On 31st March, 2023 the following Trial Balance was prepared from the Books of Manpreet: Furniture 3,400 Building 21,700

On 31st March, 2023 the following Trial Balance was prepared from the Books of Manpreet:

| Debit Balances | ₹ | Credit Balances | ₹ |

|

Furniture Building Drawings Cash at Bank Wages Discount Allowed Bank Charges Salaries Purchases Opening Stock Cash in Hand Sales Return Carriage Inwards Machinery Sundry Debtors Bad Debts Insurance Rent Advertisement |

3,400 21,700 4,200 2,470 31,250 2,640 90 5,610 1,32,700 40,200 2650 1,250 3,400 43,800 1,000 1,250 2,450 3,500 |

Capital Discount received Bank Loan Purcahses Return Sales Sundry Creditors Provision for Doubtful Debts |

1,00,000 2,000 10,000 970 1,91,940 12,450 800 |

| 3,18,160 | 3,18,160 |

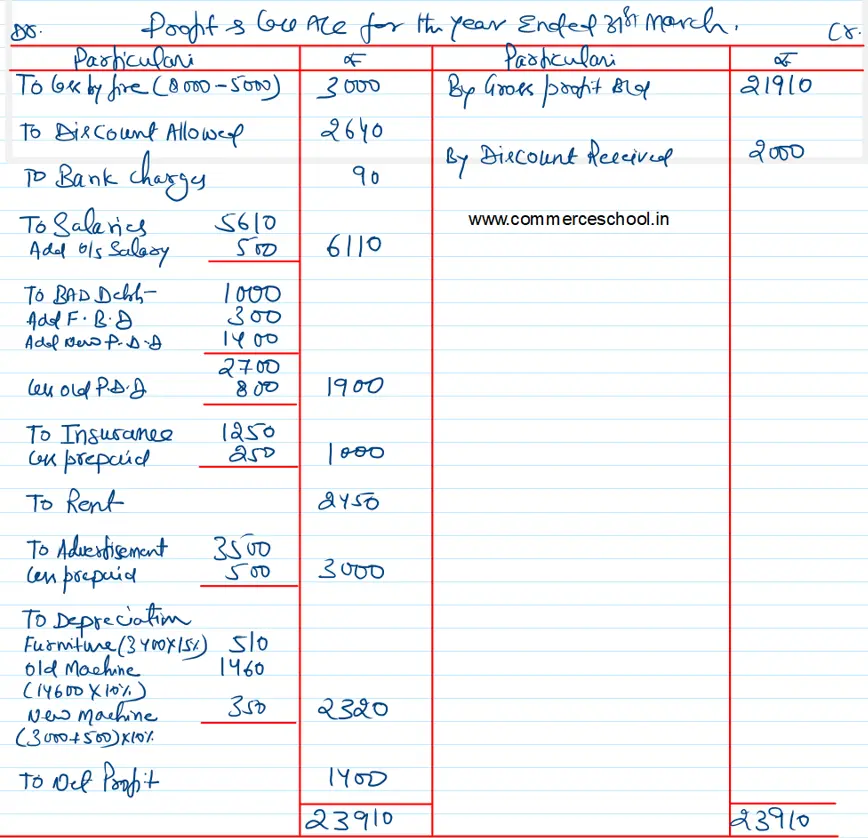

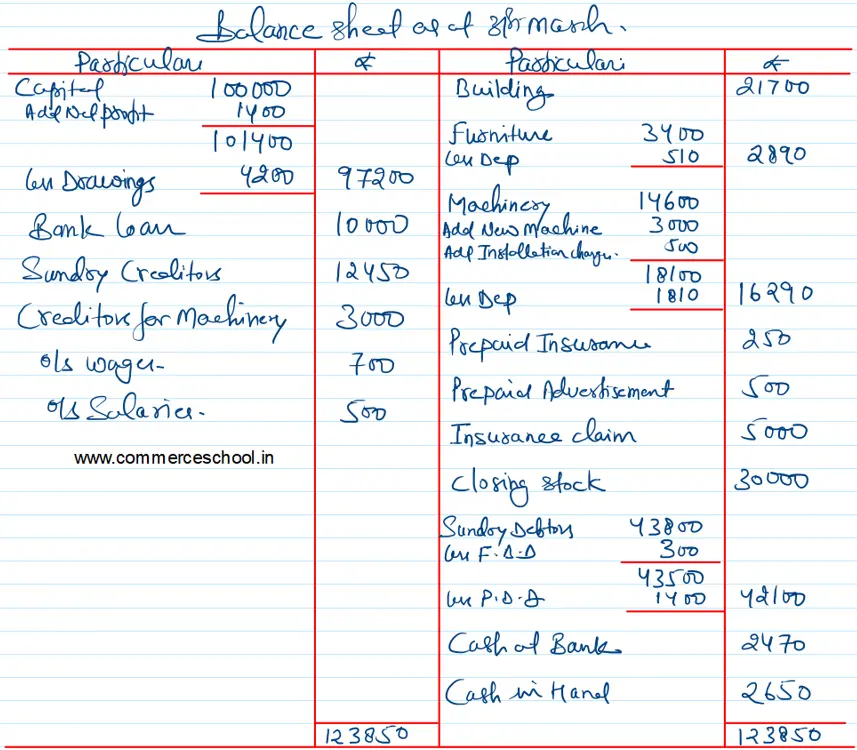

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and also the Balance Sheet as at that date after making the following adjustments:

(i) Closing Stock at cost was ₹ 35,000 whereas its net realisable value (market value) was ₹ 30,000.

(ii) A new machine was purchased for ₹ 3,000 on 1st April, 2022 but it was not paid for and no entry was passed in the books.

(iii) Wages include ₹ 500 paid for the installation of machinery.

(iv) Provision for Doubtful Debts was raised to ₹ 1,400 and further bad debts of ₹ 300 were written off.

(v) Fire broke out on 20th March, 2023 and destroyed stock to the value of ₹ 8,000. The insurance company admitted claim for loss of stock of ₹ 5,000 and the amount was paid on 15th April, 2023.

(vi) Outstanding wages were ₹ 700 while outstanding salaries were ₹ 500.

(vii) Prepaid insurance was ₹ 250 and prepaid advertisement ₹ 500.

(viii) Machinery was depreciated by 10% and Furniture by 15%.

[Gross Profit – ₹ 21,910; Net Profit – ₹ 1,400; Balance Sheet Total – ₹ 1,23,850.]