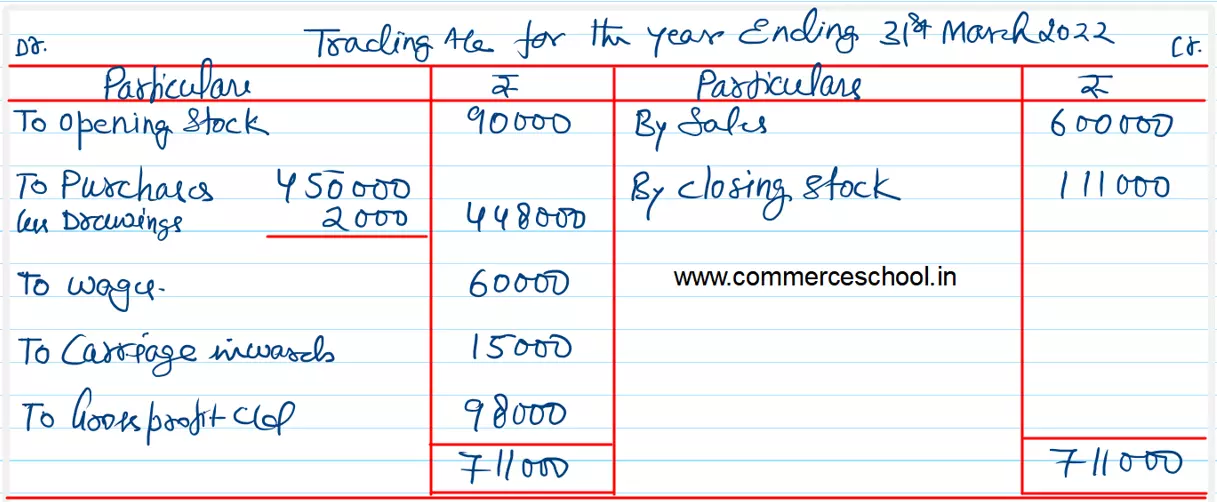

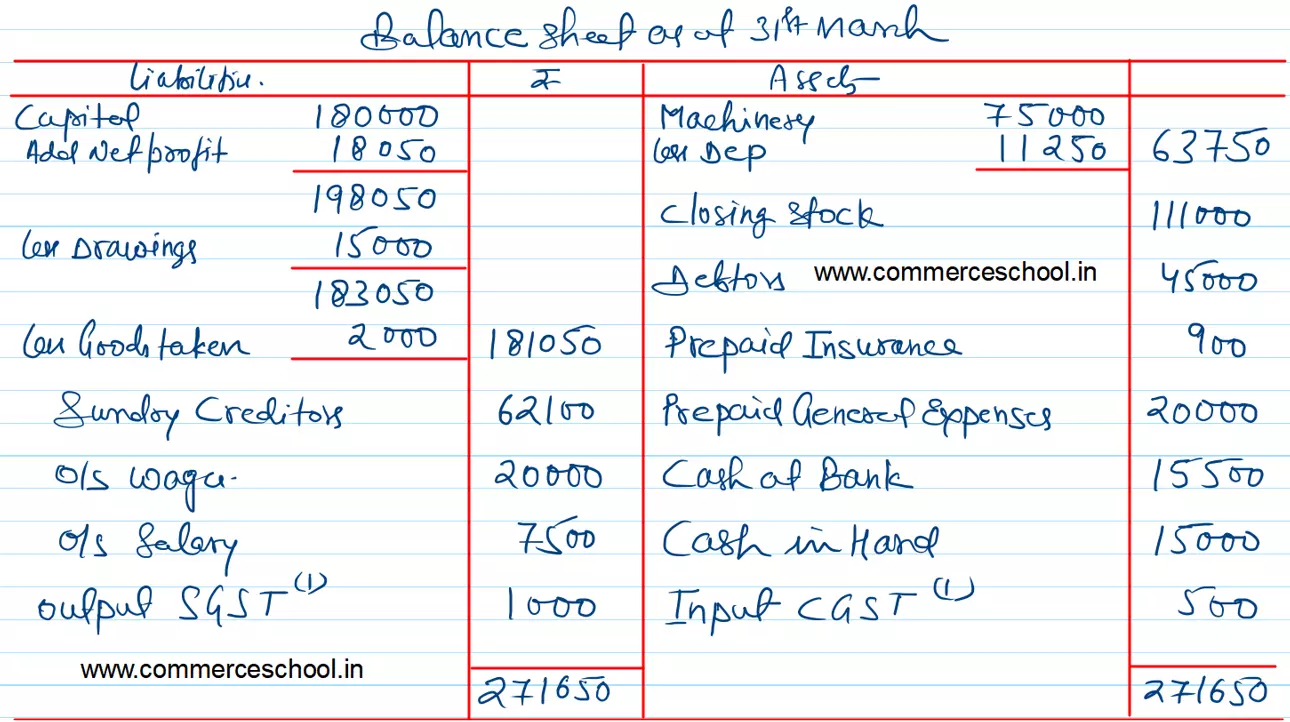

From the following Trial Balance and additional information of Bharat, a proprietor. Prepare Trading and Profit & Loss Account for the year ending 31st March, 2023 and the Balance Sheet as at that date:

From the following Trial Balance and additional information of Bharat, a proprietor. Prepare Trading and Profit & Loss Account for the year ending 31st March, 2023 and the Balance Sheet as at that date:

| Heads of Accounts | L.F. | Dr. (₹) | Cr. (₹) |

|

Opening Stock Purchases Sales Wages Wages Outstanding (at the end) Carriage Inwards Salaries Insurance General Expenses Prepaid General Expenses Machinery Debtors Creditors Cash in Hand Cash at Bank Capital Drawings Input CGST Input SGST Input IGST Output CGST Output SGST Output IGST |

90,000 4,50,000 – 60,000 – 15,000 51,000 3,000 8,100 20,000 75,000 45,000 – 15,000 15,500 – 15,000 2,500 2,500 4,500 – – – |

– – 6,00,000 – 20,000 – – – – – – – 62,100 – – 1,80,000 – – – – 35,00 35,00 35,00 |

|

| 872100 | 872100 |

Additional Information:

(i) Salaries outstanding for the month of March, 2023 is ₹ 7,500.

(ii) Prepaid Insurance is ₹ 900.

(iii) Depreciate Machinery @ 15% p.a.

(iv) Value of Closing Stock is ₹ 1,11,000.

(v) Bharat took goods of ₹ 2,000 for personal use which was not recorded (Ignore GST)

[Gross Profit – ₹ 98,000; Net Profit – ₹ 18,050; Balance sheet Total – ₹ 2,71,650; Input CGST of ₹ 500 will be shown in the Assets side and output SGST of ₹ 1,000 will be shown in the Liabilities Side of Balance Sheet.]