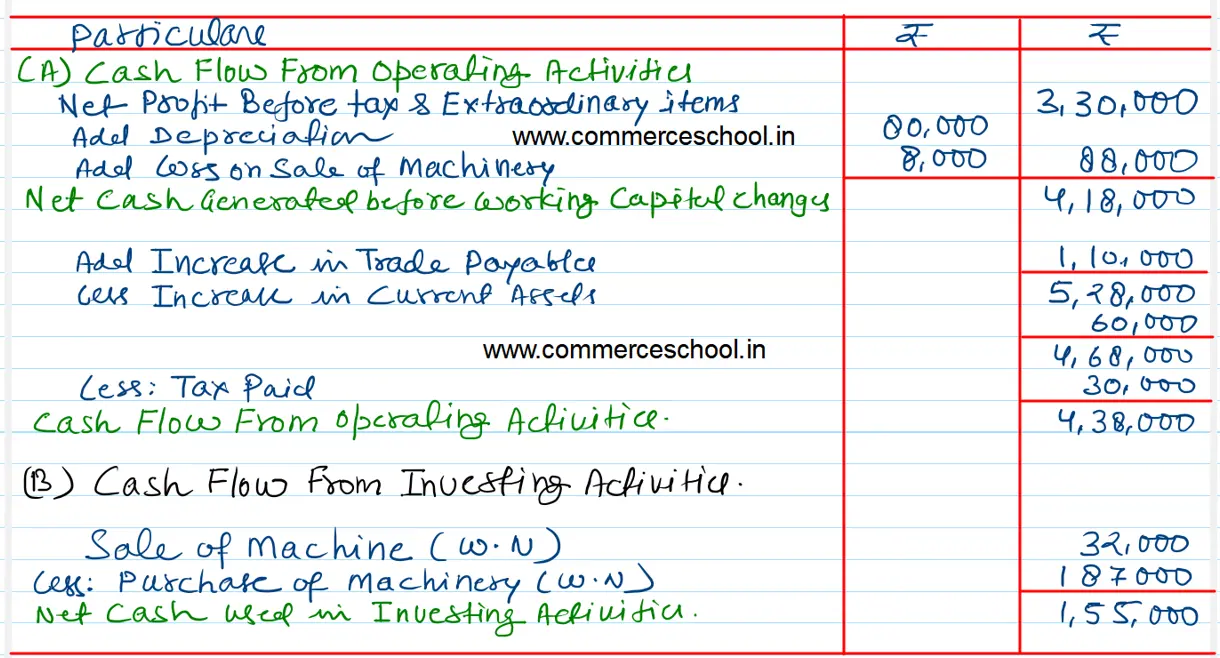

| Particulars | 31st March, 2022 (₹) |

31st March, 2023 (₹) |

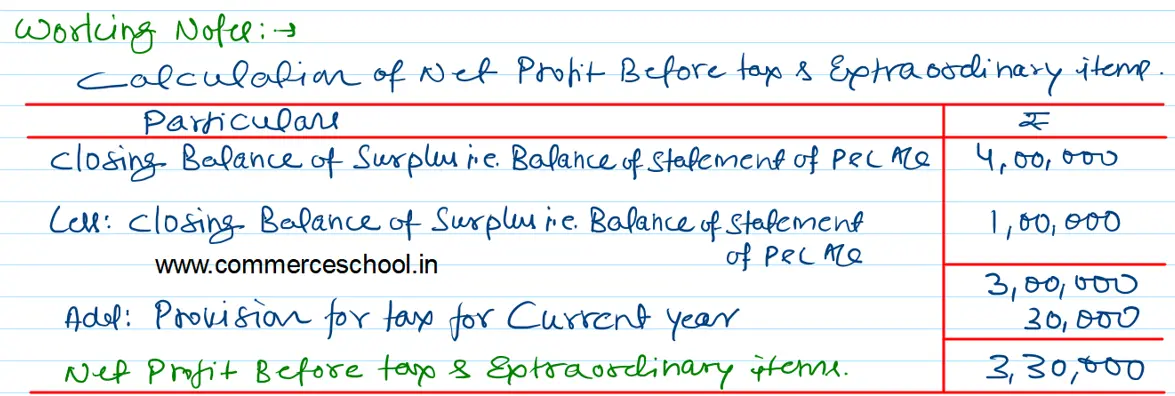

| Surplus, i.e., Balance in Statement of Profit & Loss Provision for Tax Trade Payables Current Assets (Inventories and Trade Receivables) Fixed Assets (Net) |

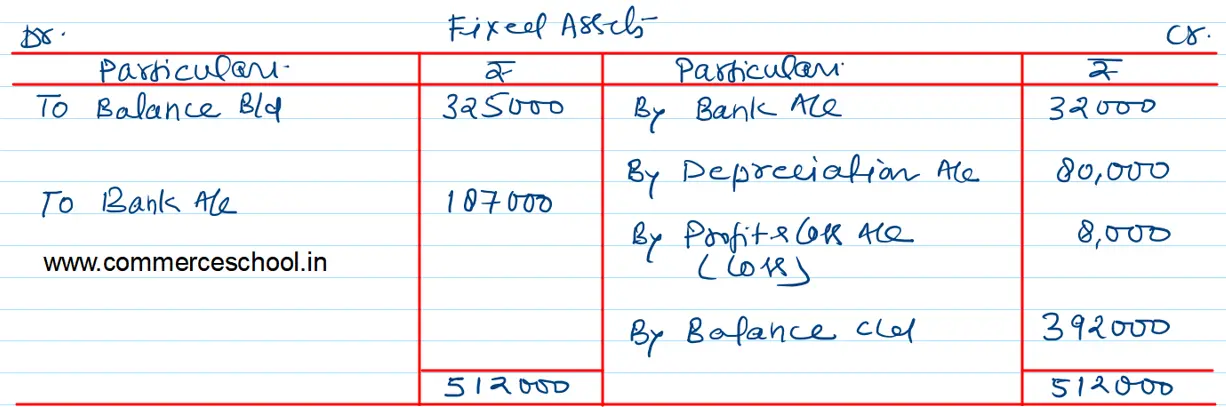

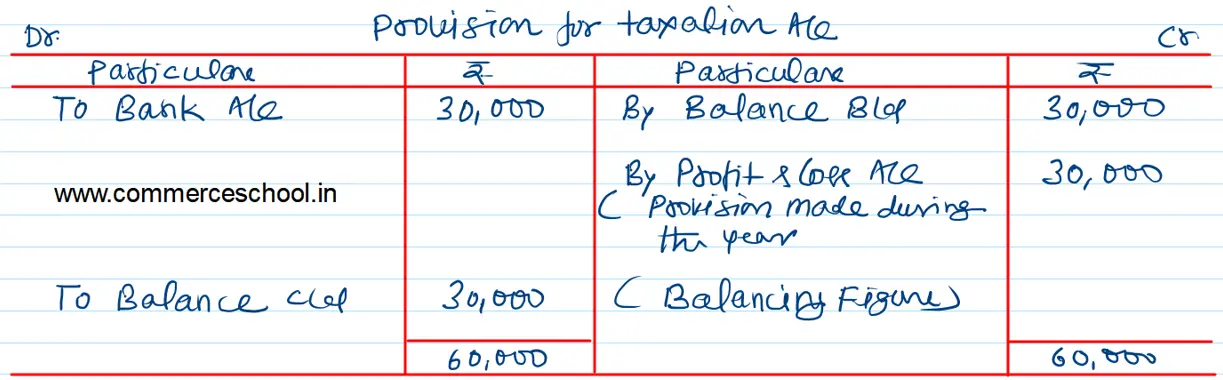

1,00,000 30,000 40,000 4,60,000 3,25,000 |

4,00,000 30,000 1,50,000 5,20,000 3,92,000 |

Depreciation of ₹ 80,000 was provided and a machine costing ₹ 1,05,000 (Depreciation provided thereon ₹ 65,000) was sold at a loss of ₹ 8,000.

Tax paid during the year ₹ 30,000.

[Ans.: Cash Flow from Operating Activities = ₹ 4,38,000. Cash used in Investing Activities = ₹ 1,55,000.]

Anurag Pathak Changed status to publish

Please provide this question video solution